AT&T: Strong Buy With A 6 P/E And A 7% Dividend

Summary

- AT&T's stock has been battered, dropping by about 25% over the last year.

- However, AT&T stock's technical image is improving. Moreover, at about six times earnings, the stock is beyond dirt cheap now.

- AT&T has surpassed EPS estimates in its last ten quarters, and the trend should continue, leading to higher-than-expected earnings in the coming years.

- Modest EPS growth and multiple expansion could propel AT&T's stock considerably in future years.

- This idea was discussed in more depth with members of my private investing community, The Financial Prophet. Learn More »

Brandon Bell

AT&T (NYSE:T) may not be the most exciting company. However, the bottom must be close when I see a 7% dividend and a 6.4 P/E ratio. Given the economic uncertainty, the slowdown effect, and other factors, AT&T's share price has dropped by approximately 25% over the last 52 weeks. Unfortunately, we may forget how important AT&T is to the U.S. and the American people. In the previous five years, the company has invested a staggering $140 billion into American infrastructure. AT&T continues to lead the nation as the most extensive fiber internet provider while enhancing America's "most reliable" 5G network.

Furthermore, AT&T is paying down debt and should continue doing so to secure growth and maintain its dividend. Additionally, now that AT&T is no longer in show business, it can focus on its core operations, optimizing efficiency and improving profitability as the company advances. AT&T's stock is exceptionally cheap now, and as the company improves processes, its multiple should expand, leading to a much higher stock price in the coming years.

Finally - The Bottom Is Close

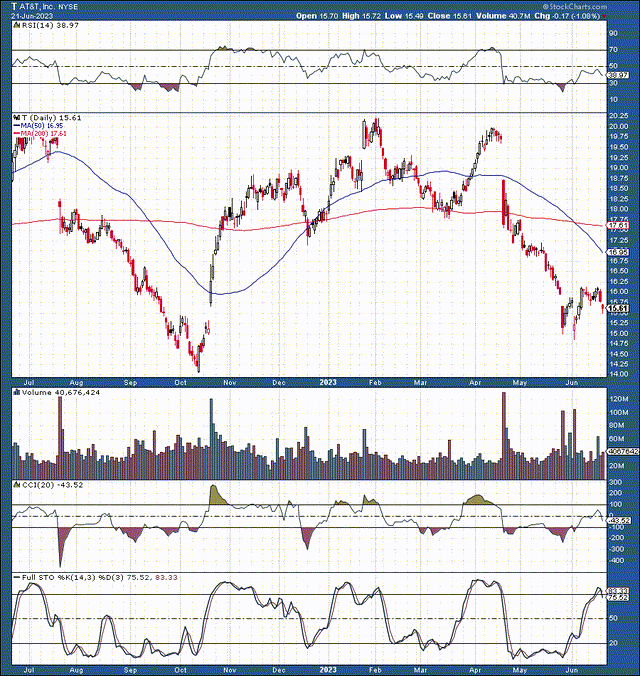

$15 is the critical support level. AT&T briefly dipped below this crucial level during the height and the panic selling of the recent bear market. However, the stock returned to test the $15 mark in late May and early June. Thus, we had a test, followed by a successful retest and a significant reversal at the $15 zone. Therefore, the $15 is a significant support point, suggesting the downside is limited from here.

Moreover, the RSI went considerably below the 30 level, hitting around 20 during the recent route. These ultra-low readings in the RSI are around the levels we witnessed during the bear market bottom in mid-October last year. Therefore, from a technical standpoint, AT&T's stock got deeply oversold recently, has a bullish (potential double-bottom) setup, and should continue moving higher as we advance.

AT&T - Paying Down Its Debt

In the last two years, AT&T sold a 30% stake in its DirecTV unit for $7.1B and spun off WarnerMedia for $40.4 billion in cash. Now, AT&T is reportedly working with Barclays to solicit bids for its cybersecurity business it acquired for approximately $600 million in 2018. AT&T reduced its net debt by about $24B in 2022 and looks to continue reducing it to roughly $100B by 2025. Paying down debt is critical for maintaining AT&T's dividend and continuing to grow in the fiber and the 5G space.

AT&T Still Needs A Management Shakeup

Let's face it. A big reason AT&T is in the mess that it's in is because of the company's botched merger with Time Warner. Of course, it was not a merger of equals, as AT&T acquired the company for a massive sum. AT&T's management used a heavy-handed approach at times, stifling Time Warner's creative potential and leading to poorer quality in its content (arguably). AT&T's management was primarily focused on its agenda and did not listen to the top managers at WarnerMedia. The results speak for themselves, and five years later, AT&T sold its WarnerMedia interests for approximately half of what the company paid initially.

How's That For An Investment?

AT&T needs a management shake-up. Everything has become so stale and stiff at AT&T that the company needs new leadership. John Stankey has spent his entire 37-year career at AT&T. Now, that's a good thing, but it is also a bad thing. How can we expect AT&T to reform its corporate culture with a lifelong AT&T executive as CEO? A change is required for AT&T to become more efficient, growth-oriented, and increasingly profitable. Therefore, more changes are needed at the organization's top to improve its bottom line eventually. Nevertheless, now that the media spinoff is complete, AT&T can focus on its core operations, and its stock is exceptionally cheap now.

Wait, How Cheap Is AT&T Now?

AT&T trades at a P/S ratio of 0.9 here, and its P/E ratio is just above a rock bottom of 6.0 now. Moreover, AT&T provides a 7% dividend, potentially making its stock as cheap as it gets. This year's EPS should be in the $2.40-$2.60 range. While consensus estimates are for $2.43, my estimate is $2.50.

EPS Estimates - Likely to Expand More

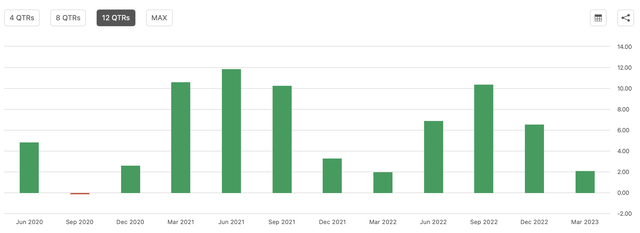

EPS Estimates (seekingalpha.com)

Don't mind the significant drop in EPS, as it's not adjusted for the WarnerMedia spinoff. However, EPS will likely show a slight decline from last year. 2022 EPS came in at $2.57, and this year should come in at about $2.50. We can attribute this phenomenon to a tighter monetary environment and an economic slowdown, transitory factors that should fade. Also, if we look at EPS surprises, AT&T has beaten consensus estimates in its last ten quarters.

EPS Surprises - Trend Likely to Continue

EPS Surprises (seekingalpha.com)

In its last four quarters, AT&T has beat the consensus estimates by an average of 6.5%. If we apply a similar beat rate to 2023 full-year estimates, we arrive at $2.59 in EPS. Also, if we use the same 6.5% beat rate to next year's consensus figure, we arrive at an EPS of $2.65. If AT&T delivers $2.65 in EPS next year, its stock is trading at only around 5.7 forward earnings. This valuation is remarkably cheap, and AT&T's stock should move higher on modest earnings growth and multiple expansion in the coming years.

Here's where AT&T's stock could be in several years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $122.5 | $124.8 | $128 | $131 | $134 | $137.5 | $140.5 |

| Revenue growth | 1.5% | 1.9% | 2.56% | 2.45% | 2.33% | 2.46% | 2.22% |

| EPS | $2.50 | $2.65 | $2.78 | $2.92 | $3.04 | $3.19 | $3.32 |

| EPS growth | N/A | 6% | 5% | 5% | 4% | 5% | 4% |

| Forward P/E | 5.66 | 7 | 8 | 10 | 11 | 12 | 11 |

| Stock price | $15 | $19.50 | $23.36 | $30.40 | $35.09 | $39.84 | $45 |

Source: The Financial Prophet

The Bottom Line - AT&T Is Dirt Cheap

AT&T is exceptionally cheap here, and its stock should benefit from mild EPS growth and multiple expansion in the coming years. While keeping my projections modest, we still see that AT&T's stock could triple in the coming years. Therefore, AT&T is a strong buy with limited downside risk and substantial upside potential as we advance. Also, there's the 7% dividend to consider, which should continue growing if the company meets my projections in the coming years.

This article was written by

Hi, I'm Victor! It all goes back to looking at stock quotes in the old Wall St. Journal when I was a kid. What do these numbers mean, I thought? Fortunately, my uncle was a successful commodities trader on the NYMEX, and I got him to teach me how to invest. I bought my first actual stock in a company when I was 20, and the rest, as they say, is history. Over the years, some of my top investments include Apple, Tesla, Amazon, Netflix, Facebook, Google, Microsoft, Nike, JPMorgan, Bitcoin, and others.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)