Warner Bros Discovery: DTC Leads The Way

Summary

- Streaming became profitable.

- Games appeared to be another strong point.

- Some of the turnarounds will take a few years to become apparent to shareholders.

- Management mentioned that they are still finding issues to deal with.

- Cash flow will now have a pattern with the first quarter as the weakest quarter.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

Mike Coppola

Warner Bros Discovery (NASDAQ:WBD) surprised the market with an announcement that the DTC moved into profitability. This is a major change from the big losses that the company inherited. There are still a lot of headwinds like a weak ad market. Besides, as management mentioned in the conference call, they're still "opening closets and stuff is falling out." So even though a lot of work is done, there could still be a surprise or two left over from before the acquisition that management has yet to uncover.

Whenever someone makes a relatively large acquisition, there's an immediate review of perceived major items. But when an acquisition as large as this one has been made, there's always the possibility of finding a major item even though that possibility declines over time (as management keeps searching).

Some things, like the movie business, take years to turn around. Last year in the first quarter, there was a batman movie to make this year's first quarter challenging. This year the second quarter appears to have the answer to last year's big success.

The Flash movie appears to be disappointing to some at the current time. But the overall movie release schedule is better than it was in the previous year. Management is still working through projects that it inherited and that includes this movie. So, while it's so far a disappointment, it's still a partial answer to the low number of releases in the previous fiscal year.

The big long-term solution is to thoroughly exploit the assets which means a higher activity level (as in more movies). Movies take about three years to develop, film, and then get ready for distribution. Therefore, the movie business may be the last part of the business to fully exploit the resources.

This company is different in that they control the games that are out there related to the movies released. That's yet another diversification that many investors may not have foreseen as a big deal initially. But management appears to already be taking advantage of this route to cash in on some franchises.

In short, there are signs of progress. But an acquisition of this size will take years to turn around and then get all the parts moving in a profit maximizing way. The reason that this management may well succeed with Warner Bros where others have failed is that they have found people with the relevant experience to run the various parts. That should help to make sure that each part of the business "pulls its own weight" in the future.

DTC Progress

There has been some concern about revenue falling. Clearly that cannot happen "forever." However, in just about every division, the profit progress appears to point to unprofitable revenue being eliminated. Sometimes that progress gets masked by things like a weak advertising environment.

In the case of the DTC, the progress is so dramatic that even with other considerations, it's very clear that progress is moving in the right direction.

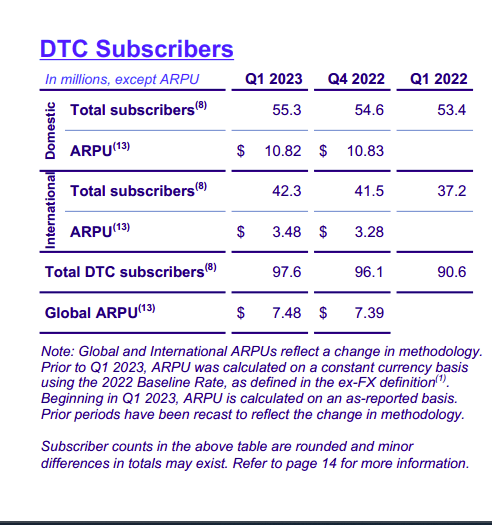

Warner Bros Discovery DTC Growth (Warner Bros Discovery First Quarter 2023, Earnings Press Release)

The fact that management was able to grow subscribers while focusing that growth is an amazing accomplishment. Management has claimed to also focus spending to gain some efficiencies. That is probably one of the harder objectives in this industry. The tendency in the past has been to outspend revenue with the idea that "someday" the growth would solve the problem.

It now appears that "someday" arrived and there really was no fast growth any longer to quickly resolve loss issues.

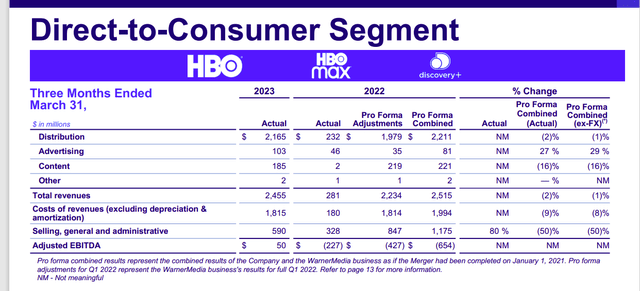

Warner Bros Discovery DTC Financial Results (Warner Bros Discovery First Quarter 2023, Earnings Press Release)

Cost control has made a big difference in the results reported in this division. Stopping the big losses is a huge plus for the combined company even if a course correction is later indicated. Much of the industry followed this company in pursuing market share first and profits later. But as this company has so far demonstrated, those profits are available when a strategic focus and tight cost controls are followed. Now let's see what the future holds.

Cash Flow

Management did explain to the market that the cash flow program for the foreseeable future would be payments first and cash flow later in the fiscal year. That should make sense to investors because most of us pay for something before we use it or profit from it.

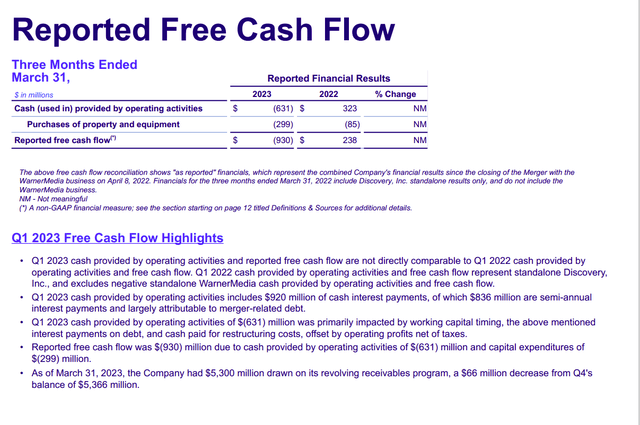

Warner Bros Discovery Summary Of Free Cash Flow Situation (Warner Bros Discovery First Quarter 2023, Earnings Press Release)

Management more or less stated that the first and third quarters will have a significant interest payment obligation from the acquisition related debt that will materially affect the free cash flow pattern. That particular obligation is likely to be around for a while.

The first quarter also has some additional program payments that further impacted first quarter cash flow and are likely to continue to affect future first quarter cash flows.

That means that the past fiscal year showed a lot of cash flow in the second half of the year. Management basically explained that the pattern will continue. Therefore, the lack of free cash flow in the first quarter is not an indication that the "wheels came off the cart."

It does appear that EBITDA will definitely top $10 billion for the year and is likely to head to $12 billion or more the way things are currently moving. Management already began a tender offer and announced the results in an attempt to repay roughly $2 billion in debt in the second quarter. Most of the tendered debt is now gone. But this is a big turnaround from the negative cash flow of the first quarter.

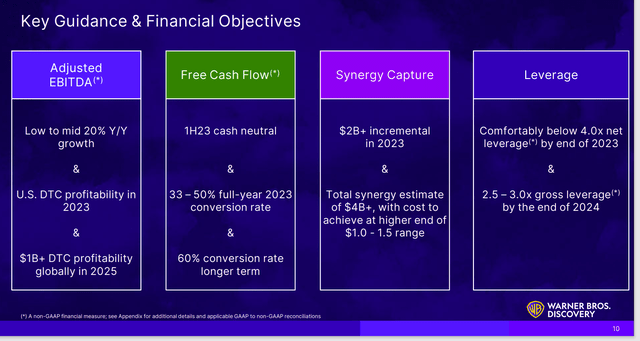

Warner Bros Discovery Key Guidance Summary (Warner Bros Discovery First Quarter 2023, Earnings Conference Call Slides)

Management essentially reiterated the original guidance. Not much has materially changed since this guidance was given. What's changing (or rather coming into view) is the pattern of meeting the guidance. The company is now materially different from the standalone Discovery. Therefore, what management is telling investors is very possible.

It does appear that turning around the huge losses in the DTC division were the easiest of all the objectives to accomplish. But there is clearly more to go and that "more to go" will be taking years.

But management is also enough current things accomplished to raise EBITDA to meet the near-term leverage goal of four during fiscal year 2023 and below that by the end of the fiscal year. This is probably the most important goal to the market and the debt market.

Management wants to keep costs down by achieving investment grade ratios. Clearly the debt market has some faith in that goal as the interest rate on the loans would indicate. Management did state that cash flow will enable them to repay more debt in the current fiscal year. That's true even though debt recently increased by a very small amount.

What appears to be helping is the significant diversification that helps offset headwinds like a weak advertising market. Management (for example) mentioned games as a strong point to add to the good news from the DTC segment.

If management keeps its focus, there will be steady additions to the good news column over time as more and more of management's strategies pay off. To me that makes this stock a strong buy consideration based upon the ability of management to turn around the whole acquisition and optimize operations. Earnings are likely to grow here for years to come just from management's continuing ability to properly utilize the assets available to profitably make money.

I analyze oil and gas companies, related companies, and Warner Bros Discovery in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)

"He [Zaslav] is known for his casual manner, favoring Diet Coke and fleece vests. He still hangs out with high-school buddies. His compensation is among the highest among CEOs, with a 2021 pay package valued at $246.6 million—much of it based on stock performance. He has several homes, and his end-of-summer star-filled soirees in East Hampton, N.Y., have become legendary."Memo to Randall Stephens, Retired CEO of AT&T Who Gifted Us Long-term Shareholders this Disaster:You should have listened very carefully to Ethel Merman when she belted out:

"THERE IS NO BUSINESS Like SHOW BUSINESS!...

Deleveraging is all about cash flow and this is a major event for that cash flow.

But as management stated, they are still opening closet doors. So there is some even if declining risk left that there will be a substantial writeoff if they find something unexpected.