FTXL: An ETF To Play The Nvidia Effect

Summary

- First Trust Nasdaq Semiconductor ETF, just like peers SOXX and SMH, may face a retrenchment after a 29% upside in the last year, partly due to the Nvidia effect.

- Nvidia's A100 GPU chips, used in Microsoft's ChatGPT AI algorithms, have seen soaring demand, leading to a 25% surge in the company's stock.

- Thus, after such excitement, expect a dose of realism especially after the Federal Reserve hikes interest rates.

- It is precisely for this purpose that investing with FTXL whose weight is more balanced between Nvidia and its competitors makes sense.

- Amid a resilient economy and high demand for semis, one can expect a moderate upside till August.

PhonlamaiPhoto

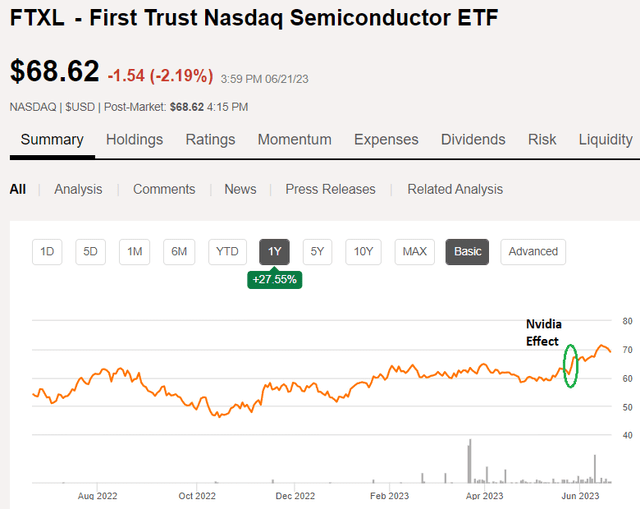

After delivering nearly a 27.55% upside in the last year as charted below, the First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) appears to be taking a pause with the latest price action of -1.54% also pointing to a probable retrenchment following some commentary from the U.S. Central bank.

The Price Action (www.seekingalpha.com)

The probability of a correction occurring has also increased due to the Nvidia (NASDAQ:NVDA) effect as encircled in green above, responsible for about an 8% upside in the last week of May alone as I will explain later. Considering that the economy is proving to be more resilient than expected and demand for semis remains high, the aim of this thesis is to make the case for investment, by taking advantage of the ETF's holdings and their relative weight to better navigate volatility, when compared to peers.

I will also elaborate on how the technology life cycle favors Nvidia's competitors like Intel (NASDAQ:INTC) and other ecosystem players like Micron (NASDAQ:MU) and start by highlighting the opportunities offered by Generative AI while making sure to bring a dose of realism to a sector whose performance has been doped by overenthusiasm.

Generative AI, the Nvidia Driver, and FTXL's Rise

First, it is this very flavor of AI which powers ChatGPT's chatbots and makes use of natural languages we use to communicate instead of complicated computer codes. As such, it has rapidly become popular among people who use the Internet to generate reports. Thus, by just typing one's requirement in the chatbot, the system can write a brand new report which just needs some fine-tuning before submission. Moreover, since the tool is available with Microsoft's (NASDAQ:MSFT) Bing search engine, it can be availed by millions globally with many corporations subscribing to the paid model to be entitled to their own private corporate versions.

Now, it is precisely Nvidia A100 and H100 GPU chips that the software giant has used to drive ChatGPT's AI algorithms as part of its Azure cloud. As a result, with demand soaring and fueled by impressive enthusiasm around its chips, the world's number one chip company with a market cap of over 1 trillion dollars, announced forecasts that beat all expectations during its latest quarter, or FQ1-2024, on May 24. It anticipated sales of $11 billion for the second quarter, or 50% more than expected by analysts with the stock surging by nearly 25%, making it one of the biggest single-session gains in history for such a market valuation.

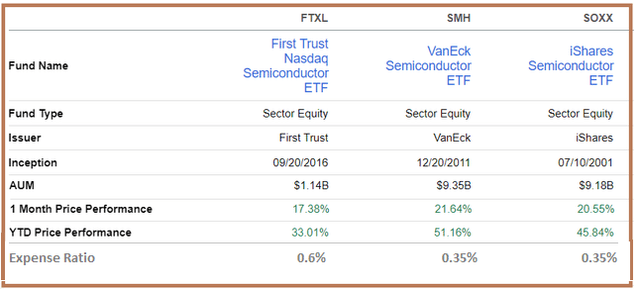

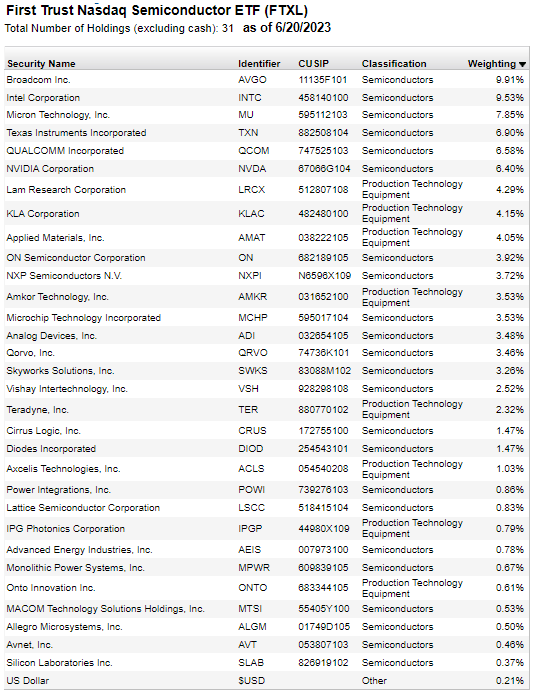

Now, since FTXL's underlying index only dedicates 6.43% of its assets to Nvidia, it has appreciated less than the iShares Semiconductor ETF (SOXX) and the VanEck Semiconductor ETF (SMH) with 8.74% and 19.07% respectively dedicated to the trillion-dollar company. The price performances are illustrated in the table below which also shows that the First Trust ETF only boasts $1.14 billion of assets under management and charges a higher fee of 0.6% compared to 0.35% for its two peers.

Comparison with peers (seekingalpha.com)

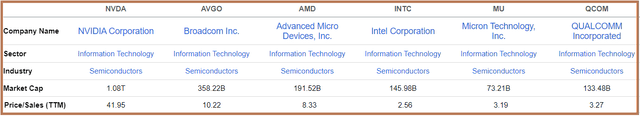

Now, the question is whether after attaining such rich valuations, notably with a share price of 42 times trailing sales as pictured below, it makes sense to buy Nvidia or ETFs which hold its shares in relatively larger amounts. Also, with a P/S of at least four times higher than peers after such an upside do expect some volatility in August when the company releases its second-quarter results, with one of the reasons being investors' high expectations priced in the stock's value.

Comparing Nvidia with Peers (seekingalpha.com)

Well, it would be great if the above 50% guidance is achieved, but, at the same time, it is important to be realistic.

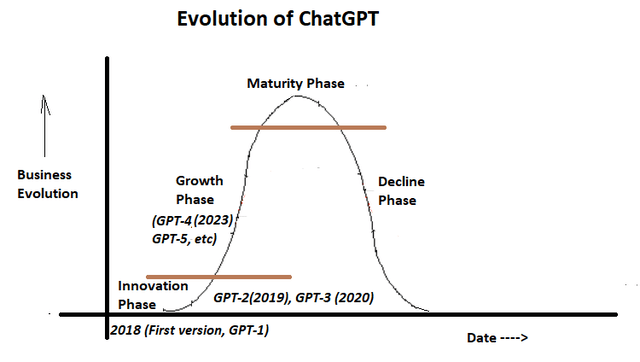

Learning from the Technology Life Cycle

In this respect, as with any new technology life cycle, there are typically four phases starting with the innovation phase which for ChatGPT started in 2018 as pictured below, followed by growth. Then comes the maturity, and, eventually, the decline. Now, ChatGPT is already at the fourth version stage with GPT-4 which may imply that it is past the innovation phase and is now growing rapidly.

Chart Built using data from (www.techtarget.com)

This is the reason for Nvidia's record guidance, as, be it hyperscalers like Microsoft expanding its Azure intelligent cloud to sell in a ChatGPT-as-a-Service format or large private corporations setting up their own infrastructures, they all require its AI chips. These equip the very servers that drive ChatGPT algorithms and explain the reason for Nvidia harvesting bulk orders.

However, as per the above chart, after growth comes maturity when enterprises, after having experience with Generative AI have a more precise idea of their requirements, and not all of them necessarily need the superfast parallelized architectures available through Nvidia GPU-based AI accelerators. In fact for small and medium-sized natural language learning models, a normal CPU like Intel's 4th generation Xeon with integrated AI capability can be sufficient.

Thus, Nvidia does not imperatively have monopoly status, and, after such an upside, it may be better to either hold to one's gain or, even take profit by reducing exposure. Another option if you choose the ETF route is to opt for FTXL, as, in contrast to either SOXX or SMH, it allows for more moderate exposure to the giant chip designer, while also holding its competitors.

Furthermore, another advantage of opting for FTXL is holding Micron, a memory chip manufacturer which has suffered due to high customer inventories, and a dim market outlook. However, it could also profit as the install base of AI GPUs gets enlarged, there is also a need for more storage capacity to store the massive amounts of data for processing in memory.

Therefore, with 9.53% and 7.85% of its overall share value invested in Intel and Micron respectively, which is more than either SOXX or SMH, FTXL provides for a broader exposure and stands a better chance of delivering capital gains in the medium term as AI infrastructure builders shop around, both for alternatives to Nvidia GPUs and request more storage capacity.

FTXL Holdings (www.ftportfolios.com)

A less Volatile ETF Going Forward

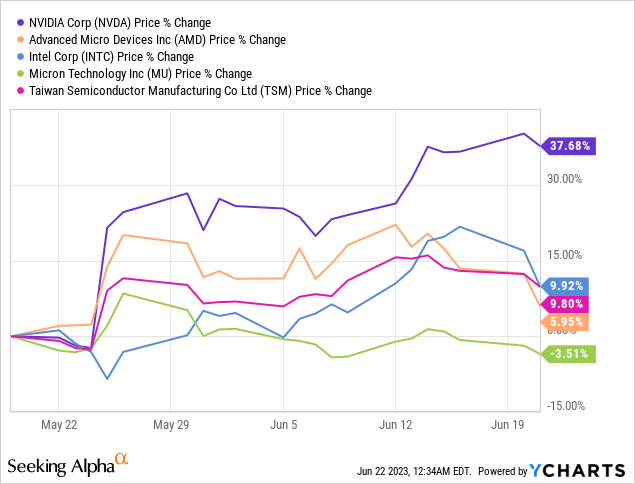

Still, to be realistic, Intel may not enjoy the same level of demand as Nvidia, which has the first-mover advantage, but, still, should suffer from less volatility as it is subject to less focus and much lower investor expectations. In this connection, as shown in the chart below, Nvidia has delivered more than a 40% upside since May 24 with Intel's 17% upside suggesting that some investors have already realized its potential in the AI industry.

I have also provided the chart for Advanced Micro Devices (AMD) above but it does not form part of FTXL's holdings (above table) which is a positive. The reason is that its MI300X accelerated AI GPU will only be commercialized in the fourth quarter of this year and, on top, be available to only a few select customers for sampling purposes, while Nvidia's H100 is well into production. Already, as seen in the green chart above, some of the initial enthusiasm around AMD seems to be fizzling out, after it rose by more than 15% in May.

Furthermore, as evidenced by its holdings, FTXL does include semiconductor equipment companies but excludes pure-play foundries like GlobalFoundries (GFS). It solely holds American companies as it tracks the Nasdaq U.S. Smart Semiconductor Index. Thus, it also shields investors from geopolitics-related volatility as it excludes semiconductor companies from South East Asia as tensions between the U.S. and China over Taiwan show no sign of abating. In this respect, the excitement induced by AI has somewhat masked exacerbating geopolitical risks as seen by Taiwan Semiconductor Company's (TSM) nearly 10% upside, as the manufacturer of Nvidia's chips.

Resilient U.S. Economy and Demand for Semiconductors

As for valuations, trading at around $69, FTXL is well below its December 2021 high of $82, and its recent price action has been pressured by the Federal Reserve Chairman leaning toward more rate hikes to tame the persistent inflation problem. Now, since higher interest rates also imply rising borrowing costs, this results in tighter monetary conditions which can dampen business sentiment if this is accompanied by deterioration in consumer sentiment. However, this has not happened, and on the contrary, sentiment has risen in June due to the overall progress made in combatting inflation and avoiding a debt-ceiling-related crisis. Furthermore, despite more news updates about a recession hitting the economy in the second half, some of the gloomy forecasts whereby corporations would lay off thousands of workers have so far not materialized.

In these conditions, expect volatility to continue, but with the economy showing resiliency and semiconductors being in demand, I am bullish on FTXL, also because of its holdings and their relative weights as I have elaborated above. As for a target, I consider its undervaluation with respect to the technology sector which is something illogical considering that without semiconductors, AI cannot exist. Thus, given its Price-to-Earnings of 21.23x with respect to the Invesco QQQ ETF's (QQQ) 26.37x, FTXL could potentially rise to $85.23 ((26.37/21.23) x 68.6)). However, again sticking to realism, I would be more inclined to target the $70-71 range, which could emerge as a new support level, at least till Nvidia's FQ2-2024 results are announced on August 23.

In conclusion, by going through its main holdings and comparing them with peers, this thesis has shown that FTXL is better positioned to navigate through the semiconductor sector after Nvidia's stellar rise. Also, the technology life cycle shows that there is likely to be more supplier diversification while opting for an ETF allows investors to have broader exposure and profit from the fact that even the fastest GPUs have to work in tandem with memory chips.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)