Raytheon Can Likely Keep Growing Its Dividends For A Long Time

Summary

- Raytheon, a defense contractor, has consistently raised its dividends for 29 years, making it a dividend champion with a current payout ratio of 57%.

- The company has a large backlog of orders totaling around $200 billion and is expected to raise its EPS by 64% between 2023 and 2027, potentially doubling dividends in the next five years.

- Raytheon's stock is attractive for dividend growth and value investors, but risks include potential cuts in defense budgets by governments worldwide.

passion4nature/iStock Editorial via Getty Images

Raytheon (NYSE:RTX) is a defense contractor specializing in aerospace and the company provides products and services for governments, militaries and corporations around the world. The company has an impressive record of growing its dividends for 29 years in a row, and it already has a special place in portfolios of many dividend growth investors. In this article we will look at not only sustainability of the company's stock but also its ability to further raise dividends in the future. My thesis is that Raytheon can keep raising its dividends for a long time if it meets or beats its growth expectations.

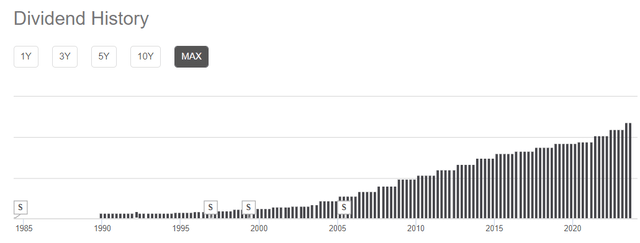

As you can see below, the company has been raising its dividends for a very long time. While it's not yet a dividend king (i.e. a company that raised its dividends for 50+ years in a row), it is a dividend champion (i.e. a company that has raised its dividends for 25+ years in a row). While it's impossible to predict a company's future dividend behavior from its past behavior with certainty, it's safe to say that a company that has raised its dividends consistently for 25+ years is more likely to keep raising them for the foreseeable future than not.

Raytheon dividend history (Seeking Alpha)

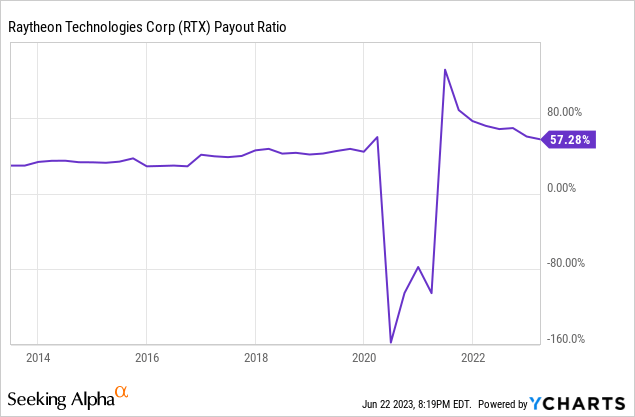

The company's current dividend payout ratio is 57% which means that for every $100 it generates in profits, it pays $57 in dividends. Typically, you want a company's dividend ratio to be around 50%, but anywhere from 40% to 60% is fine. If it's too low, maybe the company is not prioritizing its dividends (which is not necessarily bad but not best for dividend-oriented investors), if it's higher than 60%, it could mean that there is limited room for the company to grow its dividends. Of course there are also companies that have a low payout ratio but increase their dividends aggressively such as many tech stocks like Microsoft (MSFT) and Apple (AAPL) but those are rare. A dividend payout rate of 57% tells me that the company can comfortably afford to pay its current dividend and possibly keep raising it if its profits keep rising.

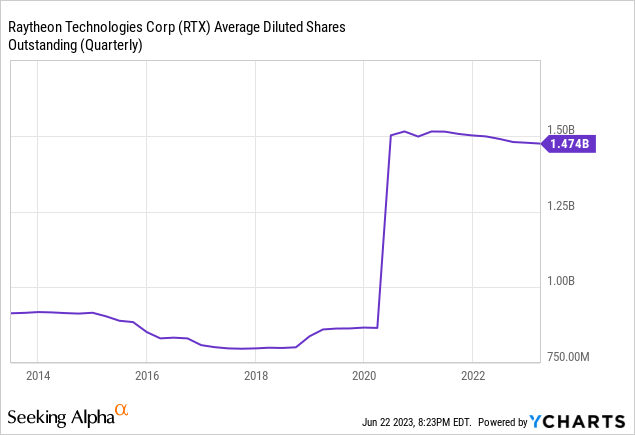

Many times when a company is raising dividends aggressively, it is also buying back shares because having fewer outstanding shares means that it can pay more per each share while keeping the total payment the same. Interestingly enough, Raytheon typically buys its shares back and reduces its share count slowly, but we see a huge spike in the company's share count in 2020. This isn't anything to worry about in my opinion because the spike you are seeing in the chart was caused by the merger of Raytheon with United Technologies. In the merger, each Raytheon stock was converted into rights offerings of 2.3348 new RTX shares, which boosted the number of shares outstanding.

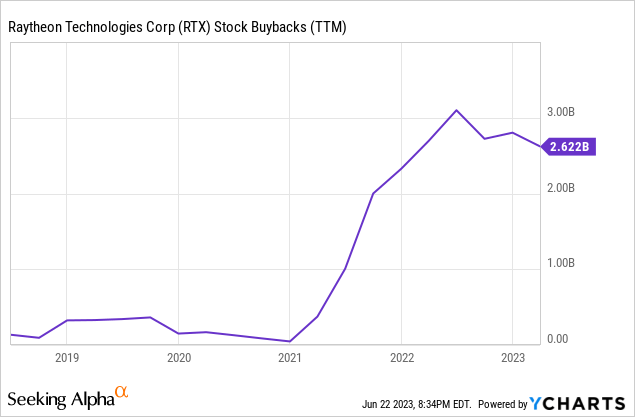

If you don't count that, the company has been buying back stocks, and it is authorized to buy back another $3 billion worth of stock this year, which corresponds to about 2% of its total share count. The more stocks the company buys back, the more room it will have for raising dividends in the future.

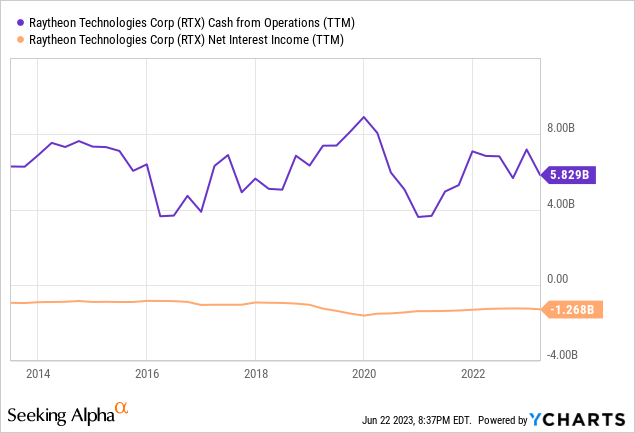

When we look at the company's cash flows, we see that it generates close to $6 billion in operating cash flow and spends about $1.27 on interest payments. This gives the company some cushion to return cash to investors in the form of dividends and stock repurchases. Meanwhile, the company still has about $36 billion in total debt, which could have been a lot worse if its merger with UTX wasn't a stock deal. Thankfully, the company didn't need to raise debt to complete the merger, even though it diluted shareholders by increasing share count.

Since we are looking at whether the company can keep hiking its dividends, it's important to talk about its future. Currently, we live in volatile times in the global politics. After Russia's invasion of Ukraine (and China's possibility of invasion of Taiwan), Germany announced a pretty sizeable hike of 100 billion euros ($110 billion) in its defense budget in the next decade. This was the first time Germany announced such a large defense budget increase since the WW2. Similarly, Poland is increasing its military budget to 3% of its total GDP and doubling its troop size. Many other countries are taking similar actions, which should benefit companies like Raytheon.

It's also interesting to note that defense weapons are getting more technological, more sophisticated and more advanced each year. Now having more advanced weapons will make even more difference than ever for countries. Raytheon and UTX jointly own many advanced technologies, and they might find little trouble finding customers in the future. Of course, since this company mainly operates in the US it can only sell weapon systems to countries with the approval of the US government, so don't bet on this company expanding into Chinese or Russian markets anytime soon.

It's also important to notice some risks that might be brewing, though. The biggest customers of this company are governments around the world, and many governments are already loaded with debt as we speak. In the future we could see a movement where countries are inclined to spend less and start having more balanced budgets and even try to pay off some of their debt. If this movement were to gain traction, military budgets can get cuts across the world. Of course, in order for this to happen, we'd need to see a cooldown in the geopolitical environment and significantly less threat of war.

It is also important to note that the company already has a pretty large backlog of orders totaling close to $200 billion, including its commercial business. The current backlog represents about ~3 years' worth of revenues for the company. While there is always the risk that governments and companies can cancel orders and no order is final until it has been fully paid for and delivered, the risk of all of this backlog disappearing is very slim. At least we know that it hasn't happened in a very long time, if ever, with the exception of some commercial orders getting canceled in 2020 during the pandemic.

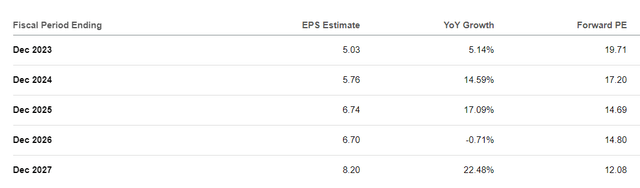

Speaking of the future, analysts covering this stock seem to be very optimistic about its prospects for the foreseeable future. They expect the company to increase its EPS by 64% between 2023 and 2027. Raytheon is expected to earn $5 this year, followed by $5.76 next year, $6.74 in 2025 and finally $8.20 by 2027. Considering that the company is spending about 57% of its net earnings in dividends, we can expect it to hike its dividends to $3.20 next year, $3.84 by 2025 and $4.67 by 2027. Even if it were to cut its dividend payout ratio to 50%, we'd still look at pretty sizeable hikes where it reaches $4.10 by 2027. Considering that the current dividend payment is $2.36 annually, we are looking at dividends almost doubling potentially in the next 5 years if the company can meet analyst expectations.

Raytheon analyst expectations (Seeking Alpha)

Raytheon is a good stock overall. It will especially satisfy needs of dividend growth investors as well as value investors with its low forward P/E which currently sits at 17 based on 2024 estimates and 15 based on 2025 estimates. It also trades at about 20 times forward operating cash flow, which can be considered solid for an industrial giant that is still in its growth stage. The biggest risk for this investment thesis is if we start seeing governments around the world start cutting defense budgets, but I don't see it happening anytime soon with the current geopolitical environment.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.