EWU: The Entire United Kingdom Is In Trouble

Summary

- The economic landscape in the United Kingdom, as covered by iShares MSCI United Kingdom ETF, is undergoing a tumultuous phase, with inflation rates soaring to unprecedented levels. A recession may be needed to break the fever.

- The Monetary Policy Committee voted 7-2 to increase the main interest rate to 5% from 4.5%, marking the highest rate since 2008.

- It's been brutally difficult to playing UK equities on the long side.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

TraceyAPhotos/iStock via Getty Images

Production is the only answer to inflation. - Chester Bowles.

The economic landscape in the United Kingdom, as covered by iShares MSCI United Kingdom ETF (NYSEARCA:EWU), is undergoing a tumultuous phase, with inflation rates soaring to unprecedented levels. A recession may be needed to break the fever.

A Growing Threat: Stubborn Inflation

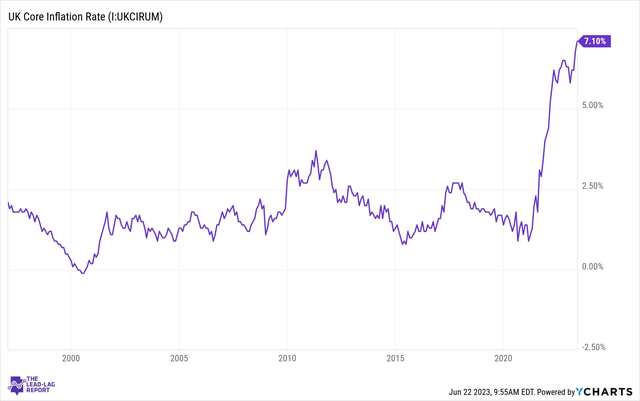

The UK's inflation rate has become a stubborn economic adversary, refusing to back down as anticipated. According to YCharts, UK Core Inflation Rate is at 7.10%, compared to 6.80% last month and 5.90% last year. This is higher than the long-term average of 1.90%.

The key driver of inflation has been the rapid increase in prices for recreation, cultural activities, and food. The cost of airfares, second-hand cars, live music events, and computer games has risen significantly, contributing to the stubbornly high inflation rate.

The Bank of England's Strategy: Interest Rate Hikes

In response to the growing inflationary pressures, the Bank of England has opted to raise borrowing costs. The Monetary Policy Committee voted 7-2 to increase the main interest rate to 5% from 4.5%, marking the highest rate since 2008.

This decision was in part due to the failure of inflation in the UK to ease as quickly as anticipated. The Bank of England Governor, Andrew Bailey, warned of further rate hikes if inflation fails to show clear signs of downward movement.

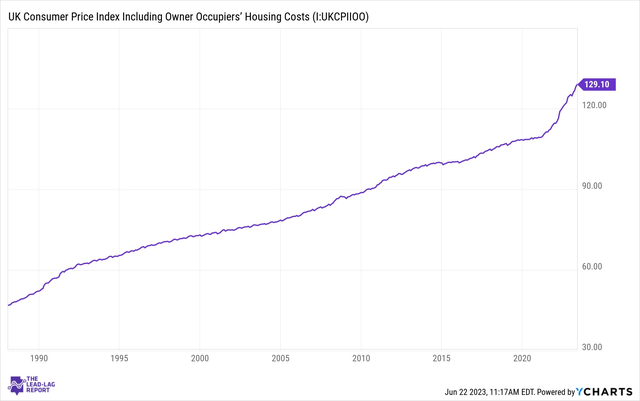

The Impact on Mortgages and Housing

The decision to raise interest rates has far-reaching implications for the housing market. The interest rate on the typical UK mortgage, a two-year fixed-rate loan, has been climbing since the start of May. With further rate increases expected, this could lead to a significant rise in mortgage payments for homeowners.

As a result, homeowners are facing what some have termed a "mortgage bomb." With around 800,000 fixed-rate mortgages set to expire in the latter half of this year, the prospect of an unaffordable jump in payments when borrowers refinance is a very real concern.

And to be clear, Housing must fall for inflation to fall.

The Global Implications: The Role of the UK in the World Economy

The UK plays a significant role in the global economy, and the current inflation crisis could have implications beyond its borders. If the UK does indeed need to create a recession to curb inflation, this could potentially impact global markets, affecting everything from global trade to foreign exchange rates.

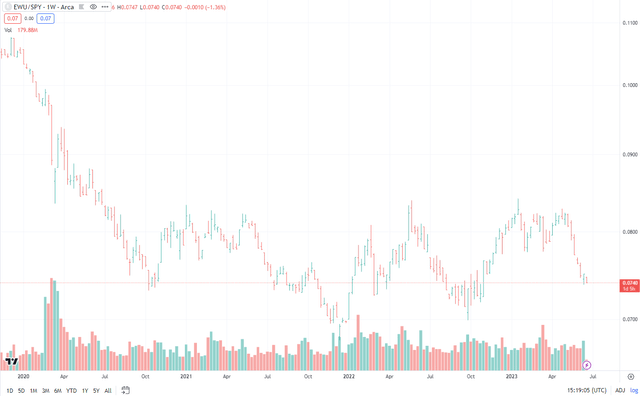

It's been brutally difficult to playing UK equities on the long side. The iShares MSCI United Kingdom ETF has seen a downward trend, underperforming the U.S. stock market's S&P 500 (SP500) pretty meaningfully, and it's hard to see this reverse any time soon on a secular basis.

Looking Ahead: Halving Inflation

UK Prime Minister Rishi Sunak has promised to halve inflation to around 5% this year. However, with inflation persistently high and the Bank of England resorting to rate hikes, this task looks increasingly daunting.

The Bank of England's decision to raise interest rates has placed the UK in a precarious situation. If the rate hikes fail to curb inflation and instead trigger a recession, the UK could face a significant economic downturn.

The UK's economic landscape is fraught with challenges. The stubborn inflation rate, coupled with the Bank of England's drastic measures to combat it, presents a complex situation that could potentially lead to a recession. As the UK grapples with this economic predicament, it serves as a stark reminder that we are NOT out of the woods on inflation or even stagflation risk. I personally would not touch investing in the United Kingdom now, although a spread trade against the U.S. could be interesting.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.