Health Catalyst: Recovery Won't Be Soon

Summary

- Health Catalyst provides data and analytics technology and professional services to healthcare providers.

- The hospital industry's current struggles remain the biggest headwinds for Health Catalyst, with hospitals postponing technology purchases with long horizon ROI.

- The post-COVID recovery might be budding for healthcare providers, but financial pressure is likely to remain.

- Given the current environment and its revenue mix, Health Catalyst's valuation is not considered cheap. I remain cautious on the stock for the next year.

SDI Productions

Thesis

Health Catalyst (NASDAQ:HCAT) shows promise but is at the mercy of a slow recovery among healthcare providers. I don't see Health Catalyst's current valuation as cheap given the uncertainties and competitive industry.

The Business

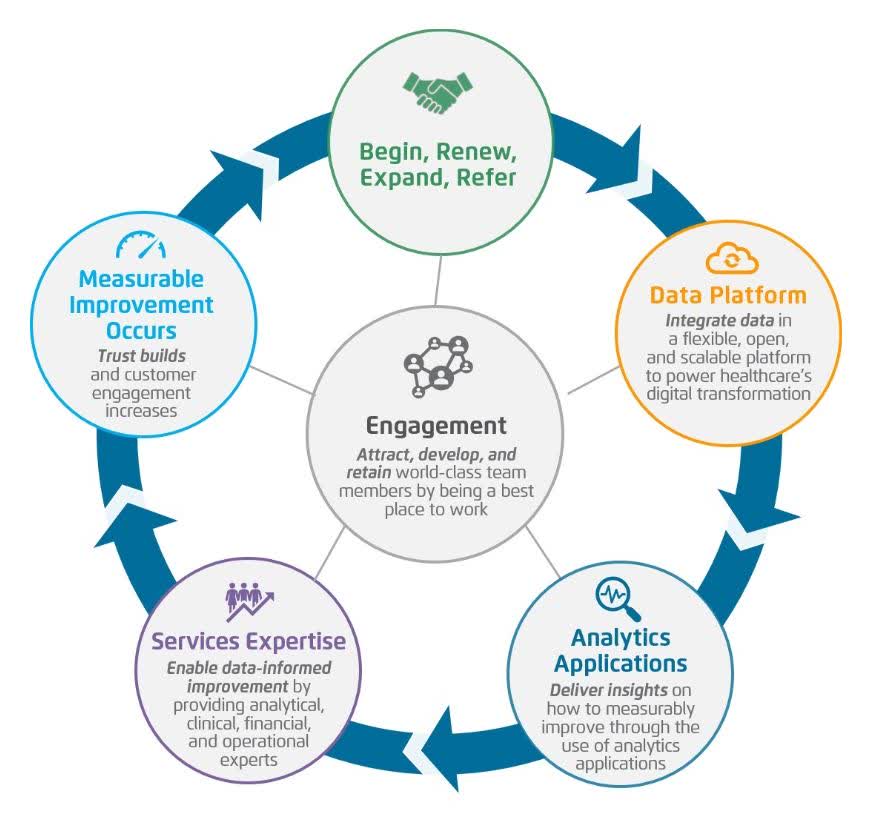

Health Catalyst is a one-stop shop that provides data and analytics technology and professional services to healthcare providers. Their flagship product is Data Operating System (DOS), a data platform that is able to integrate with many disparate systems, so healthcare data can be ingested and combined into one place for analytical purposes. They offer analytics applications either as standalone or add-ons to DOS. This application serves various use cases, such as clinical and quality, population health, and financial and operational improvements.

To top it off, they provide outsourcing and consulting services, where teams of data and domain experts can step in to help the hospitals on discovery and implementation, such as chart abstraction and process review.

Health Catalyst's business flywheel (Health Catalyst's annual filing)

Competition

Health Catalysts competes with both industry-agnostic analytics companies such as Tableau (owned by Salesforce) and Qlik, and EHR companies such as Cerner Systems (owned by Oracle (ORCL)) and Epics Systems. These companies often have significant resources and higher brand recognition than Health Catalyst. In short, it is a competitive industry.

That said, Health Catalyst possesses several moats. First, healthcare is harder to break into because of regulatory requirements. Second, Health Catalyst's existing relationships with its 100 DOS customers create a moat for the company. Lastly, Health Catalyst provides end-to-end services, and it is a competitive advantage over companies that offer point solutions. The domain knowledge and embedment from its data platform and outsourcing team are not easily replicated.

Recent Performance

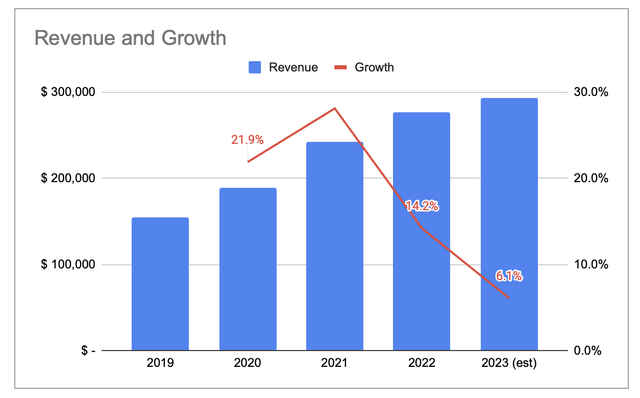

The latest earning seems to indicate that HCAT has ground to a halt. Full-year revenue guidance for 2023 is $293 million at mid-point, which is a mere 6% YoY increase. That is 2% real growth if we assume an inflation rate of 4%.

HCAT revenue numbers from 2019 to 2023(est) (Author's chart from HCAT's earning numbers)

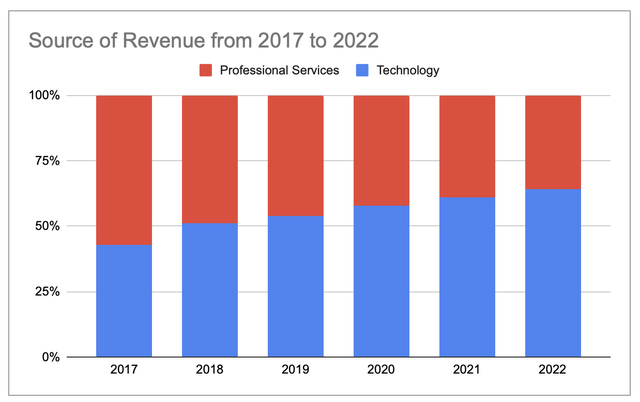

There is no clear sign of margin improvement. The recent quarter booked a gross margin of 48% and net margin of -45%. It is important to note that Health Catalyst is not a pure SaaS company. Historically it has 40-60% of revenue coming from professional services. This segment commands a gross margin of 20%, while the technology segment has it at high 60%. The improvement of the revenue mix has also slowed.

HCAT revenue mix from 2017-2022 (Author's chart with HCAT earning numbers)

Bull and Bear cases

The market dynamics from the hospital industry have clearly impacted Health Catalyst.

In fact, the biggest bear case against Health Catalyst is simply that the hospital industry is not in good shape. Since the pandemic, labor costs shot up 37% when the exploding case volume dwarfed the limited supply of trained professionals. At the same time, revenue dried up as people postponed elective procedures, which are often more lucrative for the hospitals. Even now that visits for COVID treatments have mostly abated, visits for elective procedures remain slow to return. Facing significant pressures from both supply and demand sides, hospitals are in survival mode. As a result, hospitals are in no condition to consider large technology purchases. Management has noted that healthcare providers are mostly leading with shorter-term conversations that are related to cost savings. The pressure seems likely to persist.

The bull case, on the other hand, points to the long-term trend of healthcare digitization. With the amount of EHR being generated, hospitals are bound to continue their digital investment at some point. The recent earnings from UNH have also provided hope. Senior patients seem to have started coming back for the procedures that were deferred. While we have to wait and see, it is certainly a good sign.

Risks

We talked about risks on well-resourced competition and slumping demand. The post-COVID recovery might drag out longer, which will in turn continue to dampen Health Catalyst's growth.

I also see a risk in the lack of strategic initiatives. My impression is that management is mostly biding time till the industry recovers. I would love to hear more about the product roadmap. It is slightly disconcerting when most of the next year's R&D is only spent on Snowflake and Databricks enablement. Given the healthcare ambition from Big Tech, I would like to see Health Catalyst proactively evaluate their product edge, especially when data platforms seem to sit in Big Tech's domain.

Valuation

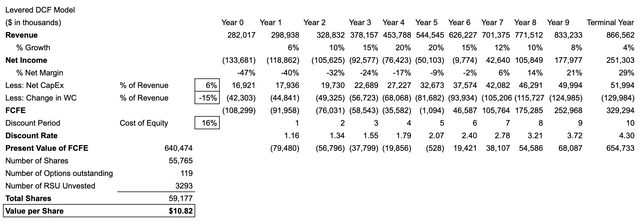

I estimated HCAT's share price using DCF valuations and the following assumptions:

Author's DCF model (Author's calculations)

Cost of Equity

Cost of equity is calculated using the CAPM, i.e., risk-free rate + beta x equity risk premium.

- Risk-free rate = 3.7%, the rate of 10-year T-bill

- Levered Beta = unlevered beta of software industry x [1 + (1- marginal tax rate) x (debt/equity)] = 1.37 x [1 + (1-25%) x (0.62)] = 2.0.

- Equity risk premium = 6%.

This gives us a cost of equity of 15.7%.

Starting Numbers and Assumptions

Summing the numbers from the most recent 4 quarters:

- Starting revenue is $282 million and net loss is $133 million, resulting in a starting net margin of -47%.

- Management has guided for a revenue growth of 6% at midpoint for full year 2023.

- Net CapEx is assumed to be 6% of revenue and Change in WC is -15% of revenue based on past year averages. I do not add back stock-based compensation since I believe this is a real ongoing expense.

- Terminal Revenue growth = 4%

- Net Margin = 29%, based on the revenue mix of mature SaaS and outsourcing companies

Denominator of the number of shares

- Current total shares outstanding = 56 million.

- Number of unvested RSUs = 3.3 million.

- Number of options outstanding = 1.7 million at a weighted average exercise price of $11.51.

Number of shares used as denominator = 56 million + 3.3 million + 1.7 million * (12.35-11.51)/12.35 = 59 million.

Revenue Growth & Net Margin

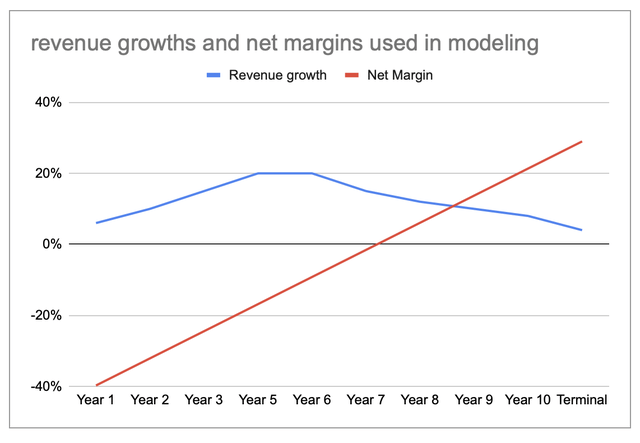

Since HCAT still has negative earnings, I estimated 10-year cash flows and adjust the revenue growth and net margin each year to arrive at the terminal assumptions. The trajectory is as follows:

Revenue growth and net margin assumptions used in author's model (Author's assumptions)

The estimated value is $10.82/share, which is 14% below $12.35, the share price as of writing.

The Bottom Line

Health Catalyst rides the long-term trend of digitization in healthcare. That said, I would prefer a larger margin of safety for this company before adding to my position. Unlike other SaaS companies, it is facing 2x macro-headwinds - both from the hospital industry and from a looming recession. Hospitals are likely to wait-and-see for another few quarters, and a recession can revert the trend of returning patients. There seem to be better alternatives to bet on the hospital recovery story.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HCAT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.