Deere: All Eyes On Inventory

Summary

- Deere & Company posted strong fiscal Q2 results with sales up 30% to $17.4 billion, but inventory concerns have impacted the stock price.

- There was some concern about a buildup in large Ag inventory in the field.

- Despite the inventory concerns, demand remains strong and DE trades below its historical multiple, suggesting potential upside if it can report solid fiscal Q3 results.

David Becker

Back in March, I wrote that Deere (NYSE:DE) should benefit from solid agricultural fundamentals, technological innovations, and an aging equipment fleet, However, I noted its Turf & Utility business was more economically sensitive and that this segment’s channel inventory was not in good shape. Overall, I thought the stock looked appropriately valued. Since that time, the stock hasn’t moved much, trailing the nearly 10% return in the S&P. Let’s take a closer look at the name.

Company Profile

As a reminder, DE is a manufacturer and distributor of farm, turf, and construction equipment that operates in 4 segments. It owns and operates 22 facilities in North America, leases 2 more, and operates 47 internationally.

Its Production & Precision Agriculture segment is its largest segment, representing over 40% of sales in 2022. With the segment it sells equipment to large-scale farmers. In the Small Agriculture & Turf segment, meanwhile, it sells equipment to turf and utility customers, as well as high-value crop producers and dairy farmers. For its Construction & Forestry segment, the company sells equipment to the construction, roadbuilding, and forest industries. It also has finance segment where it will lease equipment and finance sales through its network of independent dealers.

Great Results, But Inventory Concerns

DE posted strong fiscal Q2 results last month, seeing sales soar 30% to $17.4 billion, and easily surpassing the $14.9 billion analyst consensus. Adjusted net income, meanwhile, climbed 36% to $2.9 billion, or $9.65 per share. That also easily topped the analyst consensus for adjusted EPS of $8.64.

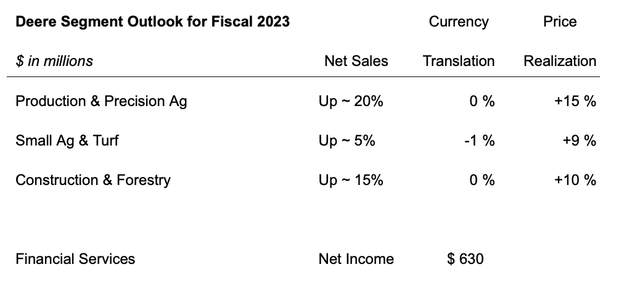

DE also forecast a robust outlook for 2023, will all of its segments seeing sales growth. Its Production & Precision Agriculture segment is expected to see about a 20% increase in sales, helped by a 15% increase in prices. Small Ag and Turf, meanwhile, is projected to see sales rise 5%, helped by a 9% price boost. Construction & Forestry is forecast to see its sales climb 15%, helped by a 10% price hike. The company also boosted its full-year earnings outlook to a range of $9.25-9.5 billion, up from a prior outlook of $8.75-$9.25 billion.

Normally, such results would lead to a jump in the stock price, but that was not the case, with DE shares rising in pre-market trading only to finish the day down -2.7%. Some of the concern appears to be around inventory, which was mentioned over 40 times on its earnings call. Overall inventory rose to $9.7 billion, up from $9 billion a year ago. That’s not a big jump given its 30% increase in sales and the rising costs of equipment.

However, there were a lot of questions on the earnings call about a buildup in large Ag inventory in the field. The company credited this to a return to normal seasonality, as well as some pull forward. However, the company also noted a couple areas where it was managing production, including with compact utility tractors in North America and small tractors in Brazil. It also said that channel inventory is up a little bit faster than expected, but noted that some of the field inventory reported is still pending delivery.

Discussing the issue on its FQ2 earnings call, SVP of Global Sales & Marketing David Gilmore said:

“The large Ag inventory build seen recently is due to the return to normal seasonality in our production schedules. Keep in mind that year-over-year comparisons aren't as relevant because of the challenges we faced in the first half of 2022 from the labor disruption to supply chain obstacles. These challenges caused us to run at low and unhealthy levels during all of 2022, making the year-over-year increase appear somewhat inflated. Compared to historic averages, however, we are still well below seasonally adjusted target levels with inventory to sales ratios for 220 plus and Four-Wheel-Drive tractors in the teens as of the end of April. Pre-COVID, both products would have been at least 10 points higher in the second quarter on an inventory-to-sales ratio basis. Meanwhile, our combined inventory to sales ratio currently sits at 23% as we were able to pull some of our production ahead into the second quarter. At this time, we expect the second quarter to be the highest production for combines this year. Combined inventory seasonally peaks during the quarter of highest production with historic average IS ratios greater than where we are currently. … Being on a more seasonal pace facilitates better used trade planning prior to the harvest season. So we've seen used inventories increase seasonally, keeping up with elevated production of new equipment, which is good for both dealers and customers. The most important takeaway is that by the end of the year, large Ag inventory to sales will be lower than both historic and target levels.”

Too much inventory in the distribution channel or in the field can be an issue, as it can hurt sales into the distribution channel and lead to lower utilization at manufacturing plants. While a different industry, Hanesbrands (HBI) is a good study of what happens with a manufacturer when there is too much inventory in the channel and it isn’t to optimize its factory utilization. It's generally not a pretty scenario and takes quite a while to get back on track.

Given that, it is understandable while despite the strong quarter and guidance, there are some worries regarding DE. That said, DE has been in this business a very long time, and they should have a better pulse on supply-demand and inventory dynamics than anyone else. The ag fleet is also aging, so the company should see a replacement cycle.

Valuation

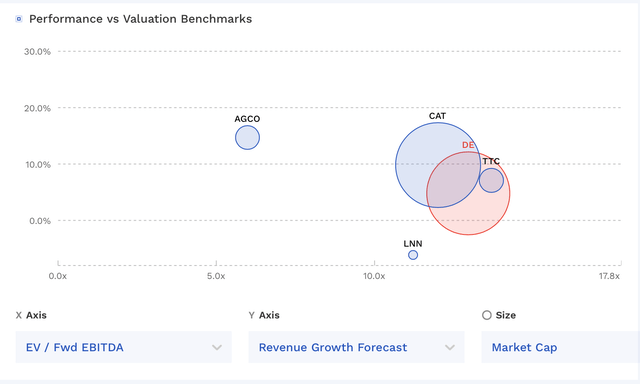

DE currently trades around 12.9x the FY2024 (ending October) consensus EBITDA of $13.52 billion and 12.7x the FY2025 consensus of $13.77 billion.

It trades at a forward PE of 12.6x the FY24 consensus of $32.17.

Revenue growth is expected to be around 5% this fiscal year, and down 1% next year.

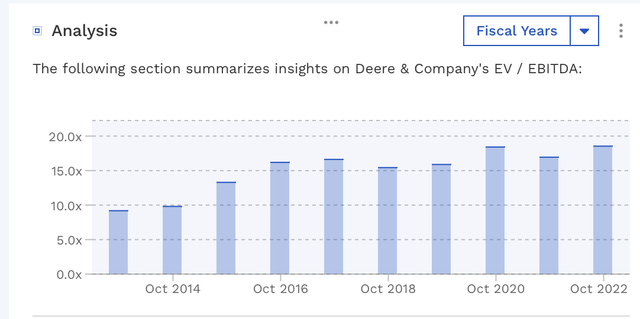

DE trades at one of the higher multiples in the machinery space, although a bit below its recent history, where it has often had a trailing multiple above 15x.

DE Valuation Vs Peers (FinBox) DE Historical Valuation (FinBox)

Conclusion

Overall, I think the channel inventory issue while a risk, is likely overblown at this point. Demand appears to be holding up, and the results show a lot of pricing power. There are some areas of real strength, such as combine sales, while also some pockets of weakness, such as smaller tractors.

Trading below its historical multiple, I think DE should have some upside from here, especially if it can report solid fiscal Q3 results. However, the upside isn’t quite high enough to put it in “Buy” territory just yet, and I’d prefer to be a buyer on weakness.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.