A Renewable Energy Powerhouse: Why Enel Chile Is Poised To Outperform

Summary

- Initiating coverage on Enel Chile with a 12-month target price of $4.20/share, offering a potential upside of 26.65% and anticipated dividend yields of 12% in 2023 and 7% in 2024.

- The company is successfully executing its non-conventional renewable energy sources (NCRE) strategy, reducing exposure to hydrologic risk, fuel prices, and polluting energy sources.

- Despite reduced political risk, growth in renewables, and an improved balance sheet, Enel Chile still trades at a steep discount to its regional peers.

A Concentrated Solar Power Plant Uses Mirrors To Produce 210MW In Atacama Desert, Chile John Moore/Getty Images News

Investment Thesis

I am initiating coverage on Enel Chile (NYSE:ENIC), giving it an outperform recommendation and a 12-month target price of $4.20/share. This offers a potential upside of 26.65%, with anticipated dividend yields of 12% in 2023 and 7% in 2024. Enel Chile's green initiatives appeal to me, as the company effectively integrates Non-Conventional Renewable Energy sources "NCRE" to reduce its exposure to hydrologic risk, fuel prices, and polluting energy sources. With reduced political risk, I find ENEL's multiples attractive and foresee a stronger balance sheet following the sale of its transmission assets and the monetization of its Shell contract. This will enable the company to further enhance its energy mix and transition its matrix.

Part 1: Company Overview

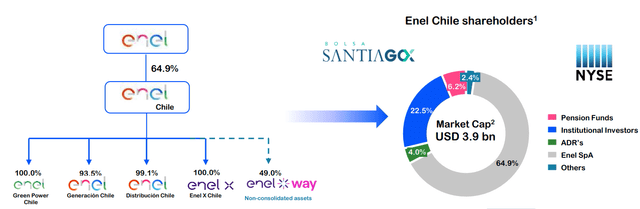

Corporate Structure (Investor Presentation, June 23 )

Enel Chile, a leading integrated utility in Chile with a market cap of $3.9 billion, boasts an impressive net installed capacity of 8.5 GW. The company's distribution segment provides services to over 2.1 million customers in Santiago de Chile under an indefinite concession. In 2022, Enel successfully unlocked value through asset sales and LNG contract negotiations. This allowed the company to not only reduce its debt profile but to also return money to shareholders by paying a dividend ($0.3157/share at delivering an attractive 11% yield) based on its enhanced liquidity. Enel's strategic plan emphasizes its commitment to its integrated portfolio, promoting efficiency, and digitalizing its grid as Chile's energy transition accelerates.

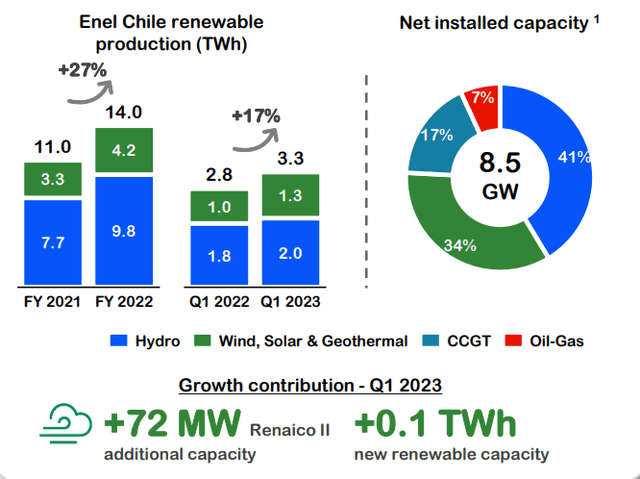

Investor Presentation, June 23

Enel's generation business is split between Enel Generación Chile and Enel Green Power, with the latter concentrating on NCRE capacity. The company has substantially advanced its energy transition, increasing NCRE investments and expediting coal plant closures. In 2022, Enel completed the coal phase-out with the Bocamina plant's disconnection, becoming Chile's first coal-free generator. As the largest generator in Chile, Enel holds a 27% share of installed capacity and nearly 24% of generation. For 2023, I expect Enel Chile to have a more diverse generation mix, with reduced reliance on thermal generation. This will allow the company to sell surplus LNG cargo and strategically import gas from Argentina at lower costs. Gas imports from Argentina resumed a few years ago, but since last October, the Argentine government permitted firm exports during off-peak months.

Investor Presentation, June 23

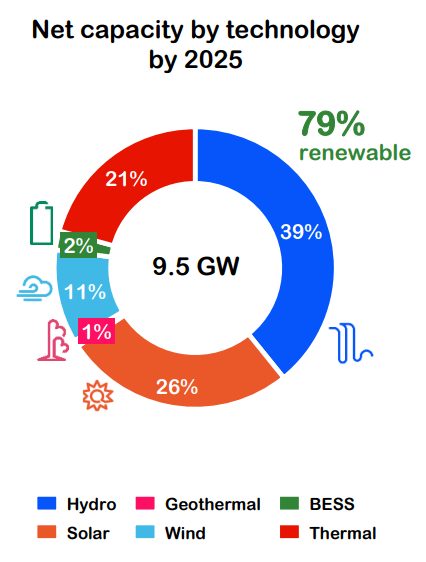

By the end of 2022, renewables constituted 76% of Enel's generation capacity. The strategic plan for this segment entails continued growth in renewables, focusing on developing a flexible portfolio while minimizing spot exposure to manage higher intraday volatility (as transmission constraints are expected to last until 2030) and a new normal of suboptimal hydrologic conditions in the region. By 2025, Enel aims to reduce its spot exposure by 26%, from 5.3 TWh in 2022 to 3.9 TWh, primarily by decreasing 1.1 TWh during non-solar hours to capitalize on low prices during solar hours.

Investor Presentation, June 23

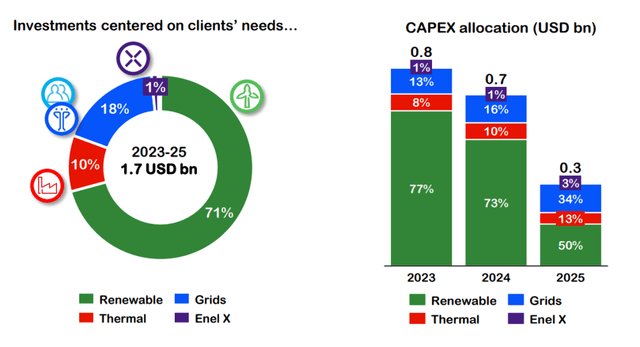

Between 2023 and 2025, Enel Chile anticipates investing US$ 1.4 billion in generation capex, with 78% allocated to developing renewables, primarily solar and wind projects, along with Battery Energy Storage Systems "BESS". This investment is expected to increase the company's net capacity from 8.5 GW to 9.5 GW. Currently, 0.7 GW of projects are under construction, with solar accounting for 43% of the total. Enel is further bolstering this strategy by entering agreements to purchase energy from third parties through PPA acquisitions.

Investor Presentation - FY 2022

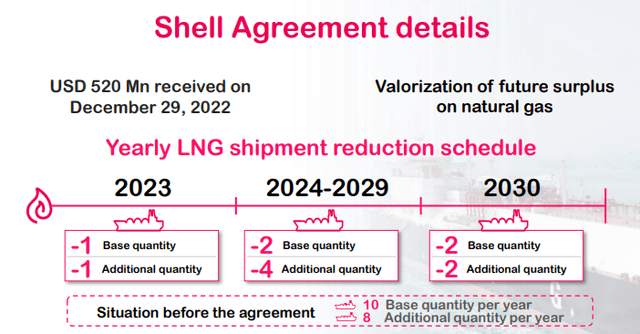

Renegotiation of Long-Term contract with Shell

In 2022, Enel Chile successfully renegotiated its long-term LNG contract with Shell, capitalizing on favourable international prices and the company's reduced future gas requirements. The amendments to the contract allowed for the partial disposal of specific LNG volumes, which were anticipated as surplus volumes based on Enel Generación Chile's acquired commitments. As a result, Shell agreed to pay US$ 520 million, a figure that was recorded in Enel's 2022 financials, contributing an additional US$ 355 million to its bottom line. Moving forward, Enel Chile plans to continue selling any surplus gas volumes. Throughout 2022, the company sold the equivalent of approximately 14 LNG ships, and by Q1 of 2023, it has already sold 4 LNG ships, generating an extra US$ 150 million in EBITDA from these surplus gas trading operations.

Renegotiated terms of Shell Agreement (Investor Presentation, FY 2022)

Distribution and Transmissions Segments

Enel's distribution segment serves over 2.1 million customers in Santiago de Chile's metropolitan area under an indefinite concession agreement. The company plans to invest US$ 400 million over the next 2 years to improve service quality, and reliability, and digitalize the grid, aiming to increase users to 2.2 million. In December 2022, Enel completed the sale of its 99.09% stake in Enel Transmision Chile to Saesa Group for US$ 1.4 billion, plus repayment of US$ 202 million of intercompany debt, generating a positive US$ 769 million impact on net income. This sale aligns with their strategy to monetize assets, reduce debt, and prioritize investments in electrification and decarbonization.

Green Hydrogen

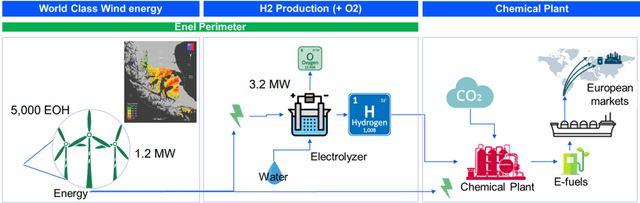

Chile has a competitive advantage in creating low-cost green hydrogen. Produced via electrolysis using renewable energy, between 60-80% of green hydrogen's cost is typically electricity, and Chile can generate renewable energy inexpensively, using solar power in the north and wind in Magallanes. The Chilean government aspires to be a global leader in Green Hydrogen production and in 2021, signed an MoU with Singapore to collaboratively develop Green Hydrogen projects in Chile. Thus far, Enel Chile owns the only operating green hydrogen pilot project in Chile - Haru Oni, an integrated commercial-scale hydrogen plant for synthetic fuel production. This positions the company to potentially benefit as Chile ramps up its green hydrogen initiatives. Haru Oni is a joint project involving HIF (Highly Innovative Fuels), Enel Chile, ENAP, Siemens Energy, Empresas Gasco, Exxon Mobile, and Porsche, and the plant will produce 130,000 litres of synthetic gasoline annually using e-methanol (a compound synthesized using Enel's Green Hydrogen).

Investor Presentation, June 2023

Part 2: Sector Overview

Chile is a leader in Latin America's energy transition, having significantly increased its NCRE capacity since implementing the NCRE Law in 2008. NCRE sources now account for 36% of Chile's installed capacity, surpassing initial targets. However, Chile must address energy storage legislation to enable pure storage systems to partake in the market and reduce solar energy curtailments, which have risen sharply (224% higher in 2022) due to transmission bottlenecks and stalled BESS projects.

In November 2022, Chile enacted a new law on electric energy storage and electromobility. However, this has not yet been incorporated into regulations due to controversy among power generators that the law's implementation would negatively impact capacity payments for solar projects.

New Projects

Chile has auctioned energy generation contracts for a total of 35,522 GWh since 2013. Average prices in these auctions have decreased due to three main factors:

- The NCRE law encouraged a transition from thermal to renewable energy sources;

- Technological advancements, which resulted in reduced capital expenditures (decreasing by 81% between 2010 and 2020, according to the International Renewable Energy Agency) and lower operating costs; and

- A low-interest-rate environment prior to the pandemic provided favourable financing options.

Electricity Price Stabilization Mechanism

Following the 2019 protests, Chile introduced an electricity tariff stabilization fund, PEC, to keep tariffs fixed and financed by generation companies. The PEC fund reached its maximum limit of US$ 1,350 million earlier than expected in February 2022, leading to the establishment of a new temporary client protection mechanism, MPC, with a maximum limit of US$ 1,800 million to be repaid by 2032.

The key difference between MPC and PEC is that Chile's Treasury Department, rather than power generation companies, will bear the difference between the average node price "PNP" and the price paid by customers. The government has secured financing through the Inter-American Development Bank "IDB" for MPC, which includes a stabilization and energy emergency fund.

In April 2023, the MPC began operation, allowing all generators, including Enel Chile, to recover their accumulated balances in accounts receivable with the IDB. Enel Chile expects to recover US$ 500 million, with US$ 300 million in 2023 and the remaining US$ 200 million in 2024.

COVID-19 Emergency Law and Impact

In 2020, as a response to the COVID-19 pandemic, the Chilean government and power companies agreed to suspend service terminations for unpaid bills. Initially focused on vulnerable households, the program was later extended to senior citizens and individuals who had lost their jobs. The initiative continued until December 2021, with 10% of the total clients accumulating a debt of US$ 355 million. Since then, users have been permitted to repay their debts in up to 48 interest-free installments, as long as they keep up with their new bills. However, the law did not cover financing, leaving distribution companies to bear this burden.

Hydrology

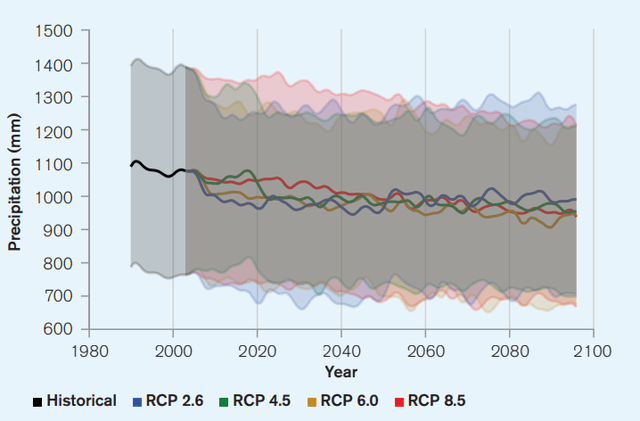

Projected Annual Precipitation in Chile (Climate Knowledge Portal, World Bank)

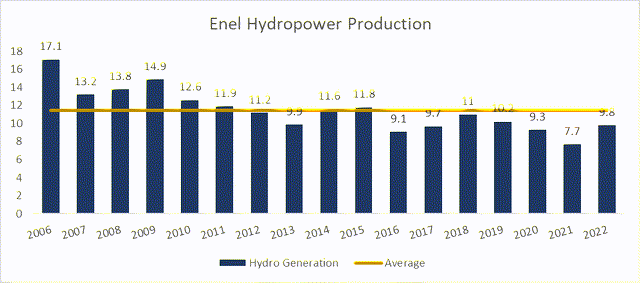

Rising temperatures and a fall in annual precipitation levels have put significant pressure on Chile's water reservoir levels. Climate change has led to increased hydrologic risks and as a result, reduced hydropower production in Chile. This has impacted Enel Chile as well, and the company's hydropower generation has been on a steady decline since 2015, with the most severe impact in 2021-2022, when Chile experienced its worst-ever drought. In response, Chile's national water authority DGA declared an extreme water shortage and implemented rationing, affecting 47% of the population. While recent hydrology reports show improvement, Enel foresees this situation as the new normal and has been investing more in NCRE to mitigate risks and shift its mix to a more renewable energy-focused generation.

Enel's Hydropower production at new normal lows (Enel Chile, MDPI)

As of early 2023, reservoir levels indicate that hydrologic conditions remain difficult. In March, the equivalent energy stored in the main reservoirs was 16% higher than the same period in 2022. Although this represents an improvement compared to 2020-21, it is crucial to keep an eye on rainfall levels, which are still 35% below the historical average for the period from 1985 to 2023.

Energy Integration with Neighbours

Argentina and Chile's governments signed an agreement in June 2022 to exchange nat. gas and solar power -> Argentina will supply Chile with natural gas, especially in the southern part of Chile, in exchange for solar and wind power exports from Chile. The deal aims to strengthen energy security and integration between the two countries. It will allow Chile to diversify its energy sources and decrease its dependence on natural gas. For Argentina, it will provide a new export market. The 5-year agreement, extendable for 5 more years, starts with swapping 2 million cubic meters per day of natural gas and 300 MW of solar/wind power but targets 10 million cubic meters of gas and 1 GW of solar/wind power.

Part 3: Investment Thesis and Estimates

In 2022, Enel Chile began shifting the balance of its exposure to hydrologic risk and polluting fuel sources - It delivered improved operational results in H2, featuring a more diverse generation mix and lower gas costs. This enabled the company to achieve a 63% YoY EBITDA increase (excluding one-off gains from the sale of its transmission assets and the valorization of its Shell contract) to US$ 948 million, up 40% YoY and a net income growth of 251% YoY to US$ 393 million, up 128% YoY. The sale of the company's transmission assets contributed US$ 769 million to the bottom line while monetizing its Shell gas contract added US$ 520 million to EBITDA and US$ 355 million to the bottom line. Additionally, the company successfully closed all its coal plants. Using proceeds from the sale of Enel's transmission business to prepay $1 billion of its debt, the company ended 2022 with a Net-Debt/EBITDA ratio of 2.8x (or 4.3x excluding one-offs in EBITDA), a 60% reduction from 2021 levels. About 84% of the company's debt is fixed with an average maturity of 3 years at average cost of 4.1%.

US$ (millions) | 2021 | 2022 | 2023E | 2024E | 2025E |

Revenue | 3,355 | 6,196 | 5,323 | 5,140 | 4,267 |

EBITDA | 675 | 1,468 | 1,282 | 1,519 | 1,300 |

Net Income | 172 | 1,636 | 571 | 699 | 499 |

Net Debt | 2,017 | 1,717 | 2,151 | 2,202 | 2,321 |

FCFE | (535) | (391) | 610 | 1,178 | 712 |

EV/EBITDA | 7.8x | 3.8x | 7.9x | 6.9x | 6.1x |

P/E | 30.1x | 2.7x | 7.7x | 7.5x | 8.4x |

FCFE Yield (%) | -14% | -3% | 14% | 27% | 16% |

Dividend Yield (%) | 8% | 1% | 12% | 7% | 8% |

As 2023 progresses, I view Enel Chile as having a reduced debt profile and enhanced flexibility to continue executing its strategy, with a focus on:

- bolstering the resilience and adaptability of its generation portfolio while transitioning to decarbonization;

- augmenting electrification and value-added services; and

- persisting with the digitalization of its grid to support the energy transition.

I anticipate the company to deliver EBITDA of US$ 1.2 billion, in line with its latest guidance, with increased contributions from renewables in the generation mix (71% of generation in 2023, compared to 63% in 2022). I project net income to reach US$ 571 million, also aligned with the company's guidance range (US$ 300-500 million).

Peer Comps

Peers | EV/EBITDA | P/E | ||

2023E | 2024E | 2023E | 2024E | |

EDP - Energias do Brasil (EDB) | 8.74x | 8.64x | 15.46x | 13.29x |

Neoenergia (NEOE3) | 15.45x | 14.65x | 9.40x | 8.97x |

COPEL - Companhia Paranaense de Energia (ELP) | 6.23x | 6.22x | 12.34x | 10.04 |

Eletrobrás - Centrais Elétricas Brasileiras (EBR) | 11.35x | 9.70x | 43.84x | 27.61x |

Equatorial Energia (OTCPK:EQUEY) | 8.23x | 7.17x | 18.27x | 13.21x |

Engie Energia Chile (ECL.SN) | 8.35x | 7.26x | 13.99x | 7.00x |

Alupar Investimento (ALUP11.SA) | 8.10x | 8.01x | 14.71x | 11.59x |

Peer Mean | 9.49x | 8.81x | 18.29x | 13.10x |

Peer Median | 8.35x | 8.01x | 14.71x | 11.59x |

Enel Chile (ENIC) | 7.88x | 6.99x | 7.77x | 7.52x |

As seen in the Comps table above - despite reduced political risk, growth in renewables and improved balance sheet, Enel Chile still trades at a significant discount to its regional peers on trading multiple such as Forward GAAP EV/EBITDA and Forward GAAP P/E (ENIC's 7.7x PE 2023 is at a 56% discount to its peers)!

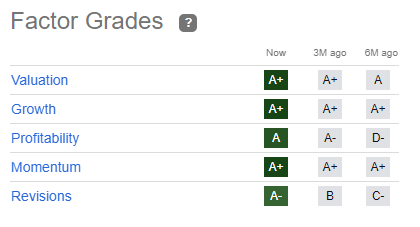

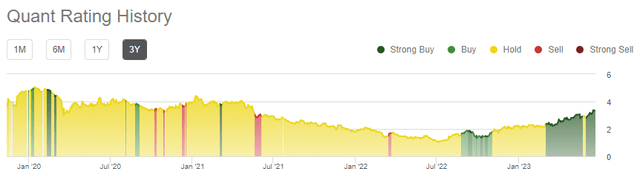

Seeking Alpha's Factor Grades also places Enel Chile at a Strong Buy (4.91) based on its valuation, growth, profitability, momentum and revisions in Revenue & EPS estimates. SA's quant ratings currently rank it at #3 in the entire Utility sector, after PAM and EDN.

Valuation and Risks

Based on the company's trading multiples as well, the company is currently trading at a cheap discount to its peers.

I derive a 12-month price target of US$ 4.20 is estimated using a DCF model with a 9.9% USD WACC. The stock price has climbed 56% YTD and 105% since rejecting the first constitution draft but still sees further upside from lower political risk, operational improvements and multiples below historical levels.

Discount Rate | |

Risk-free Rate | 4.30% |

Country Risk | 1.40% |

Equity Risk Premium | 6.50% |

Beta | 1.0 |

Cost of Equity | 12.10% |

Proportion of Equity | 70% |

Cost of Debt | 6.50% |

Effective Tax Rate | 27% |

Cost of Debt | 4.70% |

Proportion of Debt | 30% |

WACC | 9.90% |

Valuation | |

WACC | 9.9% |

Term (years) | 5 |

Perpetual Growth % | 2.0% |

Perpetual g (US$ Mn) | 4.82 |

DCF (US$ Mn) | 2.67 |

Enterprise Value (US$ Mn) | 7.49 |

(-) Net Debt (US$ Mn) | -2.04 |

Equity Value (US$ Mn) | 5.45 |

O/s shares in millions | NYSE ADR | SSE Domestic |

1383 | 69.17 | |

12M Target Price | USD | CLP |

4.204 | 67 |

However, it is important to note the following downside risks to my valuation:

- Hydrology: Energy levels accumulated in reservoirs remain below historical levels. Less hydropower would require more non-conventional renewable energy and thermal power, negatively impacting margins.

- Transmission constraints: Near-term constraints include increased energy curtailments (up 224% in 2022). The Chilean government's Kimal-Lo Aguirre HVDC (high-voltage direct current) line will address bottlenecks in 2030 but risks project delays.

- Cost pressures/project delays: Inflation could lead to overruns/delays, raising dependence on thermal power and underperformance.

- Lower demand/prices: Macro worsening could lead to reduced electricity demand. Although recent energy bid prices indicate higher prices for future PPA contracts, increased competition may reduce prices. I assume Enel's average generation price falls 8% by 2025 in USD, slightly above the 5% drop in the mean PPA price and 7% reduction in thermal.

- Regulated market exposure: Enel Chile has a significant presence in the regulated market, with regulated customers representing 36% of the company's GWh sold and 45% of its generation revenues in 2022. In 2019, prior to the pandemic, regulated customers accounted for 55% of GWh sold and 61% of generation revenues. While transitioning to a free market may result in lower prices, it also reduces the risk of delays in adjustments, which were experienced on the regulated side due to government policies responding to the social protests in Chile in 2019 and the COVID-19 pandemic.

- Regulatory risk: While a rejected first constitution draft suggests fewer extreme changes and less threat, regulatory uncertainty remains.

Part 4: Conclusion

In conclusion, Enel Chile is well-positioned to benefit from Chile's accelerating energy transition. The company has successfully advanced its strategic objectives, strengthened its balance sheet, diversified its generation mix, and is unlocking further value through asset sales and contract renegotiations. These accomplishments provide Enel Chile with the flexibility and means to continue developing its pipeline of renewable energy projects to support Chile's decarbonization goals.

Although risks related to hydrology, transmission constraints, macro conditions, and regulation remain, I believe Enel Chile's attractive valuation compensates investors for these risks. Enel Chile continues to trade at a significant discount to its regional peers, despite its reduced political risk, stellar growth in renewables and improved balance sheet. My price target of US$4.20 suggests an upside of 26.65% from the current mispriced levels.

In summary, Enel Chile exhibits a compelling investment case based on its decarbonization-focused strategy, strengthened financial position, diversified operations, and strong valuations. The company is poised to benefit as Chile's energy transition accelerates in the coming years. I reiterate my Outperform/Buy recommendation for Enel Chile.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.