Kamada: Deep Dive Following FIMI Placement, Rate Buy

Summary

- Kamada Ltd. has potential catalysts for growth, capital attraction and regulatory tailwinds.

- The company's valuation appears attractive, with forward estimates suggesting a possible re-rating.

- Key risks center around the investment in 2x new manufacturing facilities in its Israeli footprint.

- Net-net, rate buy, price targets to $8.50 then $13.50.

Michael M. Santiago

Investment Summary

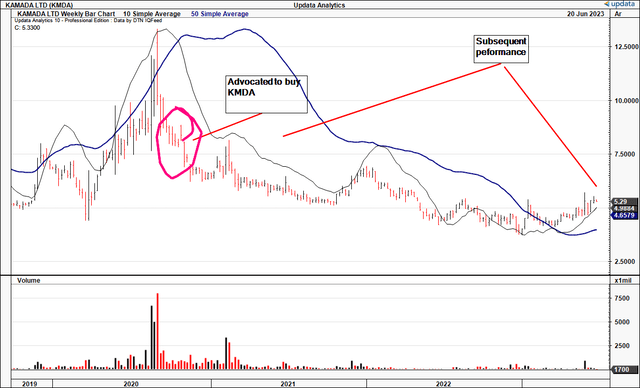

In late 2020 I advocated buying KMDA Ltd. (NASDAQ:KMDA) with a c.30% return objective in mind. Key factors underneath the thesis were 1) bottom of momentum, 2) Glassia deal with Takeda Pharmaceuticals (TAK), and 2) attractive entry prices.

These 3 catalysts weren't enough to see KMDA catch a strong bid throughout the 2020–'21 bull market– one for the ages mind you. Shares are down ~27% since that point in 2020, and down 50% over the last 10-years.

I was recently informed that major institutional investor FIMI Opportunity Funds was to buy $60mm worth of KMDA's ordinary shares in a private placement, taking up quite the stake in the company. Immediately, the investment cortex fired up. "What could I be missing?", I thought.

That led me to completing the following deep dive into KMDA's equity value. It is presented below. It involves an honest appraisal of the company's cash flows, the asset factors tied up in the company, and what valuation[s] we're looking at. Net-net, I believe there are multiple catalysts that could lead to a long-term price change of $8.60 then $13.50, supporting a buy rating.

Figure 1. KMDA long-term price evolution

Data: Updata

KMDA Deep Dive: Critical Facts

Looking to the investment findings, there is a great deal of data to unpack. It relates to a spectrum of factors that could impact KMDA's market valuation going forward.

FIMI Placement

I would certainly suggest that a key banner in the KMDA investment debate is the securities purchase agreement with FIMI Opportunity Funds. This is no small feat – FIMI is a leading private equity firm, with 25 years in the game from its Israeli hub post. As to the details:

- FIMI purchased $60mm of KMDA's ordinary shares in a private placement under the agreement. This transaction is expected to result in FIMI owning approximately 38% of KMDA's outstanding common shares, making it a controlling shareholder.

- The strategic investment from FIMI provides KMDA with the capital backing to accelerate the growth of its existing business whilst committing capital to additional growth projects in my view. This partnership strengthened its liquidity position as well– FIMI can now act as KMDA's 'banker' in a way.

Second, it is a major vote of confidence on KMDA's outlook. There is no way you'd get a player like FIMI committing to 38% of the equity stock of a company if it didn't "see" something of substance into the future. Either that, or it has big plans in mind for the company, and that leaves multiple options on the table. It does suggest the good part of growth may be ahead of KMDA, not behind it.

Gross margins & asset utilization

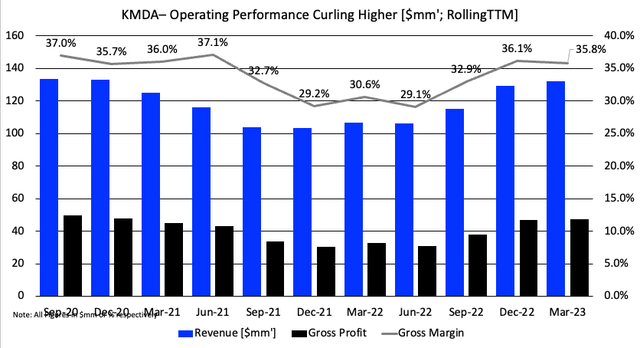

KMDA booked Q1 sales of $30.7mm, a YoY growth of 9% on core EBITDA of $3.8mm up 16%. It pulled this to $11.8mm in gross (flat on last year), with flat operating income of $0.3mm for the quarter. These numbers are about flat on FY'20 using a TTM analysis. You can see the cycle in turnover from the company over this roughly 3-year period. Gross margin has clipped back to ~36%, and could definitely use some improvement in my view.

Figure 2.

Data: Author, KMDA 10-K's

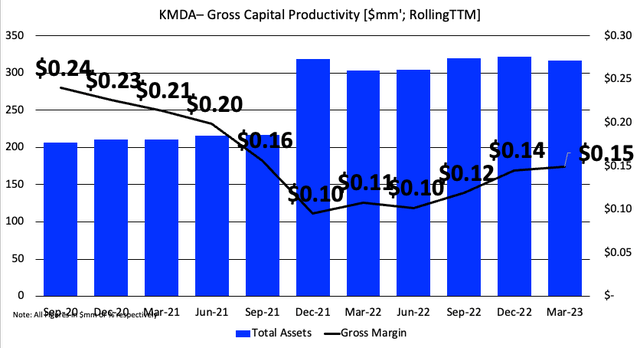

Scaling this against the firm's operating assets tells a different story. The gross return produced from its operating capital has slipped from an already tight $0.24 to $0.15. That's every $1 in assets recycling back to 24 cents– not really the ideal situation in my view. It is curious as to what FIMI might think of these points. However, there may be capacity for the company to push these factors far higher given the points discussed below.

Figure 3. NOTE: Numbers are shown in large for display effect.

Data: Author, KMDA 10-K's

Regulatory momentum

Another significant development for KMDA is the recent FDA approval for manufacturing CYTOGAM at its Beit Kama, Israel facility. As mentioned earlier, this may have a positive impact on gross profitability.

As a result of the approval, the technology transfer process for CYTOGAM from the previous manufacturer, CSL Behring, is now complete. KMDA has since initiated commercial manufacturing at the Israeli facility. My intuition, although not quantified, is that these efforts could increase both margins and asset utilization for the company. CYTOGAM, one of the four immune globulin products acquired by KMDA in November 2021, generated approximately $23mm or just 17% in sales in FY'22, with gross margins exceeding 50%, compared to the company's overall gross margin of 36% in 2022. Hence, scale in this segment is sure to be a meaningful tailwind to gross margin in my view. On my calculus, a shift to 25% of the product mix to CYTOGAM could add $20.4mm in gross profit to $67mm, based on the company's FY'22 revenue of $129mm.

KMDA's investment in international markets has also yielded promising results. Swissmedic, the Swiss regulatory authority, recently granted marketing authorization for GLASSIA, the asset I was originally bullish on in 2020. As a potential secondary bullish factor, I would estimate this approval enables KMDA to commercialize GLASSIA in Switzerland, providing a high probability access to the European market. Moreover, the company has made significant progress in its regulatory submissions for GLASSIA in other European countries and expects additional approvals in the coming months. Should these come through, you're looking at:

- Multiple approvals in several jurisdictions for GLASSIA (Switzerland, multiple European zones);

- A lengthier tail of asset returns on GLASSIA to drive income down KMDA's bottom-line.

In FY'22, the company started booking royalty revenue from KMDA– exactly my original investment thesis. It clipped $12.1mm in royalty income, and expects $10–$20mm in annual royalty income from TAK through to 2040.

Perhaps this is one major reason underpinning FIMI's decision.

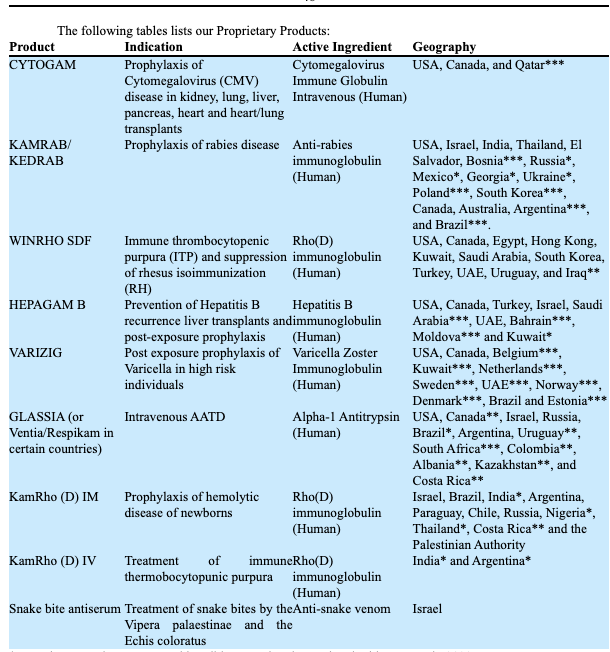

KMDA's full product line is observed below:

Table 1.

Data: KMDA 10-K FY'22

Guidance & Capital investments

- Guidance

- Of course, yesterday's results don't dictate tomorrow's returns. I noted that KMDA reaffirmed FY'23 revenue guidance of $138mm–$146mm on EBITDA of $22mm–$26mm.

- You're looking at 35% YoY growth in profitability compared to FY'22. Furthermore, KMDA's positive outlook extends beyond 2023, as the company anticipates achieving annual double-digit revenue and profitability growth in the foreseeable future with the royalty income folded in.

- Investments for future growth

Looking ahead, I would submit that one of the critical investments for KMDA is the completion of its new manufacturing facility in Rehovot, Israel. The 5,000 sqm facility will significantly expand KMDA's production capacity in my view. This is absolutely essential for it to hit critical mass. Especially given the points on gross margin raised above– my assumptions imply that every 1% increase in higher margin products (CYTOGAM, for example) could generate up to >50% higher gross profit. The capital investment to bring the facility online is ~$45mm, and is expected to go live in H2 this year.

Valuation factors

KMDA is trading at a premium to peers at 23x forward EBITDA, 37% premium to the sector. However, I believe it's best to look more pragmatically. The company has created $0.4 in market value for the investments it has made (price to book of 1.4x). It has grown its book value per share at an incremental 54% since 2013, and 38.7% since 2018 (10 and 5-year incremental gains, respectively). Meanwhile, the benchmark indices have rallied well beyond this.

Forward valuations are attractive in my opinion– at 23x management's FY'23 EBITDA estimates you get to $13.60/share in equity value (23x$26/44 = $13.60). That suggests a huge re-rating, and therefore could be undiscovered by the market in my opinion. This FIMI investment may be causing investors to place a large premium on the company's forward pre-tax earnings. This supports a buy rating.

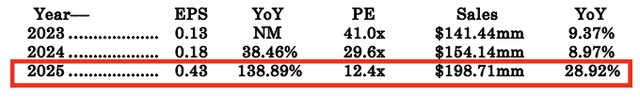

The other thing to factor is the estimates out to FY'25 on the company's earnings. FY'25 earnings are tipped to grow 139% YoY to $0.43. Investors are paying 41x forward to gain access to this. Even at the sector multiple of 20x, you're getting to $8.60/share in intrinsic value on this.

Table 2. KMDA forward estimates

Data: Seeking Alpha

Discussion of investment findings

This deep dive covered a broad spectrum of KMDA's prospects going forward. What is telling, is there are several catalysts that I believe the market has yet to fully identify, or fully appreciate just yet. I will be clear, I don't think the market is wrong, just late. Chief among the reasoning is the FIMI placement. This tells me something is constructive for KMDA amongst that investment house.

It also looks forward to $20–$40mm in royalty revenue from TAK each year into 2040, and could expand GLASSIA into Europe, thereby potentially increasing royalty revenue further.

KMDA is also investing heavily in two of its Israeli manufacturing sites to increase capacity, improve efficiency and increase capital productivity. Management expect 35% YoY growth in core EBITDA this year as evidence of the growth prospects on show here.

In that vein, it is my recommendation that KMDA is a buy on the catalysts discussed here. I would be looking towards two targets of $8.60 and then $13.60. This supports a buy rating. Net-net, rate buy.

Key risks to investment thesis

There are several risks that investors must realise before proceeding into any investment decision on KMDA. These include:

- The fact that the identified catalysts may not come to fruition, just as they didn't in my last KMDA buy rating in 2020.

- Small-cap equities are intensely more volatile than firms of a larger market size. Volatility can be an issue, and not relate to any fundamental reasons. Investors should keep this in mind.

- The firm has thin quarterly growth in operating profit as a historical trend, and even though this is projected to change, would be a risk to the investor if it persisted. It would clamp earnings growth substantially.

- Cost blowouts in the company's manufacturing facility investments, reducing the viable return on those capital investments, and therefore the company's intrinsic valuation.

Investors MUST recognize these risks in full.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KMDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.