Charles Schwab: The Real Value Lies Hidden In One Of Its Preferred Stocks

Summary

- We propose a pair trade opportunity by The Charles Schwab Corporation preferred stocks.

- Deeply undervalued OTC traded with fixed-to-floating preferred.

- This is one of the best fixed-income opportunities on the market today.

- This idea was discussed in more depth with members of my private investing community, Trade With Beta. Learn More »

champc

We usually post our articles to members of our service 1 week before we publish them to the public. This article was first published on Jun 15, 2023.

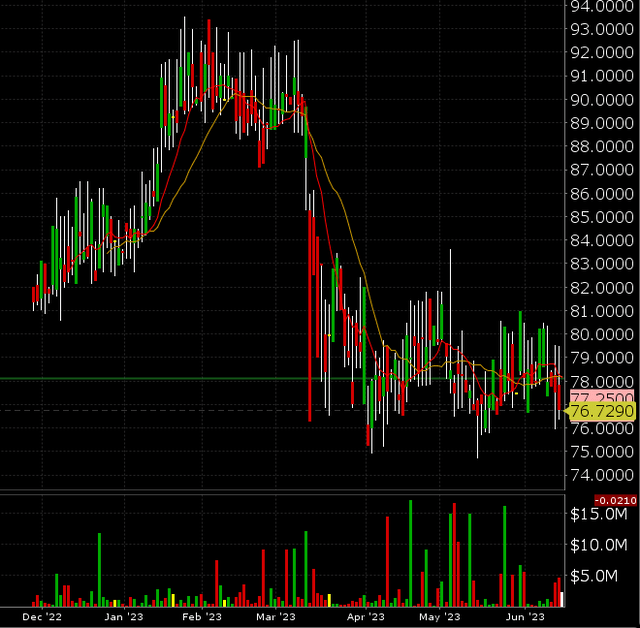

The bank sector crisis in March 2023 caused a lot of volatility in the market, especially in its financial segment. The elevated fluctuations in the price and the increase in the traded volumes affected not only the common stocks of the companies but also the products that are higher in the capital structure. This kind of trading behavior of financial products in a troubled sector is typical and expected by the market participants and forces them to be more cautious with their picks. However, seasoned investors know better and are looking for the big relative mispricings in similar securities that are associated with such turmoil.

The average market participant is usually mostly invested in the common stocks, and as a rule, the preferred stocks receive a lot less attention. This fact, in combination with the increased volatility in recent months, creates real bargain opportunities among the fixed-income securities, and it is up to the investors to put a little more effort to find them out and respectively profit from them. With this short article, we would like to present to your attention exactly this kind of pair trading opportunity that The Charles Schwab Corporation (NYSE:SCHW) preferred stocks are offering us.

Long leg

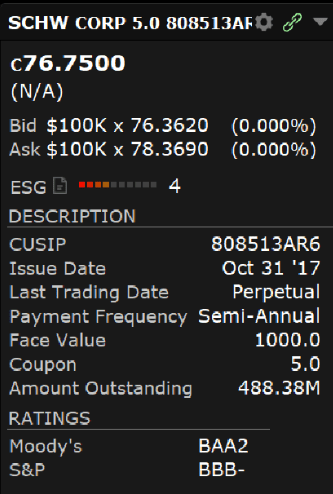

The preferred stock we like as a long leg for our pair trade is the OTC traded 5.00% fixed-to-floating rate perpetuity issued by Charles Schwab Corp. on Oct 31, 2017. If your broker allows you to trade on the Bond Market, it should be easily found by its CUSIP 808513AR6.

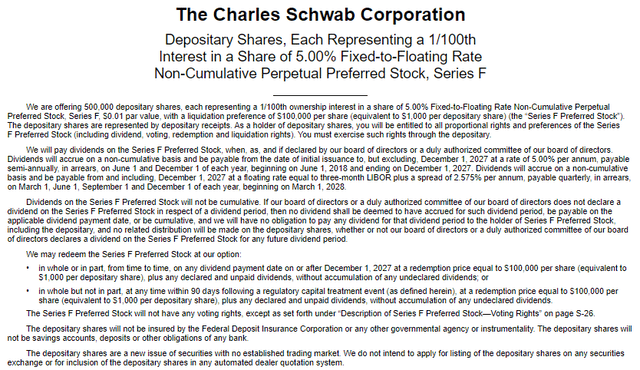

SCHW OTC preferred stock prospectus (sec.gov)

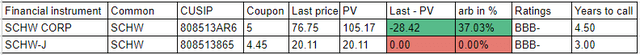

The security is redeemable after Dec 1, 2027, and if not called, it will trade with a floating rate equal to three-month LIBOR (the corresponding SOFR) plus a spread of 2.575% per year, payable quarterly. It is rated Baa2 by Moody's and BBB- by S&P. At the moment of writing this article, it trades at 76.75% of par.

SCHW OTC preferred quote (IBKR) SCHW OTC preferred price chart (IBKR)

Short leg

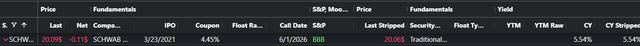

For the short side of our pair trade, we like the 4.45% fixed rate exchange-traded perpetual preferred stock (NYSE:SCHW.PJ) issued by Charles Schwab Corp. on Mar 23, 2021. It is rated Baa2 by Moody's and BBB- by S&P.

SCHW-J stock info (proprietary software)

At the moment of writing the article, SCHW-J trades at 5.54% CY at a price of 20.11 USD.

The trade

In the pair trade we have in mind, we have two securities that are not identical: as a long leg, we have fixed-to-floating rate perpetuity, and as a short leg - fixed-rate perpetuity. In our recent article, "Bank Panic Creates Old-Fashioned Arbitrage Opportunities, 13% From KeyCorp Preferred Stocks," we compared two fixed-to-floating products. However, now the case is a little different, and we are not comparing apples to apples. In order for us to be able to set side by side the current two investment vehicles, we need to make some adjustments to equalize them.

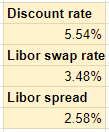

When comparing securities with floating interest rates, we choose to use swap rates in order to make them fixed-rate comparable. More information about the swap model we use to evaluate floating-rate securities is given in our recent article, "Annaly And AGNC Preferred Stocks - Crazy Mispricings Create An Opportunity." As the OTC-traded Schwab preferred stock, we are considering for the long position in our pair trade is perpetuity, we are using the USD 30 Years Interest Rate Swap for a three-month LIBOR (USDSB3L30Y=), which is 3.48% as of the moment the calculations are made. For the calculations of the fair value of the OTC preferred, we are using the CY of SCHW-J as a rate of financing for the Charles Schwab Corp. and therefore as a discount rate for determining the present value of future cash flows of this security.

Model rates (proprietary spreadsheet)

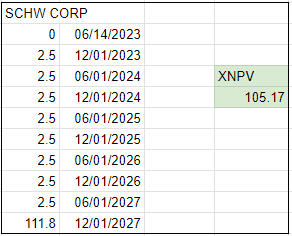

We accept that the fixed-rate preferred stock SCHW-J is fairly priced, and the calculations that follow are meant to determine the fair value of the OTC-traded security relative to the price of SCHW-J. We are discounting the cash flows for both preferred stocks up to the redemption date of the OTC traded one, and after that date, we are calculating the terminal value for each security.

SCHW-J cashflows estimate (proprietary spreadsheet)

With such a discount rate, LIBOR swap rate and the calculated above XIRR for SCHW-J, the calculations we made are pricing the long leg of the arbitrage - the OTC-traded preferred stock with CUSIP 808513AR6 is fairly valued, as shown here:

SCHW OTC preferred stock model calculations (proprietary spreadsheet)

Calculated this way, XNPV represents a "fair price" for the 808513AR6 issue, with SCHW-J set as a benchmark. This type of calculation gives us a relative evaluation of one stock with the other set as a basis. At this point, the huge market mistake in the prices of the two securities is pretty obvious. The OTC-traded preferred stock is clearly undervalued to the exchange-traded one, SCHW-J.

Model values (proprietary spreadsheet)

As a final note, we would like to mention that it is extremely difficult to predict whether LIBOR-based security will transit to SOFR, or not. STT-D and STT-G are recent examples that even securities from the same issuer can have different transition clauses. That being said, if the OTC pref remains fixed rate, it should trade at 90% of par, based on the CY of SCHW-J. Even in this worst-case scenario, we have a rather decent arbitrage opportunity.

Conclusion

As long as our model of evaluation of fixed-to-floating securities and the calculations associated with it are correct, investors have a really good opportunity to lock credit risk-free pair trade between two preferred stocks issued by The Charles Schwab Corporation. Our thesis is that as the two securities stand in the same place in the capital structure of the issuing company, there is no reason for the market to love them differently. One of the securities offered to your attention is trading OTC, and that fact makes this trade available only for investors that have access to the bond market.

Trade With Beta

we discuss ideas like this as they happen in more detail. All active investors are welcome to join on a free trial and ask any question in our chat room full of sophisticated traders and investors.

This article was written by

Day trader whose strategy is based on arbitrages in preferred stocks and closed-end funds. I have been trading the markets since I started my education in Finance. My professional trading career started right before the big financial crisis of 2008-2009 and I clearly understand what are the risks the average investor faces. Being a very competitive trader I have always worked hard on improving my research and knowledge. All my bets are heavily leveraged(up to 25 times) so there is very little room for mistakes. Through the years my approach has been constantly changing. I started as a pure day trader. Later I added pair trades. At the moment most of my profits come from leveraging my fixed income picks. I find myself somewhere in between a trader and an investor. I am always invested in the markets but constantly replace my normally valued constituents with undervalued ones. This approach is similar to rebalancing your portfolio and I just do this any time there is some better value in the markets. I separate my trading results from my trading/investment results. I target 40% ROE on my investment account and since inception in 2015, I am very close to this target.

My main activity is running a group of traders. Currently, I have around 40 traders on my team. We share our research and make sure not to miss anything. If there is something going on in the markets it is impossible not to participate somehow. Some of my traders are involved in writing the articles in SA. As such Ilia Iliev is writing all fixed-income IPO articles. This is part of their development as successful traders.

My thoughts about the market in general:

*If it is on the exchange it is overvalued and our job is to find the least overvalued.

*Never trust gurus - they are clueless.

*Work hard - this is the only way to convince yourself you deserve success.

*If you take the risk it is you who has to do the research.

*High yield is always too expensive.

We are running a service here on SA. It is a great community with very knowledgable people inside. Even though we are not in the spotlight as often as we would like to our articles' results are among the strongest on SA. You can always contact me to share some of our articles and best picks so far.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of SCHW.PJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a long position in the OTC-traded preferred stock of Schwab Corporation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

Short iepCheck it out

Also exchange traded debt is typically (rightly or wrongly) perceived as less risky (more marketable) than bonds with cusip trades only.

Because it includes 2 securities from the same company that are equal in credit risk. There are a lot of other risks involved in the trade.