Intel Updates Its Opportunistic Foundry Model

Summary

- Intel's disclosures during the Internal Foundry Model Investor Webinar suggest that the Company is doing what it needs to do to make the fabs and business units competitive.

- However, the business model does not inspire confidence that Intel will be a leading-edge foundry anytime in the near future - and understandably so.

- Intel management is destroying considerable shareholder value by delaying and not even talking about the fab spin-off.

- This idea was discussed in more depth with members of my private investing community, Beyond The Hype. Learn More »

Justin Sullivan

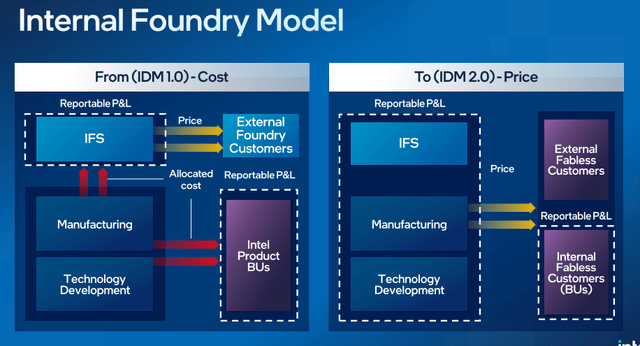

Intel (NASDAQ:INTC) gave more details about its foundry model transition in a webinar today. At the root of it, the difference between IDM1.0 and IDM2.0 is that Intel will run the foundry operations as a separate P&L and will treat all customers - internal and external on an arms-length basis (image below). The idea is that running the fabs this way would enable both the fab and the internal business units to be benchmarked against the fabless industry - which in turn would lead to more visible and responsible operating units.

Internal Foundry Model Investor Webinar (Intel)

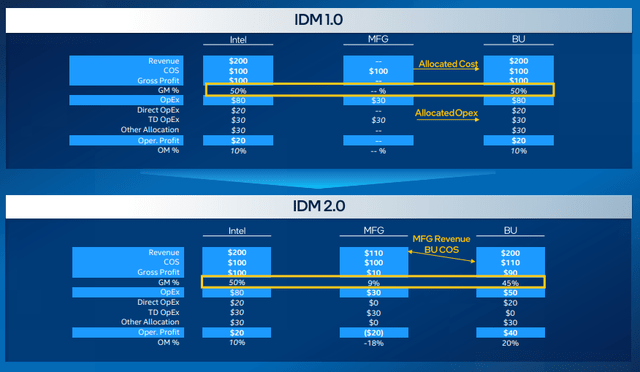

Intel gave an insight into how the P&Ls of the manufacturing and business unit parts would look once IDM2.0 is adopted later this year (see image below). The chart below is just an example, and Intel has commented that its foundry business will be a $20B+ business when it starts reporting separately. While the numbers in the chart are just examples, Intel is clearly sending a message on the type of numbers we can expect to see once this type of reporting begins. For example, the manufacturing side shows a 9% gross margin and -18% operating margin in the chart, whereas the business unit shows 50% gross margin and 10% operating margin. While the exact numbers may be different, we can expect decent gross margins and profitability on the business unit side and low gross margins and heavy losses for the foundry side.

Internal Foundry Model Investor Webinar (Intel)

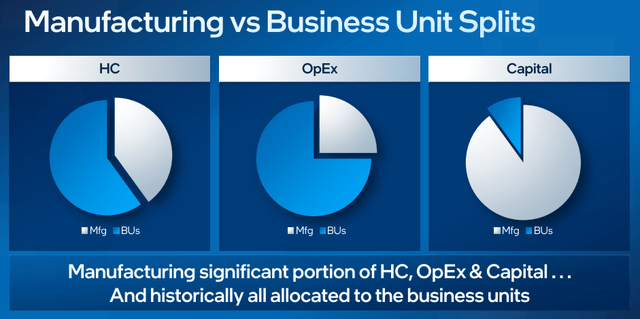

Intel also gave a flavor of how the headcount, opex, and capex are likely to be split between the foundry and the business units (image below). Not surprisingly, foundry operations will not be opex intensive but will be capex intensive. On the other hand, the business units will be capex-light but opex-intensive.

Internal Foundry Model Investor Webinar (Intel)

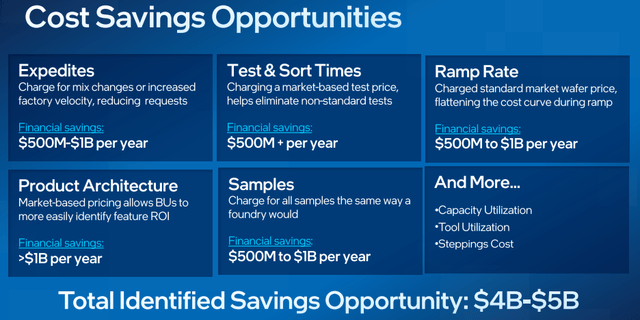

Intel is keenly aware of the losing nature of the foundry operations as well as the relatively low margin nature of the business units and has identified a number of areas where it can reduce cost (image below). Many of the identified savings are expected to be achieved during 2024, but other savings will not be achieved until later.

Internal Foundry Model Investor Webinar (Intel)

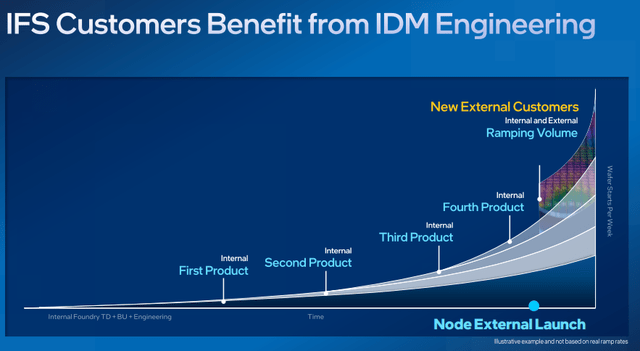

Probably the most insightful part of the presentation was a slide showing how Intel plans to go about taking on external foundry customers (image below). This slide shows that Intel will first roll out several Intel products on a new process before taking on external customers on that process (4 Intel products in the example below). This clearly means that cutting-edge processes will not be available to external customers until several quarters after they are available to Intel business units. This virtually assures that no external customers with leading-edge process needs will consider Intel as a foundry. Only customers looking at one or two process nodes behind the leading edge will consider Intel. Outside of "made-in-USA" and national security reasons, leading-edge customers are not likely to use Intel as a foundry, which in turn makes building scale difficult.

While this may seem like a bad strategy, there are good reasons for such a strategy. This lag could be because Intel's processes are immature, and the Company does not have the capability to support external customers on a leading-edge process at the current time. This could be true because Intel is early in this reorganization and may be limited in what it can deliver. More likely, the lag is because Intel has been and is continuing to see the foundry operations as an opportunistic business. While Intel needs scale on the fab side, it even more acutely needs its fabs to become competitive. Intel has been able to garner huge subsidies pretending to be a foundry, but the subsidies are mainly to shore up the Company's competitive position. This latter explanation is the likely one, and hence the heading of the article.

Internal Foundry Model Investor Webinar (Intel)

Wrap Up

Intel is doing what it needs to do - i.e., clean up its operations to make the defunct IDM model viable. By separating the fabs into a separate P&L, Intel will make both its business units and fabs more efficient, accountable, and competitive. The Company has identified $8B to $10B of cost reductions that it plans to deliver by the end of 2025. While Intel wants to be a foundry, it also understands that it first needs to become competitive to be a strong player. So, the name of the game here is not about becoming a foundry but creating a competitive process with an acceptable cost structure. In the long term, Intel needs the foundry business scale to be viable, but for the time being it is being opportunistic about the foundry business.

By 2025, Intel hopes to clean up its act and have competitive products and competitive fabs - both of which the Company believes are essential for its recovery. However, this strategy is misguided. Intel is likely to be a much smaller company in 2025 (due to severe market share losses to Advanced Micro Devices (AMD) and Nvidia (NVDA) in the interim) and by the time Intel cleans up its fab act, the fab business will be deeply subscale and not competitive. This is the unfortunate situation that Intel now finds itself in.

Beyond The Hype continues to advocate a rapid spin-off of the foundry operation to improve the chances of the Company's recovery.

Subscribers to Beyond The Hype have access to all the linked articles that may otherwise be inaccessible. For timely, cutting-edge insights, analysis and investing ideas in technology, semiconductor, solar, battery, autonomous vehicles, and other emerging technology stocks, check out Beyond the Hype. This Marketplace service gives you early access to my best investing ideas, along with event driven and arbitrage opportunities when they are most edgy and actionable.

This article was written by

Author of Beyond the Hype, a comprehensive emerging technology stock analysis and discussion service on Seeking Alpha Marketplace. Currently, we focus on identifying and investing in the semiconductor, renewable energy, storage, EV, autonomous vehicle, CPU, and GPU markets.

Beyond the Hype is different because it is dedicated to cutting through management and Wall Street commentary and providing fresh and insightful perspectives from a mid-market M&A consultant specializing in the technology and energy industries who's also been an individual Investor for over 25 years. The platform is about growth oriented investments primarily in market leaders and technology leaders. Investment philosophy is long term buy and hold with average holding time of several years.

Beyond the Hype is different because it is dedicated to cutting through management and Wall Street commentary and providing fresh and insightful perspectives on companies and investments. We see through hype, show the true value of companies, and make investments safer. A lot of views tend to be controversial, against the grain, and remarkably accurate.

In investing, people typically talk about high risk, high reward. At Beyond The Hype, we would like to do a little better. Our motto is: Low Risk, High Reward

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)

semiwiki.com/...Bottom line: Intel is now the #2 foundry in the world, absolutely.

"the foundry business is a marathon not a sprint"

Not a good comparison. The question is "so what?". The leader keeps pulling away and the second rank keeps falling further behind. The longer the run, the farther behind the loser gets.

"Intel is now the #2 foundry in the world, absolutely."

Technical argument. The real measure of the foundry business is the non-IDM business. On that measure, Intel is nowhere.