PICK: Rising Global Demand For Materials Creates Opportunity For Long-Term Investors

Summary

- Demand for basic materials is expected to remain high due to global population growth, increasing living standards, and investment in infrastructure and renewable energy.

- The iShares MSCI Global Metals & Mining Producers ETF offers exposure to a globally diversified basket of major producers in the basic materials sector.

- The fund is subject to geopolitical risks and has exhibited significant volatility since its inception, but offers strong returns and increased portfolio diversification.

Ekaterina Nazarova/iStock via Getty Images

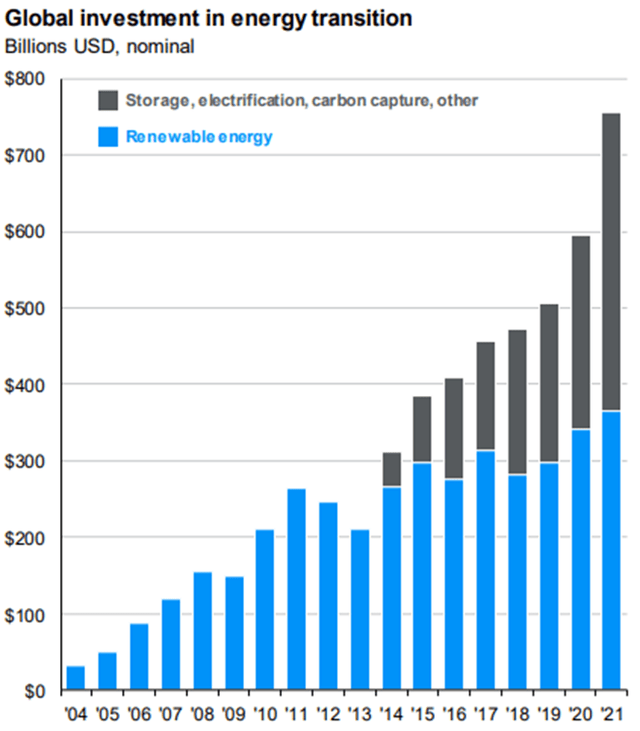

The demand for basic materials is expected to accelerate and remain at an elevated pace for years and possibly decades to come. This demand is driven by a growing global population, increasing standards of living, and the growth and investment in infrastructure to support the increasing needs of the world's population. The increase in energy demand and the transition to renewable energy generation and storage are major contributors to infrastructure spending. Globally, the investment in this transition is approaching $1 trillion annually, and grew at a compound annual growth rate of over 20% from 2004 through 2021.

Global Investment in Energy Transition (JP Morgan)

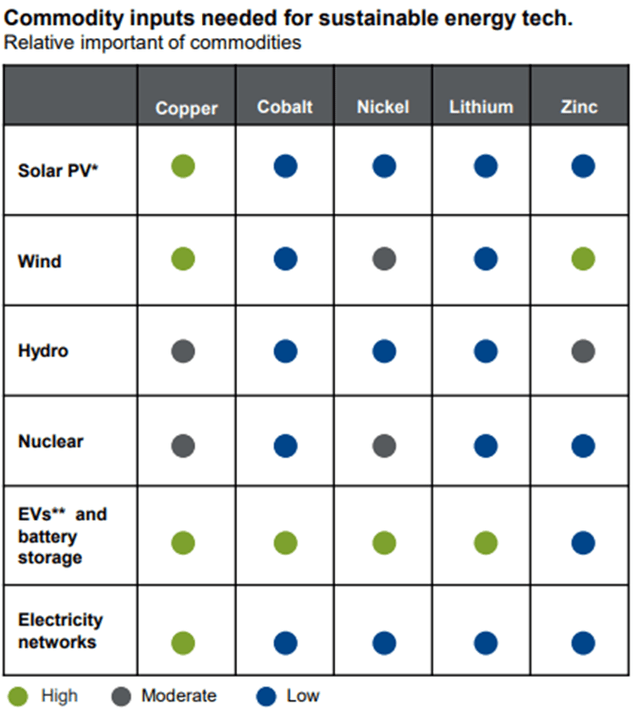

The transition to renewable energy generation and storage will drive demand of specific basic materials and commodities globally. The table below from JPMorgan (JPM) shows the relative importance of certain industrial metals as inputs to develop and construct critical renewable energy infrastructure. From what the table displays, copper and nickel are the most highly demanded for these purposes, although many metals and other materials are required for non-energy infrastructure development as well.

Commodity Inputs for Renewable Energy Technology (JP Morgan)

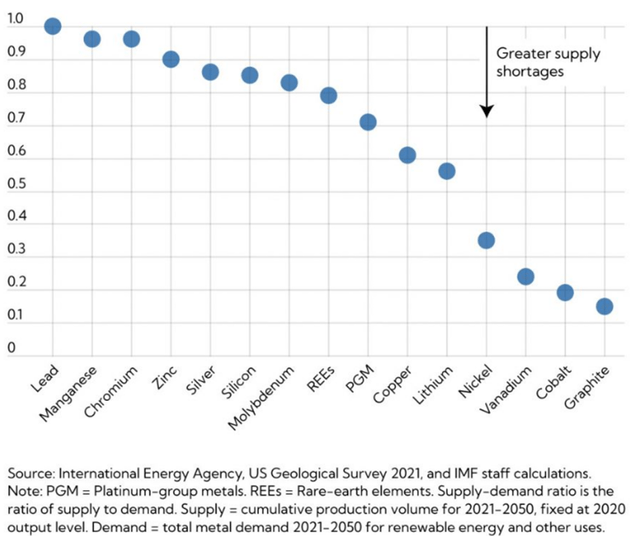

That energy transition, combined with non-energy related demand increases the supply/demand imbalances, at least in the short run. This growing demand relative to supply is not only expected to push commodity prices higher but incentivize producers to expand production efforts to increase output. If supply for certain critical commodities cannot be increased, this will create a bottleneck in the expansion of renewable energy generation, and likely cause global economic growth to slow. In other words, the mining and extraction of these key commodities are critical to the continued improvement in the standard of living globally and to the sustainability of those standards.

The chart below from the IMF illustrates this point by showing which markets are expected to experience the greatest imbalances from now through 2050. If more supply is not produced, then it is reasonable to expect prices to spike higher and/or growth to slow dramatically. Particularly concerning areas include the markets for copper, lithium, nickel, and cobalt.

Supply/demand ratio, energy and non-energy demand coverage (IMF, IEA, USGS)

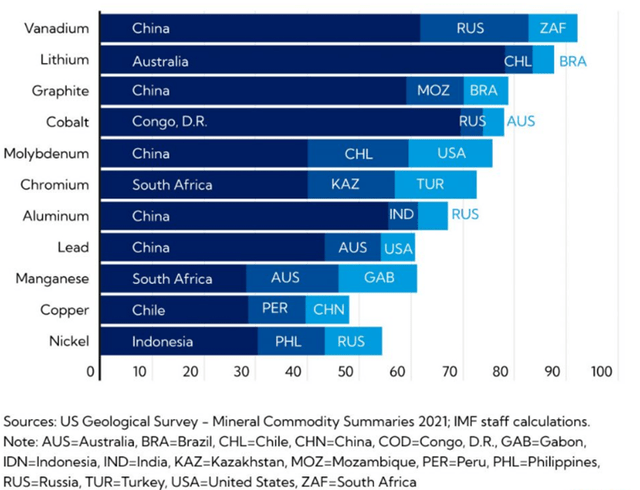

Adding to these challenges is that the largest producers of many of these critical inputs are in countries that pose significant geopolitical risks. Specifically, China and Russia are major producers of many commodities, including industrial metals and rare earth materials that are needed for renewable energy generation and use in EVs.

Largest Producers (% of market) (IMF, USGS)

Opportunity for Long-Term (Patient) Investors

To capture the secular increase in demand and importance of basic materials, it makes sense to add exposure to a globally diversified basket of major producers. The iShares MSCI Global Metals & Mining Producers ETF (BATS:PICK) accomplishes that objective.

Portfolio Characteristics

The fund currently holds about 300 positions focused on the basic materials sector. The fund has less than 20% exposure to U.S.-based companies with the largest ex-U.S. exposures to Australia, United Kingdom, Switzerland, Brazil, and Canada. The exposure to China-based companies is only about 2% of portfolio value while Russian exposure is immaterial.

The fund has an expense ratio of 0.39% and a current dividend yield of over 4%. While the dividend amount has been relatively volatile since the fund's 2012 inception, it has exhibited growth and is expected to do so going forward. The current demand in the materials mined by these companies is well understood as is the growth in that demand, factors that should push volume, prices, and profit higher, as well as dividend payouts.

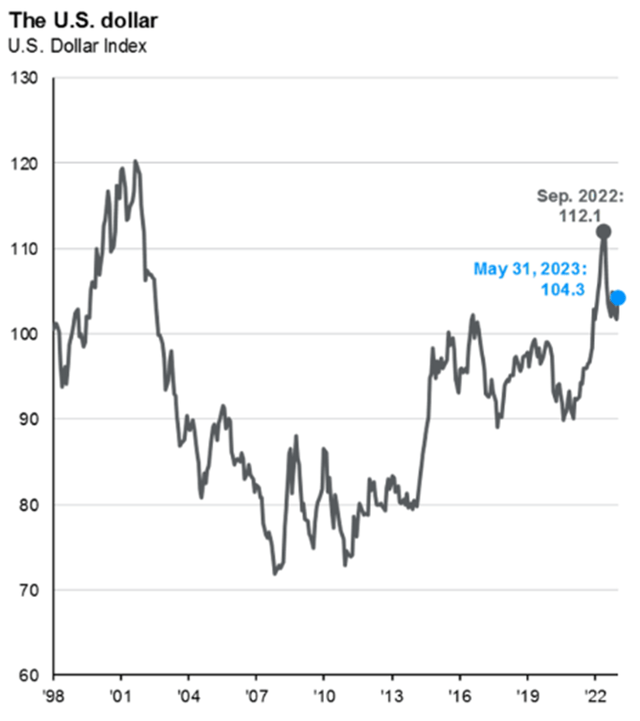

Impact of the Dollar

The strengthening of the U.S. dollar in recent years has created a headwind for international investment returns. With the tightening monetary policy in the U.S. this trend has accelerated, pushing the dollar to its highest level relative to other global currencies in more than 20 years. However, the expected slowdown in quantitative tightening, and possible future easing, as inflation trends toward the Fed's target, could serve as a tailwind for international securities.

The strength of the dollar has historically tracked closely the spread between Treasuries and government bonds of other countries. As this spread narrows as a result of more moderate monetary policy in the U.S., it is reasonable to expect the dollar to weaken, at least against developed market currencies. As more than 80% of PICK's holdings are based outside the U.S., the fund would be expected to benefit from these dynamics.

Spread Between Treasuries and International 10-Year Yields (JP Morgan)

Recent Performance

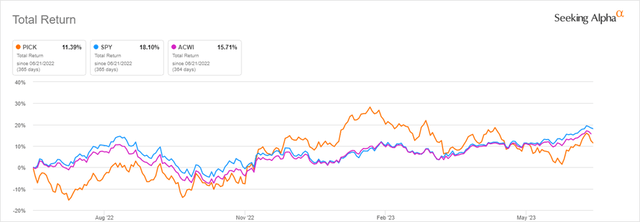

The recent performance of the fund has been solid but lagged that of the S&P 500 and global stocks (represented by the iShares MSCI ACWI ETF (ACWI)) year-to-date and over the last 1-year period on a total return basis.

1-Year Total Return: PICK versus SPY versus ACWI (Seeking Alpha)

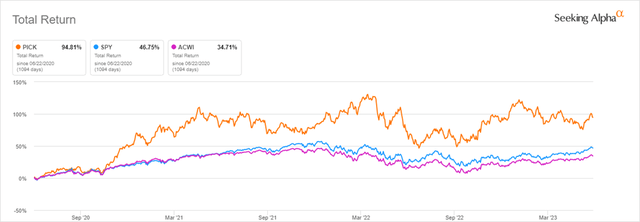

Over the last 3-year period PICK has significantly outperformed, largely driven by its rebound off the 2020 pandemic lows that outpace that of the broader market. Performance since the end of 2020 has been positive and exceeded the S&P 500 and ACWI on a total return basis, but has been more volatile than those benchmarks, as shown in the chart below.

Total Return: Year-End 2020 Through Today (Seeking Alpha)

Portfolio Holdings

The largest single holding, BHP Group (BHP) is based in Australia and is one of the world's largest producers of iron, copper, nickel, potash, and metallurgical coal. BHP currently represents almost 15% of fund value. By allocation, BHP is followed by Rio Tinto (RIO) at 7%, Glencore (OTCPK:GLCNF) at almost 6%, Freeport-McMoRan (FCX) at just over 5%, and Vale (VALE) at about 4.5%. The top 10 names in the portfolio represent about 51% of portfolio value.

As seen in the table below, the top five holdings are generally trading at low multiples to earnings, generate robust gross profit margins and ROE, and payout large dividends. Freeport-McMoRan is the notable exception when looking at P/E and dividend yield. It trades at a much higher P/E and has a significantly lower dividend yield. However, PICK's overall portfolio of over 300 positions is similar to these top positions with an average P/E ratio of about 8.4x and SEC yield of 4.25%.

Holding | P/E (FWD) | P/B (TTM) | Gross Profit Margin (TTM) | Return on Common Equity (TTM) | Dividend Yield (TTM) |

BHP | 12.74 | 3.77 | 85.10% | 39.04% | 8.50% |

Tio Tinto | 7.83 | 2.15 | 38.34% | 24.45% | 7.46% |

Glencore | 4.44 | 1.49 | 10.65% | 38.77% | 6.05% |

Freeport-McMoRan | 19.60 | 3.52 | 39.33% | 16.80% | 0.76% |

Vale | 5.78 | 1.67 | 41.14% | 39.45% | 7.75% |

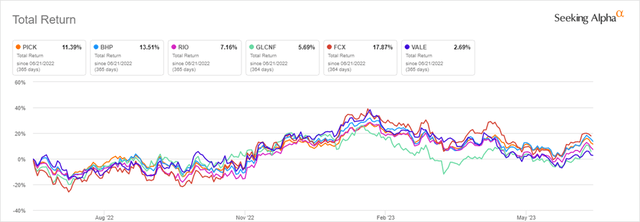

Over the last year, performance among the top holdings has been tight. On a total return basis, Freeport-McMoRan led with a return of nearly 18% while Vale lagged with a gain of 2.7%. Freeport was the leader over the last 3-and 5-year periods.

1-Year Total Return: Top 5 Holdings (Seeking Alpha)

Risk

The fund and its holdings are subject to numerous risks. While the long-term thesis of growing demand for basic materials is well supported, events beyond the control of the portfolio companies are possible. For a fund with global exposure, geopolitical risks are always a potential threat. While the fund mostly avoids direct exposure to China and Russia, the actions of those governments can have a material impact on the development of renewables and infrastructure that could negatively impact the demand for raw materials.

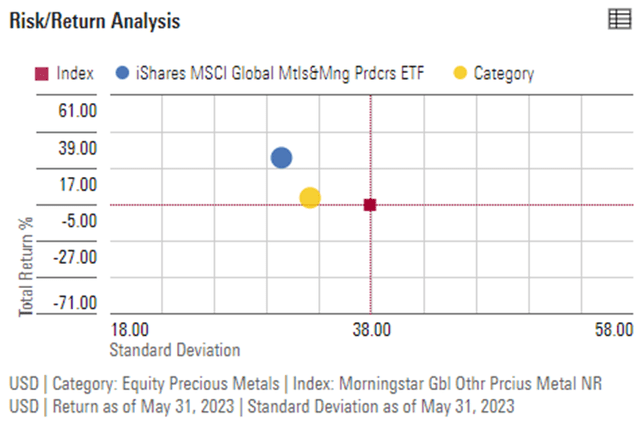

The fund has exhibited significant volatility since its 2012 inception, typically far higher than the broader market. While this is an important consideration, it alone should not drive investor decisions. The fund has also delivered strong returns over that period and given the direction of the global economy and focus on renewable energy and infrastructure, it is reasonable to expect that to continue. In fact, over the last three years, the upside/downside capture has heavily favored the upside. This in turn has resulted in attractive risk-adjusted returns.

Risk/Return Analysis (Morningstar)

Satellite Position to Core Equity Allocations

This fund can be added to the alternative sleeve within equity allocations. Although the companies within the fund's portfolio are well-established and financially sound, the external risks and the historical volatility of the fund must be considered. This should be viewed as a satellite position to core equity exposure and sized accordingly.

Final Thoughts

The iShares MSCI Global Metals & Mining Producers ETF is an efficient way to gain global exposure to the basic materials sector. That sector, and what it produces are expected to become increasingly more important for years and decades to come with the continued investment in renewable energy and infrastructure in addition to the perpetually increasing living standards and resource demands driven by demographics. Furthermore, moderating monetary policy in the U.S. should create a tailwind as foreign currencies stabilize or strengthen relative to the dollar. While volatile at times and exposed to geopolitical risks, it is reasonable to expect that a small position added to equity allocations will increase portfolio diversification and risk-adjusted returns.

This suggestion should be considered within the broader context of strategic asset allocations as well as personal needs and constraints. Any overweight or underweight positions need to be considered carefully to understand the impact on long-term total returns. Thank you for reading. I look forward to seeing your feedback and comments below.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PICK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.