LifeStance Health: Best May Not Be Yet To Come, Reiterate Hold

Summary

- LifeStance Health has seen a 98% rally since October 2022, with new CEO Ken Burdick focusing on execution, profitability, and operational excellence.

- Despite the gains, there is insufficient fundamental, sentimental, or valuation evidence to support a strong investment case for LFST without resorting to speculation.

- The company needs to demonstrate better capital productivity and profitability growth in line with asset growth in my view.

- Reiterate hold.

naphtalina/iStock via Getty Images

Investment Summary

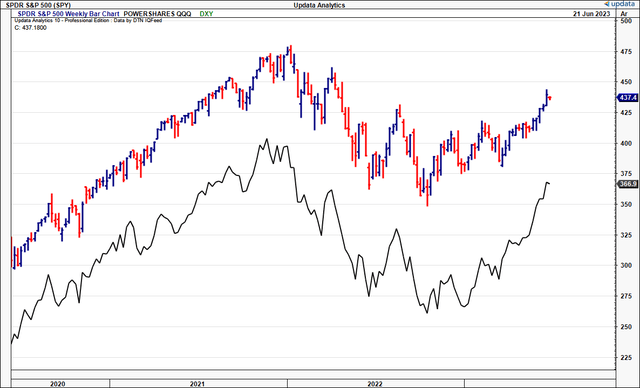

FY'23 is turning into an exciting year in U.S. equities, with both the S&P 500 (SPY) and NASDAQ (QQQ) rallying hard off October 2022 lows. It being a tech market, or more specifically– an "AI" led market, is no surprise given what we've seen the last few years to date, and more specifically with AI in 2023. Nevertheless, the rally ignites a risk-on flame that is more constructive for equity investors.

Figure 1. SPY + QQQ

A prime example is the case of LifeStance Health (NASDAQ:LFST), that has rallied 98% since my December publication. I rated the company hold, noting hurdles it had to overcome– and it would seem it has. The question is, how much of this is just beta, with the broad rally in the benchmark indices?

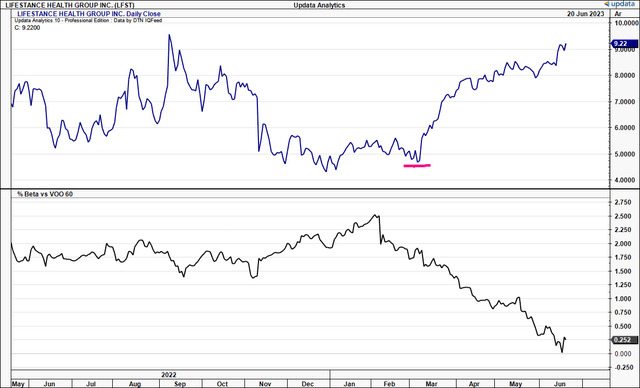

It would appear "not much" with what's shown in Figure 2. Au contraire– there's been a divergence in equity beta to LFST's recent price gains, informing me the advance may be idiosyncratic in nature.

Figure 1a.

Instead, what's ensued is a substantial re-rating that's seen LFST be a star performer among other issues on the list. We now have to ask if the market has priced in all of the revised expectations, or if there is reason to believe for a further re-rating. We want to know if the good fortune of the company is still ahead for LFST, and not already harvested.

This report will delve into the critical facts underpinning the LFST investment debate and portray the key investment findings. Net-net, whilst the gains are a spectacle, there is insufficient fundamental, sentimental or valuation evidence that aligns with a sound framework of investment criteria, without resorting to a degree of speculation. Reiterate hold.

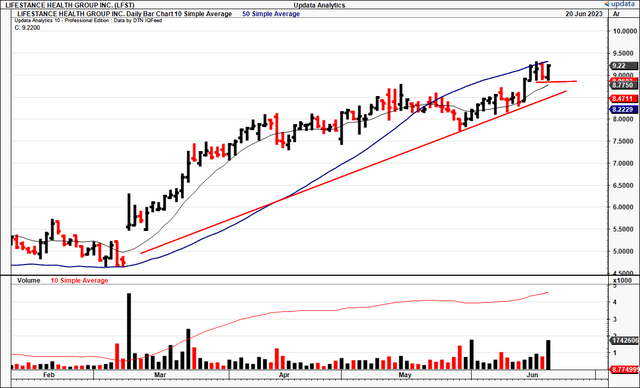

Figure 1b. LFST 2023 strong advancement and base

Critical facts underpinning investment debate

One of the major changes worth mentioning is the company's new CEO, Ken Burdick. I covered this at lengths in the last publication. Burdick's language at the time was telling, painting a picture of a reformed attitude: "It is clear to me that we're not performing to our full potential. In taking on leadership of LifeStance, I am laser-focused on execution, profitability and operational excellence".

Based on the latest market activity, investors believe in the new skipper's potential. Looking at the key investment facts, these ought to be separated into fundamental, sentimental and valuation factors.

1. Fundamental factors

The character of buying began to weaken following the release of the company's Q1 FY'23 results last month. This is curious, as the results were tidy, implying the market perhaps expected more from the firm.

Top line fundamentals

It booked Q1 revenue of $253mm, up 254% YoY on adj. EBITDA of $10mm. Growth was underlined by higher clinician productivity, flowing to increased visit numbers downstream.

Specifically:

- LFST recorded visit volumes of $1,665,000 for the quarter, up 20% YoY.

- Total revenue per visit increased by 4% YoY to $152, with heavy contribution from improvements in payer rates.

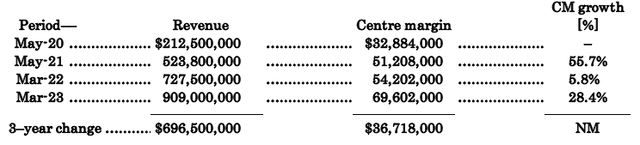

The number to look at for LFST is its centre margin, which clipped c.$70mm and secured a 28% YoY growth. The company's centre margin records LFST's ability to grow profits. It is calculated as the profit/loss from operations, adding back depreciation and a portion of the G&A line. It has grown its Q1 contribution margin $36mm over the last 3-years, a change of $131.5mm annualized to $278.4mm annualized.

Meanwhile, it has grown turnover by $696.5mm over the 3-years. Since 2021, it has grown the top line at an annual compound rate of 31%, as shown in table 1.

Table 1.

Data: Author, LFST SEC Filings

Capital commitments

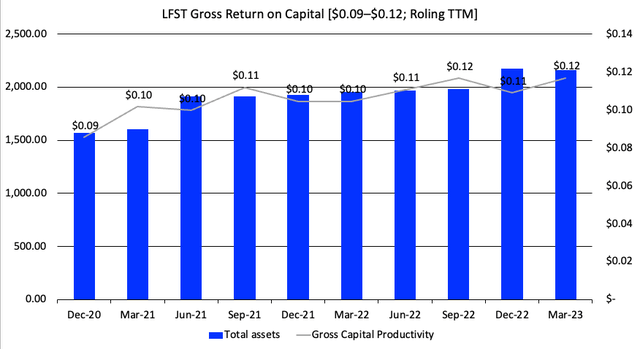

Can LFST compound turnover at a similar, or even higher rate than the 31% exhibited over the last 2-3 years? This is quite the ask and would call for substantial growth in operating assets in my view. To date, capital productivity and asset growth haven't been fruitful endeavours for the company. Since 2020, the firm's operating assets have returned just $0.12 gross on the dollar, up from $0.09 (rolling TTM). At the same time, gross assets have sized up to ~$2.1Bn, just 5.6% incremental gain in gross capital productivity.

In terms of the ability to create value ahead, this isn't a bullish sign in my view. As an investor, the capital you are buying in LFST is recycling just 12% gross return each period (TTM figures). Meanwhile, there are multiple selective names competing with LFST returning 85–90%.

Figure 2.

Data: Author, LFST SEC Filings

Further, the company is rationing capital to reduce the size of the business, along with required operating costs and operating capital charges. Another testament to the new CEO, and the proactivity shown. For instance:

- It is on a one-way track to consolidate 30 to 40 centres to reduce its real estate footprint. It has already consolidated 20 centres to date.

- The second aim is to reduce administrative complexity by terminating lower-volume payer contracts on its books. Termination notifications for ~140 payer contracts have been sent out, representing ~30% of the company's total payer contract value. Volume impact is expected to be minimal, per management's language on the call. It is also aimed to enhance credentialing efficiencies, total intake, and revenue cycle management teams.

Figure 3.

Data: LFST Investor presentation

Forward estimates + internal guidance

Management now expects $990mm–$1.02Bn in turnover on a centre margin range of $274mm–$290mm, calling for 16.5% growth at the top line. It hopes to pull this down to adj. EBITDA of $50mm–$62mm. It also projected Q2 sales of $250mm to $260mm, a centre margin range of $69mm to $76mm, and an adjusted EBITDA range of $10mm to $16mm, helping form the FY'23 view.

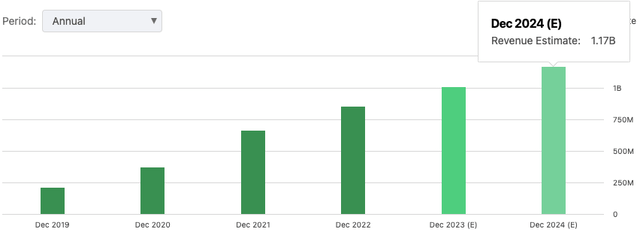

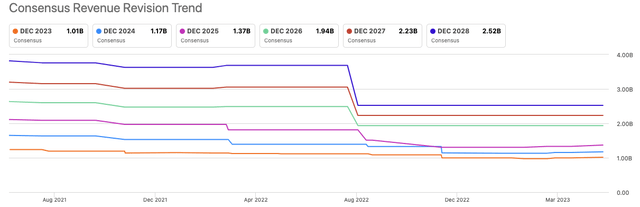

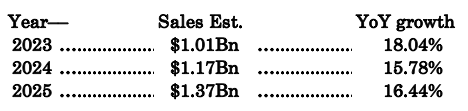

Further, consensus has high expectations on the company heading into FY'23 and FY'24. The projected revenue ramp calls for $1.17Bn in FY'24, in-line with my own assumptions seen in table 2. I would suggest this is a constructive feature in the debate here. That projected revenues, both on the sell-side and internally, are expected to increase at 15-18% could bode in well for the firm.

In the same breath, I'd also note this is around half the compounding rate the firm has exhibited over the last 2–3 years, questioning if the best really is ahead for the firm. Further, these are fairly benign growth numbers on relative terms in my view, especially when firms of similar size have grown the top-line at triple digits in Q1 this year.

Table 2. LFST forward revenue growth assumptions

Data: Author Estimates

Figure 4.

2. Sentimental factors

The recent price action has accompanied a change in sentiment as well. Sentiment changes are one of the critical factors needed in order to see a company attract a higher market value over time. If the fundamentals and economic characteristics of the business are strong, but the sentiment is poor (think the sentiment on an industry, or type of sector for instance, especially with the emergence of ESG), then it is unlikely investors will pay higher prices over time.

There have been 7 revisions to LFST's revenue projections from analysts over the last 3 months. No down revisions. This would suggest that investors expect a higher output from the company in the next 2-3 years, certainly helpful to attracting future investment.

Figure 5.

Options positioning in the stock shows heavy open interest and trading volume in contracts expiring in June with a strike of $10. This is only a shade above the market price, which is surprising, as given the rally I would expect to see further depth in the strike ladder if investors – those with actual skin in the game, not just commentators – were actually putting additional money at risk with LFST. It would appear not based on these findings. This is further supportive of a neutral view.

3. Valuation factors

The stock is trading at a 2% premium to the sector at 4x sales and 2x book value. I'd call these neutral ratings and suggest they are about right, based on the points discussed thus far. That includes:

- Fairly benign revenue growth of ~16-20% projected into the next 3 years

- Reduction in capital base with leaner operating structure, focus on operating efficiencies

- Just 12% gross capital productivity, making the case for earnings growth difficult to ascertain.

With these facts in mind, would you pay a premium to the sector to buy LFST, when factoring in its future prospects? Using my own investment criteria, the answer is now, and at 4x forward sales, this gets you to $10.62 per share in equity value, flat on the current market price. This too supports a neutral viewpoint.

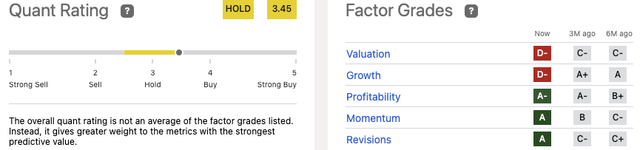

These findings are also supported objectively by findings shown in the quant system, that finds LFST a hold on the same factors I have– valuation and growth. I would add a layer of confidence to the findings presented here based on the quant system's data. Collectively, there are now multiple data points implying a neutral view on the company.

Figure 6.

In short

Judging from the most recent set of investment criteria it does not appear there are the required catalysts to see LFST's equity stock rate higher over the long-term. Based on my own investment criteria, the firm would need to demonstrate more attractive capital productivity numbers and demonstrate its ability to increase profitability at the same pace as asset growth. Valuations are also unsupportive in my view. I would note the new CEO seems incredibly proactive and is taking measures to preserve liquidity and grow the top line.

Whilst the firm is embarking on a plan to achieve operational efficiencies, this will involve a scale back in the amount of business the firm is doing, and will thus take some time to eventuate. I would keep a close eye on the name in that regard, to see the further impacts of the new CEO. Net-net, reiterate hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.