UMH Properties: Overvalued, High Dividend Payout Ratio A Concern

Summary

- UMH Properties is a residential REIT specializing in manufactured home communities, with a portfolio of 135 communities and 25,700 homesites, primarily in Pennsylvania and Ohio.

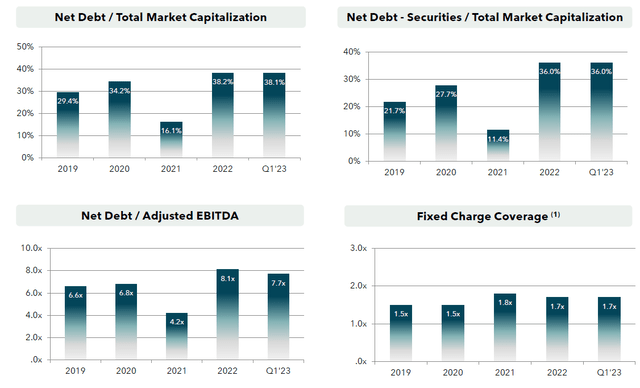

- The company has a high net debt-to-EBITDA ratio of 7.7x and a history of high dividend payout ratios, raising concerns about its financial stability and dividend sustainability.

- Despite management's expectations of increased income from clearing the backlog of homesites, the perceived risks and current overvaluation lead to a "Sell" rating for the company.

Marje

Introduction

Regular readers of my articles will know that I write mainly about REITs. I am always seeking to expand my dividend portfolio and this means keeping a lookout for new REITs to add to my portfolio. So it should come as no surprise that the focus of this article, UMH Properties (NYSE: NYSE:UMH), is a REIT. In this article, I will evaluate the company based on the available information to determine if I will add it to my portfolio.

The Business

UMH Properties is a residential REIT specializing in manufactured home communities. The company's primary business is the ownership and operation of these communities. The main bulk of the company's revenue comes from rental income through leasing the manufactured homes to residents, while the remaining revenue comes from the sale of both new and used manufactured homes.

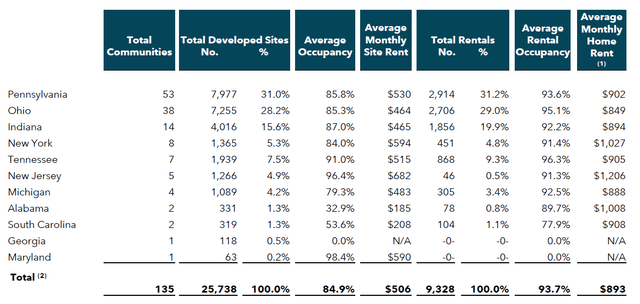

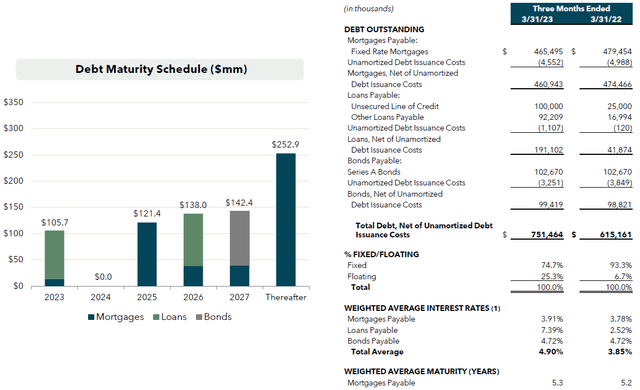

As at 31 March 2023, the company's portfolio comprises 135 manufactured home communities, encompassing approximately 25,700 homesites. This is an increase of 6 communities and 1,500 homesites compared to the prior year. The majority of these communities are located in the states of Pennsylvania and Ohio. In fact, approximately half of the company's developed and non-developed homesites are located in the Marcellus and Utica Shale Region - these are energy rich areas and one of the largest sources of natural gas. With increasing demand expected in these areas, the company is well-positioned to benefit from any potential growth opportunities driven by the natural gas industry.

The company's rental portfolio currently comprises 9,300 units, an increase of 570 units compared to the prior year. Looking ahead, the company expects to add an additional 700-800 homes to its portfolio each year. The company has 4,000 unoccupied homesites at present, with a capacity for a further 8,400 future homesites, potentially increasing the company's future revenue.

UMH Jun 2023 Investor Presentation UMH Jun 2023 Investor Presentation

Balance Sheet

The company currently holds $32.9 million in cash and cash equivalents, with a further $39.3 million in marketable securities which can be readily converted into cash. The company also has an $80 million credit facility, along with access to a further $51.4 million through its lines of credit for the financing of home sales and purchase of inventory as well as a $34.9 million line of credit secured by rental home and rental home leases. To further strengthen its liquidity, the company also has the potential to access an additional $400 million through an accordion feature. Additionally, the company recently announced that it had entered into a $25 million term loan with FirstBank.

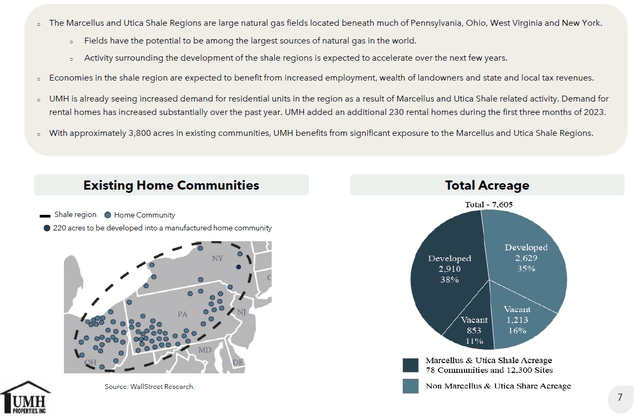

When it comes to the company's debt profile, UMH Properties carries approximately $750 million in debt with a weighted average maturity of 5.3 years. Funnily enough, there are no debt payments due in 2024, meaning that once the company has fulfilled its debt payments of $105 million for the year, it will have no outstanding liabilities until 2025. 74.7% of the company's debt is fixed, reducing the risk of interest rate fluctuations (which look like they will be rising further) and ensuring more predictable cashflows for the company.

UMH Jun 2023 Investor Presentation

While the company has a reasonably healthy interest coverage ratio of 2.4x, meaning the company is able to cover its interest payments, the company has a net debt-to-EBITDA ratio of 7.7x. This is fairly high, and it has to be noted that it has increased in recent years.

UMH Jun 2023 Investor Presentation

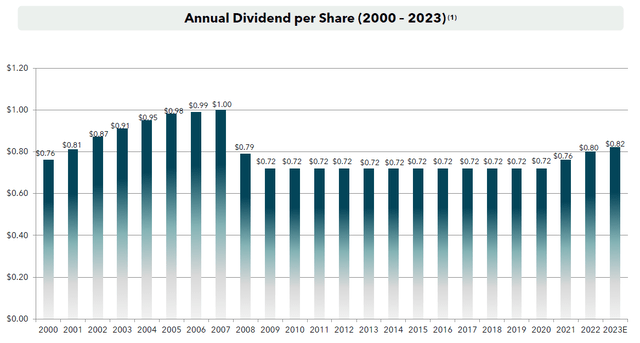

Dividend

When it comes to dividends, the company has a commendable track record, consistently paying dividends even during the pandemic. For over a decade, and throughout the pandemic, the company maintained a quarterly dividend of $0.18/share. The company finally increased its dividends in 2021, again in 2022 and once more this year in 2023 to give a quarterly dividend of $0.205/share. Based on the current share price of approximately $15.50, this gives the company a forward dividend yield of around 5.30%.

UMH Jun 2023 Investor Presentation

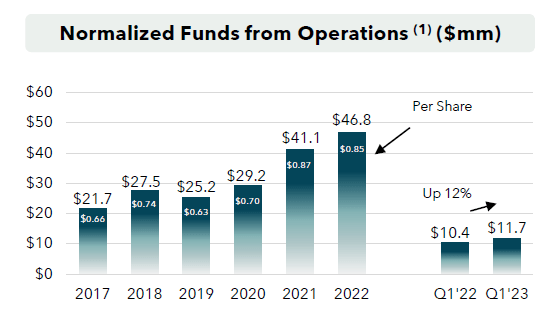

While a consistent dividend is good, the sustainability of the company's dividend has to be considered as well. From 2017 to 2020 (excluding 2018), the company's dividend payout ratio actually exceed 100%, with the annual dividend payout of $0.72/share exceeding its normalized funds from operations (FFO). While the dividend payout ratio improved slightly in 2021 to 87%, it increased again to 94% in 2022. For the latest period, Q1 2023, the dividend payout ratio was just over 100% with a quarterly dividend of $0.205/share in dividends compared to $0.20/share in normalized FFO.

According the management, the company has a targeted dividend payout ratio of 80%. While that is certainly a good target, as it means the dividends will be amply covered, it remains to be seen if the company will be able to meet its target.

UMH Jun 2023 Investor Presentation

Valuation

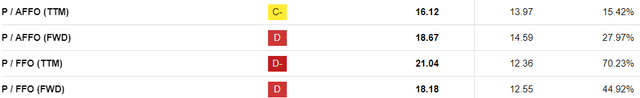

The company currently trades at a premium compared to its peers, based on various metrics. In fact, the Seeking Alpha quant rating for the company's valuation is a "C-", indicating a less than attractive valuation. While valuation shouldn't be the sole consideration in deciding whether to invest in a company, it does play a significant factor and the fact that the company is currently overvalued is important.

Risks

There are several concerns I have regarding UMH Properties, which are interrelated. First is the company's high leverage - its net debt-to-EBITDA ratio of 7.7x is one of the highest it has been in recent years which does raise concerns about its financial stability, which brings me to my next point. The company has historically had high dividend payout ratios, sometimes exceeding 100%. While management has a stated target payout ratio of 80%, I find it hard to believe it will be able to meet it given how it hasn't come close previously. The alternative to increasing its FFO would be to decrease its dividends, which isn't ideal.

Next, the company's significant exposure to the Marcellus & Utica Shale Region raises concerns about the company's overreliance on these areas and the potential impact of any accidents or shifts in natural gas demand. Any adverse events in the region would negatively impact the company's rental income and property values. Adding to my concerns is the company's current overvaluation, with it trading at a premium compared to its peers.

Of course, it has to be stated that it is not all doom and gloom. Management has highlighted the company is still suffering from supply chain issues from the pandemic resulting in a backlog of homesites. As this backlog clears, the company should see its income increase.

Conclusion

UMH Properties faces several challenges, chief among them a high dividend payout ratio and a heavy reliance on the demand for natural gas. Management has stated that the company's income is expected to pick up as it clears its existing backlog of homesites, thereby alleviating some of the challenges. However, to me, the perceived risks outweigh the benefits - the risks right now are very real while the management's expectations of an increase in income are merely a forecast. Additionally, with the shares trading at a premium, I don't find any value in investing in the company at the moment.

All things considered, this leads me to have a "Sell" rating on the company. Of course, things may change and I will re-look at the company again in a few months to see if there are any new updates which make me change my mind.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.