Motor insurance could remain unchanged, as per Ministry of Road Transport and Highways draft rate card.

Your car or bike insurance premiums are unlikely to go up due to any hike in third-party motor premium rates this financial year.

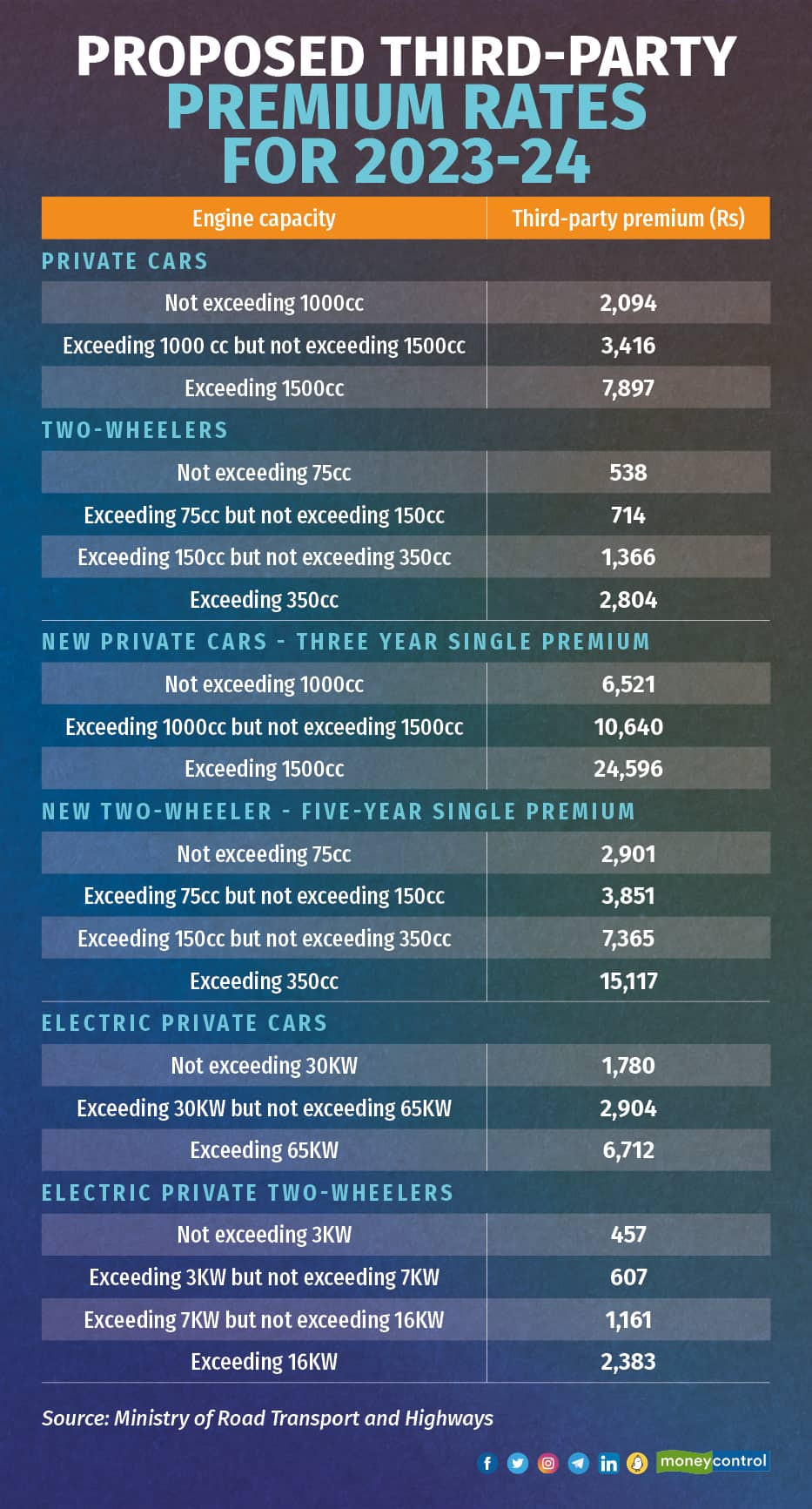

The Ministry of Road Transport and Highways (MoRTH) has proposed to leave the rates unchanged for 2023-24. Last financial year, car- and two-wheeler owners had seen rate increases in the range of 0.1-20.7 percent, depending on the vehicle’s engine capacity.

Read on to understand how third-party motor insurance rates affect your car and two-wheeler premiums and why it is a must-buy, irrespective of premium revisions.

What is third-party motor insurance?

As soon as a vehicle rolls out of a showroom onto the road, it has to be covered under third-party liability insurance. It is the component of your motor insurance cover that is mandated by law.

As the name suggests, it insures the policyholder against compensation that she might have to pay if the vehicle were to be involved in an accident, causing harm to another individual (third-party). The cover will also pay for any claims and damages that your car may have caused to such individuals’ assets.

How are the third-party liability premium rates determined?

Unlike other insurance covers, premium rates for third-party motor insurance are tightly controlled by the government and the Insurance Regulatory and Development Authority of India (IRDAI).

The road transport ministry announces third-party motor premium rates every year. Last June, it raised the annual premiums after a gap of two COVID-hit years. The rates are linked to the type of vehicle and the engine capacity.

What is the status of premium revisions this year?

This time round, the road transport ministry has proposed not to tinker with the rates. A final decision is awaited.

According to the ministry’s draft rate card, the third-party premium rate applicable to a private car with an engine capacity of less than 1,000cc will be Rs 2,094. In the case of two-wheelers, the third-party liability premium will be Rs 1,366 for a vehicle with engine capacities of between 150cc and 350cc (see table for details).

Can I choose not to buy own damage component?

Ideally, you should not ignore own damage component of car insurance covers. Unlike third-party liability covers, it is not mandated by law.

However, it is a must in your protection portfolio as it reimburses expenses you might incur if your vehicle is damaged. In fact, you should also consider rider benefits such as engine protect and zero depreciation covers to make your policy more comprehensive.

For instance, repairs necessitated by damage due to accidents, floods, fire, burglary and so on. An own damage cover makes good the financial losses incurred due to such incidents. The premiums vary as per the make, age of the vehicle, engine capacity, accumulated no-claim bonuses, if any, scope of coverage and the insurer, among other things.