Enerpac Tool Group: 'ASCEND Transformation' Can Push Shares Higher

Summary

- Enerpac Tool Group reported fiscal Q3 earnings highlighted by climbing margins and positive guidance.

- The company is benefiting from continued strong demand globally for its specialized industrial equipment.

- Efforts to drive growth and improve profitability are paying off and support a positive long-term outlook.

- This idea was discussed in more depth with members of my private investing community, Conviction Dossier. Learn More »

gipi23/iStock via Getty Images

Enerpac Tool Group (NYSE:EPAC) is recognized as a global manufacturing leader for high pressure hydraulic and controlled force products. These are specialized equipment with applications across several industrial markets including infrastructure, civil construction markets, oil & gas, mining, and other types of heavy operations.

Despite what has been a volatile macro backdrop, the company's latest financial results helped brush aside concerns of any slowdown with the report highlighted by solid core growth and firming profitability.

Indeed, a strategy initiative launched last year known as the "ASCEND transformation" appears to be paying off with the company benefiting from a more streamlined operation driving efficiencies and helping to lift margins. Even with shares trading near a multi-year high, we see value in the stock and expect more upside going forward.

EPAC Earnings Recap

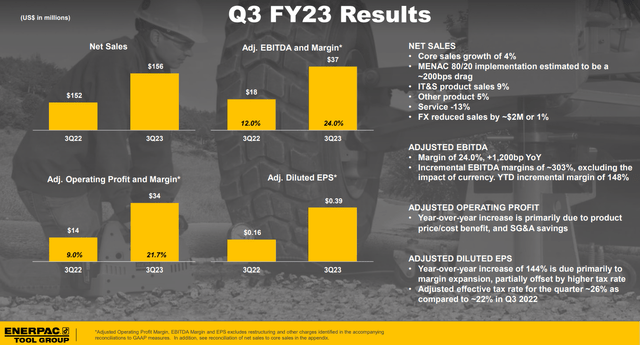

EPAC reported Q3 non-GAAP EPS of $0.39, which more than doubled from the $0.16 result in the period last year. While net sales of $156 million climbed by a modest 2.9%, or 4% on a core basis, the story was the sharply higher margins with an improvement compared to the start of 2022 that was defined by supply chain disruptions and inflationary cost pressures.

The adjusted EBITDA margin at 24.0% climbed from 12% in Q3 2022 with the company capturing SG&A savings and a more favorable sales mix. Strong trends in the Asia Pacific region delivering core sales growth in the "high teens" with activity from oil & gas along with mining end users otherwise resilient compared to lower commodity prices. Management projected confidence during the conference call.

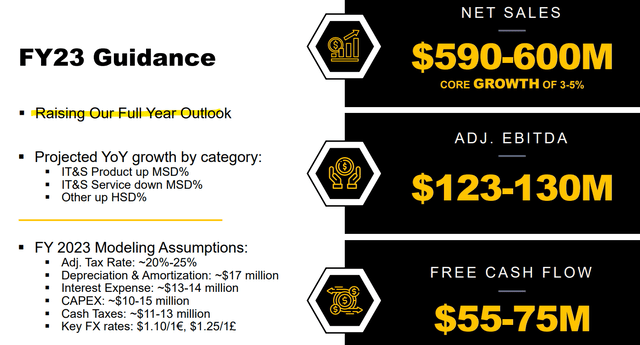

The effort was good enough to raise full-year guidance, tightening the net sales outlook to a midpoint estimate of $595 million, from a prior $590 target. The company now expects full-year adjusted EBITDA between $123 and $130 million compared to the previous range between $118 and $128 million.

What's Next For EPAC?

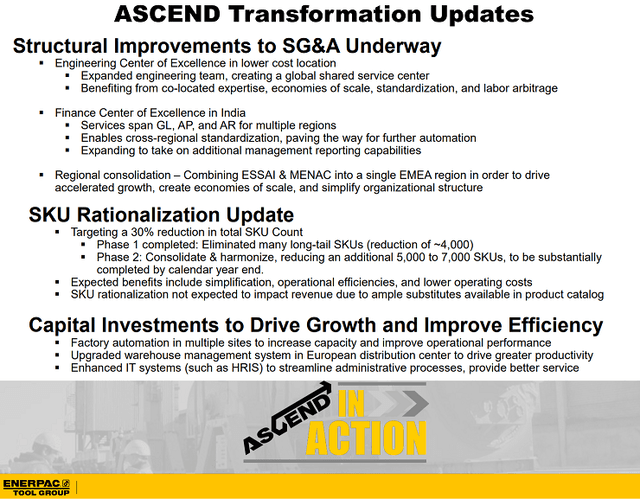

We mentioned the ASCEND transformation initiatives as a major theme for the company. Announced back in 2022, the effort here is to enhance shareholder value by streamlining the business and improve efficiency. Steps include consolidating the organizational structure to control SG&A expenses while also targeting a 30% reduction in the total number of unique products.

While the Q3 results already captured good progress, the understanding is that there is more room for further improvement that should translate into even stronger margins through 2024.

Beyond the full-year 2023 guidance, management is reiterating its longer-run outlook targeting organic revenue growth between 6% and 7% with a sustained adjusted EBITDA margin above 25%.

The potential for free cash flow conversion to trend above 100% by 2026 is supportive to ongoing share buybacks including the current 5.4 million outstanding share buyback authorization representing approximately 9% yield on shares outstanding. Keep in mind that EPAC also pays a modest annual dividend of $0.04 per share which we believe could be increased down the line.

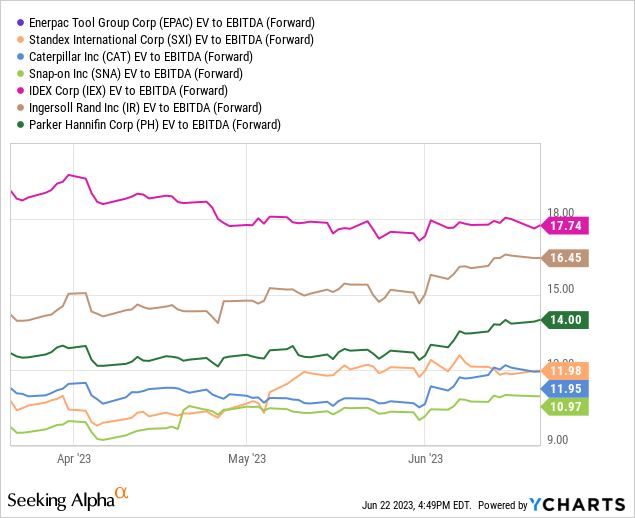

The setup here ties into what we view as a compelling valuation for EPAC considering its current market cap around $1.5 billion or $1.6 billion enterprise value.

Recognizing the ongoing ramp up in EBITDA, the full year guidance suggests shares are trading at an EV to forward EBTIDA multiple of just 13x. The metric improves towards 10x if we look out into 2024 simply annualizing the Q3 results to approach $150 million as an adjusted EBITDA run rate.

Notably, these measures are below a peer group of industrial names including competitors like Standex International Corp. (SXI), IDEX Corp. (IEX), Snap-on Inc. (SNA), and Ingersoll Rand Inc. (IR) which all compete with EPAC in particular categories.

In many ways, EPAC stands out with its more targeted profile focusing on mechanical high-force hydraulics and heavy lifting technology solutions. The understanding is that EPAC is well positioned to capture demand from increasingly complex engineering demand in several markets.

Final Thoughts

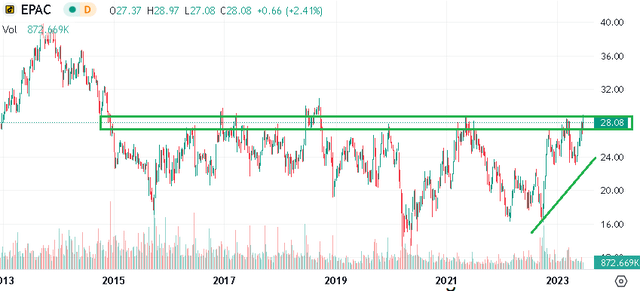

We like EPAC as a high-quality small cap with a combination of strong fundamentals and a positive long-term outlook as a strong tailwind for the stock. On that point, we note that shares are currently trading above $28.00 and approaching the upper end of what has been a relatively tight trading range over the past decade.

In our view, given the newfound earnings momentum, there is a case to be made that the outlook is stronger than ever which could be enough for the stock to breakout higher.

At the same time, it's clear that as an "industrial name", the company has exposure to shifting global economic conditions. A scenario where industrial production sputters with weaker than expected trends in sectors like oil & gas or mining would undermine the near term growth outlook as a key risk to watch. Monitoring points over the next few quarters include cash flow levels and the trends in margins.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

BOOX Research is now Dan Victor, CFA

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.