Deere: Buy The Bullish Momentum (Technical Analysis)

Summary

- Deere & Company's focus on AI and automation in agriculture, strong financial performance, and declining price-to-earnings ratio indicate bullish potential.

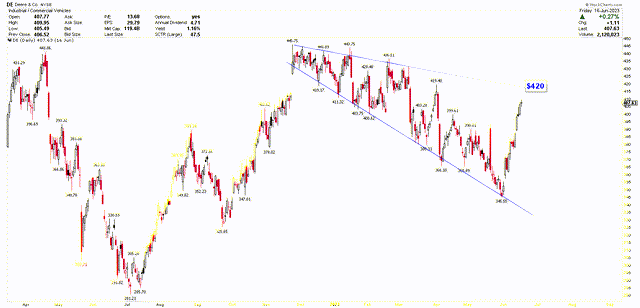

- The technical analysis reveals bullish price structures, including a symmetrical broadening wedge and falling wedge, suggesting continued upward momentum.

- A surge past the $420 mark will disrupt the falling wedge pattern, potentially triggering a substantial upward rally.

Ethan Miller/Getty Images News

This article delves into the bullish potential of Deere & Company (NYSE:DE), recognized as a trailblazer in the application of AI and automation to transform the agricultural sector. Deere's consistent financial growth, strategic deployment of technology, and dedication to shareholder value render it a compelling investment prospect. The emphasis of the article is on the technical analysis of Deere, indicating that the appearance of the falling wedge pattern is a robust bullish signal. Any market correction is seen as a significant buying opportunity.

Deere Development in AI & Innovation

Deere's focus on AI and automation in the agricultural sector has strong bullish potential for several reasons. Firstly, the company has consistently delivered on its promises to investors, evidenced by its record-breaking fiscal years and impressive financial results. This track record instills confidence in investors regarding Deere's ability to execute its strategies effectively and generate substantial returns. Secondly, Deere is leveraging AI and automation in various ways to revolutionize farm operations. The company's autonomous tractors showcased at the CES conference, represent just one aspect of its automation offerings. Deere is also employing AI to automate path planning for straighter rows during planting, optimize seed placement for maximum crop yield, and use smart sprayers to detect crops versus weeds, resulting in significant cost savings for farmers. These advancements position Deere as a leader in adopting technology within the agriculture industry.

Furthermore, Deere's approach combines the strength of physical machinery with data-driven insights and automation. Today's tractors not only provide the brawn required for agricultural tasks but also serve as a vital source of intelligence, enhancing farm efficiency and resource utilization. By empowering farmers with tools that optimize productivity, reduce costs, and automate mundane tasks, Deere offers a compelling value proposition that resonates with its target market.

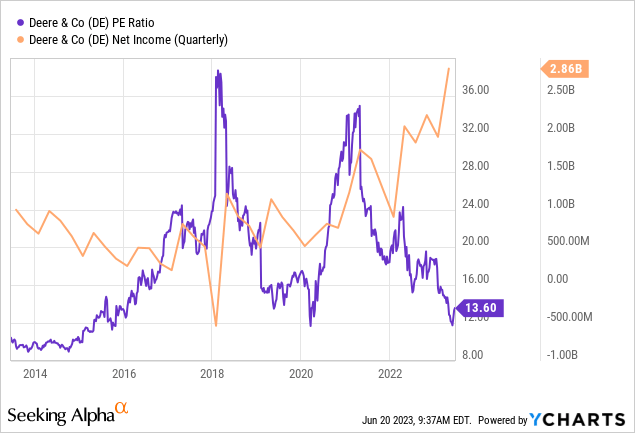

Additionally, Deere's strong financial performance and declining price-to-earnings (P/E) ratio indicate its growth potential. The company's record-breaking net income of $2.86 billion for the latest quarter results, combined with its low P/E ratio, suggest that profit growth is outpacing the appreciation of its stock price. The ongoing stock buybacks by Deere further demonstrate the company's commitment to enhancing shareholder value and its confidence in long-term returns on investment.

Additionally, Deere benefits from being an industry leader in agriculture machinery. As one of civilization's entire industries, agriculture remains indispensable. Deere's position as a trusted and established player in this sector, coupled with its investments in AI and automation, provides a unique investment opportunity. Unlike many unproven companies relying on capital markets for growth, Deere combines present-day success with long-term upside potential, making it an appealing choice for investors interested in AI and automation with a lower to moderate risk tolerance.

Bullish Price Structures for Deere

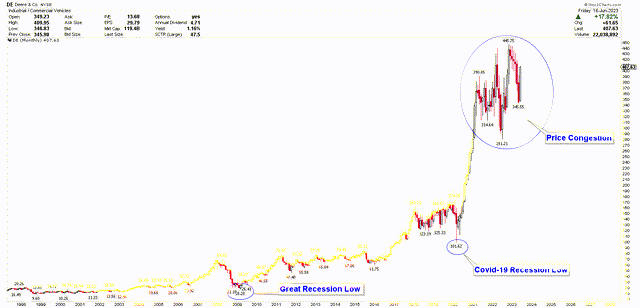

The provided monthly chart illuminates a notably bullish outlook, demonstrating an ongoing upward trend in the price over the long term. Historical market lows were experienced during the periods of the Great Recession and the COVID-19 pandemic. The Great Recession was a substantial worldwide economic decline, marked by a financial crisis and decreased consumer spending, which adversely impacted various sectors including agriculture and construction - key markets for Deere. Lower demand for agricultural and construction equipment during this period negatively affected Deere's sales and profitability. The financial crisis also tightened credit markets, creating obstacles for customers seeking equipment financing. This limited customers' ability to purchase new machinery, including Deere's products, which further impacted Deere's sales volume and revenue. Despite hitting a low of $18.28, Deere's prices began to ascend with economic recovery.

The second significant dip in Deere's stock price occurred during the COVID-19 recession due to widespread economic disruption. However, the classification of agriculture as an essential industry during the pandemic meant that farming and agricultural businesses continued operations, albeit with challenges. Deere's agricultural equipment focus served to its advantage, allowing it to capitalize on ongoing demand and stabilize its business, contributing to the stock price recovery. The pandemic initially caused a slowdown in equipment purchases, but as conditions improved and restrictions lifted, pent-up demand for agricultural equipment surfaced. Farmers' need to replace old machinery or invest in new equipment to boost productivity led to increased sales for Deere and a positive impact on its stock price. Post-pandemic, Deere's prices rebounded sharply from a low of $101.62, peaking in the $445 region, followed by a significant consolidation range indicating a bullish trend in the market.

Deere Monthly Chart (stockcharts.com)

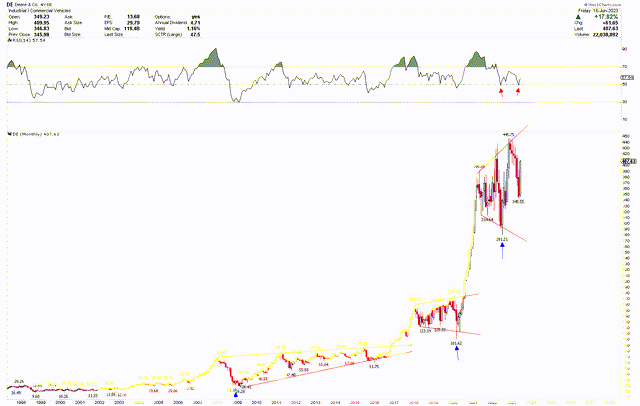

The monthly chart below also reveals a symmetrical broadening wedge formation, indicative of substantial market volatility and suggesting potential price escalation in the future. These patterns, alongside a double bottom in the RSI above the mid-level, fortify the bullish basis for Deere's stock prices.

Deere Monthly Chart (stockcharts.com)

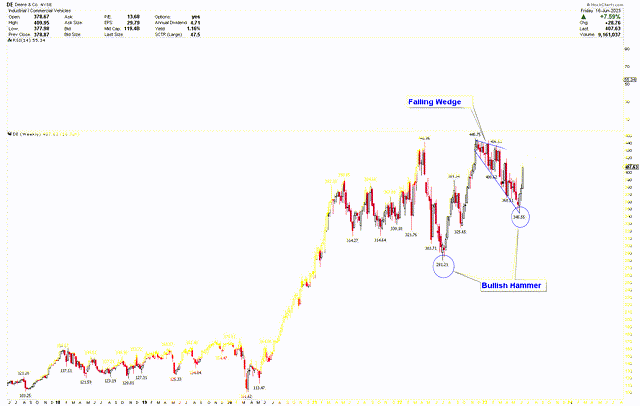

Additionally, the weekly chart showcases bullish hammers at the lows of $281.21 and $345.55, which historically precede price rallies. While Deere's stock price has already seen an upward trend, the emergence of a bullish falling wedge pattern signifies the likelihood of continued price increase and an upward market trend, thereby strengthening the bullish outlook for Deere's stock prices.

Deere Weekly Chart (stockcharts.com)

Key Actions for Investors

The above analysis confirms that Deere maintains a strong bullish trend. Price consolidation within a broad range further underscores the bullish outlook over the long term. The significant price surge post the formation of a bullish hammer suggests ongoing upward momentum. Nevertheless, considering the falling wedge pattern on the daily chart, the price is nearing the resistance level of $420. It is projected that this resistance will be surpassed and the price will continue to climb. Any price correction from this level, however, could present a robust buying opportunity. Investors, thus, may consider buying in anticipation of higher prices or on any correction, or at a breakout above $420.

Deere Daily Chart (stockcharts.com)

Bottom Line

In conclusion, Deere demonstrates a robust bullish potential due to a confluence of factors, including a solid commitment to AI and automation, a steady financial track record, and a strong position in the indispensable agriculture sector. Deere's proven ability to weather economic downturns, like the Great Recession and the COVID-19 pandemic, attests to its resilience and long-term investment potential. As the company continues to forge ahead with tech adoption and value creation, it stands well-positioned to deliver consistent and substantial returns to investors. Moreover, the presence of strong bullish indicators in the market trends, such as a symmetrical broadening wedge, falling wedge, and a double bottom in the RSI, further underlines Deere's potential for sustained upward momentum. A break above $420 will break the falling wedge pattern and initiate a strong rally to the upside. However, any correction in the market is considered a strong buying opportunity for investors.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.