Kinder Morgan: A 2015 Bear Selloff Redux Cannot Be Ruled Out

Summary

- Kinder Morgan is now facing both a decline in energy-related sales and rising interest expense, similar to the bearish setup of 2015, which could negatively impact its stock price.

- The company's high debt level during a period of rising interest rates makes it a risky investment at the moment.

- I rate Kinder Morgan a Sell and Avoid due to these factors, with positive total return performance unlikely for owners during the next 6-12 months.

kali9/E+ via Getty Images

I have written a number of bearish articles on Kinder Morgan (NYSE:KMI) over the years, one of America's largest energy pipeline/transportation companies. My last effort in December 2021 is linked here. The problem child has always been management's aggressive use of debt. Luckily, profit margins of late have been high enough to keep things going, even as most all net cash flow after necessary capital expenditures is used to pay a 5% to 6% dividend yield annually to shareholders.

The huge spike in crude oil and natural gas prices during 2021-22 has faded over time. So, the company cannot count on any growth in sales, with energy prices moving in reverse and a recession in demand looming.

The newest concern is rising interest rates over the last 18 months are starting to pull net interest expense on debt issuance and rollovers on maturity in the wrong direction. Honestly, if interest rates stay at multi-year highs or go even higher in the U.S., Kinder Morgan will remain a meaningful investment laggard vs. the pipeline industry and S&P 500 in general. Let me explain why.

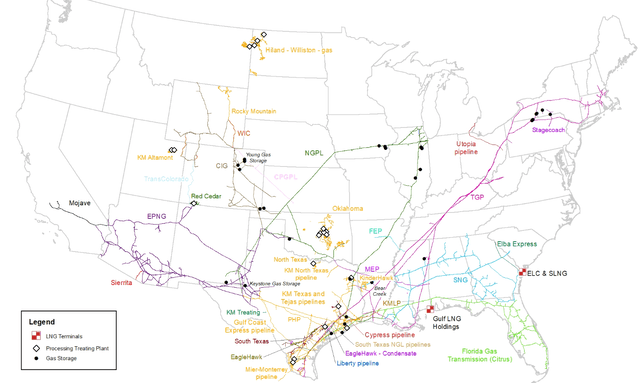

Kinder Morgan 2022 10-K, Natural Gas Pipeline Map Kinder Morgan 2022 10-K, Crude Oil & Refined Product Transportation Asset Map

History of Weak Stock Performance

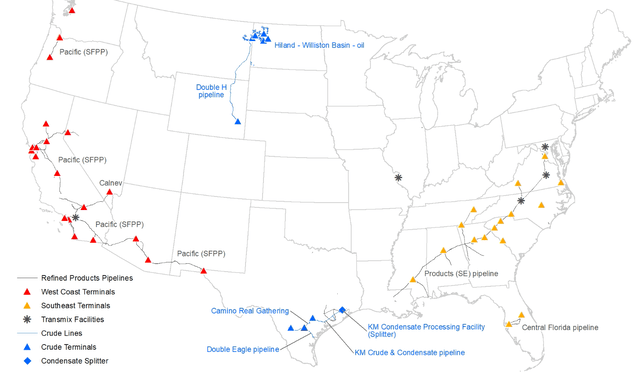

I know most writers on Seeking Alpha love the nice KMI dividend yield, and are always forecasting a turn toward higher income levels every year. But, the fact is Kinder has severely underperformed for investors, on almost any time scale. The truly rotten losses have come to those buying the stock a decade ago on promises of robust rates of business growth. All told, even with a decent cash dividend, KMI's total return has been NEGATIVE for the buy-and-hold crowd, measured from 2013.

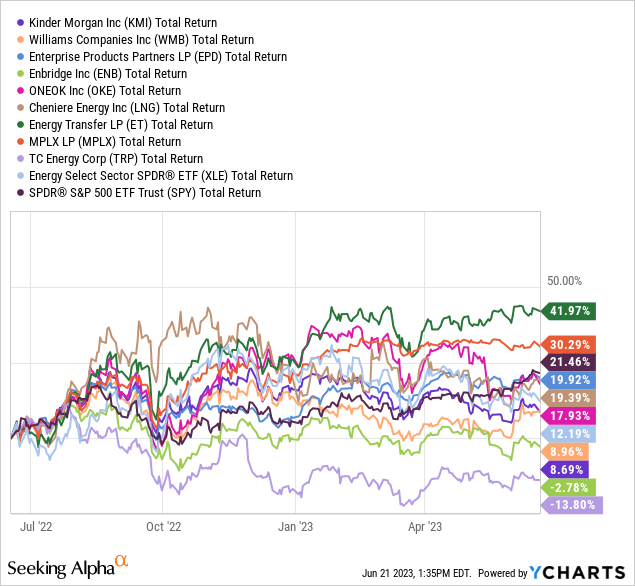

I have drawn the awful -25% total return over the past decade below, with the S&P 500 equivalent and alternative gain of +231% pictured, alongside peers/competitors Williams Companies (WMB), Enterprise Products (EPD), Enbridge (ENB), ONEOK (OKE), Cheniere Energy (LNG), Energy Transfer (ET), MPLX LP (MPLX), TC Energy (TRP), plus the whole Energy Sector SPDR ETF (XLE).

YCharts - Kinder Morgan vs. Major Pipeline Peers, Total Returns, 10 Years

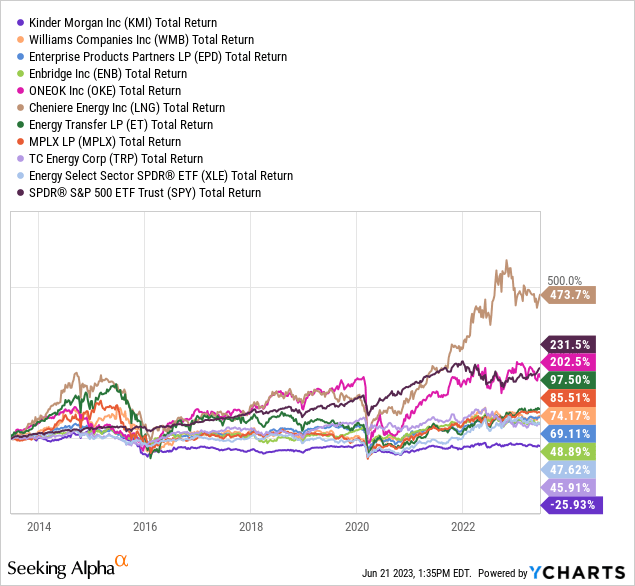

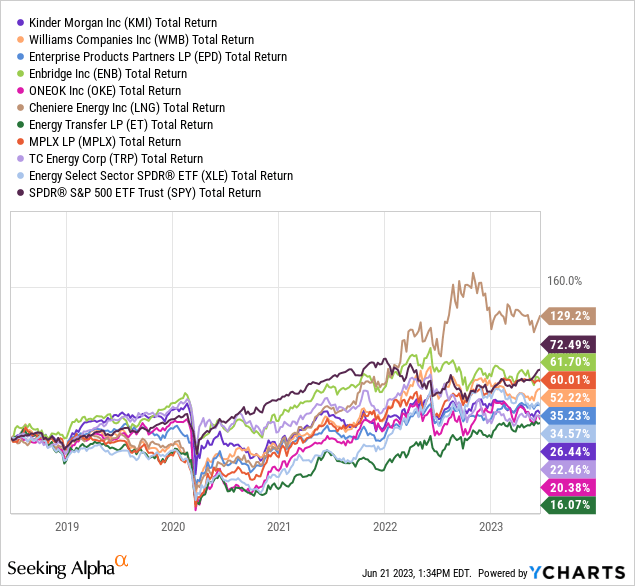

On a 5-year historical graph, Kinder moves into a positive return at least. However, it has still lagged peers by a wide margin and the overall U.S. equity market by yet more.

YCharts - Kinder Morgan vs. Major Pipeline Peers, Total Returns, 5 Years

On a 1-year total return basis, the same "underperformance" picture appears. For Kinder Morgan, weak relative equity performance is primarily the result of too much debt, plain and simple.

YCharts - Kinder Morgan vs. Major Pipeline Peers, Total Returns, 1 Year

Valuation Review

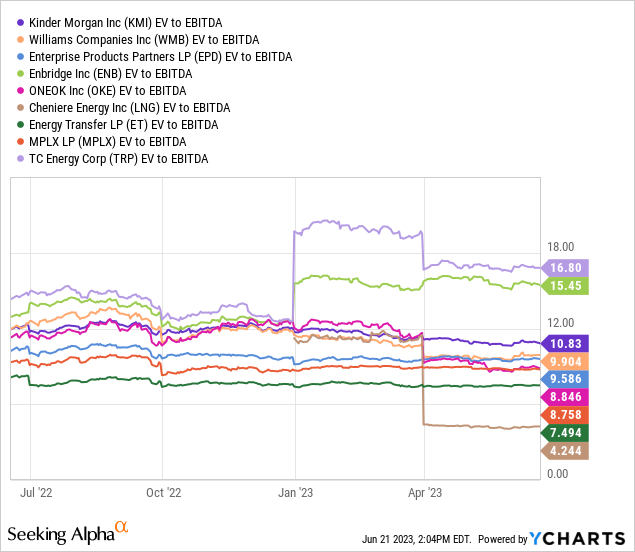

When we include debt and equity capitalization minus cash holdings, the enterprise valuation of Kinder remains on the high end of the energy transportation peer group, on basic EBITDA. I prefer to buy businesses sitting on the low end of industry-wide valuations, with some sort of growth outlook.

YCharts - Kinder Morgan vs. Major Pipeline Peers, EV to EBITDA, 1 Year

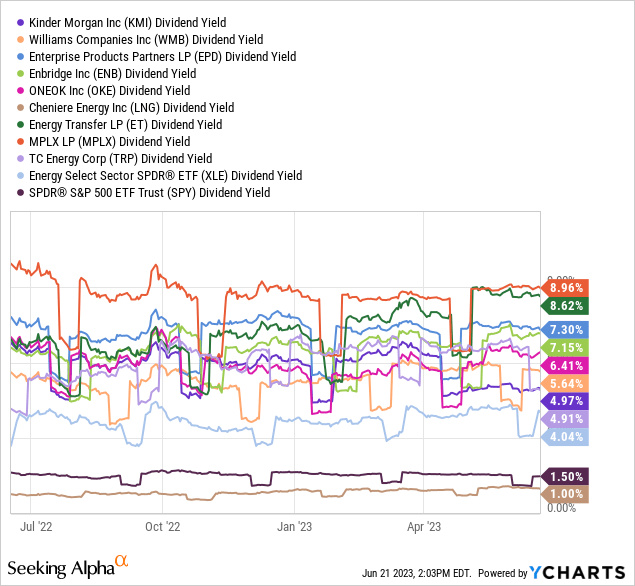

Plus, the trailing dividend yield of 5% was actually on the lower end of the industry spectrum for investors. Why not just buy a Treasury security yielding 5% in the 1-year range, and leave price risk off the table?

YCharts - Kinder Morgan vs. Major Pipeline Peers, Trailing Dividend Yield, 1 Year

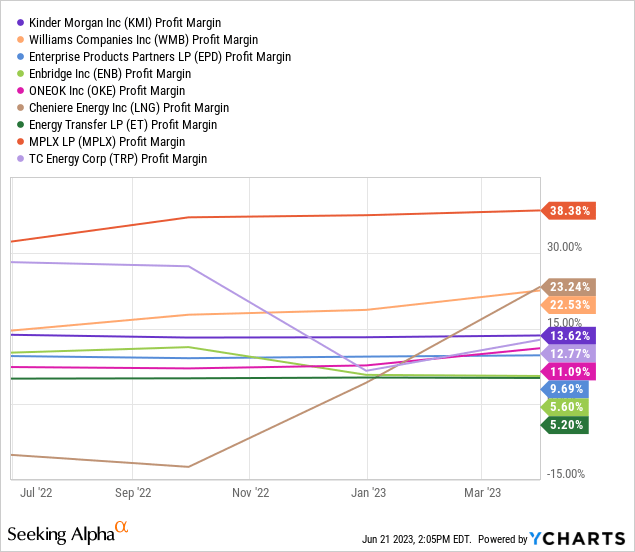

The one saving grace for the stock quote during 2022 and early 2023 was slightly better-than-average margins of 14% on sales. The biggest ownership issue to be faced during the rest of the year is margins have likely peaked and are set to decline rapidly. Why?

YCharts - Kinder Morgan vs. Major Pipeline Peers, Final Income Margin, 1 Year

The Debt Problem

Here's the rub. Interest rates are rising and such will add to Kinder Morgan's cost structure, all other variables remaining the same. But there's a double whammy also at play. Energy prices peaked in the first half of 2022, which should translate into declining sales at the company the remainder of 2023 and all of 2024.

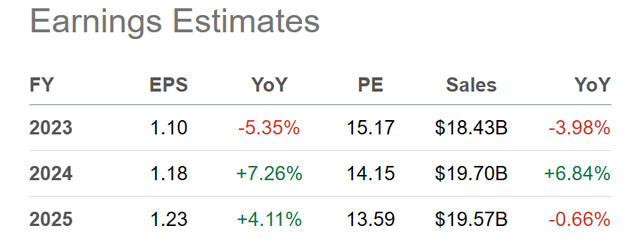

Per usual, Wall Street analysts seem content overestimating the impact of each on future operating results. The consensus forecast is sales will stagnant, while earnings magically rise for no good reason into 2025.

Seeking Alpha Table - Kinder Morgan, Analyst Estimates for 2023-25, Made June 20th, 2023

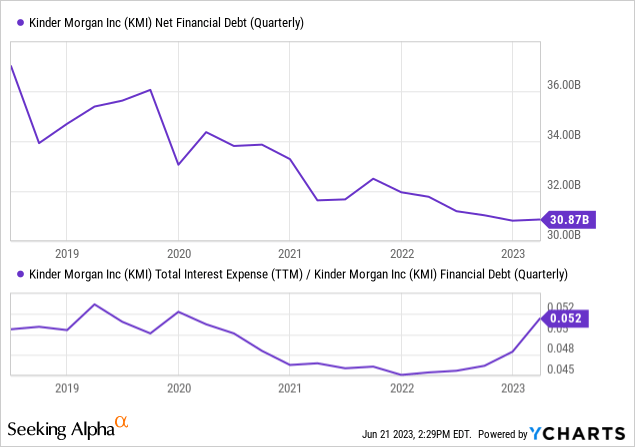

One hint of trouble ahead is total interest expense is now on the rise with higher refinancing costs. Although total net debt has declined from $37 to $31 billion over five years, climbing interest expense won't improve margins for the company, just the opposite. You can review the substantial ramp in overall interest rates paid on debt from 4.5% a year ago to 5.2% today. The bad news is this rate squeeze on margins may continue for a few years, as debt matures and is refinanced at higher cost levels.

YCharts - Kinder Morgan, Net Financial Debt, Effective Interest Rate, 5 Years

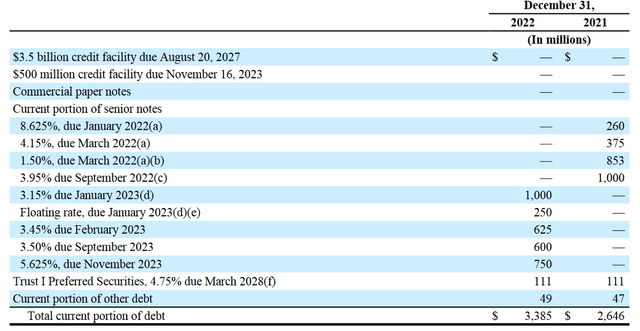

Debt maturing in 2023 amounts to $3.2 billion, with another $2 billion due to be refinanced or repaid in 2024. If you want to take a bullish slant, assuming the company has no new projects to finance (which they do), rolling the debt over to today's interest rate regime will only add $50 to $100 million in extra company expense per annum this year and next.

Kinder Morgan 2022 10-K, Debt Maturity Table

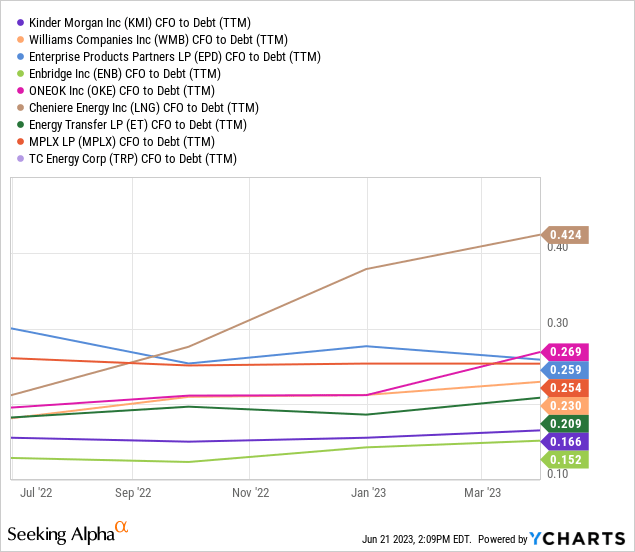

My biggest worry is holding one of the lowest ratios of cash flow coverage vs. debt is not the place to be going into recession. A major drawdown in margins will likely knock operating cash flows dramatically in the wrong direction, going into 2024, before the negative effect of rising interest expense comes into full view.

YCharts - Kinder Morgan, Cash Flow to Debt Ratio, 1 Year

2015 Disaster Revisited Soon?

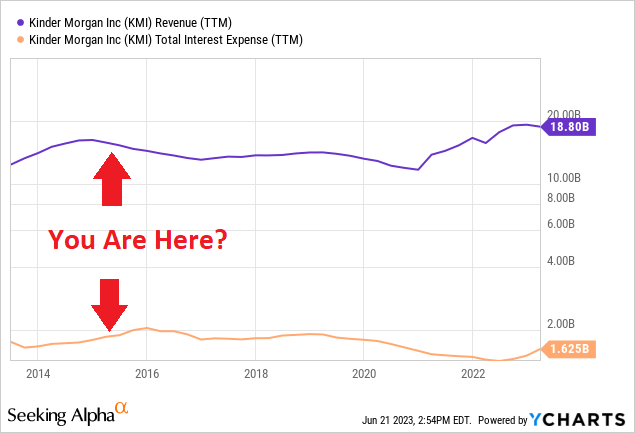

My thinking is we could be headed for a worst-case scenario for Kinder of falling sales AND rising interest expense. The last time such a situation unfolded was 2015.

YCharts - Kinder Morgan, Trailing 12-Month Sales & Interest Expense, 10 Years

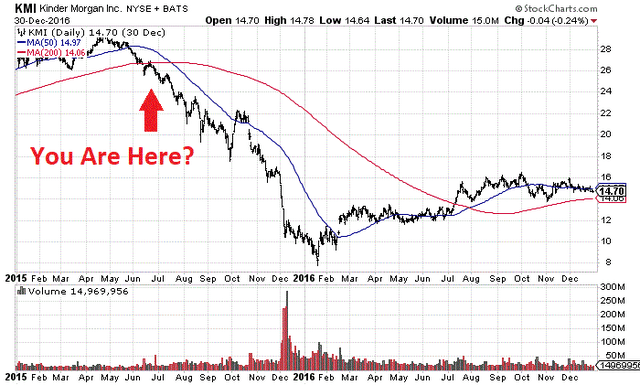

You can review for yourself below how Kinder's share price cratered on far lower profitability. Basically, price imploded by greater than 60% into early 2016. For reference, company sales fell -20% and reported income by -80% between the end of 2014 and middle of 2016.

StockCharts.com - Kinder Morgan, Daily Price & Volume Changes, 2015-2016, Author Reference Point

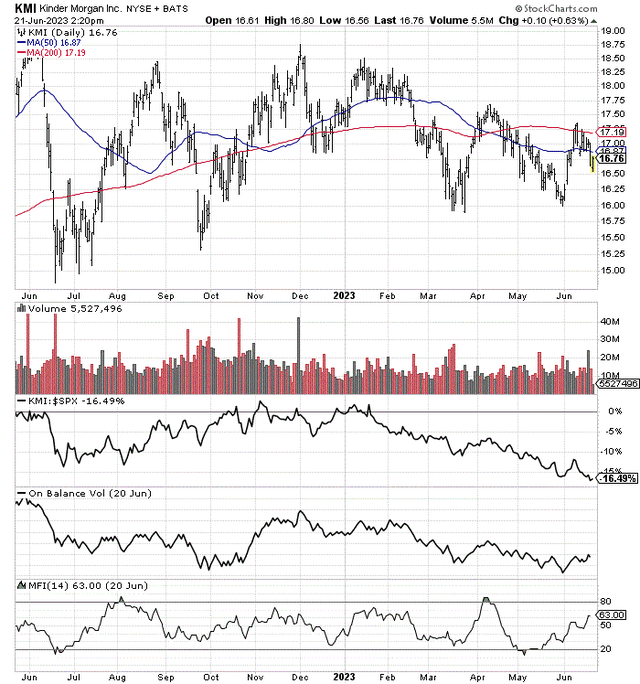

We could be in for a similar tough sled for the stock quote over the next 6-12 months, assuming energy prices do not recover and interest rates stay elevated. Don't say it cannot happen. The current chart pattern is showing truly bearish signals of late. Shares are sharply underperforming the S&P 500 in calendar 2023, with price now trading underneath the important 50-day and 200-day moving averages, as both MAs trend lower for direction.

StockCharts.com - Kinder Morgan, 13 Months of Daily Price & Volume Changes

Final Thoughts

All the negative forces that affected the business during 2015-16 may be reappearing in 2023. Of course, a deep recession and even lower oil prices would be horrific news for Kinder Morgan shareholders over the next year. The squeeze on profit margins could bring results back closer to breakeven for income rather quickly.

Q1 2023 results may be a harbinger of trouble ahead, with a -7% drop in sales and +2% increase in net income vs. the 2022 March quarter. Analysts are calling for a YoY drop in income for each of the remaining three quarters of fiscal 2023. Rising interest costs on debt and a material drop in energy prices are hurting margins.

With net income barely covering the dividend payout over the past year, a recession now could damage the stock quote more than competitors. Any downturn in operating profitability means management will have to borrow additional funds or sell assets to continue paying today's dividend rate (with little cash on hand and a negative number for working capital), similar to its mode of operation for years.

My view is Kinder is chock full of "risk" right now. I rate shares a Sell if you own a position, and an Avoid if you are contemplating buying the stock for its 6% forward projected dividend yield.

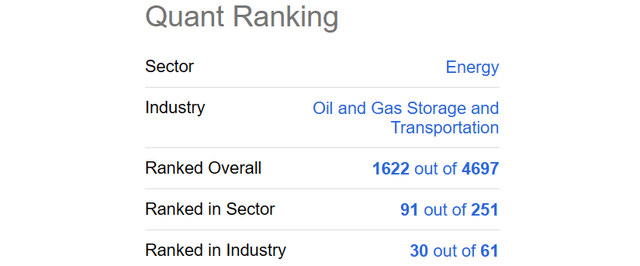

Based on rearview mirror stats, Seeking Alpha has a Quant rating slightly better than the average equity.

Seeking Alpha - Kinder Morgan, Computer Quant Rank, June 21st, 2023

But, selling could erupt quickly on the likelihood of U.S. economic contraction, as natural gas & crude oil demand/prices have the potential to slide yet further. (My feelings are more neutral about immediate spot energy commodity pricing this summer, with bullish and bearish forces roughly equal in weight. But this forecast is subject to change, based on GDP direction.)

What could prove this bearish KMI forecast wrong? Basically, the opposite of current reality. Rising petroleum/gas prices in combination with a major decline in interest rates could support the Kinder share price in a $15 to $20 range. Nevertheless, this looks to be a unicorn-world type bet today. You may have stronger odds putting money down on the Kansas City Royals or Oakland Athletics to win a game, with the worst records in professional baseball.

Statistically speaking, Kinder is facing an uphill battle to generate a positive total return in my view, including both price appreciation and dividends, over the next 6-12 months. Significant total return underperformance of the S&P 500 over the intermediate term should continue.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. When investing in securities, investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but the author’s opinion written at a point in time. Opinions expressed herein address only a small cross-section of data related to an investment in the securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (13)

seekingalpha.com/...