InfuSystem: Long-Term Business Economics Eroding Value, Reiterate Hold

Summary

- Since November 2022, InfuSystem Holdings has rallied 23% and been included into the Russel 3000 index.

- Despite strong growth in its operating segments, the company's economic characteristics are troubling, and might lack the impulse to create value.

- Net-net, I reiterate INFU as a hold for reasons discussed here.

Matteo Colombo

Investment Summary

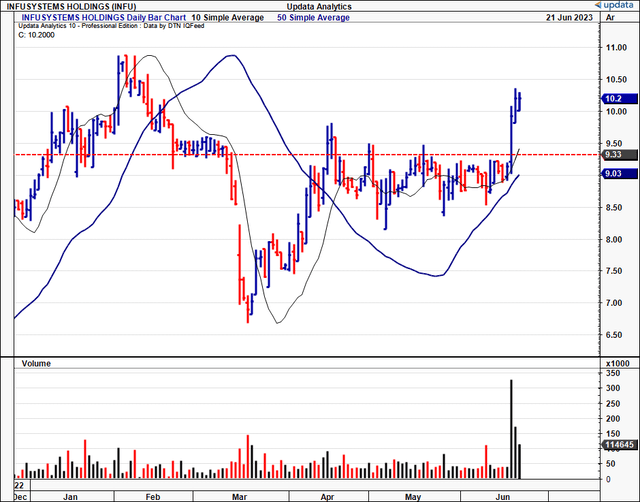

Since my last rating on InfuSystem Holdings, Inc. (NYSE:INFU) in November, the company has been rated ~23% higher by the market at the time of writing. That is a good return in a 7–8 month time span. Most of the long-term gain was achieved this month, when the stock broke out above a level as shown in Figure 1.

However, I believe the character of buying is less idiosyncratic than it is of the institutional crowd, after confirmation of the firm's re-inclusion into the Russel 3000 index this week. This will result in mandated buying from passive vehicles structured to track the index with <1% tracking error, along with other investment mandates tied to that universe. In other words, large, prolonged buying spells based on rebalancing effects of the index.

After rigorous analysis of the company's economic characteristics over the systematic drivers, my opinion is that INFU is fairly valued at its current market values and that it lacks fundamental, sentimental and valuation-based characteristics needed to see it re-rate in the medium term. In that vein, I reiterate the company as a hold from an investment perspective from now.

Figure 1.

INFU critical investment facts

The investment debate ought to be broken down into first principles, analysing the value drivers of INFU's equity stock. Looking at the latest advance in market price, you might be inclined to play for a pull here, having missed the turn. However, dear readers, I would encourage you this– think of the value drivers as mentioned– 1) fundamentals and business economics, 2) investor/market sentiment, and 3) valuation and mispricing. Thoughtful analysis is appreciated on each point.

1. Fundamentals

The firm's latest numbers, that were presented last month, are telling of a broader investment theme. For one, INFU's expansion into multiple care settings raises a fundamental question: Is the company spreading itself too thin? On thorough consideration, it becomes evident that INFU remains well within its core competency at the top-line. However, when you look at things on a deeper level, by peeling back the "growth" numbers, the case is less appealing.

For instance, take the "face value" facts– the core businesses of 1) revenue cycle management ("RCM"), 2) clinical expertise, and 3) device specialization, form the bedrock of INFU's operations. It booked $30.4 mm in Q1 sales, a 13.5% YoY increase, and a new all-time record for the company.

Further, momentum on this is strong– this is the 6th record in the last 7 sequential quarters.

The notable growth in net revenues can be attributed to both of INFU's operating segments:

- In Q1, its oncology and biomedical services divisions were strong, adding another $1.6 mm and $1.7 mm in turnover respectively. It also clipped wound care and pain management growth rates of 63% and 28% each.

- The standout however–– its biomed segment flew in and led the charge with a 98% YoY revenue increase in turnover, driven in principle by its master services agreement with GE Healthcare.

The segmental growth in Q1 is something to take note of for the momentum heading forward.

But now, take the firm's business economics, the "hidden facts"– revenue growth is only good (in the long run) if it is "profitable growth", in the sense, that it pulls down to the operating line at least. From a company perspective, this is critical, not in the least from an investor's.

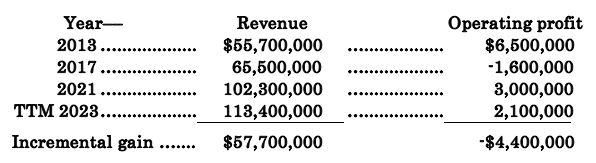

Note, the divergence in top-line to operating line growth from 2013–2023 (where 2023 is shown in the TTM). I've given the company 10 years here to demonstrate something of substance in the way of investment value here– yet with a $57.7mm increase in turnover has come a $4.4mm decrease in operating profit, with the decline occurring gradually over time as well.

Table 1. Divergence in turnover to operating income

Data: Author, INFU SEC Filings

The discussions above raise an important set of data points:

- The company's expansion into nursing homes and acute care facilities, alongside its core focus on health care in the home, has unlocked new revenue streams and opportunities for growth. This was evidenced by the upsides in wound care and pain management– two lucrative end markets as it is. Hence, one might expect this kind of accelerated sales growth moving forward.

- The master services agreement with GE Healthcare has emerged as a key driver of revenue growth. The 98% YoY increase in biomed segment sales is exemplary of this point. Although it's early days, this could be a meaningful tailwind for the company moving forward, and absolutely comes in as a supporting factor within the hold thesis.

- While INFU's expansion into biomedical services has incurred additional costs, the lack of operating margin is a risk moving forward in my view. It's even more of a risk because it has occurred over a lengthy, sequential period when top-line sales have been expanding. Hence, the more sales growth, the wider the operating loss– terrible combination for the investment account. Hence, with any sales growth going forward ––whilst well received–– may incur heavier losses.

2. Economic factors

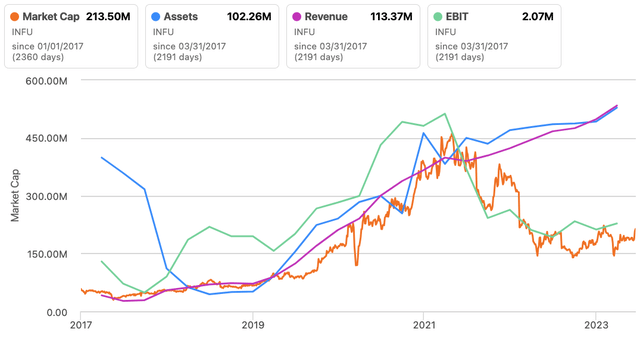

One thing appears clear: the market looks to be valuing INFU on the pre-tax earnings it generates over time. You can see this display in Figure 2. This makes sense, as INFU is selling products, and thus profit generated on sales would be a key driver of value versus the book value of its assets.

Despite long-term sales and asset growth, the reverse has been true for operating income since 2021/'22, and thus the firm's market value (granted, we went through the '22 bear market as well). Prior, it may or may not have been on asset factors as well. What this means going forward is telling.

Figure 2.

Telling why, you may ask?

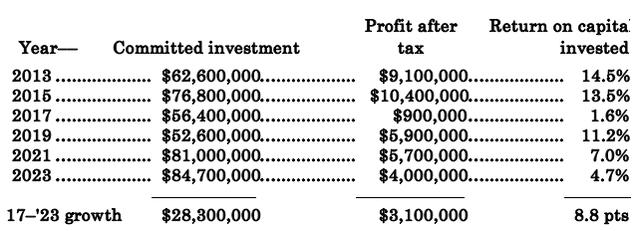

One, the firm has committed an additional $28.3mm of investor capital since 2013 in order to grow the business. CapEx has generally been above depreciation charge each year as well, indicating the company has likely been investing in growth opportunities each year. Investment is critical– the market appreciates firms that can appreciate capital by investing it to generate more profits over time. Moving forward, I would expect similar rates of investment from the firm.

Two, although it has made these investments, the cross-over into additional profit growth would leave a starving man hungry. Just 11% return on incremental capital, or an additional $3.1mm in post-tax profit (note, this adds back depreciation and amortization). Hence, you're looking at an 8.8 percentage point decline in the last 5-6 years in the returns INFU has produced on the capital it has committed to growth (the shareholder's capital). Once again, my numbers have the firm to maintain this trend into the coming 2-3 years. There just aren't the catalysts to suggest otherwise.

Table 2.

Data: Author, INFU SEC Filings

Subsequently, with minimal earnings to reinvest (indicating a lack of opportunity due to lack of capital) and dwindling returns on existing assets, there is reason to believe the future may be neutral for INFU, in my view.

3. Valuation factors

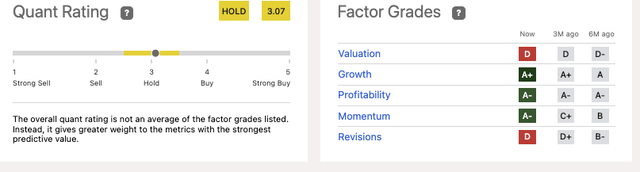

Investors have been selling their INFU stock at a significant multiple of ~ 33x future earnings, clear indications on their expectation of substantial growth. However, the current PEG ratio of 1.1x suggests that the growth potential may already be factored into the current price. In addition, it trades at 80x forward EBIT, and this appears excessive in my view without adequate upside to justify it. Despite the market's optimism, there have only been two earnings revisions in the last three months, even with the breakout. Based on my investment criteria, I estimate the current market price of $10.20 to be fair, and that recent purchases may be linked to index inclusion.

Critically, these findings are also well supported in the quant system, which also rates INFU as a hold. This is gratifying to the investment thesis because the quant system has sifted through all of the data and collated it into a composite, using a "traffic light" system to indicate where the value is or not, helping to guide decisions. You'll see it agrees with my findings on valuation and revisions, but I would also say it rates INFU highly in profitability on relative terms not on absolute terms. Nevertheless, it accurately projects the investment rating for INFU in my view, and the quant systems ratings are to be ignored at one's own peril.

Figure 3.

In short

In summary, INFU has demonstrated resilience by surpassing previous highs. However, a closer examination of the firm's business economics reveals underlying challenges, with returns on capital trailing behind the market return on capital. Although expected revenue growth and strong tailwinds in its core businesses are promising, my recommendation is to maintain a hold on INFU.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)