Stocks

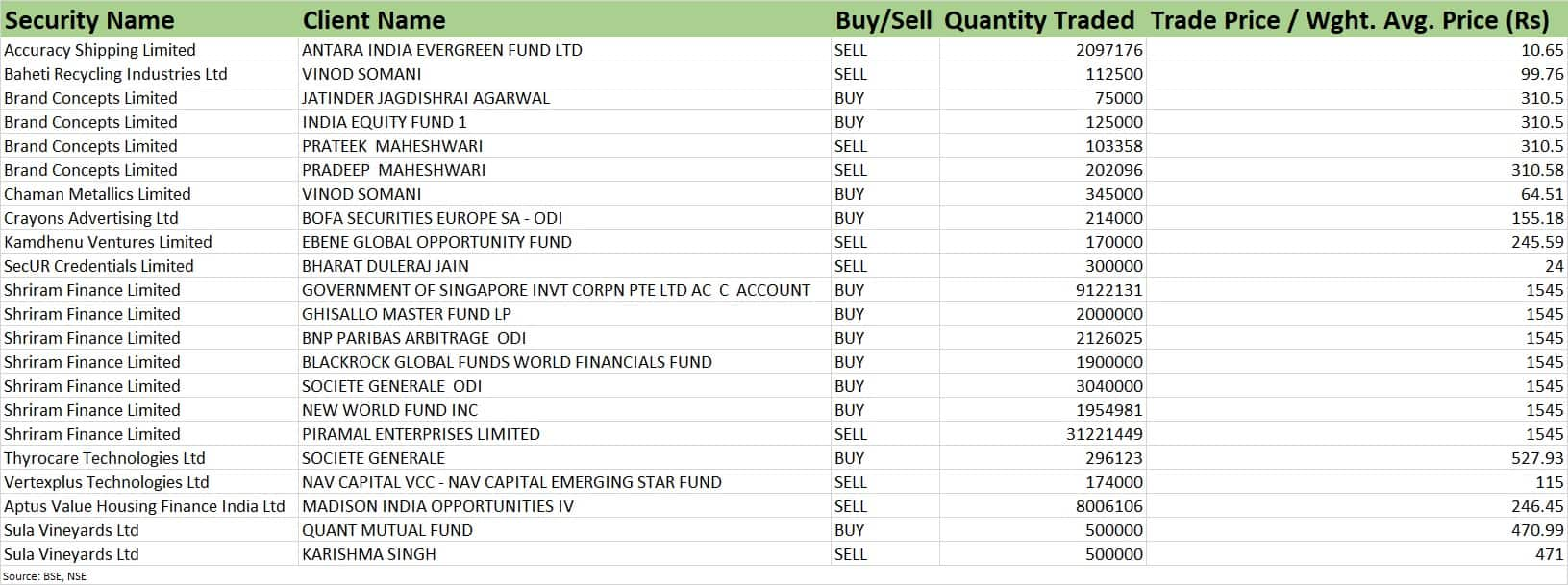

A total of six investors, including Ghisallo Master Fund LP, Blackrock Global Funds, Societe Generale and New World Fund Inc acquired 2.01 crore equity shares, which is equivalent to 5.38 percent of paid-up equity in Shriram Finance via open market transactions on June 21.

Government of Singapore Investment Corporation Pte Ltd AC C Account has bought over 91.2 lakh shares, Ghisallo Master Fund LP 20 lakh shares and BNP Paribas Arbitrage ODI bought more than 21.26 lakh shares in the non-banking finance company, as per the bulk deals data available on exchanges.

Blackrock Global Funds World Financials Fund has purchased 19 lakh shares in Shriram Finance and Societe Generale ODI bought 30.4 lakh shares, while New World Fund Inc acquired additional x19.54 lakh shares in the company.

The average buying price for all six investors was Rs 1,545 per share and the total transaction was valued at Rs 3,112.11 crore.

As of March 2023, New World Fund Inc already held 50.72 lakh shares or a 1.35 percent stake in Shriram Finance, formerly Shriram Transport Finance Company.

However, Piramal Enterprises was a seller in Shriram Finance, as it exited the company by selling its entire 8.34 percent stake or 3.12 crore shares at the same price. The stake sale was worth Rs 4,823.71 crore.

Despite the big stake sale, Shriram Finance shares reacted positively on June 21, rising 11.2 percent to Rs 1,734.

Among other deals, Madison India Opportunities IV, the private equity fund managed by Madison India Capital Advisors, has sold 80.06 lakh equity shares or 1.6 percent stake in Aptus Value Housing Finance India.

Madison pared stake at an average price of Rs 246.45 per share and the stake sale was worth Rs 197.31 crore. As of March 2023, foreign company Madison held a 1.86 percent stake or 92.6 lakh shares in Aptus.

Click Here To Know Details About All Bulk Deals

Aptus Value Housing Finance shares corrected sharply, falling nearly 9 percent to Rs 242.50.

Sula Vineyards was also in focus as bulk deals showed that 0.6 percent equity exchanged hands during the day. The stock settled with 0.2 percent gains at Rs 469.6.

Quant Mutual Fund has acquired additional 5 lakh shares or 0.59 percent equity stake in the country's largest wine manufacturer at an average price of Rs 470.99 per share. However, Karishma Singh was the seller in a deal, offloading same number of shares at an average price of Rs 471 per share.

Quant Mutual Fund via Quant Quantamental Fund already held 21.03 lakh shares 2.5 percent stake in Sula as of March 2023.

Thyrocare Technologies remained in action for yet another day, rising 3.52 percent to Rs 528.35 on top of a nearly 7 percent rally in the previous session.

Europe-based financial services group Societe Generale on June 21 bought 2.96 lakh shares or 0.56 percent equity stake in the diagnostic and preventive care laboratories chain at an average price of Rs 527.93 per share.

In the previous session, ICICI Prudential Mutual Fund bought 22.53 lakh equity shares or a 4.25 percent stake in Thyrocare, whereas foreign portfolio investor Arisaig Asia Consumer Fund sold 26.72 lakh equity shares or a 5.05 percent stake in the diagnostic firm.

Kamdhenu Ventures shares fell over a percent to Rs 245. Foreign portfolio investor Ebene Global Opportunity Fund has sold 1.7 lakh equity shares or 0.54 percent stake in the paint manufacturer at an average price of Rs 245.59 per share.

As of March 2023, Ebene Global held 15 lakh shares or 4.77 percent stake in the Kamdhenu group company.