SOYB: The Long And The Short Of It

Summary

- The Teucrium Soybean Fund is designed to mirror the performance of soybean futures.

- We present the long-term investment case.

- We touch upon a few short-term developments.

- We cover the technical picture.

Drs Producoes/E+ via Getty Images

Introduction

Equity investors who are on the lookout for alternative avenues of diversification may consider dabbling with the Teucrium Soybean Fund (NYSEARCA:SOYB) which has exhibited a negative correlation with the S&P500 (-0.005) since its listing date. In fact, Soybeans have traditionally proven to be one of the most notable commodities that has enjoyed the lowest correlation with equities.

Teucrium

For the uninitiated, SOYB does not track spot prices of soybeans but is rather set up to track the weighted average daily settlement price of three Soybean futures contracts of differing maturities.

Long-Term Investment Case

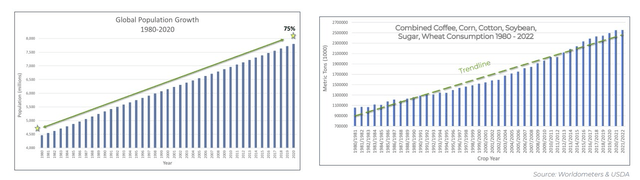

Firstly, on the demand side, it's worth considering that over the last 40 years, the global population has grown by 75%, and that has provided the foundation for not just increased soybean requirements but other key agri-commodities as well.

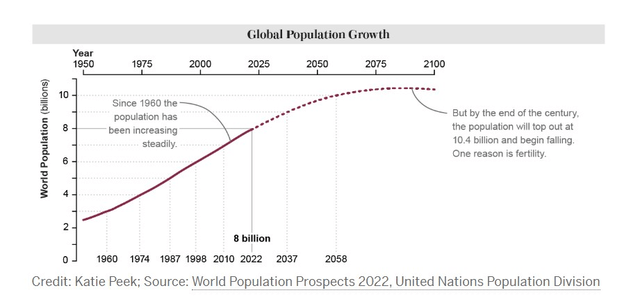

Some cynics would point to the specter of the slowdown in population growth, and whilst that is a legitimate concern, the situation is not expected to top out until 2080 or so, which is a long way off.

Even if you want to downplay the population effect, one shouldn't underestimate the prosperity effect where the per capita spending has been going up. This is of course driven by the spending habits of an emerging middle class are expected to account for 57% of the global population by the end of this decade (up from 45% in 2020).

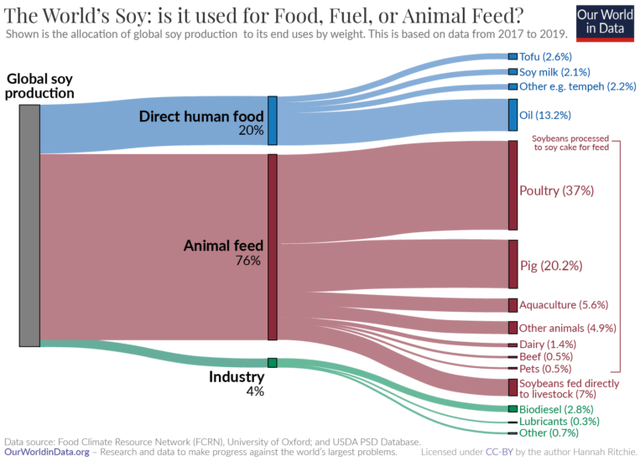

A growing middle class also means greater demand for meat consumption, and that's where soybean in particular stands to gain, as over three-quarters of production is directed towards animal feed.

Due to its high protein content, and amino acid characteristics, soy's utilitarian qualities are most keenly felt in the poultry sector. Global poultry consumption is expected to steadily grow at 2% CAGR through the end of this decade.

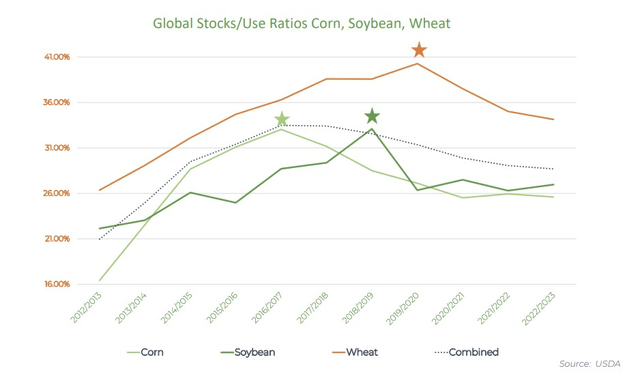

On the supply side, global soybean supplies are estimated to have peaked in 2018/2019 with the global stocks-to-use ratio hovering above the 26% levels in recent years (the stocks-to-use ratio captures ending soybean stocks as a function of total usage).

Short-Term Developments

Supply dynamics within US and Brazil are worth monitoring as these two nations jointly account for 69% of total global production. Broadly it's fair to say that the supply-side position in both these regions could likely cap soybean prices although inclement weather-related developments may cause spikes like we've seen recently.

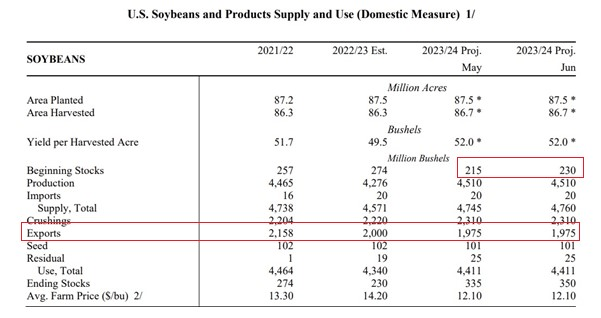

In the US, for the marketing year 2023/24, the closing stock looks set to ramp up by ~5% YoY and hit levels of 350 million bushels. Firstly, the June report from the USDA suggests that the carryover from last year will be a lot more than previously thought (May's forecast was for 215m bushels, but this has recently been lifted by ~7% again).

USDA

Then, after some tremendous export momentum in recent years, the US is staring at a fairly underwhelming export narrative for the second straight year (1975 million bushels).

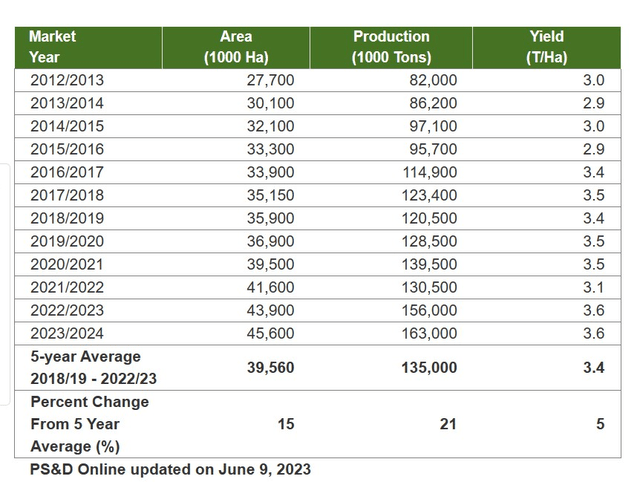

America's export position is largely being hampered by Brazil which has been going at full throttle, to make up for the 10% decline seen in its soybean exports last year (ANEC, Brazil's grain exporter association believes that exports from Brazil will likely grow by 17%). Production levels in Brazil are poised to come in at 163m metric tons, around 21% higher than the 5-year average, even as the overall acreage grows by 4%. YoY. All, in all, one is staring at a record-high crop level there as well.

Brazil soybean backdrop (USDA)

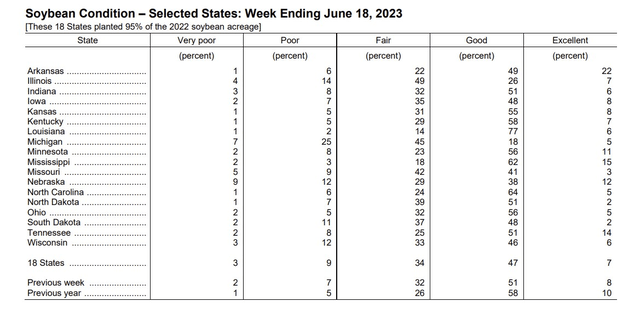

As things stand, soybean prices may continue to receive support from the world's largest consumer-China. Reports suggest that recently it imported record levels of 12m metric tonnes (implying 24% annual growth), but some of the inordinate spikes in May could be explained by an easing of stricter custom procedures at Chinese ports. Nonetheless, experts in China believe that June imports could be even larger at 13m. A failure to hit those levels may be taken poorly by the market. Soybean prices have also recently received a fillip from the USDA's crop progress report which suggests that soybean crops rated as good or excellent continue to dip sequentially.

Closing Thoughts - What Does The Technical Picture Look Like

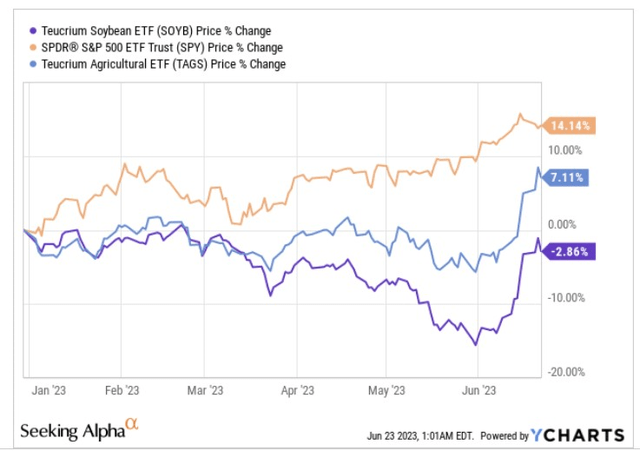

Admittedly SOYB hasn't been a rewarding play this year, witnessing price erosion of -3%, and not just underperforming large-cap US equities, but also lagging a diversified agri-futures fund - The Teucrium Agricultural Fund (besides Soybean, the TAGS ETF also covers corn, wheat, and sugar futures).

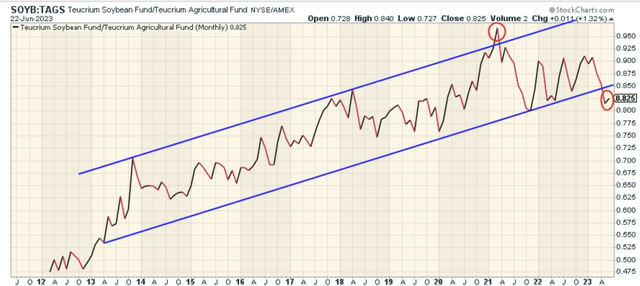

The underperformance this year may prompt some investors to question if SOYB could benefit from some mean-reversion interest in the future. Well, if we consider SOYB's positioning relative to the diversified agri portfolio, we can see that the former has been gaining clout over the latter since its listing date. Basically, SOYB's monthly relative strength (RS) over TAGS, has coalesced in the shape of an ascending channel over time.

Based on this chart alone, SOYB certainly looks like a very attractive bounce-back proposition as the RS ratio has now fallen below the lower boundary of the long-term ascending channel (just like it looked overbought in early 2021) and may mean-revert soon enough.

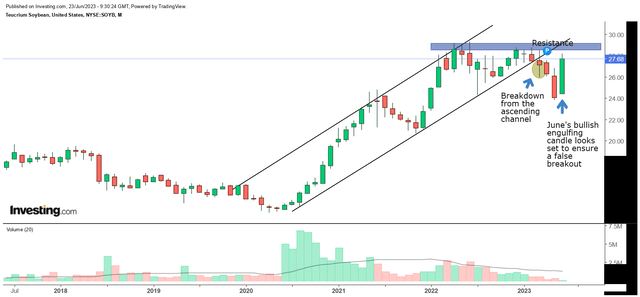

On the standalone monthly chart, there are both good and not-so-good developments. Firstly, it's been encouraging to note that the breakdown we saw in March from the ascending channel could well turn out to be a false breakout. Even though we still have another week to go and a lot could change by then, June's bullish engulfing candle looks set to cancel out the three preceding monthly candles, reflecting the degree of bullish momentum that's in play. However, investors also ought to be mindful of the fact that SOYB could now run into some resistance below the sub $30 levels.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.