Leonardo DRS: Favorable Tailwinds, But Maybe It's Time To Cash Out (Rating Downgrade)

Summary

- Leonardo DRS has seen significant growth and positive developments, including new orders, technology releases, and partnerships.

- The company's stock has reached its fair value, making it riskier for investors to buy at the current price.

- Despite being a good long-term investment, it is recommended to wait for a more favorable stock price before entering the market.

NiseriN/iStock via Getty Images

In this article, I want to provide an update on my previous article written on April 15th about Leonardo DRS (NASDAQ:DRS). You can find the link to the complete article here. In my previous analysis, I explained how, from my point of view, the company was undervalued due to lower-than-expected guidance. However, I emphasized its solid fundamentals and, most importantly, its central role in the US defense sector.

In the past two months, several noteworthy developments have occurred that we need to consider, which I will explain in this article. The first is related to the strengthening of the backlog, thanks to new orders and the release of new technologies. Additionally, there have been announcements of new partnerships that highlight the emerging role of DRS.

The second aspect regards the valuation of the company. While I have been bullish and optimistic, DRS has now reached its fair value, making it riskier for investors who wish to buy at this price.

Therefore, although I consider DRS an excellent long-term investment, I recommend not buying at this price and perhaps waiting for a sufficient safety margin to make a first entry.

For now, Leonardo DRS' month of June has been fantastic

Leonardo's month of June has been fantastic so far. Going chronologically, on June 5, Leonardo DRS announced that it will join the Russell 2000 and 3000 indexes, entering officially on June 26, 2023. This is great as, according to Leonardo's website, the Russell indices have approximately $12.1 trillion in assets, so the company will certainly be able to benefit from this opportunity by drawing on a very large pool of capital.

Another very positive news comes from the $94 million contract signed with the US Army, announced on June 8th.

Leonardo DRS, Inc. announced today that it has received a new contract to produce its next-generation infrared weapon sights for U.S. Army infantry snipers. The firm-fixed-price contract from the Army's Contracting Command is valued at more than $94 million over five years.

(Source: Leonardo DRS, News)

Finally, just a few days ago, the new STAG 8 gimbal multi-sensor EO/IR payload gimbal for drones and helicopters was presented at the Paris Air Show. According to the company,

STAG-8 delivers higher performance through significant savings in weight and volume over current competitor products.

(Source: Leonardo DRS, News)

In conclusion, strong backlog, cutting-edge technology, and investment visibility: a great combination!

The war in Ukraine could unfortunately last much longer, but this is bullish for DRS

In my last article I explained how I was bullish on the company due to its positioning in US Defense supply chain. Here is an excerpt:

Leonardo DRS could strongly benefit from tailwinds in 2023 thanks to its positioning in the defense sector. Indeed, looking at the revenue, 84% comes from the defense sector, with 37% from the US Army and 32% from the US Navy. Therefore, the company will be strongly favored by the increase in US Government military spending, not only in 2023 but also in the coming years. Therefore, it will be able to play a fundamental role, also thanks to its relevance in the sector (over 60% of its production is not subject to any competition in the market).

(Source: “Leonardo DRS: Lower 2023 Guidance, But The Stock Is Undervalued”)

The U.S. President's government fiscal year 2024 budget request included $842 billion for national defense programs, which marks continued growth from prior years. The most recent National Defense Strategy and annual defense budget request continue to prioritize a strategic focus on countering and deterring threats from near-peer adversaries.

(Source: 10-K Leonardo DRS)

This simply means that DRS earnings are directly related to the increase in US defense spending, and this trend could continue for a significant period due to the ongoing war in Ukraine. The Ukrainian counter-offensive has begun in its initial stages, advancing in three directions: southwest of Donetsk, in Zaporizhzhia, and in Bakhmut. However, it is expected to be a long and challenging process for several reasons.

Firstly, the Ukrainian territorial gains have so far reached only the frontlines of the Russian forces and have not yet reached the heavily fortified hinterland. Secondly, the Ukrainians lack sufficient air cover. Finally, the main offensive is yet to come, and Ukraine has already suffered significant losses. This could potentially lead to a new phase of attrition in the counteroffensive.

A few months ago, I read an interesting article of the Financial Times, a transcript of the episode "Ukraine series: how long will the war last?" from the podcast "The Rachman Review". In the interview, Hein Goemans, the interviewee, commented on the Russians Army, saying,

They can dig in. They can actually, you know, try to recreate trench warfare if they want to.

(Source: Financial Times, link to the article, link to the podcast).

Therefore, even in an optimistic scenario where the Ukrainian counter-offensive does not stall in trench warfare, it would still require months, if not years, to achieve all the strategic objectives. This ultimately translates to increased defense spending and a subsequent boost in sales for defense companies.

The stock has reached my fair value: time to cash out?

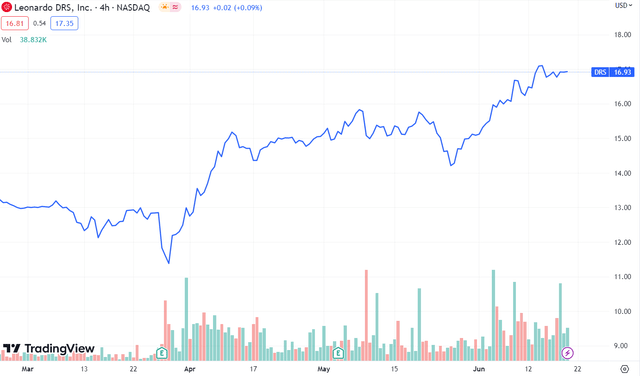

Since my last article, in which I gave a "Buy" rating, Leonardo DRS has seen a gain of +14.84% over the past 2 months, rising from $14.76 to $16.95. In fact, two months ago, the company's shares had fallen significantly following a below-then-expected guidance, but in my opinion, the company had all the possibilities and tailwinds to quickly return to its fair value. However, now the current price reflects the fair value I had indicated ($16.90)!

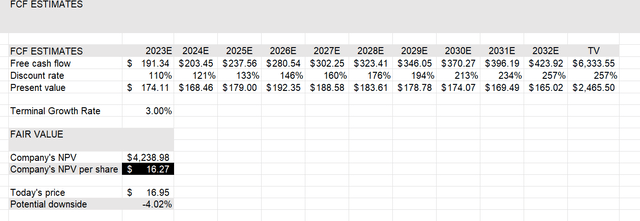

After revising the DCF model and making adjustments to some factors and margins, the estimated FCF slightly increased. However, due to the increasing interest rates, the new model returned a slightly lower fair value compared to the previous analysis.

WACC Final Table (Excel Personal DCF Model) FCF Final Table (Excel Personal DCF Model)

Given the volatility of interest rates, I didn't heavily rely on the new model and I therefore maintained the previous target price of $16.90.

However, the key question remains: is it worth investing at these prices?

Bottom Line

In conclusion, while I believe Leonardo DRS is an excellent long-term investment that can generate above-average returns in the coming years, I anticipate a potential decline in the stock price in the coming months.

Therefore, my recommendation is to avoid entering at current prices, as the lack of an adequate safety margin increases the risk of short to medium-term losses. However, for long-term investors like myself, it would be wise to keep an eye on Leonardo DRS for potential opportunities when the stock price becomes slightly more favorable. A solid and innovative company in a high-potential sector is always a good investment choice!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Anyways, like i said. Interesting take.

Good luck trading!