Modiv's Preferred Stock Remains Attractive With An 8.1% Yield

Summary

- Modiv Inc. CEO Aaron Halfacre plans to dispose of office assets to focus on industrial manufacturing facilities.

- MDV.PA preferred stock remains an attractive buy, with an 8%+ yield and roughly 10% upside to par value.

- Halfacre intends to redeem/retire MDV.PA when possible and simplify the company's balance sheet and capital structure.

- Looking for a helping hand in the market? Members of High Yield Landlord get exclusive ideas and guidance to navigate any climate. Learn More »

soumik das/iStock via Getty Images

Modiv Inc. (MDV) is one of the newer net lease real estate investment trusts ("REITs") to hit the public market. The portfolio was cobbled together by a handful of former real estate crowdfunding platforms, most notably Rich Uncles, which owned net lease properties while paying their investors a flat yield.

Interestingly, before MDV's IPO in early 2022 (in which it raised a mere $1 million for lack of need for capital), the still-private MDV raised $50 million through the public issuance of its 7.375% Series A Cumulative Redeemable Preferred Stock (NYSE:MDV.PA).

Recently, I got the chance to interview the CEO of MDV, Aaron Halfacre. It was a great conversation that gave me a distinct sense of his investment philosophy and alignment with shareholders. The full interview will be published exclusively for members of High Yield Landlord, but below we'll look at and discuss an excerpt from it.

If you aren't familiar with MDV, all you need to know is the above information plus the fact the small REIT is internally managed, owns 56 properties worth about $634 million in gross value that are 100% leased, and its portfolio is a mix of (mostly) industrial, retail, and office.

Halfacre made clear he doesn't like and has never liked owning office buildings, but these are vestiges from the crowdfunding portfolios that have not yet been sold. Halfacre's plan is to dispose of these office assets as quickly as possible so that MDV can become solely focused on industrial manufacturing facilities.

Why manufacturing properties? A cynic might respond that that is simply the best type of net lease real estate that works with MDV's high cost of capital (including equity, debt, and disposition cap rates).

But Halfacre targets tenants that are established companies, typically sponsored by well-aligned, low-leverage private equity sponsors (unlike the vulture PE firms that buy companies with heavy leverage basically just to pull out anything of value), and the properties he targets are mission-critical to those tenants.

Update On MDV.PA

I last pitched MDV.PA in a January 2023 article, at which time MDV.PA traded below $21 at a yield of almost 9%.

Today, MDV.PA has rebounded a bit to the mid- to high-$22 range and now yields about 8.1%. In my opinion, it remains an attractive buy today for an 8%+ yield and roughly 10% upside to par value.

But is that yield safe? Yes, I think so.

Here's some pertinent financial information from the last four quarters, taken from MDV's Q1 2023 Supplemental:

| Q1 23 | Q4 22 | Q3 22 | Q2 22 | |

| Adjusted EBITDA | $7.50m | $10.29m | $7.52m | $7.52m |

| Interest Expense | $2.30m | $2.83m | $2.51m | $1.20m |

| EBITDA Less Interest Expense | $5.20m | $7.46m | $5.01m | $6.32m |

| Preferred Dividends | $0.92m | $0.92m | $0.92m | $0.92m |

| Preferred Dividend Coverage | 5.65x | 8.11x | 5.45x | 6.87x |

| Preferred Dividend Payout Ratio | 17.7% | 12.3% | 18.4% | 14.6% |

Preferred dividend coverage and the payout ratio are inverse of each other. The higher the coverage, the lower the payout ratio. These have jumped around over the last four quarters, but they remain quite comfortable over time. And the last twelve months include significant levels of capital recycling in the form of property dispositions and acquisitions.

Meanwhile, interest expenses have gone up, especially after the recast of the credit facility, but interest coverage remains robust.

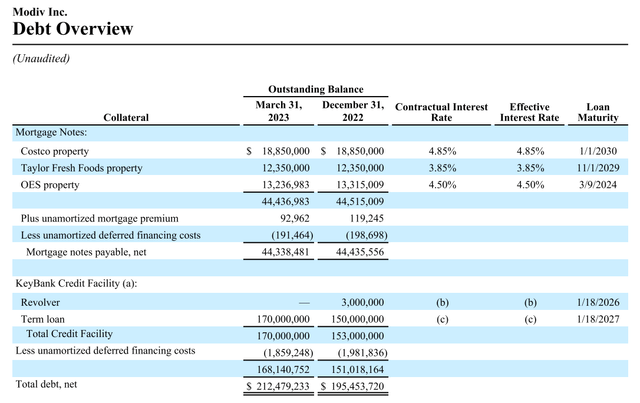

More good news for preferred shareholders is that MDV's debt maturity schedule presents no red flags anytime soon. The soonest debt maturity is a single-property mortgage maturing in March 2024. The vast majority of MDV's debt is in the form of a term loan (with an interest rate swap to fix the rate) maturing in January 2027.

In other words, MDV's debt costs are fixed for years into the future, which means that MDV's preferred dividends are not threatened on the balance sheet side.

What are the odds that MDV will redeem MDV.PA after its redemption date in September 2026? Of course, that depends on the prevailing situation in the capital markets at the time, but it was good to hear directly from Halfacre about his intentions for the preferred stock.

Here's an excerpt from my interview with him:

Halfacre: I have no designs on increasing the dividend. Those that are buying our stock expecting the dividend to go up, they’re going to have to wait a long time.

On the preferred, people always need to ask if there’s going to be an influx of supply. Some REITs will do a Class A, B, C, D, E, and so on. I’m not doing any more preferred. I’ve had many overtures to issuing more preferred. I won’t. To me, the preferred is a no-brainer investment. [Although] there’s a lot more upside in the common, only $2.50 of upside in the preferred.

Eventually, down the road, God willing, we’ll retire the preferred.

Austin: I love to see simplicity in a REIT’s capitalization. Just to let you know, my largest holding is Agree Realty (ADC). They do have a preferred (ADC.PA), but it’s the second lowest-yielding REIT pref at par behind one of Public Storage's (PSA) prefs. It’s a phenomenal cost of capital [4.25% at par], but other than that, their capitalization is just common equity and unsecured debt. I love that simplicity.

Halfacre: That’s my goal.

From this snippet of our conversation, I learned four important things:

- Halfacre is focused on lowering the common dividend payout ratio over time, which should increase retained cash (good for the preferred).

- Halfacre has no intentions to issue more preferred stock, either in the Series A or a new series.

- Halfacre intends to redeem/retire MDV.PA when possible, rather than allow it to be a perpetual form of capital.

- Halfacre's goal is to simplify MDV's balance sheet and capital structure eventually.

The most important and pertinent point for MDV.PA is that Halfacre is adamantly against issuing more preferred stock.

My Thoughts

I appreciate Halfacre's candor and thoughtfulness. It's too bad that, so far, MDV has been straddled with a high cost of capital and some negative sentiment from the office exposure.

Personally, I will wait to see if / how much the common payout ratio declines over the next year or so, and I'll hold off on buying MDV (common shares) in the meantime. But I do believe MDV could someday become the kind of compounder that I like in my portfolio.

If and when interest rates come down from the present level, I could see MDV being one of the strongest performers in the net lease REIT peer group. But over the next few years, the REIT does have some notable headwinds to fight through, such as strategically disposing of its remaining office properties, converting OP units to dividend-paying common stock in 2024, and potentially getting through a recession.

However, I continue to own MDV.PA and may buy more of its 8.1%-yielding shares soon. The preferred dividend is well-covered, and of course, it has to be paid in full (including in arrears in the case of a hypothetical preferred dividend suspension) before the common stock dividend can be paid.

If MDV.PA is redeemed on its redemption date in September 2026, then buyers of MDV.PA at today's price would enjoy total returns of a little over 11%.

If you want access to our entire Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the largest real estate investment community on Seeking Alpha with over 2,000 members on board and a perfect 5/5 rating from 400+ reviews:

For a Limited Time - You can join us at a deeply reduced rate!

This article was written by

I write about high-quality dividend growth stocks with the goal of generating the safest, largest, and fastest growing passive income stream possible. My style might be called "Quality at a Reasonable Price" (QARP) in service to the larger strategy of low-risk, low-maintenance, low-turnover dividend growth investing. Since my ideal holding period is "lifelong," my focus is on portfolio income growth rather than total returns.

My background and previous work experience is in commercial real estate, which is why I tend to heavily focus on real estate investment trusts ("REITs"). Currently, I write for the investing group, High Yield Landlord.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MDV.PA, ADC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.