Toronto-Dominion: The Mean, Green, Yield Machine Faces The Canadian Bubble

Summary

- Toronto-Dominion dominates banking in Canada alongside the other big five.

- On a valuation level, the big six are finally starting to get attractive.

- We look at risks from the elephant in the room, the unhinged housing market.

- We also suggest two lower risk plays.

- I do much more than just articles at Conservative Income Portfolio: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

mizoula

Note: All amounts discussed are in Canadian Dollars unless noted otherwise.

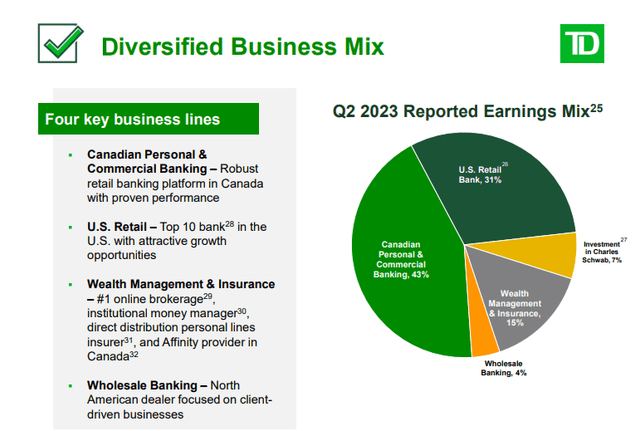

Toronto-Dominion Bank (NYSE:TD) (TSX:TD:CA) is one of "big six" institutions that collectively run 90% of the banking system in Canada. Among the big six, TD has the highest exposure to non-Canadian sources of income. About 38% of its income comes from the US, which includes an investment in The Charles Schwab Corporation (SCHW). The bank also has a substantial presence in the United States, having the most branches in the country among Canadian banks.

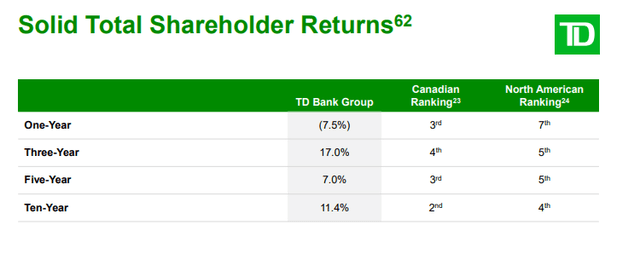

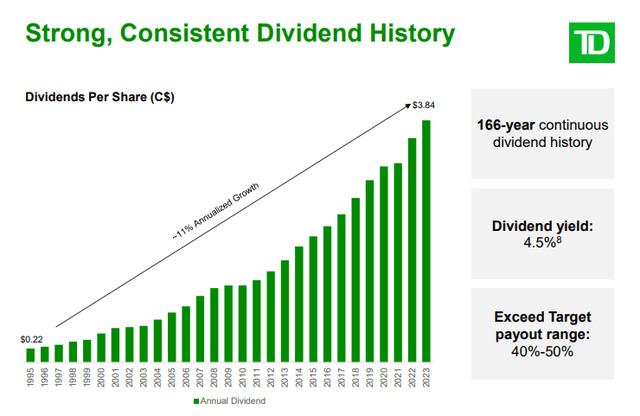

While the big six dominate the market, they do compete intensely with each other. TD has risen to first or second place in multiple areas of banking including business banking and credit card issuance. We have followed this bank for a long time and the tone at the top has generally been one of aiming for lower risk than what they can get away with just to please the regulators. In other words, this bank has risk management as its primary focus and that is something we can really get behind. Despite this focus (we would say because of it), the bank has delivered attractive long term returns.

Current Results

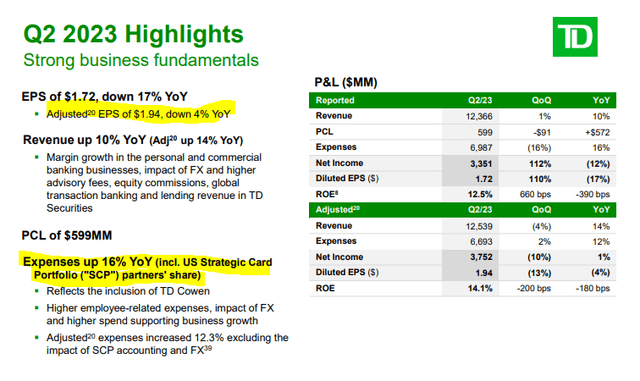

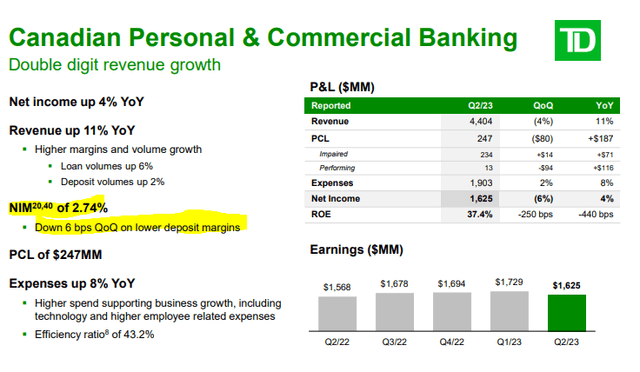

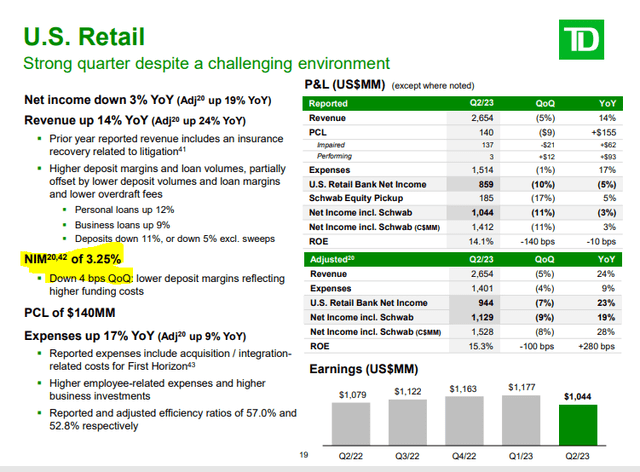

TD has its fiscal year ending in October. The last reported results were for Q2-2023 ending on April 30, 2023. The bank's adjusted earnings were down 4% year over year and 13% quarter over quarter. The declines can be blamed on a combination of rising expenses and falling net interest margins.

The tight labor markets and acquisition of Cowen played the biggest role in higher expenses. On the falling net interest margins, one must note that they remain incredibly strong, even though we have seen some drops recently. On the Canadian side they were at 2.74%.

On the US side, they were even higher.

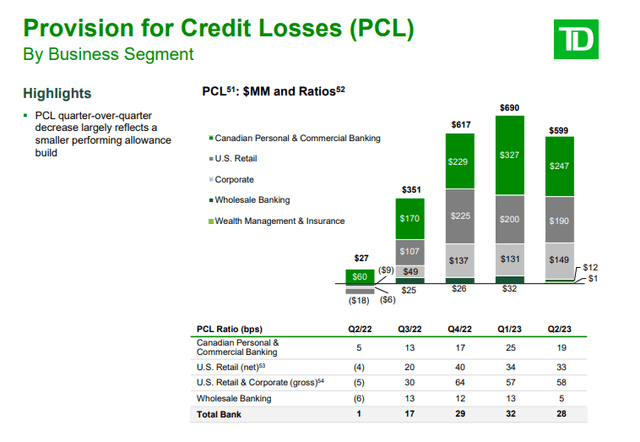

TD also booked a higher level of loss provisions as credit strains began to emerge on both sides of the border.

Current Challenges

There are three major challenges for the bank here. The first and foremost is the Canadian housing market. The extended valuations alongside rapid-fire rate hikes by the Bank Of Canada, have created one of the silliest cases of overvaluation we have seen.

Twitter

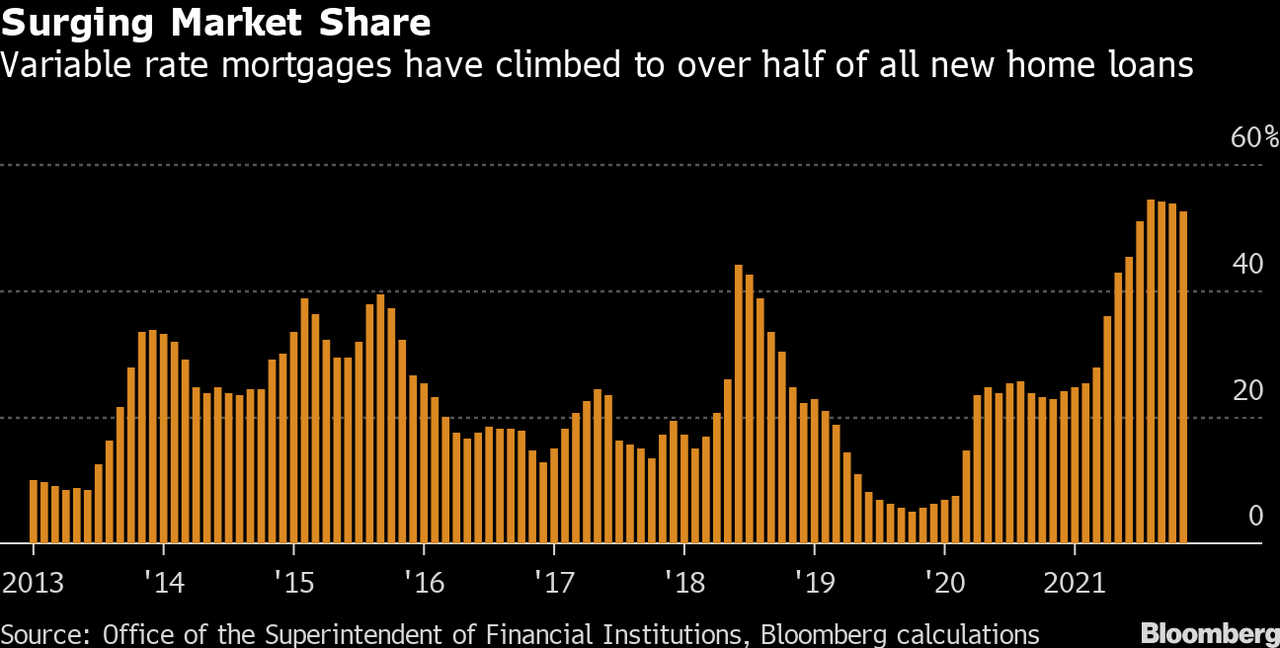

This level of valuation would be hard to justify even if Vancouver, BC changed its name to Vancouver, AI. An added stress here is that the predominant mortgage originated in the last 2 years is a 5-year floating rate one in Canada, as opposed to a 30-year fixed in the US.

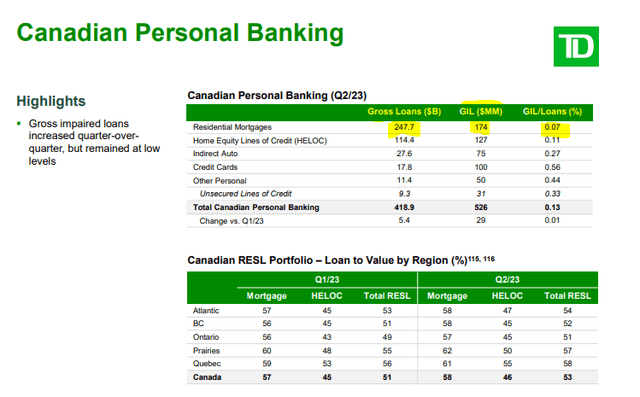

So far, the residential mortgage side has not blinked. Gross impaired loans look ok. This has been helped by relatively conservative loan to value ratios.

But we might still be in the honeymoon period. The rate hikes have pushed up the length of amortizations as payments cover less and less of the principal balance.

More than half of Big Six banks have a large share of mortgages with 30 or more years to go. Topping the list was Bank of Montreal (BMO), (BMO:CA), with nearly a third (32.4%) of their portfolio having 30 years or more remaining as of Q1 2023. Not far behind was Canadian Imperial Bank of Commerce (CM), (CM:CA) (30.0% of its portfolio), TD (29.3%), and Royal Bank of Canada (RY), (RY:CA) (27%).

It's worth emphasizing that these aren't mortgages with 30 year terms. They're mortgages with at least 30 years of repayment left. Many with significantly more, but we'll come back to that.

Before we do, it's important to understand this isn't a problem seen at all banks. The share at The Bank of Nova Scotia (BNS), (BNS:CA) (1.5%), and National Bank (NA:CA) (1%) remain similar to any other year. At the very least, this tells us it's not a widespread banking issue but one at those specific banks.

A significant share of the above banks' portfolios had at least 35 years left. Over a quarter (27.4%) of TD's Canadian residential portfolio have amortizations of at least 35 years left in Q1. Not far behind are CM (27%), and RY (26%).

Source: Better Dwelling (emphasis ours)

This is a massive long-term challenge. Not only for TD's portfolio, but also for the Canadian economy. Regulation continues to make the problem worse. Despite Canada having more surface area than we know what to do with, developing new affordable housing is like pulling teeth. At the same time, immigration has been run extra-hot in the name of replacing our depleting work force. The net result is housing shortages, which prevent prices from adjusting to where they need to go.

The second problem for TD is the one stemming from the first. We will likely see a compression in net interest margins, far beyond what we have seen so far. There is no rationale reason that banks should be making these levels of margins in an inverted yield curve. Profits are going to go down, only question is how much.

Finally, as the economy weakens, thanks to an indebted consumer hamstrung with variable rate mortgages, expect a lot more charge-offs.

Valuation

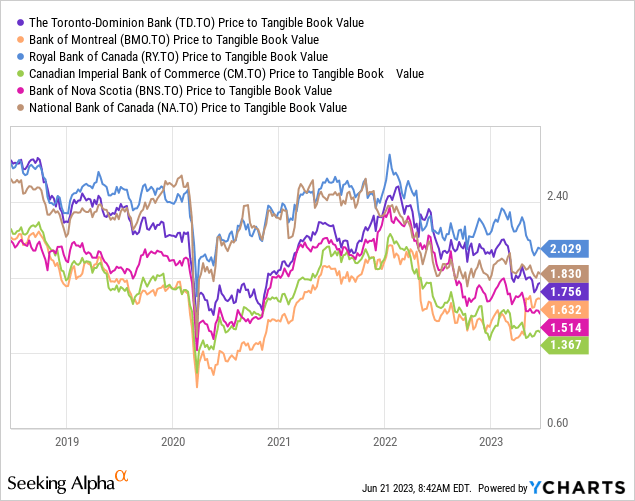

Earnings are great to look at, but they tend to always show Canadian banks as "cheap". You are not going to get large multiples for these behemoths and the low P/E ratios tend to be well deserved. Price to tangible book is a better measure and does show that both BNS and CM are near COVID-19 lows.

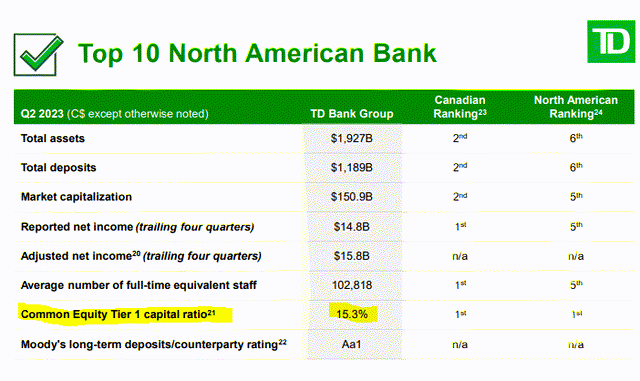

TD is not too far from those levels either. This is despite current Tier-1 capital levels being fantastic.

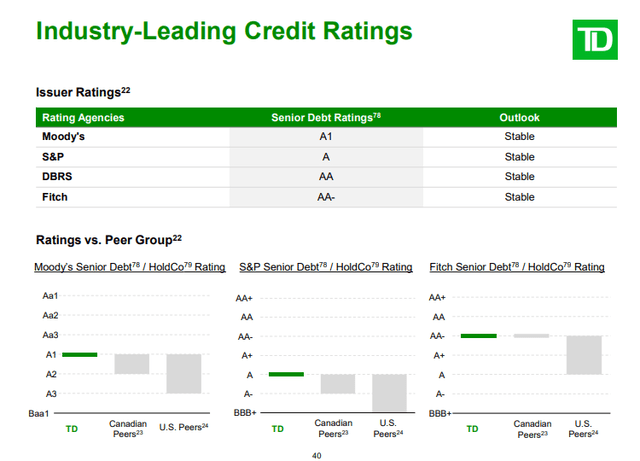

Credit ratings remain strong and overall management of risk helps investors feel comfortable with TD.

Verdict

Macro always trumps micro for us and the macro setup looks really difficult for Canadian banks. The "micro" offsets are an attractive valuation and one of the better risk management teams in the business. Can we get behind this here? Balancing the information, we think that the bank will be ok, but it might take years to get any capital appreciation. Of course, you might be just interested in the next slide.

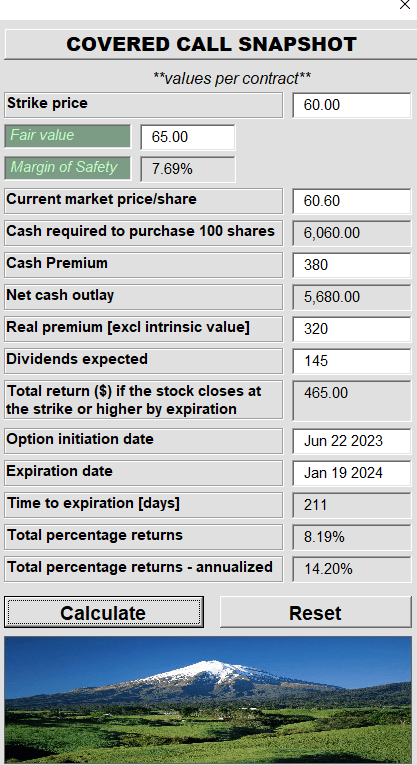

In that case, a covered call makes a lot more sense. We have shown one example here using the January 19, 2024 covered calls for the $60 strike which create a very solid yield for a flattish price. Note that this is using the NYSE price and dividends in US Dollars.

Author's App

These can navigate the risks better and offer a solid total return, even if shares stay rangebound as we expect.

Preferred Shares

If you believe in a "higher for longer" situation and one where inflation remains sticky, TD's preferred shares make a lot of sense. Higher short term rates for long would likely create a compressing margin for TD and force its earnings lower. In that case, preferred shares could outperform substantially. All of its preferreds are the resetting variety, tied to the 5-year Government Of Canada (GOC-5) bond yields and trade on the TSX. Like almost all other banking preferred shares, they are non-cumulative. There are two issues that we like at present.

We like Series 3 (TSX:TD.PFB:CA) shares, which are currently yielding 5.32% and due to rest in July 2024 (prospectus link) at GOC-5 plus 2.27%. At current rates, with the GOC-5 yielding 3.75% the reset would happen at 6.02% on par. Since TD.PFB:CA is trading at $17.29, it would create a yield of 8.7%. One added plus for those that believe rates are likely to stay higher is that the GOC-5 trades far below short term rates so in other words, it implies there will be interest rate cuts. In the absence of that, the GOC-5 could drift higher and create a massive double-digit yield for these preferreds at this price.

We also like the TD Series 1 Preferred Shares (TSX:TD.PFA:CA) yielding 5.36%. The Series 1 are almost identical to Series. The key differences are that the reset date is October 2024 and hence you have slightly longer time to reset. The spread is slightly lower and (GOC-5 plus 2.24%) and implied yield on reset is slightly higher at 8.74%. On any given day you may find one or the other slightly better depending upon liquidity and offers.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TD.PFA:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)

We agree, TD came up on my radar a while ago. I sold the October 57.5 Puts for 4.59$. Hope it dips, I have no problem holding for yield growth if it does.

Bought BMO during the GFC and it worked out well.