Zoetis: A Purrfect Addition To Your Portfolio

Summary

- Zoetis, a global leader in the animal health industry, has beaten the S&P 500 over the last five years and offers diverse growth opportunities.

- The company has a strong international presence, a commitment to innovation, and a focus on key growth areas such as dermatology, parasiticides, pain, diagnostics, and emerging markets.

- Despite a high valuation and significant debt, Zoetis is a high-quality business that could reward patient, long-term investors.

TatyanaGl/iStock via Getty Images

The S&P 500 is up roughly 14% year to date. Although, these returns have been generated essentially from seven large companies. The returns for the last month (roughly 5%) may have investors wondering if the market may be too hot right now.

These are the type of questions that plague investors. In early 2023, many investors held cash due to interest rates increases and the belief a recession was looming. Now investors may be holding cash due to the belief the market has risen too abruptly due to the AI hype.

When it comes to investing, I believe that often the simplest advice is most often the best. That is why, I’m a particular fan of Terry Smith. Smith is a fund manager and has been overseeing his fund, Fundsmith since its inception in 2010.

Smith’s investing philosophy focuses on the long-term. Some of his “golden rules” as mentioned in his book, “Investing for Growth,” include investing in high-quality businesses, not trying to time the market, and dealing infrequently as possible.

I am a believer in much of Smith’s wisdom and believe that investing in quality businesses over the long-term can generate excellent returns for investors.

Today I’d like to discuss one stock which is in Smith’s fund which has beaten the S&P 500 over the last five years and has established itself as a leader within a niche global industry. That company is Zoetis.

The Company

Zoetis (NYSE:ZTS) is a global leader in the animal health industry. The company provides medicines, vaccinations, and various other products and services for pets and livestock. Zoetis went public in 2013 when it spun off from Pfizer (PFE). The company’s various products focus on eight main species: dogs, cats and horses (companion animals) and cattle, swine, sheep, fish, and poultry (livestock).

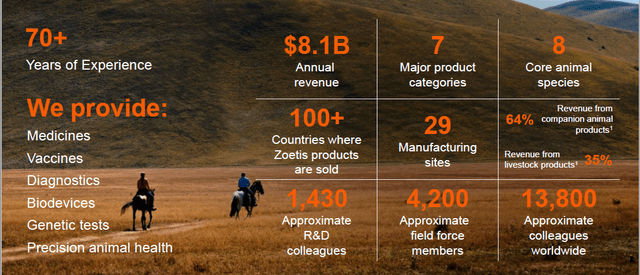

Despite going public for only a decade the company has 70 plus years of experience and has a strong global presence in the industry:

The company has a robust international presence as well as this below graphic illustrates that Zoetis is a leader in animal health. For example, Zoetis has a leading position for companion animals, cattle, and fish. Also, the company is the leading animal health provider within vital markets such as North America, Latin America, and Asia.

It is clear that Zoetis has established itself as a leader in the animal health industry and I can believe there are various reasons why Zoetis will continue to grow in the years and perhaps decades to come.

Moat and Opportunity

With approximately 300 comprehensive product lines within the different product categories Zoetis clearly has a diverse and impressive product portfolio. Roughly 64% of the company’s revenue comes from companion animal products and 35% come from livestock related products (1% of revenue comes from contract manufacturing services to third parties and human health products).

Zoetis sells products in over 100 countries and in 2022 roughly 46% of revenue came from operations outside of the United States. Much of this revenue was derived from emerging markets such as China and Brazil.

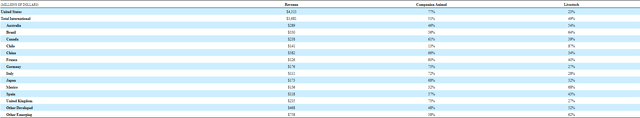

Below is a table from the company's most recent 10K showing the various countries, the amount of revenue, and the percentage of revenue related to companion animals compared to livestock:

I think this diverse mix is outstanding and certainly helps mitigate Zoetis’s risk should issues arise in a certain country or area of the world.

Zoetis appears to have numerous opportunities for growth and various trends put the company in an advantageous position. One trend in Zoetis’s favor is that folks love their pets. 95% of pet owners view their pet as a part of the family and according to market research, 20% of pet owners say they wouldn’t spend less on their pet when faced with a decrease in budget. Currently, 90% of pet owners state they would do anything to prevent their pet from suffering and 50% of pet owners in the United States are Millennials or Gen Z and many of these owners have one than one pet.

As this human-animal bond grows stronger, pets are receiving more medical care and thus are living longer. Since 2017 vet clinic visits, vet clinic revenues, and the amount spend per visit have all increased.

Zoetis also believes livestock is poised to continue to grow as the population increases. The company believes tailwinds such as the significant investment in vaccines, the impact of generics, and the decline in plant-based meat consumption will benefit the organization.

The company has been a leader in innovation making R&D a focal point for the organization. Zoetis has invested over $4 billion in R&D since going public. The company has received over 2,000 regulatory approvals and 15 blockbusters, which is a product or product line that now generates over $100 million in annual revenue. Of these 15 blockbusters, 9 were delivered in the last 10 years.

Going forward the company plans to invest roughly 60-70% of R&D expenses on new products and the rest on lifecycle innovation. As the company's CEO Kristin Peck mentioned on the company’s last conference call, the company is focusing on five key areas to drive growth. These five areas include: dermatology, parasiticides, pain, diagnostics and emerging markets.

Given these different growth opportunities as well as the company’s focus on innovating through continued R&D investments, I believe Zoetis can continue to deliver and maintain their leadership position within the animal health industry.

Management

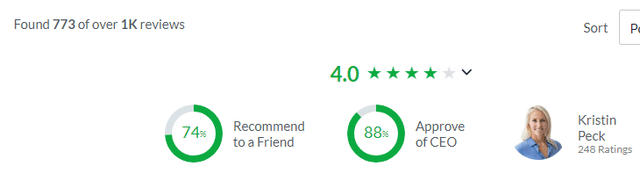

Kristin Peck is the current CEO of Zoetis. Zoetis went public in 2013 and Peck has held numerous roles throughout the organization since that time including Global Manufacturing and Supply, Global Poultry, Global Diagnostics, Corporate Development, and New Product Marketing and Global Market Research.

Wetteny Joseph is the company’s current CFO. Joseph joined Zoetis in 2021. Joseph previously held executive positions at Catalent.

As you can see from the Glassdoor ratings, Zoetis is viewed as an excellent place work. Additionally, employees at the company clearly approve of Peck too.

Zoetis has received various additional accolades as well showcasing it is clearly a great organization for employees:

Zoetis Investor Presentation

Financials

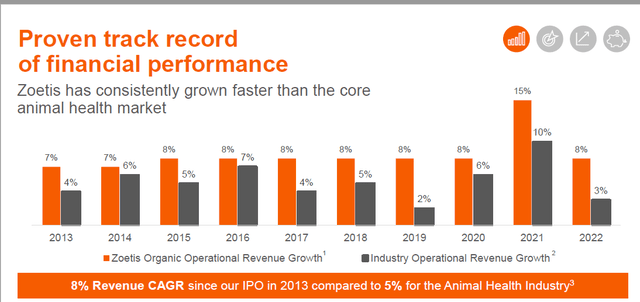

Zoetis has continued to grow revenue since the company went public in 2013. As shown in the below investor presentation graph, Zoetis has grown faster than the core animal health market.

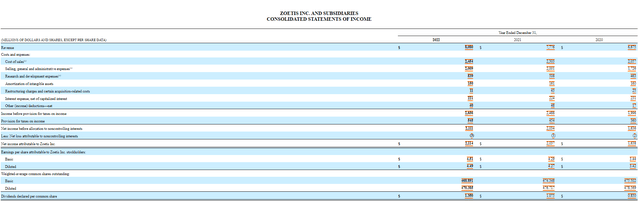

Financial data from the most recent 10K show Zoetis has been able to grow revenue, net income and earnings per share over the past three years:

On the Balance Sheet, the company does have a decent amount of debt which is higher than most others in this industry:

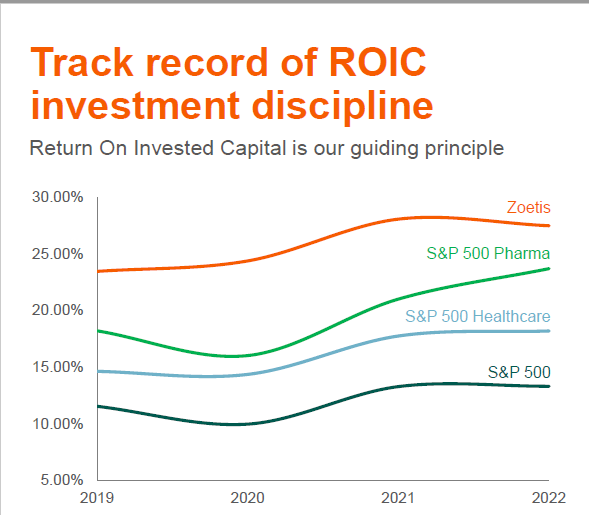

The company does have a high return on equity at roughly 45% and a return on invested capital (ROIC) which is stellar as this graph below illustrates:

Zoetis Investor Presentation

Additionally, although the yield is low, Zoetis does provide a dividend to shareholders. The company has increased the dividend for ten consecutive years.

For the first quarter of 2023, Zoetis delivered decent results. The company generated revenue of roughly $2 billion which is an increase of 1%. The livestock portfolio grew 12% operationally (in particular thanks to the growth in cattle, poultry, sheep and fish) while the companion animal revenues were flat. Additionally international revenues grew 10% operationally which offset the domestic decline.

Risks

There are a variety of longer-term risks such as, climate change, indebtedness, regulatory matters and being unable to stay on the forefront of product innovation.

Climate change can impact not only the global landscape but can adversely impact the food supply for the various species Zoetis aims to support.

The company could face numerous regulatory issues both domestically and internationally. One issue for example could be restricting animal testing.

I mentioned the long-term debt issue above. One could argue capital allocation may be a risk as well if cash is spent on items such as stock buybacks instead of reducing long-term debt.

Additionally, the company could unevenly allocate R&D costs and if product launches fail this could adversely impact the organization.

This brings me to my biggest risk which is product innovation. If competitors can create similar products or Zoetis fails to continue to create new and exciting products the company could lose market share.

Valuation

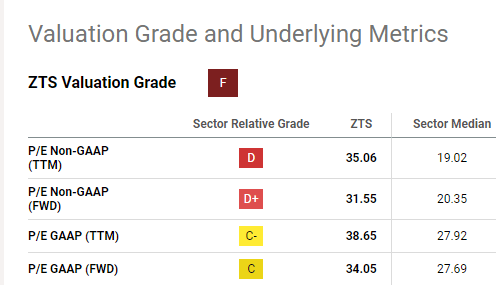

Zoetis is not a cheap stock. As you can see from the below valuation metrics from Seeking Alpha, the overall value grade is a “F.” Zoetis is higher than the sector median for many of these metrics such as the P/E ones I have shown below.

Seeking Alpha

When you come across a quality business it is often difficult to justify the valuation. One quote I love regarding valuation comes from Chris Mayer, the author of 100-Baggers. Mayer states, “Great stocks have a ready fan club, and many will spend most of their time near their 52-week highs, as you’d expect. It is rare to get a truly great business at dirt-cheap prices.”

In Investing for Growth, Smith argues that at times it is safe to pay up for quality. That said, I don’t like the current price of Zoetis and would prefer the stock to drop 10% or more before continuing to add. However, I do think this is an exceptional company that will reward patient, long-term investors.

Conclusion

Zoetis is an industry leader within the animal healthcare space with a diverse mix of products. The company has a strong international presence as well to help mitigate risk.

The company has numerous opportunities to grow the business and I believe their continued commitment to spend on innovation will serve the organization and its stakeholders well.

Zoetis has a high valuation and has a significant amount of debt. However, given the company’s historical performance since spinning off from Pfizer I believe management will continue to allocate capital appropriately.

I agree with Smith that Zoetis is very high-quality business and believe long-term investors will be rewarded especially if they can add during a potential market selloff.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.