My $10,000 'Importance' Portfolio: The Start Of A New Series

Summary

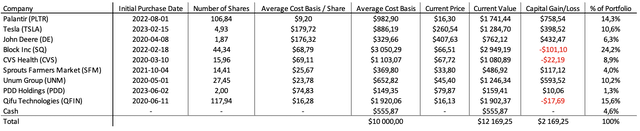

- I introduce a new series following my long-term investment portfolio, which currently consists of nine positions (95.4% stock exposure & 4.6% cash).

- My investment philosophy is centered around buying companies that are important and will continue to be or become even more important going forward.

- Financials are or will be a reflection of the relative importance of a company. A strong growth potential, high returns on capital, and a focus on product development are indicators.

- My $10,000 portfolio includes companies such as Palantir, Tesla, John Deere, and Block Inc., with a strategy of continually trying to lower my cost-basis per share with small continuous purchases.

Ton Photograph/iStock via Getty Images

The Start of A New Series

I have recently surpassed the 150-follower mark. I am incredibly thankful to be able to analyze companies and write about them here on Seeking Alpha. The best thing about this platform is the connection it establishes between us, the investors, which lends room for insights, critique, and learning. So, to further make use of this platform for investor connection and learning I'm going to begin a writing series following my portfolio on a monthly basis.

I am a long-term-oriented investor and I would like to disclaim that I don't trade very often. Currently, my portfolio is made up of 9 positions that I follow continuously. Furthermore, I steadily add to positions as opposed to buying a big chunk at once. Therefore, my goal for this series is to provide valuable monthly updates about how this group of companies is developing and the valuations I am buying them for.

My $10,000 Portfolio Setup

I have replicated my portfolio so that it has an original input value of $10,000. This makes the portfolio anonymous, general, and easy to follow and evaluate. This means that the actual number of shares and the value of the portfolio are not representative of my own, but the % of the portfolio are the same as well as the capital gain/loss % and dividend yield. Let's dive into the portfolio right away.

My portfolio consists of 95.4% stock exposure and 4.6% cash. As stated earlier, I continually buy into my existing positions over time. I do this in an attempt to continue lowering my cost basis per share, which has been an especially good strategy for me during the past year. The oldest position in my portfolio is John Deere and the newest is PDD Holdings. Let's look into the capital gain % on each position separately as of June 19, 2023.

| Company | Average Cost Basis / Share | Current Share Price | Percentage Gain/(Loss) |

| Palantir (PLTR) | $9.20 | $16.30 | 77.2% |

| Tesla (TSLA) | $179.72 | $260.54 | 45.0% |

| Deere & Company (DE) | $176.32 | $407.63 | 131.2% |

| Block, Inc. (SQ) | $68.79 | $66.51 | (3.3)% |

| CVS Health (CVS) | $69.11 | $67.72 | (2.0)% |

| Sprouts Farmers Market (SFM) | $25.67 | $33.80 | 31.7% |

| Unum Group (UNM) | $23.78 | $45.40 | 90.9% |

| PDD Holdings (PDD) | $74.83 | $79.87 | 6.7% |

| Qifu Technology (QFIN) | $16.28 | $16.13 | (0.9)% |

By continuously buying into these companies, I have been able to lower my cost basis per share and hence lower my unrealized losses. One example of this is buying SQ for the first time in February of 2022 at a price per share of ~$130. This position is down over -50%, but by amassing shares throughout the year I have also been able to buy more heavily in the $50-$70 range. I have consistently reduced my cost basis per share for PLTR, QFIN, and TSLA as well. With regards to DE, SFM, UNM, PDD, and CVS I have continued to add shares at higher prices than I originally bought for as their stock prices have performed well.

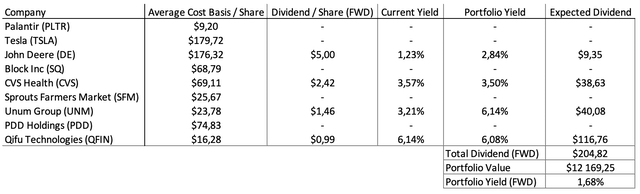

Regarding dividends, it is not a big focus for me. With regards to the companies in my portfolio that do pay dividends, I try to buy them at the best yields which goes hand in hand with trying to push down my cost basis per share in my positions. Below are the FWD dividend per share for my positions, the current dividend yield, the historical portfolio yield (based on my cost basis per share), and the expected dividend I will receive in a full year for each position.

My Investment Philosophy

I believe that the most important principle of investing is to buy companies that are important, will continue being important, or will begin being important. Although this sounds simple, finding companies that truly are important is ultimately subjective. The way I go about deciding whether a company is/will be important or not is by starting with a problem, then evaluating how a company is working toward solving the problem and with what set of technologies.

The next question I ask myself is, will the company continue being important and why? Answering this question involves evaluating management, company incentives/structure (inside ownership or not?), competitive positioning, and the forward-looking demand for the set of products that the company is offering. Forward-looking demand is a measure of how much customers of a product will continue needing/using that product. Furthermore, the best signal that a company is important is that its customers will need the company's products even more going forward. This creates a natural tailwind for the company and can generally be described by industry growth metrics.

Another important principle that I abide by is owning companies over the long term. This means that I like to own companies that have a large market potential going forward. Many investors have said something along the lines of, it's much more fun to own a company that has a small market share that is steadily increasing with time rather than a company with a dominant market share that is declining over time. Companies with the former dynamic have 'long runways' for growth that will only benefit the long-term investor since revenues and profits will increase over time.

To conclude, the level of a given company's importance will, to a large extent, be reflected in the company's financial statements. Companies that already are, and will continue to be, important will have high returns on capital and strong margins since the customer is so in need of the product that they will pay a substantial premium for it compared to its produced cost. Other signs of companies that fall into this category are a management team that prioritizes internal growth opportunities over shareholder distributions (share buybacks & dividends) and companies that have dominant products that continue to be ahead of competition. The category of companies that will become important (or will become even more important) is the most fascinating to me. These companies are usually investing heavily in internal growth opportunities. They focus on product, product, product over everything else. For companies that fall into this category, profits should not be equated to company performance. Rather revenue, market share, product offering, and customer growth are much more important measures. The reason that these companies are interesting from an investment standpoint is that through continuous investment they can drive huge operating leverage over time, meaning that profits can quickly flip from deeply negative to extremely positive. I believe that my portfolio consists of a mixture of important companies and those that will become even more important, all in varying degrees. Since this is my first article in the series, I am going to present the reasoning for why I have invested in the 9 companies I currently own as it relates to my investment philosophy.

Block Inc. (24.2% position; -3.3% unrealized loss)

Block Inc, to me, is an ecosystem company within the commerce and payments industry. This company falls into the category of companies that I believe will become more important over time. Currently, it operates Square, Cash App, Afterpay, TBD, Tidal, C=, Bitkey, and Mining Development Kit (MDK). The first three are the most established businesses. Square has millions of merchants using its products, Cash App has 51 million monthly transacting actives, and Afterpay has 20 million monthly active consumers & 144 thousand merchants (2022). The latter business units are relatively new and experimental. Block Inc currently spends less than 3% of non-GAAP operating expenses on these businesses. However, the results of these investments can be extremely complementary to established businesses, as I mention in my first article about the start-up ecosystem.

The reason Block Inc will become even more important is that the company's goal is to deeply integrate and connect the business they operate. Currently, Cash App & Afterpay are stand-alone apps, integrations with Square are weak, and the new Bitcoin ecosystems are too nascent to integrate within existing offerings. The company is striving to integrate Cash App, Square, and Afterpay so that consumers will

"eventually [see] the merchants around them, mostly Square merchants around them. Ask for permission to show that up and actually show items and items from merchants around you, but also online, which brings in more and more of the Afterpay and the larger retailers."

Jack Dorsey; J.P Morgan Technology, Media, and Communications Conference

Furthermore, the company wants to create

"a new tab that people want to visit every single day because they find something that they want to engage with or they want to purchase... And then you can imagine other models within that, including advertising, where I can pay for placement within that... And you hear this in other folks talking about the everything app and whatnot and the success that China has had in this, that's basically what this is."

I have italicized the part of the last sentence because it communicates the long-term goal of Cash App and the Block ecosystem: to build an everything app. The implications of an everything app are huge. With integrated technologies between consumers and merchants, Block Inc can drive huge value-add on both sides of the ecosystem and generate substantial revenue from its combined businesses. This integration will drive Block Inc's importance up vastly as the company will become a cost-saving, fun, and seamless ecosystem for consumers and a platform to drive sales for merchants.

Qifu Technology (15.6% position; -0.9% unrealized loss)

Qifu is an enabler of high-quality credit growth in China. The company operates a two-sided ecosystem with consumers & SMEs on one side and banks & financial institutions on the other. I classify this company as important, and I believe that it will continue to be important. The reason for my belief is grounded in the thinking that loans are essentially a time machine. Consumers & SMEs are empowered with financing directly, which they can use to consume as well as grow their business which otherwise might have been impossible. Credit essentially spurs growth in societies and in nations, but only when it is placed correctly. Qifu uses AI models, with an extensive amount of inputs to determine the quality of borrowers on its platform. After a quick determination by the model, either Qifu or banks/financial institutions extend credit to these users in exchange for interest. Currently, the average loan tenure on originated loans is between 11-12 months and first-day delinquencies were only around 4.1% in the previous quarter.

Qifu generates revenue from interest on loans they underwrite themselves, platform fees from financial institutions, and referral services. The importance of the company's services is reflected by its 21% ROE, 24% net income margin, 28% return on total capital, and $912 million earned in cash from operations (TTM) (Seeking Alpha). I believe that this company will continue to be important due to the timeless importance of quality credit. Qifu, with powerful technology, can continue improving its models in order to increase the quality as well as breadth of its offering. The company can also increase its marketing presence, as it recently did with Tencent (article 2), both of which will drive growth going forward.

Palantir (14.3% position; +77.2% unrealized gain)

Palantir is an advanced data analytics platform for both government and commercial customers. The company has many different products, all of which have their roots in a military context. The most popular commercial product is Palantir Foundry. On this platform, customers can gather every bit of data from different systems such as Salesforce, SAP, IoT devices, proprietary data within the organization, and more. Foundry easily presents this data as a single source of truth and the data can be used together in order to create AI models that drive efficiency within the business. Palantir has a proven track record of developing new, useful products which leads me to believe that this company will become more and more important going forward.

Palantir recently launched a new product called AIP (Artificial Intelligence Platform), which allows users to type commands into a built-in LLM (large language model) and push those commands through the business. In essence, the LLM allows customers to navigate Palantir's platform, create AI models, and connect disparate data sources with more ease since no coding is required. AIP has received unprecedented demand, according to the company.

The most exciting part about this investment is that commercial companies and governments are seemingly just beginning to understand the potential of data-driven operations. Palantir has the potential to capitalize upon this opportunity since its platform is several years ahead of competitors, according to the company, and it is gaining a stronger brand image over time as the company expands its sales force.

Tesla (10.6% position; +45% unrealized gain)

Tesla has undoubtedly become one of the most important companies in the world. The EV automaker, energy storage & solar producer, largest supercharging network producer, and AI company has recently been dominating the EV and electrical energy supply chain.

In 2022, Tesla was rated the top workplace by engineering students (Teslarati.com). The company promotes creativity within engineering, which is most likely the reason why it can consistently reduce the cost of manufacturing while upholding quality.

"At Tesla, meaningful engineering ideas can come from interns, analysts, or executives. We strive to minimize red tape so our engineers can be creative and solve engineering problems that have never been solved”

Tesla has a ~4% total vehicle market share in the US & Canada, and ~2% in China & Europe. This has grown rapidly from around 0% in 2017-2018 (Q1 2023 Report). While the company's growth may have been unprecedently large, it still has a huge runway to continue growing. Tesla has intentions of releasing a new model that is cheaper, more energy efficient, and has the best FSD (Full self-driving) capabilities. Furthermore, the energy storage business is growing faster than the EV business. Solar power and Tesla batteries are extremely complementary to the EV business because a consumer can optimize his/her energy usage/cost with Tesla hardware and the Tesla app.

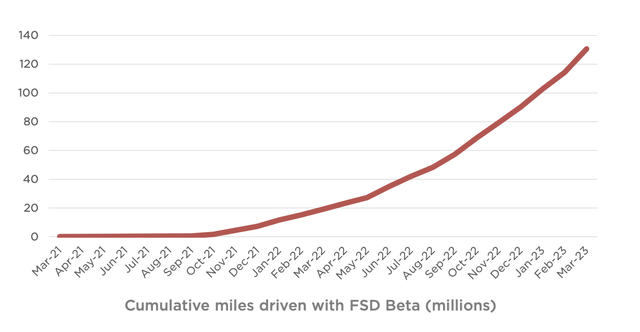

However, the single largest factor that leads me to believe that this company will become even more important is the wide-scale adoption of FSD. Tesla has recently taken large steps forward in its AI-driving capabilities which have driven increased adoption since the end of 2021. Customers can use these capabilities for $200/month which given that adoption increases, will drive immense profit contribution.

Unum Group (10.2% position; +90.9% unrealized gain)

Unum is an international provider of workplace benefits and services such as disability, life, accident, critical illness, dental, vision and stop-loss insurance; leave and absence management support and behavioral health services. In the company's largest market, the US, 54.6% of the population has health insurance through their employer (Statista). I believe Unum is important because health insurance is a necessity for financial security in society. Furthermore, delivering insurance as employee benefit plans promotes employment and makes it easy for consumers to receive insurance plans for themselves and their families.

This company may not be as 'sexy' as the others. I began buying shares in 2020 when depressed due to the company needing to pay high payouts as a result of Covid. Since then, earnings have surprised on the upside as Covid mortality began waning which has been the largest contributor to the company's stock price appreciation. Going forward, I expect Unum to grow earnings steadily, continue repurchasing shares, and increase the dividend payout ratio. Currently, I have a 6.14% historical dividend yield on my average cost basis which I am pleased with. The company has a 14.4% ROE (TTM), a 9.23% return on total capital, and achieved $1.24 billion in cash from operations (TTM) at a market capitalization of $8.95 billion (Seeking Alpha).

CVS (8.9% position; -2.0% unrealized loss)

- CVS: A High Cash Flow Yield, But A Low Return On Capital

- Walgreens Is Fundamentally Weak, While CVS Remains Strong

CVS Health is a healthcare giant. What initially convinced me to buy into this company was its incredible cash flow generation. The company accumulated over $80 billion in debt following its acquisition of the healthcare insurer Aetna in 2018 but has managed to pay it down to around $50 billion. With that said, the level of importance of CVS has recently been a question I have been asking myself. As I describe in my first article, the company has several business units. It is a pharmacy retail chain, pharmacy benefits manager (PBM), health insurer, and most recently with the acquisitions of Oak Street Health and Signify Health, a primary care provider. The company plays an important and integrated part in the health care system in the US, but the health care system is considered by many as inefficient, cumbersome, and expensive. Furthermore, regulatory bodies such as the Federal Trade Commission ("FTC") are looking into PBMs as well as group purchasing organizations ("GPO") to determine whether their pricing strategies are fair (Seeking Alpha News). There has been further scrutiny from investors and politicians regarding the rising costs of Medicare and Medicaid in America, amidst the debt-ceiling debates. Aetna, Oak Street Health, and Signify Health all rely on Medicare and Medicaid revenues, which on one hand are forecasted to grow by ~5.2% annually, but on the other hand, are subject to regulatory overhaul.

Since I do not see how CVS currently fits into my long-term importance scale, I am looking to downsize or sell off completely this position once/if the stock price recovers. Currently, the company is selling for an extremely low cash flow yield, which leads me to believe that the stock has room for a recovery backed by strong fundamentals.

John Deere (6.4% position; 131.2% unrealized gain)

This is the old-fashioned tractor brand that isn't so old-fashioned anymore. John Deere initiated its LEAPS strategy in 2020, and I outline in my article how this strategy will drive subscription growth for AI-enabled products that allow farmers to become more productive. This includes See & Spray which is used to optimize fertilizer and pesticide usage, ExactShot which is used for planting seeds and utilizing fertilizer with precision, and the long-awaited autonomous driving functionality for large ag tractors.

John Deere is undoubtedly an important company which is reflected in its strong financials. In this up-cycle, ROE was 43% (TTM), net income margin was 15% (TTM), return on total capital was 10.4% (TTM), and cash from operations was $6.31 billion (TTM) (Seeking Alpha). As an important and financially successful company, it is important that Deere is investing in itself firsthand and returning capital to shareholders secondarily. The company has an incredibly large R&D unit that is focused on delivering AI-integrated products. 41% of operating expenditure was designated to R&D in 2022 and made up 3.6% of revenue. Although the latter number is not as large as R&D expenditures at companies such as Block Inc (13.1%), Deere is a much older company.

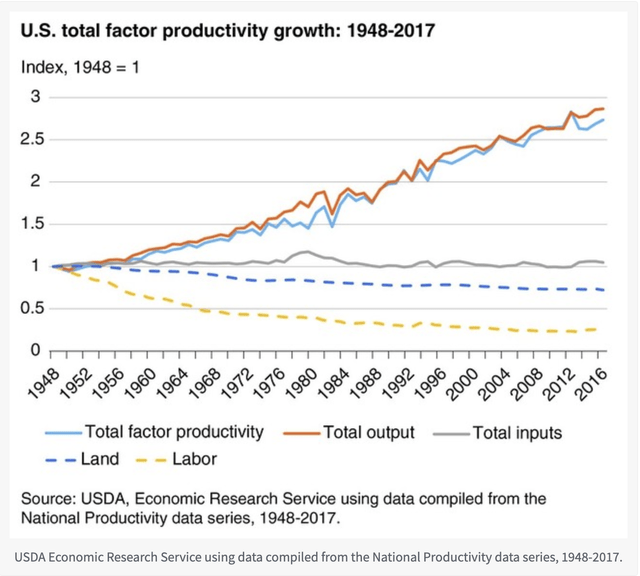

Reinvestment by Deere into the future of farming is what will keep the company relevant and important for farmers and consumers going forward. Farmers around the world have had an incredible couple of years based on farm income which I mentioned in my article, but farmers are heavily reliant on government subsidies to operate their businesses. Not only is Deere enabling cost reductions by lowering input costs, but it is also enabling farmers to be more productive through autonomous tractor usage. The past 70 years have been characterized by decreasing labor costs (due to the tractor & more), as well as decreased land usage (due to higher-yielding strains, GMO, and chemical equipment). Over the next few decades, productivity growth will most likely be aided by continued decreases in labor costs and a new decrease in input costs. John Deere is at the forefront of the new technologies that will enable this.

Sprouts Farmers Market (4.0% position; +31.7% unrealized gain)

Sprouts is an Arizona-based grocery store with strong values for health, nutrition, and local production. Some inspiring statistics from Sprouts are that 87% of food waste is saved and donated, 26% of sales are from organic products, 250 local growers provide fresh and seasonal produce, and 100% of Sprout's own Chicken brands are raised without antibiotics (Investor Deck, May). I consider this nutritional grocery chain to be important due to the well-known poor average American diet and the immense health problems that it brings with it.

Sprout's importance is, similar to Deere, reflected in the company's financials. According to the investor deck, the company has a gross margin of 37.5%, a return on invested capital of 12.7%, and it has reduced the number of shares outstanding by 39% since 2015, or ~4.8% per year. Furthermore, store unit economics are incredible:

- $3.8M average new store build including CapEx, Inventory, and Pre-opening expenses.

- The average store opens at $13M in year 1. Annual sales grow from 20% to 25% over next the next 4 years.

- Breakeven EBITDA within 1 year.

I believe Sprouts will become even more of a household name in the future. The company currently has ~390 stores in the US and is planning on increasing store count by +10% annually after 2023. In my article, I used the company's projections to calculate the implications of this store growth goal. In short, Sprouts has a ~4-6x upside over the next ten years with very low downside risk; in fact, even if the company doesn't meet its targets and its P/E ratio declines to 10, it still has a 2.56x upside over the same period.

PDD Holdings (1.3% position; +6.7% unrealized gain)

This is a very new position for me, which is why I am starting off small. PDD is an incredibly innovative e-commerce company that utilizes a group-buying model in order to help merchants sell in large quantities while giving consumers lower prices. This company is important because it collects value by simplifying a complex supply chain. In the PDD supply chain/platform, there are only three actors: the merchant (seller), a 3rd party logistics provider, and the consumer. Since PDD creates so much value for consumers, I believe it will continue to be important going forward.

The company recently drove incredible operating leverage as it became profitable in 2021 with $4.5 billion in net income and $7 billion in operating cash flow (2022). As opposed to retailers such as Alibaba (BABA) & JD.com (JD) with 33% and 14.8% gross margins respectively, Pinduoduo has a high gross margin of 70.4%. The reason for this is that PDD hardly carries any inventory themselves. The supply chain is completely up to PDD merchants to solve, while other Chinese online retailers usually buy in bulk and re-sell on their platforms. Although PDD doesn't have the same scale as its peers yet, growth will be supported by China's e-commerce trends and global expansion.

In my article, I researched the internal culture at PDD. It is extremely competitive! The company sets up teams to strive after the same goals and then rates the results of each against each other. Furthermore, the most successful are promoted into the PDD Partnership program which incentivizes employees to work very hard. I believe that the internal culture will serve the company well because it is focused on continually driving cost reductions for the consumers on its platform, which is PDD's ultimate competitive edge.

Cash (4.6% position)

I am currently holding a little bit of cash. I am always trying to hold several percentage points of cash so that I can deploy it when the stocks in my portfolio dip. Over the next coming months, I expect my cash position to further increase if I sell my position in CVS. I plan to use this extra cash to continue investing in the companies I believe are most important and selling for the largest bargain.

Conclusion

Thank you for reading the start of my new series which is aimed toward following my $10,000 portfolio. My goal is to provide monthly updates on how the portfolio has developed and how the portfolio companies are performing. Reach out to me if you have any questions, comments, recommendations, thoughts, or interesting discussion points!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ, PLTR, QFIN, DE, CVS, PDD, SFM, TSLA, UNM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.