NIO: Now Is The Time To Sell And Get Out (Rating Downgrade)

Summary

- I upgraded NIO before its disappointing earnings release, anticipating that the market priced in most of the bad news pre-earnings.

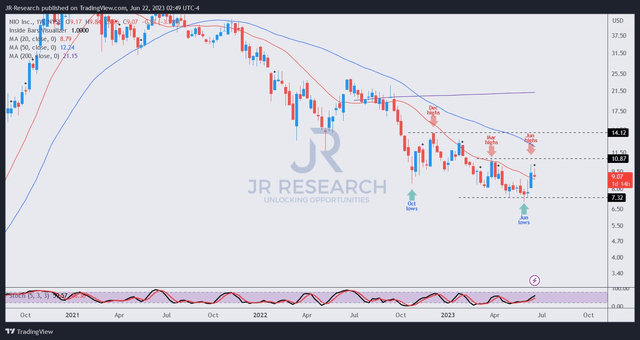

- NIO surged more than 20% from its June lows, but likely faces stiff resistance at the current levels.

- NIO management has a track record of overpromising and underdelivering, and the company may need more funding to finance its scaling needs and mass-market model launch in 2024.

- NIO could face stiffer competition in China as BYD scales, and Tesla maintains its pricing advantages. Li Auto intends to compete more aggressively in the premium segment.

- I have sold all my positions, as NIO could be the next one getting squeezed out.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

Drew Angerer

NIO Inc. (NYSE:NIO) investors witnessed a highly remarkable recovery in NIO recently, as I upgraded it, even as it headed toward a pre-earnings low of $7. NIO's early June lows also formed its near-term bottom, which saw dip buyers returning swiftly despite its disappointing first-quarter earnings release.

Some investors could wonder why such is the case, even as NIO posted some of the worst results that could be contemplated, as its overall gross margin fell to 1.5%. If December 2022's 3.9% gross margin wasn't bad enough, CEO William Li and his team proved that when it rains, it often pours. Yet, NIO bottomed out and surged more than 20% since my upgrade in early June.

While I was pleasantly surprised, I was not utterly surprised. I indicated in a reply to a member's question in my service, suggesting why investors need to be forward-looking:

The company cut prices to compete [more effectively] and reported a horrible Q1 report, but the stock rose. It corroborates my thesis that the market is forward-looking, priced in the bad news pre-earnings. - Ultimate Growth Investing 13 June 2023 chat message

That's right. I believe the market priced in the bad news in early June, even before the analysts could take down their estimates. I reminded investors to expect further writedowns in Nio's forecasts and expect a longer-than-expected profitability ramp following its disappointing deliveries report for May. I stressed:

As a result, I expect analysts' estimates for FY23 and likely FY24 to be taken down substantially, and possibly its ability to turn profitable on adjusted EBIT terms by FY25. - JR Research article on Nio (2 June 2023)

Accordingly, the revised consensus estimates expect NIO to post adjusted EBIT losses for FY25, with an average margin of -2.5%. Hence, the profitability ramp is expected to be pushed out further, as NIO faces significant competition, despite its premium positioning. Li Auto (LI) has emerged as the leading contender to establish its leadership claim among China's leading EV upstarts, including Nio, XPeng (XPEV), and Li Auto.

The company clarified that it "aims to outsell German luxury brands (Mercedes-Benz, BMW, Audi) in China by 2024." In addition, Li Auto has executed much better this year, putting the company in a solid position to scale its upcoming offering in the battery electric vehicle or BEV segment by the end of 2023.

While NIO management has secured external funding from the Abu Dhabi government recently, it was because it faced a significant cash burn that likely forced its hand.

Keen investors should recall that CYVN Holdings, which is majority-owned by the Abu Dhabi government, pumped in an additional $738.5M in cash for $8.72 per share. It also bought out 40.1M shares from a Tencent (OTCPK:TCEHY) affiliate, lifting its total additional investment by about $1.1B.

However, Nio's cash and short-term investments fell to $4.75B in Q1, down from Q4's $5.71B, burning nearly $1B over a quarter. As such, investors must consider whether NIO could seek more funding to finance its scaling needs, coupled with its push to launch a mass-market model in 2024.

Management has continued its usual optimism, expecting to deliver 20K vehicles monthly in the second half. Given its track record of overpromising and underdelivering so far, I believe putting NIO in the penalty box is essential until proven otherwise.

Management would likely point to the tailwinds from the clarity in NEV purchase tax exemptions, which have been extended through 2027, benefiting NIO's market segments. However, I assessed that NIO's recent optimism has likely been priced in, suggesting that further upside will depend on management fulfilling its delivery targets expeditiously.

NIO price chart (weekly) (TradingView)

I have averaged down my positions sufficiently, allowing me to get out of NIO at a profit recently, taking advantage of the price spike in June.

While NIO still holds promise, I assessed that the intensifying competition in China could turn highly unfavorable for the company. The company's early lead in the premium segment has not panned out into a sustainable competitive advantage, and it has lost momentum to Li Auto's much better execution. BYD Company (OTCPK:BYDDF) poses an increasingly significant threat as it scales, adding more pressure to NIO, already affected by Tesla's (TSLA) well-timed price cuts to stifle competition.

As such, I assessed that NIO's chances of getting squeezed out have increased much higher, and I'm not keen to stick around to witness further destruction. I count my blessings that I'm out and on the prowl to redeploy my funds.

Rating: Sell (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Nio isn't BYD and the middle easterns know this.

www.reuters.com/...