Corning: More Measures To Expect Based On Its Management Framework

Summary

- Declining free cash flow co-exists with improved margin from management's actions.

- Measures to cushion lower net sales' impact have been taken, and are expected to continue.

- Historical data suggested its lower cash flow could be bottoming out.

- Long term growth prospects remain bright.

John M. Chase

Investment Thesis

The stock has dropped below our bearish case fair valuation level since our initial coverage of Corning (NYSE:GLW) with a "Hold" rating. We review the latest development in the company and see the value for long-term investors to start accumulating at current or lower prices.

Strength

We previously pointed out that Corning has a consistent management strategy. In time of uncertainty, it is good to refer back to this strategy and gauge how it will handle the challenge.

As Corning's presentation at Q4's earnings report stated, it expected Q1's sales to decline more than the normal seasonality but margin to improve, as it has taken the strategy of raising prices in Optical Communications and Life Sciences.

Corning: Profitability and Cash Generation (Company Q4 Presentation)

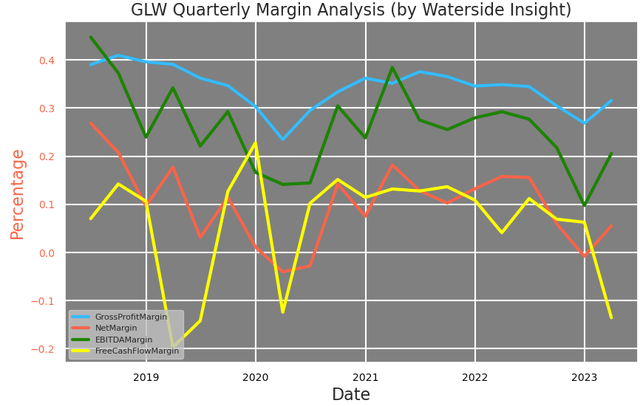

Indeed, as expected, most of its margins have improved in Q1, with its EBITDA margin recovering more than its gross profit margin and net margin. The only margin that stood out as falling was the free cash flow margin, which we will dig into later.

Corning: Margin (Calculated and Charted by Waterside Insight with data from company)

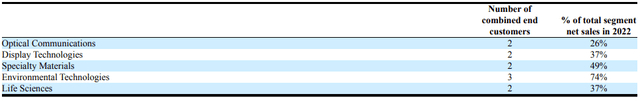

On the other hand, The concentrated client base concern we mentioned previously seemed to have improved. Its Display Technologies segment's concentrated customers now only accounted for 37% as opposed to 55% by Q3 last year, and all other segments' concentration levels have eased slightly.

Corning: Combined End Customer Concentration (Company Q1 '23 10Q)

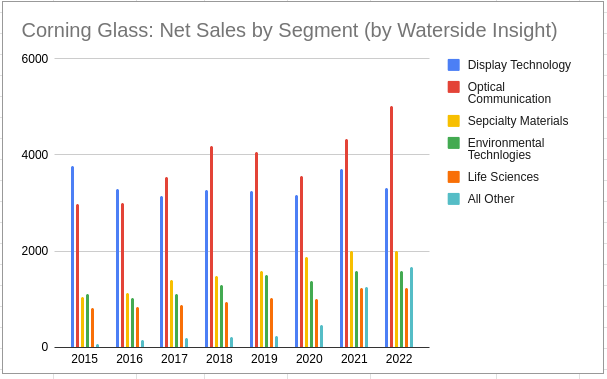

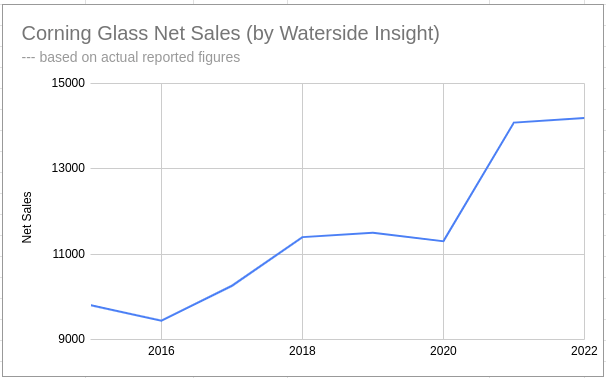

By the end of 2022, Corning's net sales have seen an acceleration of growth, particularly in Optical Communication, while all other segments maintained at similar levels.

Corning: Net Sales by Segment (Calculated and Charted by Waterside Insight with data from company)

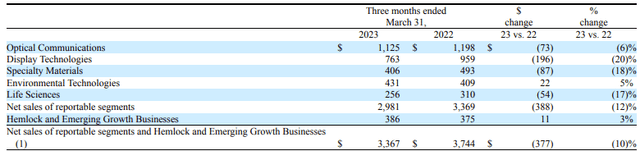

While in Q1 2023, the net sales have dropped by 10% YoY, with Display Technologies, Specialty Materials and Life Science leading the decline. However, to put it in perspective, Q1 2022 was a high base to compare to on a historical basis. We will delve into it more.

Corning: Q1 '23 Net Sales by Segment (Company Q1 '23 10-Q)

Weakness

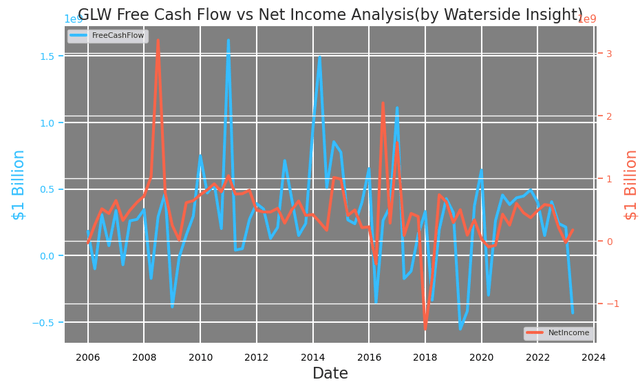

Now let's dig into its cash flow. Since our initial coverage, Corning's free cash flow has deteriorated. It dropped from $214 million in Q4 to $431 million in Q1. Since CapEx has been stable, it is mostly due to the lower operating cash flow.

Corning: Free Cash Flow vs Net Income (Calculated and Charted by Waterside Insight with data from company)

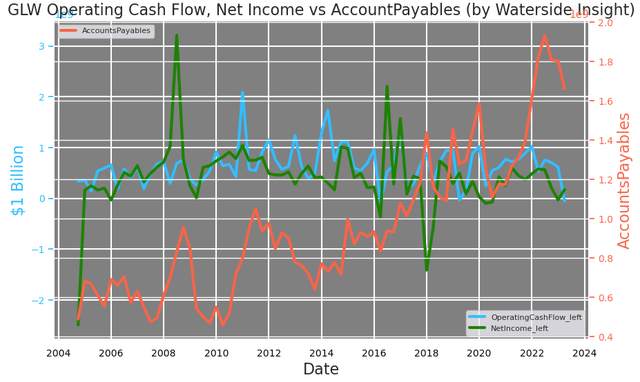

Corning's operating cash flow dropped to negative $49 million in Q1 from $617 million in Q4, basically at the bottom of the stable range formed since 2015, when the company published its Capital Allocation Framework. Looking at the components of its operating cash flow, the biggest drags were lower net income and a larger subtraction of accounts payable, which means they have been paying down the bills. It's not necessarily a bad thing, given the overall accounts payable were coming down. However, if the company were to stick to the Framework, more cuts in costs and expenses should be expected.

Corning: Operating Cash flow, Net Income vs Account Payables (Calculated and Charted by Waterside Insight with data from company)

Its Q1 net income was $191 million, down from $602 million in the same quarter last year. Its net sales decreased from $3.6 billion to $3.1 billion YoY, a 13.8% decline. But its cost of sales also has declined by 9.3%. They are all based on one of the highest net sales levels in its history. Corning didn't always cut costs to preserve cash flow. For example, its net sales started to decline by $127 million in Q3 '22, and its net cost of sales actually went up by almost $132 million. It shows the company has started taking action to control the net income decline. And it turned out the negative impact also came from two obscure items called "Translated earnings contract" and "other income, net" that did not contribute much to the net income as they used to. The lack of these two's contributions together accounted for $281 million short compared on a YoY basis.

Corning: Net Sales (Calculated and Charted by Waterside Insight with data from company)

The takeaway here is that Corning's net sales in 2022 were a record year, so some items became normalized in Q1, which isn't as alarming as it seemed. If the company focuses on paying down its bills, it will only help the cash conversion in the next few quarters, should accounts receivable maintain similar levels. And since the company is also cutting down the cost of sales, the net income deterioration should be mitigated.

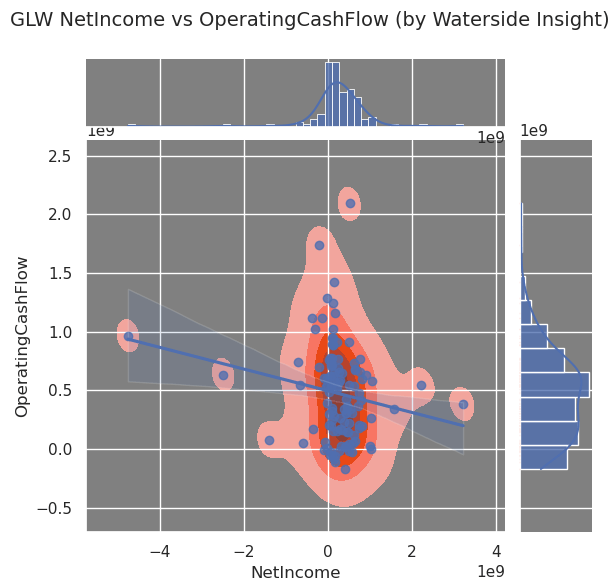

With net income at a similar level, its operating cash flow is at the bottom of its expected value historically. Unless something completely falls off a cliff, even if its net income stays at the current level, there is still large room for operating cash flow to improve. And even if its net income goes down to negative, it seems the company has mitigation measures that could still improve its overall operating cash flow. In short, the negative operating cash flow is at its "rock bottom" and only has room to go up from here.

Corning: Net Income vs Operating Cash Flow (Calculated and Charted by Waterside Insight with data from company)

The dive-in of its cash flow and net income gives us the impression that Corning is actively managing the decline in sales coming from a high comparable base while working to improve its cash conversion. Our expectation is that the company could produce better cash flow in the next few quarters, given its consistent management frame that we outlined previously.

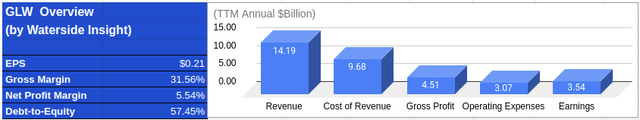

Financial Overview

Corning: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

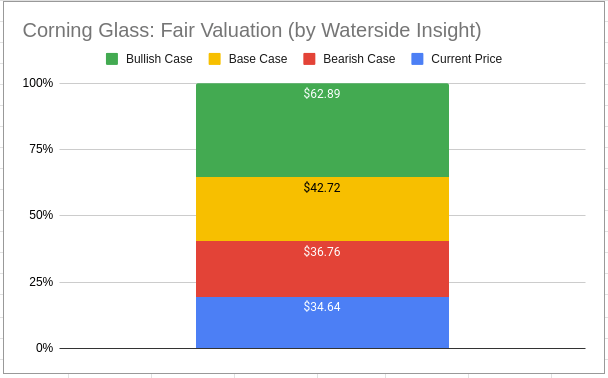

Valuation

We incorporated all our analysis above, built on top of our previous assessment and adjusted the fair valuation. The main change is we lowered the base case fair value from $49.26 to $42.72 in light of the recent quarter slowdown in its operating cash flow. But we slightly raised the bullish case from $59.08 to $60.84 while maintaining the bearish case fair price at around $36. The reason is that if the company can control the cost and avoid negative growth in its cash flow for '24, it could expect an accelerated momentum after that. Its Optical Communication segment, which is its largest one, could expect higher expansion on the back of the AI and 5G/6G development. On the other hand, as we analyzed above, there is a good chance the cash flow decline is bottoming out. Hence our updated fair valuation is as below. The current market price is below our bearish case.

Corning: Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

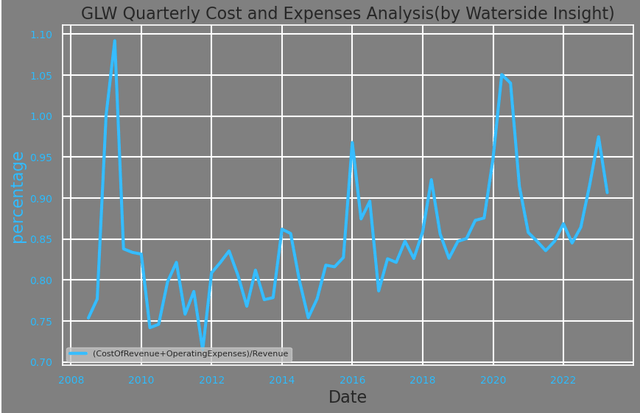

The risk to our valuation on the downside will be a large and unexpected negative shock to the sales along with stickiness of the cost and expenses. But if Corning were to stick to its management framework, it would continue making reasonable cut on the product cost and marketing/admin expenses. Data suggested that this is the path the company has started taking, with its cost of revenue and operating expenses as a percentage of revenue coming down from 97% to 90%. If the company continues bringing them down to 80%, that should cushion the free cash flow decline.

Corning: Cost and Expenses Analysis (Calculated and Charted by Waterside Insight with data from company)

Conclusion

We maintain our long-term bullish growth expectation of Corning, as we outlined in our previous article, that its product applications are fundamental and multi-faceted enough due to faster market growth and emerging application to turn up within the next few years. It is going through a sales decline of a high comparable base, while historically, these are still healthy numbers. The current market price is below our fair valuation. Given the company's management Framework, it is likely active measures will be put in place to not only recover the margin but also the cash flow. Long-term investors could start accumulating at or below the current price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.