Earn A Dividend Check Every Month With These 3 Stocks

Summary

- This article discusses three high-quality blue-chip dividend stocks that can provide investors with monthly dividend income when staggered.

- These stocks are currently trading at reasonable valuations and have strong financials, making them attractive options for investors seeking regular income.

- All three stocks have shown the ability to generate strong free cash flow, which has led to rising dividend payouts.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Mongkol Onnuan

Earning dividends is great! Earning dividends EVERY month hits a little differently.

You can do this a few different ways:

- You can buy ETFs that pay a monthly dividend like (JEPI) or (JEPQ)

- You can buy a monthly paying dividend stock like (O) or (STAG)

- Or you can stagger quarterly paying dividend stocks that pay their dividends on different months from the other

For example, you could have Stock A pay you in January, Stock B pay in February, and Stock C pay you in March before restarting the process again. Three different stocks, dividend income EVERY month.

That is exactly what we are going to look at today, three high-quality blue-chip dividend stocks that are trading at intriguing valuations and would have you earning a dividend paycheck EVERY month.

3 Dividend Stocks To Earn A Dividend EVERY Month

Dividend Stock #1 - JPMorgan Chase (JPM)

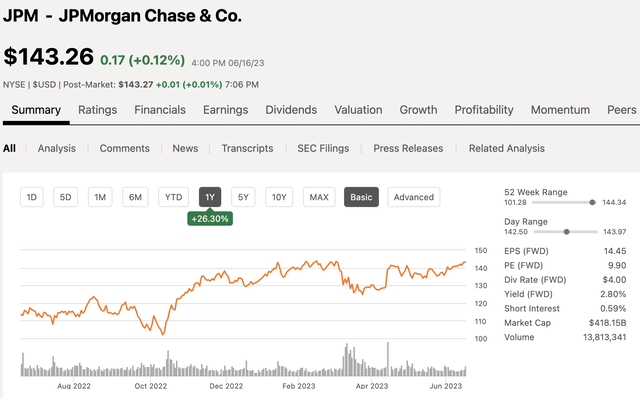

JPMorgan chase is the largest US bank, having $3.7 Trillion in total assets. The company currently has a market cap of $418 billion and over the past year, shares of JPM have climbed 26%, once again trading at levels last seen prior to the mini banking crisis we went through.

JPM is not only the largest US bank, but they have also been one of the best performing banks over the past 12 months, up 22% over that period. There has been a lot of turmoil in the banking sector, especially the regional banking sector, in 2023 as we have now seen three bank failures of some pretty substantial regional banks.

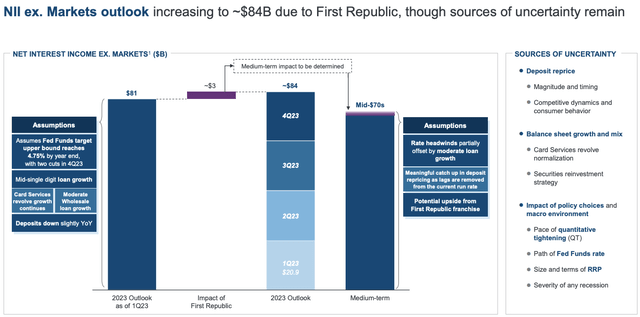

One of those banks that went under was First Republic, to which JPM scooped up their assets for a very favorable amount, booking a $2.6 billion one-time gain from the transaction.

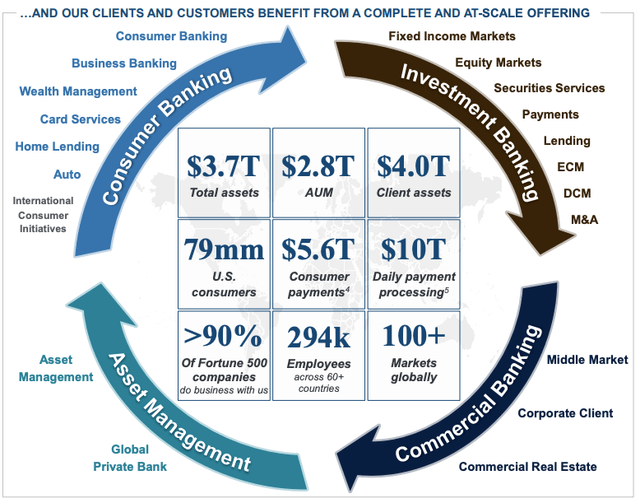

The bank operates within four major segments:

- Consumer Banking

- Investment Banking

- Commercial Banking

- Asset Management

Although the rise in interest rates over the past 12+ months has put a strain on some areas of the economy, what it does for banks is increase what is call NII or Net Interest Income.

NII is essentially the difference between the interest the bank EARNS from loans and what they pay in interest for something like a savings account. The loan rates have increased far faster than the savings account rates.

JPM is looking for NII of $81 billion in 2023, which was before the First Republic acquisition, which is supposed to be accretive by $3 billion during the year.

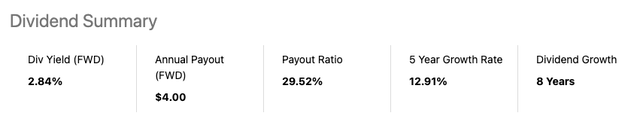

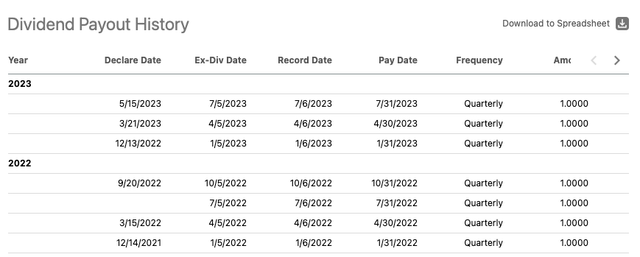

In terms of the dividend, JPM pays an annual dividend of $4 per share, which equates to a dividend yield of 2.8%. The bank has a low payout ratio slightly below 30% and over the past five years, investors have enjoyed an annual dividend growth rate near 13%, making them also a dividend growth stock.

As you can see on this chart, JPM pays out their dividend on a quarterly basis every January, April, July and October.

Now let’s look at valuation to see if the stock is worthy of a buy, after all, we never want to invest based on yield alone and definitely not based on the month they pay a dividend.

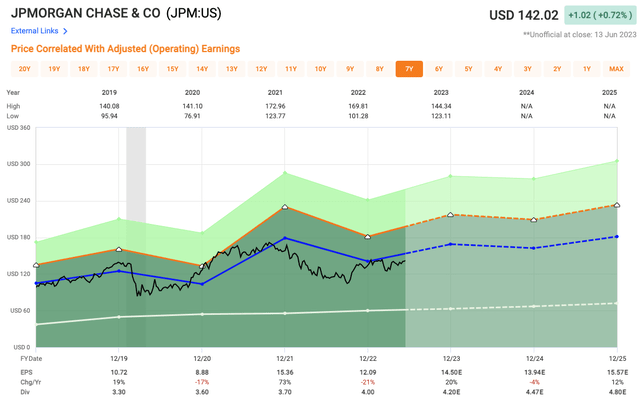

JPM is expected to generate EPS of $14.50 in 2023, which equates to an earnings multiple of only 9.8x, which is quite low for a stock that has traded at an average multiple of 11.7x over the past five years and 12.4x over the past decade.

Dividend Stock #2 - Starbucks Corporation (SBUX)

Starbucks has built an extremely strong brand over the years, expanding from just a coffee shop to more of a status symbol, it feels these days. Carrying around that SBUX cup just makes some people feel good. The company has built a very strong and loyal customer base, on par with the likes of Apple (AAPL).

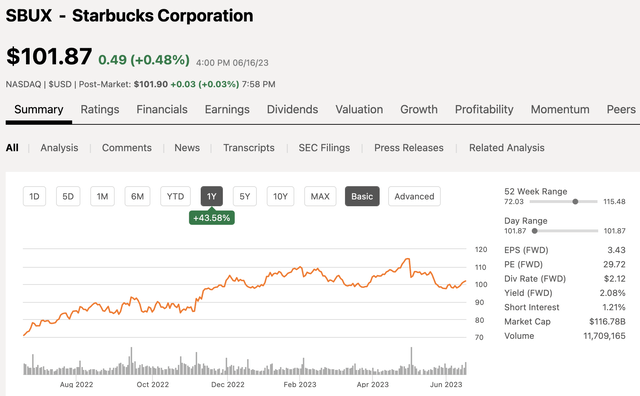

SBUX currently has a Market cap of $117 Billion and over the past 12 months, shares are up over 40%. However, in 2023, shares have stalled out as they are roughly flat so far on the year after falling 7% in the past month.

Why are the shares under pressure of late, you might ask?

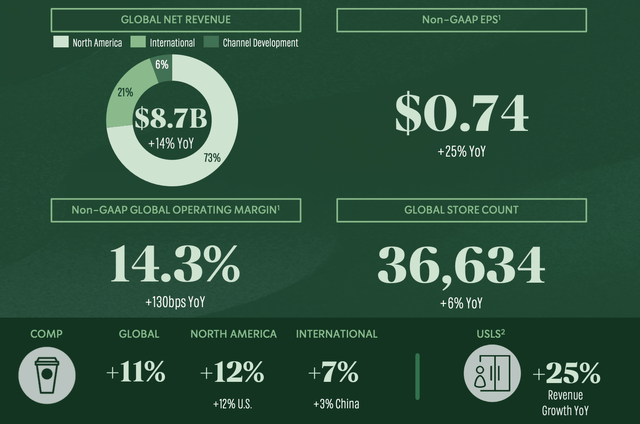

The US is the company’s largest region, but that is followed by China, which is a region the company is very focused on growing the next few years.

In Q2, the company recently reported US same store sales growth comps of 12%, but China only grew by 3%. Since the beginning of the year, China did away with their pandemic restrictions, which many had hoped would drive the stock higher due to higher expected economic growth in the region. That has failed to take shape across numerous sectors in the region, which resulted in a mini sell-off in companies connected to the region.

The stock price baked a lot of this growth in as the share price climbed to $115 after sitting around $70 in June of last year.

Once the company reported their Q2 earnings, which showed slower than expected growth in China and other companies and economic data also showed slower than expected growth, the share price plummeted and now sits around $100.

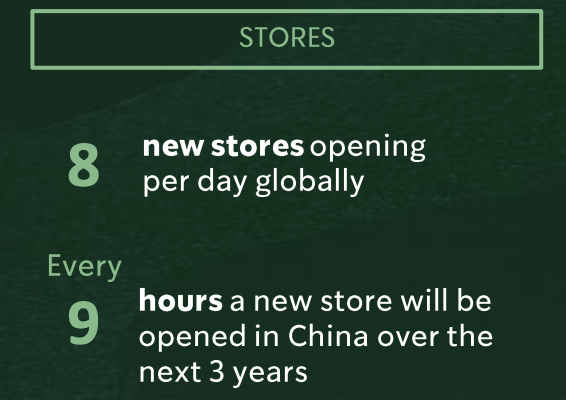

The company is so focused on China growth that they have committed to opening a new store every 9 hours in the region, over the course of the next three years.

SBUX Investor

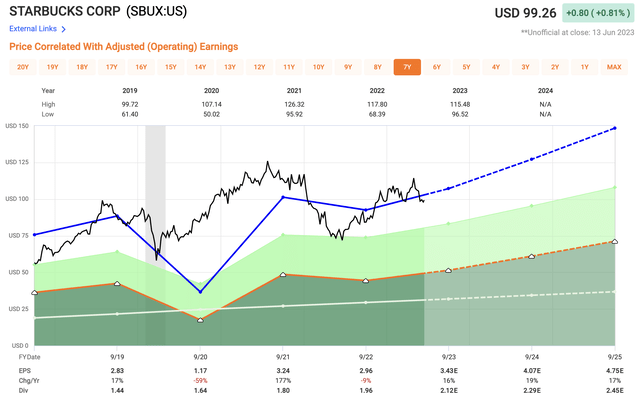

SBUX has long been a company known for generating large amounts of free cash flow, which has helped them increase their dividend over the years at a fast pace.

Shares of SBUX currently yield a dividend of 2.15% with a 5yr DGR of 12.5%, which is slower than in years past as they have dealt with some slower growth years after the pandemic hit. Management has increased the dividend for 12 consecutive years.

Starbucks pays their dividend on a quarterly basis during the months of February, May, August, and November.

So JPM paid us a dividend in January, and now Starbucks paid us a dividend in February, we have received dividend payments both months from different companies.

Now for valuation, are SBUX shares a buy, sell or Hold?

Analysts are looking for FY23 EPS of $3.43 per share, which equates to an earnings multiple of 28.9x. Over the past five years, SBUX shares have traded at an avg of 31x and 30x over the past decade.

Growth is expected to return to the company with 16% growth expected in FY 2023 followed by 19% growth in FY 2024 and 17% in FY 2025.

Today's valuation does look intriguing, but with the growth expected the following years, the valuation looks even cheaper

Dividend Stock #3 - Pfizer (PFE)

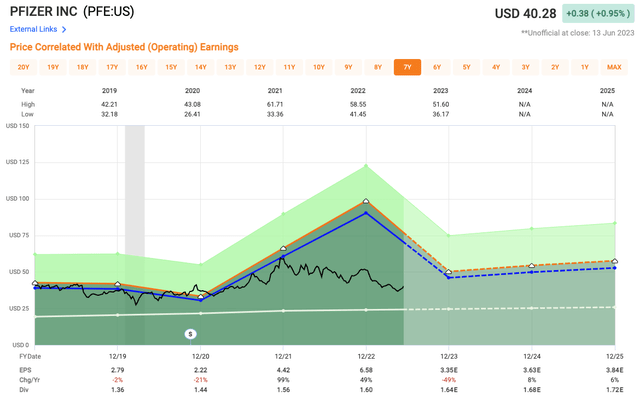

Pfizer is a company that has been talked about a lot over the past three years as they were at the forefront of the pandemic based on their developed vaccine.

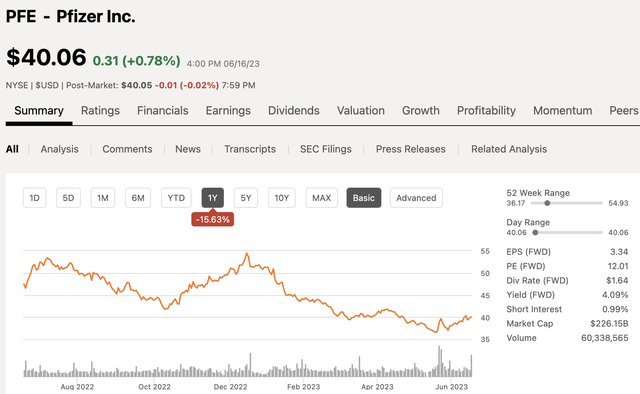

Pfizer has a market cap of $226 Billion and over the past 12-months, shares of PFE have fallen more than 15%, with all of that coming in 2023. YTD the stock has been under intense pressure, falling more than 20%.

One reason for the decline has been the decline in sales and net earnings the company has seen of late, which primarily has been related to slowing pandemic related revenues, which is to be expected.

In addition, the company is facing a patent cliff for many of its top pharmaceutical products, something very similar to what AbbVie (ABBV) is going through and many within the pharmaceutical space.

Although the pandemic revenues are down, the company does expect those to rebound in 2025 when they are expected to roll out a combo vaccine for the Flu and COVID.

However, the company also has a pipeline of new products that are set to roll out in 2024 that will help offset the loss in revenue. One of those new drugs that is rolling out is focused on RSV, which has been a hot topic within the media. The company recently received FDA approval for older adults.

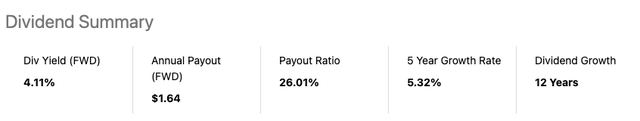

Regardless, the company continues to generate strong amounts of FCF to fully support their dividend. Pfizer's dividend yield is the highest dividend on today’s list as Pfizer has a dividend yield of 4.1% right now with a low payout ratio below 30%. The five-year dividend growth rate is 5.3% and the company has increased the dividend for 12 consecutive years.

Pfizer pays out their quarterly dividend in the months of March, June September and December.

So now we receive dividend income as follows:

- January - Dividend from JPM

- February - Dividend from SBUX

- March - Dividend from PFE

- April - Dividend from JPM

- May - Dividend from SBUX

- June - Dividend from PFE

- July - Dividend from JPM

- August - Dividend from SBUX

- September - Dividend from PFE

- October - Dividend from JPM

- November - Dividend from SBUX

- December - Dividend from PFE

In terms of valuation, analysts are looking for Pfizer to generate 2023 EPS of $3.35, half of what they did last year largely due to the loss of the pandemic related revenues, which equates to a 2023 earnings multiple of 12x. Over the past five years, shares have traded at an avg multiple of 13.7x, which is in line with where the stock has traded over the past decade as well.

Investor Takeaway

Earning monthly dividends is great, both for retired living, or it allows you to put the money back to work on a regular basis. However, a stock should not be bought based on the month they pay a dividend or based on the dividend yield.

All three of these dividend stocks are high-quality and trading at reasonable valuations to have on your watchlist.

In the COMMENT section, let me know if you earn dividends every month.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

no marketing to add

This article was written by

Mark Roussin is an active Certified Public Accountant (CPA) in the state of California. Mark has worked as a CPA, serving both public and private Real Estate corporations for over 10 years. Today, he provides his followers insights to both undervalued dividend stocks mixed with high-growth opportunities with a goal of them reaching financial freedom in the long-term. Mark tends to invest primarily in dividend stocks with a strong emphasis on Real Estate Investment Trusts (REITs).

Author of the weekly financial newsletter, "The Dividend Investor's Edge."

Mark has partnered with "iREIT on Alpha”, which is the premiere marketplace service that provides the best daily in-depth REIT research. The service boasts a community of like minded investors that also receive complete access to our various portfolios that you can track in real-time. Come check out all the exclusive content today!

-----------

DISCLAIMER: Mark is not a Registered Investment Advisor or Financial Planner. The Information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. He asks that you perform your own due diligence or seek the advice of a qualified professional. You are responsible for your own investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.