HDFC Bank has the highest number of outstanding cards at 1.78 crore.

According to Reserve Bank of India (RBI) data, in April 2023, over 8.6 crore credit cards were outstanding. This is a growth of about 15 percent from the 7.5 crore outstanding credit cards in April 2022. Industry insiders say this number could touch the 10-crore mark by the turn of the calendar year.

Factors leading to growth of credit card usage

Credit-confident Indians are flipping out their credit cards for big-ticket purchases, encouraged by reward points, cashback, no-cost equated monthly instalments (EMIs), and premium lifestyle rewards. This is reflected in the steady growth of the average transaction.

According to the RBI data, in April 2023, the industry average was Rs 5,120 per transaction. The industry average monthly spend per card was Rs 15,388. In April 2022, the industry average spend per card was Rs 14,070, and the average transaction was Rs 4,731. Similarly, the outstanding debt on credit cards grew a whopping 30 percent from Rs 1.54 lakh crore to Rs 2 lakh crore compared to April 2022.

"When it comes to big and mid-sized spends like travel, electronics, dining, or shopping, people prefer to use their credit cards for the rewards it gives them," says Adhil Shetty, Chief Executive Officer (CEO), Bankbazaar.com. He adds that, with RuPay cards, you can even make UPI payments. Credit cards are also the way the young will continue to initiate and strengthen their credit histories. More young Indians will buy their first credit card, and credit-wise Indians will upgrade to premium credit cards.

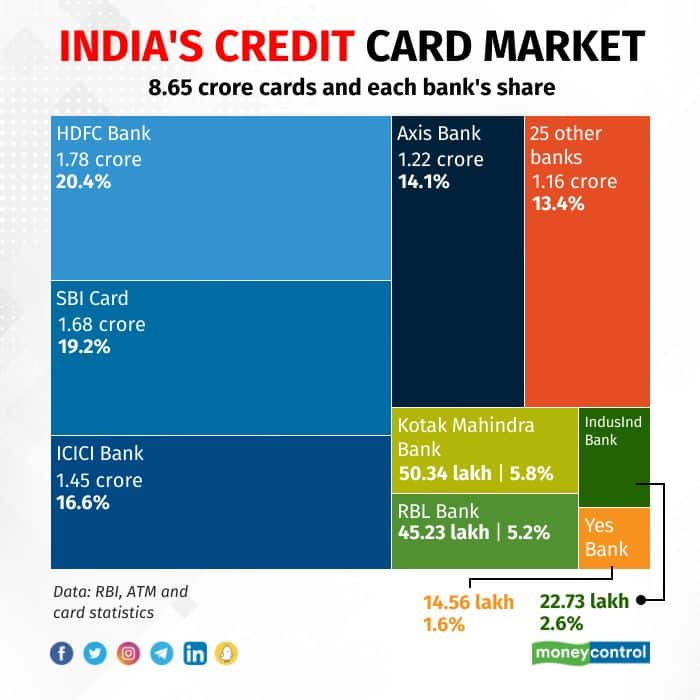

Four banks with 71 percent market share

HDFC Bank has the highest number of outstanding cards at 1.78 crore, followed by SBI, ICICI Bank, and Axis Bank with 1.68 crore, 1.45 crore and 1.22 crore, respectively. These four banks together comprise 71 percent market share in the credit card segment.

One of the major developments in the credit card market has been the acquisition of Citi Bank's retail assets by Axis Bank. Citi's credit cards have therefore moved to Axis, which has seen a huge jump of over 30 lakh in its outstanding cards. Kotak Mahindra Bank, too, has made giant strides.

Bankbazaar, in its India credit card report of June 2023, says that the biggest risers are smaller private banks such as South Indian Bank, which recently ventured into credit cards and is expanding its retail assets rapidly. Among government banks, Bank of Baroda has seen 63 percent growth, while Bank of India, Bank of Maharashtra, and Canara Bank have cut back.

Tips to use your cards smartly

Avoid minimum payments: Pay your card dues in full. Rolling over your dues attracts interest, often at a rate of 40 percent a year.

Never be late: A single late credit card payment can bring your credit score down by 100 points.

Keep your utilisation low: Stay at 30 percent of your spending limit. Go over it when you're confident of full and timely repayment.

Know your terms and conditions: Know the fees, penalties, and terms and conditions of your card. Never be taken by surprise.

Tips to use your cards safely

Protect your details: Safeguard sensitive credit card data such as card number, expiry date, CVV, and passwords.

Secure your card: Keep it physically safe. Never leave it unattended. If your card is lost, report it to the issuer as soon as possible.

Monitor your statements: Regularly review your credit card statements for any unauthorised transactions.

Beware of phishing: Beware of suspicious emails or calls asking for sensitive financial information.