FLJH: Japan's Winning Streak And The Warren Buffett Effect

Summary

- Japanese equities have seen impressive returns this year, driven by factors such as Warren Buffett's investments and corporate actions pick-up.

- Potential short-term headwinds include overbought conditions and uncertainty regarding the Bank of Japan's yield curve control policy, which could impact Japanese equities negatively.

- Investors should monitor inflation and economic activity, as these factors will influence BoJ's decisions and the trajectory of Japanese equities in the future.

StockByM

Investment Thesis

Japanese equities have been the standout winners in developed markets so far this year, boasting impressive returns. Warren Buffett's disclosure of positions in Japanese equities has been a major catalyst for this rally, driven by attractive valuations and momentum pick-up, while Japan's undervaluation relative to other developed markets adds to the bullish sentiment. Should Japanese companies continue to deliver shareholder-friendly policies, such as record-level stock buybacks at attractive valuations, I believe there is a high probability for investors to reap attractive returns out of Japan over the long term. In the short term, however, overbought conditions and fading momentum could add some headwinds for the bulls.

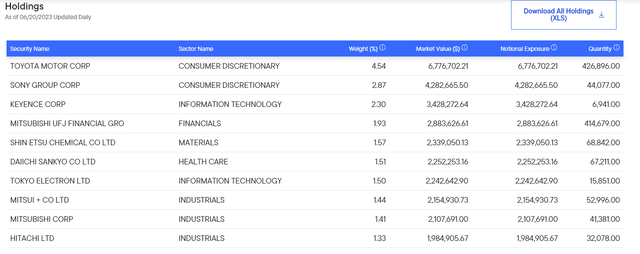

About FLJH

The Franklin FTSE Japan Hedged ETF (NYSEARCA:FLJH) tracks the FTSE Japan Capped Hedged Index, which consists of large and mid-cap Japanese companies. By employing a currency hedging strategy, FLJH aims to mitigate the impact of fluctuations between the Japanese yen and the U.S. dollar, providing investors with a more focused and potentially less volatile investment experience. By adding FLJH to their portfolio, investors can strategically incorporate Japanese equities while managing currency risks, offering a well-rounded approach to capitalizing on the opportunities presented by the Japanese market.

Franklin Templeton

For more details on FLJH, please check the fund's prospectus.

Riding Buffett's Wave

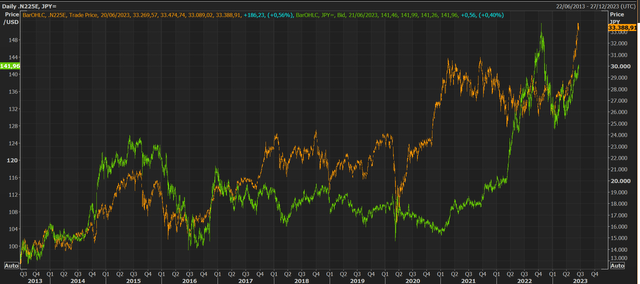

Japanese equities have emerged as the standout winners in developed markets this year, boasting an impressive 26% return when hedged in USD. In JPY, the actual returns are even higher, reaching 31%, which truly emphasizes the remarkable performance of Japan thus far. Following this impressive surge and strong momentum, many investors are now pondering whether to hold, sell, or increase their positions in Japanese stocks.

Refinitiv Eikon

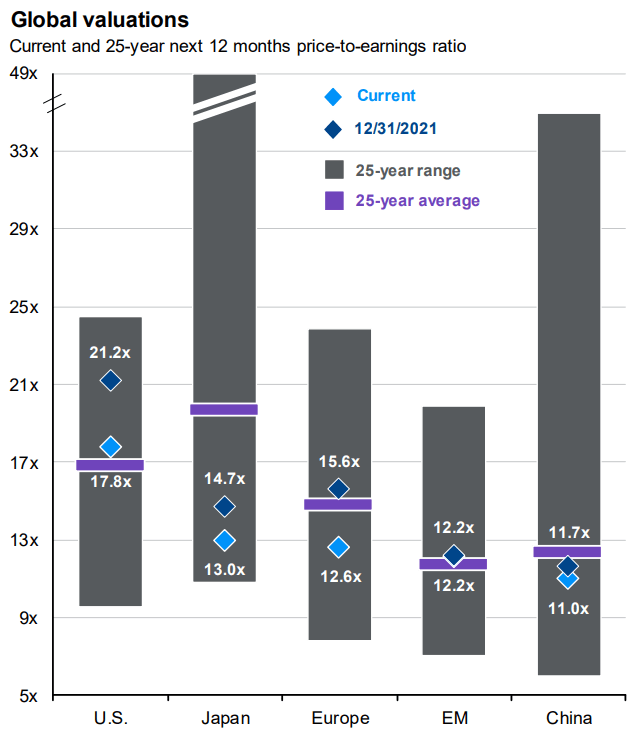

The primary catalyst behind this rally can be attributed to Warren Buffett's disclosure of positions in several Japanese equities. More information on this can be found here. Undoubtedly, one of the key factors driving Warren Buffett's interest in Japan is the appealing valuations of certain names. On the broader index level, Japan is also remarkably undervalued, positioned at the lower end of its 25-year range and well below the 25-year average.

JP Morgan

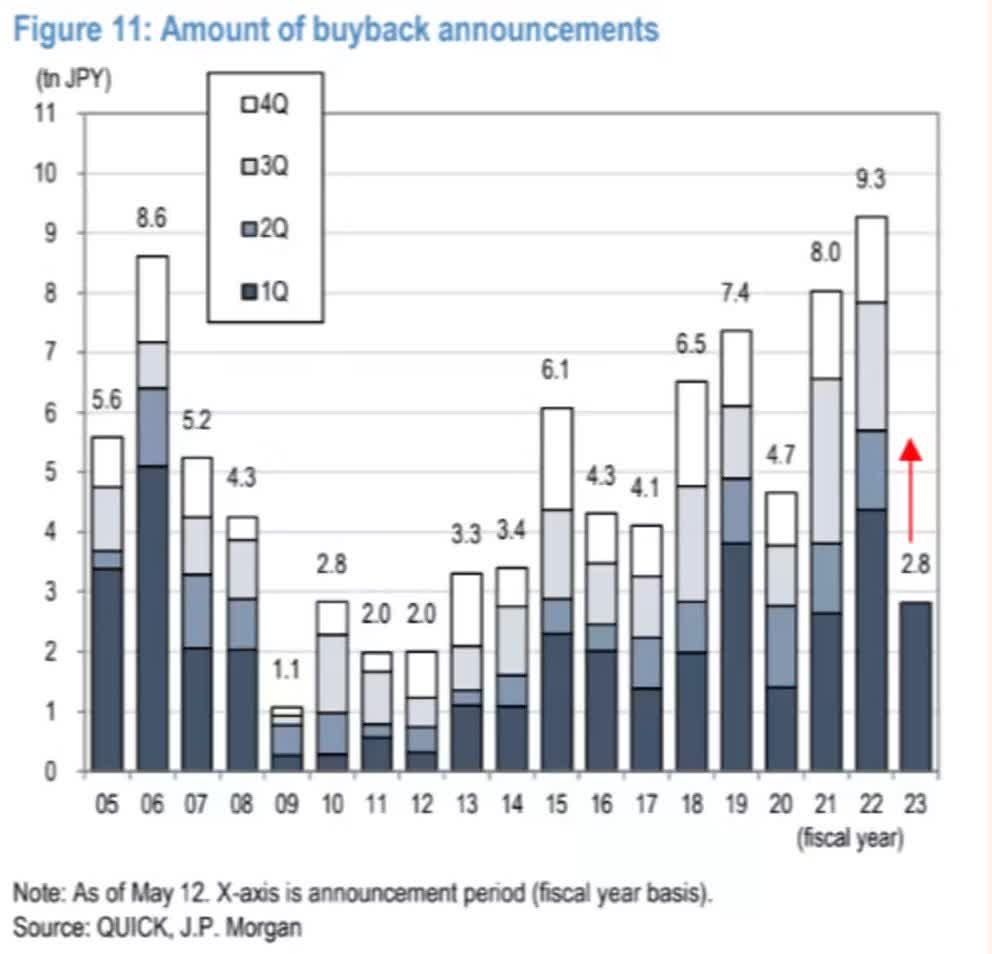

Low valuations with increasingly shareholder-friendly policies are encouraging for the bulls. Japanese firms have been buying back their stock at record levels in recent years, with 2023 expected to be at least as good as 2021. Should this trend continue, I expect Japanese stocks to deliver solid returns over the long term given the fact that these buybacks are value accretive at current valuations.

JP Morgan

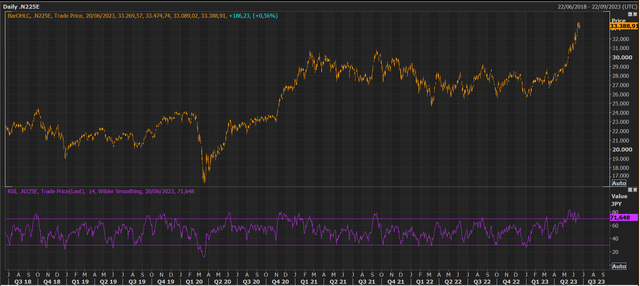

However, bulls might encounter some headwinds in the short-term. If we take a look at the Nikkei chart, the RSI is currently signaling overbought conditions, having remained in that territory for a few weeks. Additionally, with the index failing to establish new highs, I anticipate a temporary pause or pullback in the rally in the near term. For those bullish on Japan, such a correction could present an opportune moment to enter the market and secure a more favorable entry point.

Refinitiv Eikon

In recent quarters, I have also observed a noteworthy shift in the correlation of the Nikkei with the yen, which has turned positive. This development is understandable, considering the commitment of the Bank of Japan (BoJ), to maintaining an extremely accommodative monetary policy amidst rising inflation and interest rate differentials with other developed markets, weakening the JPY in the process. Abundant liquidity, coupled with inflation concerns, has certainly contributed to the Nikkei's stronger performance this year. However, lingering questions remain regarding whether the BoJ will continue its yield curve control policy, especially given the leadership changes within the bank.

Refinitiv Eikon

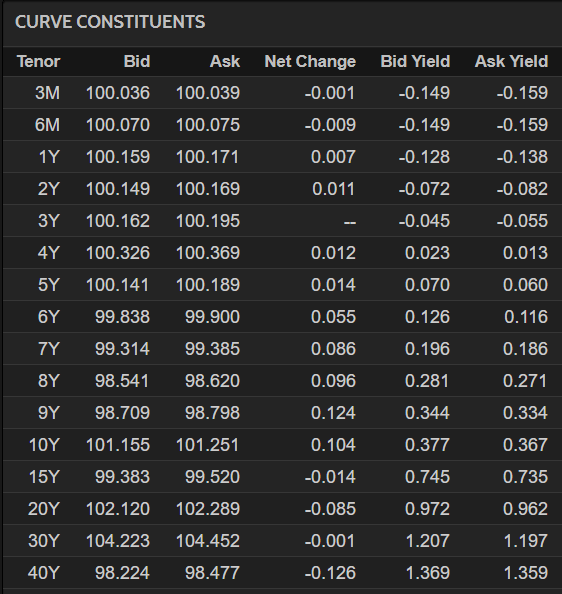

Japanese consumer price index (CPI) figures have displayed significant upward momentum in recent months, bucking the trend seen in other developed markets where the CPI has been affected by base effects and declined. Prolonged high CPI levels will undoubtedly impact inflation expectations, which have already begun to rise, and will ultimately influence the BoJ's decision-making process. Scrapping yield curve control could potentially strike a balance between taming a weaker currency while still maintaining a loose monetary policy. However, in my opinion, such a move would ultimately have a bearish effect on Japanese equities.

Refinitiv Eikon

Although Japanese 10-year interest rate swaps remain well below their Q1 2023 highs, they could experience a resurgence if the BoJ adopts a hawkish stance. The ultimate trajectory of this will depend, in my opinion, on the path of inflation. If economic activity starts to pick up again in Q2 2024, coupled with a rise in commodity prices, it could potentially force the BoJ's hand.

Refinitiv Eikon

Refinitiv Eikon

In summary, I believe Japanese stocks have performed very well this year, but we're currently entering overbought territory. This could pose challenges for the bulls in sustaining the rally in the near future. Looking ahead, if Japanese companies persist in implementing shareholder-friendly measures like attractive-value buybacks, I anticipate that FLJH could deliver favorable returns in the long run.

Key Takeaways

With remarkable returns, Japanese equities have emerged as the clear winners in developed markets this year. The disclosure of Warren Buffett's positions in Japanese equities has played a significant role in fueling this rally, benefiting from both appealing valuations and a surge in momentum. Moreover, Japan's undervaluation compared to other developed markets contributes to the prevailing optimistic outlook. If Japanese companies persist in implementing shareholder-friendly measures, such as engaging in buybacks at attractive valuations, I see good odds of FLJH delivering satisfactory returns in the long run. However, in the short term, challenges may arise from overbought conditions and waning momentum.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.