Surfing The Waves Of Oilfield Services: A Deep Dive Into OIH

Summary

- OIH is the largest oilfield services fund, providing investors with exposure to 25 top US-listed oilfield service providers.

- Uncertainty dominates the oil price scenario, and there's a slight decline in the deployment of oil and gas rigs in the US.

- In contrast to the US situation, international oil producers are increasing their rig count, indicating a rise in drilling activity and investment in oil and gas projects.

- OIH is dominated by companies like Schlumberger, Halliburton, and Baker Hughes, which have significant operations in the international markets.

Otakeja/iStock via Getty Images

The world of oil prices is filled with uncertainty, particularly when it comes to demand. This fluctuating oil price landscape has sparked some intriguing responses from oil producers. Take a look at the US, for example. Even though oil producers are still raking in hefty profits, there's a slight reduction in the deployment of oil and gas rigs. Now, let's shift our gaze to the international scene, where the narrative takes a sharp turn. Here, oil producers are putting more and more rigs into action. Investment and drilling activities in oil and gas projects are on an upward trajectory.

All of these developments could bode well for the VanEck Oil Services ETF (NYSEARCA:OIH). As the biggest oilfield services fund, it provides investors with access to 25 of the top US-listed oilfield service providers. However, the lion's share of the VanEck Oil Services ETF is held by companies with a strong presence in international markets. These are the organizations that stand to benefit the most from the rising tide of drilling activity outside of North America. So, let's dive in and see what's going on.

About OIH

The VanEck Oil Services ETF is the undisputed heavyweight in the oilfield services ETF arena, offering investors a piece of 25 leading US-listed oilfield services companies. With a staggering $2.13 billion in assets under management, OIH stands as the largest oilfield services fund, dwarfing its counterparts such as the SPDR S&P Oil & Gas Equipment & Services ETF (XES), the iShares U.S. Oil Equipment & Services ETF (IEZ), and the Invesco Dynamic Oil & Gas Services ETF (PXJ). These funds manage respective asset portfolios of $270 million, $181.34 million, and $34.26 million, demonstrating OIH's commanding lead.

Unlike a few of its competitors, OIH flaunts commendable liquidity, with a daily trading volume hovering around 600,000 shares (as per the 3-month average). This robust liquidity sets OIH apart from other ETFs such as the SPDR S&P Oil & Gas Equipment & Services ETF, which posts a daily trading volume of less than 100,000 shares. This heightened level of liquidity ensures easier trading of OIH shares for investors, enabling swift position shifts. It also translates into a narrower bid-ask spread, implying lower transaction costs and reduced volatility.

However, OIH hasn't been immune to market pressures this year, as its shares have witnessed a 9% decline year-to-date. This downward trend can be traced back to the softness in oil prices coupled with a shrink in US drilling activity, factors that have muted the earnings growth horizon for US-centric oilfield services firms. This theme was previously highlighted in my analysis of RPC, Inc. (RES), which is also part of OIH's portfolio.

Contrasting Rig Count Numbers

This year has seen a considerable ebb and flow in oil prices. Although WTI oil has dipped 8% year-to-date, settling at $72 a barrel at the time of writing, it has oscillated within a range of $83 a barrel and $66 a barrel. Despite OPEC+, responsible for around 40% of the global crude oil production, tightening the oil supply and Saudi Arabia, OPEC's primary producer, announcing an unprecedented 1 million bpd output cut from July, oil prices have failed to rally. The primary hindrance has been the fears of sluggish demand, predominantly from emerging markets, China being the focal point, as outlined in my preceding article.

Conventional wisdom had painted a rather bleak picture for oil demand from the Western nations like the US and Europe, attributing it to an economic slowdown. China, however, was projected to be a silver lining. The Asian giant's recovery from the pandemic was expected to fuel oil demand and drive up prices. Contrary to these expectations, China's economic engine seems to be losing steam, as evidenced by its lackluster economic performance in May. Indicators of industrial output, retail sales, property investments, and import and export figures were all underwhelming. These less than ideal numbers have pushed the Chinese central bank into implementing stimulus measures.

China grabbed headlines on Tuesday when it slashed its benchmark lending rates for the first time in 10 months. However, the size of the cut fell short of expectations and, so far, it hasn't made a notable impact on oil prices. What it has done, though, is reaffirm concerns about China's economic recovery and its ripple effects on oil prices.

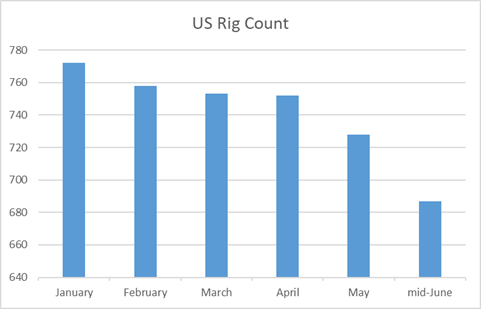

Author (Data: Baker Hughes)

Against the backdrop of fluctuating oil prices, US drilling activity has followed a downward trend. Exacerbated by weakening gas prices in the US, oil producers, who are currently prioritizing shareholder returns, have removed both oil and gas rigs this year. According to monthly data from Baker Hughes (BKR), the US rig count declined from 772 rigs in January to 728 rigs in May. Recent weekly figures indicate that the rig count has now dropped below 690 units.

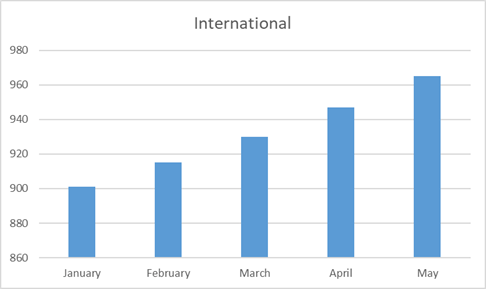

Contrastingly, drilling activity in the international market demonstrates an opposing trend. The rig count has seen a gradual increase throughout the year, climbing from 901 units in January to 965 units in May, as per Baker Hughes' data. This growth is spearheaded by oil producers in the Middle East, Asia Pacific, and Latin America, where the rig count consistently increases. Between January and May, the Middle East observed a 6.6% increase in rig count to 339 units, while Latin America and Asia Pacific, relatively smaller markets, experienced a 12% to 14% growth in the same period.

Author (Data: Baker Hughes)

This growth pattern in international drilling activity has been corroborated by industry executives and was a focus in recent conference calls. Despite volatile prices, oil producers both within the US and overseas can generate reasonable returns with oil prices lingering around $70 a barrel-a significant improvement from the $50 a barrel or less seen in the years 2015-2020. Major producers like Exxon Mobil (XOM) exhibited this in the first quarter with robust results.

However, it's important to note the contrasting nature of the US and international oil industries. While the US industry consists of private-sector companies, including majors like Exxon Mobil and independents like EOG Resources (EOG), the international oil market is largely dominated by national oil companies like Saudi Aramco. These different entities are facing similar oil price scenarios, but their responses vary. While private-sector operators are focused on maximizing shareholder returns, national oil companies aim to strengthen their nations' energy security and meet national goals, leading to the deployment of more rigs.

Energy security has been a long-standing priority for many national oil companies, motivating investment in oil and gas projects globally. The Middle East region, in particular, has seen a surge in long-cycle project investment, visible in the earlier mentioned rise in rig count. Oilfield service providers with significant Middle East presence, like Schlumberger (SLB), have reported the region experiencing its largest ever investment cycle, with local oil companies undertaking numerous projects to increase output capacity over the next four years.

Another promising area is the growth in international offshore projects. There's been a surge in activity across leading basins, with major projects worth over $200 billion, such as those in Guyana, Brazil, and Qatar, expected to fuel sector growth at the highest rate in a decade over the next couple of years. It's not just new projects though; exploration and appraisal work have also seen an increase, with new blocks being awarded to oil producers planning to collaborate with service providers to explore new hydrocarbon frontiers.

OIH's Advantage

This evolving landscape is generating significant business opportunities for oilfield service providers who are active in international markets. This includes some of OIH's top holdings that are already seizing this trend. OIH is a top-heavy fund dominated by premier oilfield service providers such as Schlumberger, Halliburton (HAL), and Baker Hughes. Combined, these three companies make up 40% of the ETF's assets, with Schlumberger alone representing a fifth of OIH's assets. Contrary to US-centric operators, these companies derive the majority of their revenue from international markets.

Schlumberger, Halliburton, and Baker Hughes traditionally source most of their revenues from outside of North America. Last year, for example, Schlumberger derived 78% of its revenues from international markets. Schlumberger, in particular, is a global leader holding prominent positions in various service industries worldwide. Firms like Schlumberger are already reaping the benefits of this positive trend. The company anticipates growing its revenues by 45% and EBITDA by 60% by 2025, driven by robust growth in international markets, especially in the Middle East where it expects to generate record revenues.

I believe the internationally-focused companies holding significant positions in OIH are well-positioned to continue driving earnings growth. This bodes well for the ETF's future performance. However, uncertainties surrounding oil prices, largely tied to the commodity's demand, may pose future risks to OIH.

Another appealing feature of OIH is its reasonable fee structure. The ETF carries an expense ratio of 0.35%, which means it charges $35 annually for every $10,000 invested. While XES charges a similar fee, it is considerably smaller in terms of AUM and liquidity compared to OIH, as noted earlier. IEZ and PXJ, on the other hand, have higher expense ratios of 0.39% and 0.63% respectively.

Takeaway

The global oilfield service industry is experiencing divergent trends, with a decline in rig count in the US contrasted with increasing exploration and production activities in international markets. This dynamic may favor OIH, which holds substantial stakes in leading oilfield service providers like Schlumberger, Halliburton, and Baker Hughes. These firms are capitalizing on the robust growth in international markets. However, in the short term, the ETF might continue to experience pressure due to volatility and weakness in oil prices. For this reason, I recommend investors to exercise patience and wait for the oil market demand scenario to stabilize. Once there is more clarity regarding oil demand, this ETF could be a promising investment opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.