Dynex Capital: Patience Is Key But The Short-Term Still Looks Rocky

Summary

- Dynex Capital faces short-term financing struggles and uncertainty in dividend sustainability, as well as a large share dilution which seems set to continue.

- The company's focus on agency MBS products could prove advantageous in the long term as rates reverse and costs of finance shrink, narrowing spreads.

- A liquid position and small size allow them to rapidly adjust to market conditions and capitalize on opportunity changes before larger competitors.

- Insiders have been accumulating shares at current prices, demonstrating confidence in their opportunistic investing strategy.

kitzcorner

Investment Thesis

Dynex Capital (NYSE:DX) is shaping up to opportunistically invest and take advantage of market volatility in the short term, but this may not be enough to guarantee stability in the current state of the short-term finance market. This, combined with high share dilution and the uncertainty of dividend sustainability, results in a Hold rating until the picture becomes clearer.

Short-Term Financing Struggles

Dynex is a financial services company focused on producing dividend income through the financing of assets within real estate. The share price of DX is down 11.6% across the last 12 months, as mortgage REITs have struggled in the face of higher interest rates, which have served to decelerate real estate value and increase the short-term cost of debt. This represents an adjusted 12-month return of -0.6% when accounting for dividends, with a forward yield of 12.57%.

On the 24th of April, Dynex reported a net income of -$0.81 per share, compared to $0.85 seen in Q4 2022, representing a total economic return of -3.7%. This in turn led to earnings available for distribution of -$0.16 per share. Widened mortgage spreads resulted in a BV decrease of over 6% this quarter.

Volatility amongst the banking sector through Q1 had a substantial impact upon mortgage REITs, as spreads widened on Mortgage Backed Securities (MBS). A snapshot of other Q1 performance factors can be seen below.

Q1 Performance Highlights (Dynex Capital)

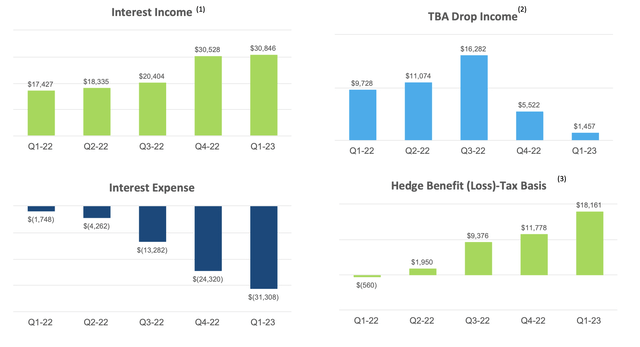

Following this weakness, management has suggested that they are planning to add to assets and commit to opportunistic capital gathering and deployment. A more detailed look into the primary components constituting this quarter's earnings results can be seen below.

Primary Components of Earnings (Dynex Capital)

Leverage ticked back up to 7.8x, after a substantial dip to 6.1x seen in the last quarter. This is a demonstration of commitment to re-bolstering assets and possibly showing confidence in the sustainability of their dividend despite a TTM cash payout ratio of almost 83%. A result of this is rising interest costs through the drawbacks of the current debt environment. However, deferred tax hedge benefits are aiding the control of greater short-term financing costs.

Nimble by Nature

Management has suggested that their forward strategy is aligned to the current market volatility through greater liquidity, which will allow them to capitalise on opportunities as they present themselves. In the current inflationary environment, central bank policies and wider debt dynamics will become crucial to determining the direction of growth and valuation.

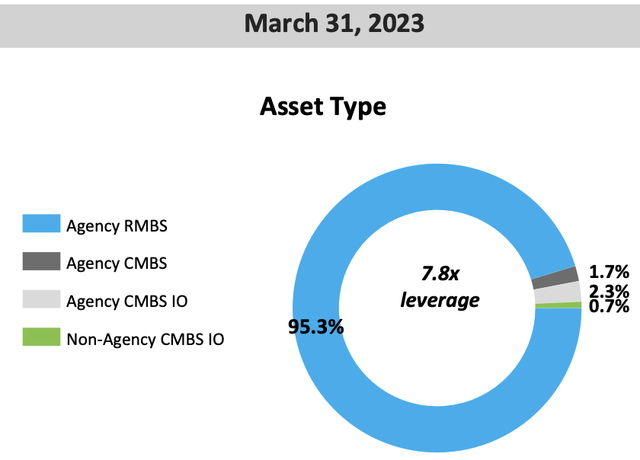

Over 95% of Dynex's portfolio efforts revolve around agency residential MBS products, due to the clear liquidity benefits offered. This, coupled with their relatively small size, enables them to be reactive to market change, with nimbleness being a distinct advantage over larger firms within the sector that cannot reasonably liquidate and re-adjust in the same timeframe.

Current Investment Portfolio (Dynex Capital)

As well as this, agency MBS products could offer greater opportunity amidst a higher probability of defaults amongst consumer and corporate borrowers. Delinquency rates have cooled since the pandemic, however, 30-year fixed mortgage rates have remained at around 7% with generally low affordability and limited refinancing capability. As well as this, the unemployment rate has slightly risen to 3.7%. Dynex estimates that around 80% of mortgages are not eligible for refinance at current rates.

If MBS spreads continue to widen in the coming months, Dynex may be able to utilise its parked cash to capitalise upon an attractive entry point, opening a period of high investment return opportunity. This is especially true amongst seemingly favourable supply-demand economics for Agency MBS products, as the supply overhang of fallen banks in recent months has been fed into the markets.

Charting a Rebound Path

In the last year, total shares outstanding for common stock have grown by 45% to a current value of 53.9 million, a significant dilution which cannot be ignored. This forms part of an aggressive capital gathering scheme which could demonstrate weakness in the position and sustainability of alternative financing initiatives, indicating that there is no sign of dilution decelerating.

Nevertheless, it is good to see that the majority of interest and power remains with retail investors, with the public owning 53% of shares. As well as this, 3 executives have been accumulating shares across the last 12 months, totalling $734 thousand collectively. This could represent subtle confidence from the inside that things are heading in the intended direction. The last insider purchase possessed an average share price of $12.16

Despite this, from our view, there doesn't appear to be clear value in the share price at current levels when accounting for recent dilution. Free cash flow has dropped 47% in the last three years, resulting in a trailing price to cash flow ratio almost 14% higher than the sector median. As well as this, the capital structure reveals a trailing total debt to equity ratio that is over 400% greater than the sector median. This, when combined with uncertainties surrounding future dividend safety, renders DX a relatively unpredictable investment for us in the medium term.

Fortunately for bulls, when rate hikes pause and interest rates cool, mREITs will be capable of generating greater profits. Financing will become healthier and spreads on MBS products will have a clear path to tighten; providing Dynex with greater investment returns. Once downward pressures on MBS are removed, Dynex seems to certainly be in a great position to capitalise.

Conclusion

Wrapping up, Dynex has shown recent weakness amidst short-term financing costs and widening mortgage product spreads; however, this turmoil may be mitigated by a strategy of patient yet opportunistic investment hunting, whilst hedging efforts reduce the burden of interest costs in the near term.

The current liquid position allows a firm of Dynex's size to rapidly adjust to market conditions, capitalising on changes before larger competitors. As well as this, the downward pressure that the current inflationary environment has on mREITs will likely diminish once rate hikes reverse, reducing costs of financing and potentially releasing the share price of DX.

Despite this, the dividend payout may prove simply too large to be reasonably sustainable in the current short-term debt market conditions. Combining this with abnormally high share issuance means that there doesn't seem to be a clear value or income investment opportunity. When considering this with the current market shape and financing position, we are neutral and mark DX with a Hold rating for now.

However, the deep focus on agency MBS products could prove to be a long-term advantage once rates reverse and costs of finance shrink. Narrowing MBS spreads in the future could manifest a period of successful investment for Dynex and open up rapid readjustment possibilities into other markets. Long timeframe bulls certainly have an argument to remain cautiously optimistic.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.