SPY: Protect Against Surprises During The Bear To Bull Market Transition With This Strategy

Summary

- The bull market appears to be back with low volatility, the Fed pausing rate hikes, and AI outperforming the market.

- However, concerns remain, such as potential supply chain disruptions, inflation, and depleted pandemic savings.

- A long-dated strangle on SPY can be a good hedge against a volatility spike, while also keeping with the bull market trend.

sutthirat sutthisumdang

The bull market is back! Rejoicing in the streets! The bears have been sent to hibernate, and it’s time to chase new all-time highs! But is it as simple as an S&P 500 (NYSEARCA:SPY) price close 20% higher than the lows? While there is no strict definition on a new bull market, I do like Reuters take on the bull market or as they phrase it “Behold Wall Street's new bull market, maybe”. One key quote that stuck out to me was from Sam Stovall, chief investment strategist at CFRA in New York, when asked about bear market criteria:

In 2008, the S&P hit its low on Nov 20, we then advanced by more than 20% into early January only to turnaround and set an even lower low, by March 9, said Stovall. I just think it was a blip within a longer-term bear market.

The market seems to be firmly entrenched in the bull market belief, with volatility hitting multi-year lows. The VIX 18 level and 15 level have both been breached, which is historically a bullish sign.

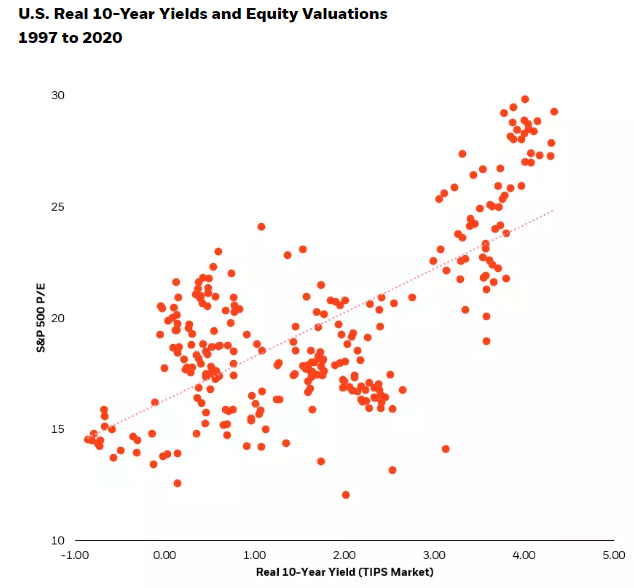

And while there has been much talk about the fed and interest rates negatively impacting equity prices, the S&P 500 typically rises in valuation as interest rates rise.

Blackrock (from Bloomberg)

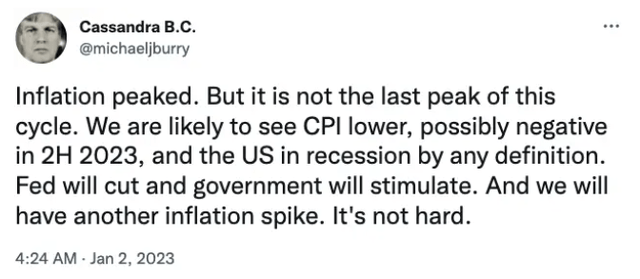

This is a very interesting crossroad on whether to be bullish or bearish. There are multiple bullish signs with low volatility, the fed pausing rate hikes for a session, and AI crushing the market lately. However, I was thinking of an article I read earlier this year where Michael Burry from The Big Short predicted inflation has not hit its last peak and that the second half of 2023 will enter a recessionary period.

Besides the regional bank crisis in March, markets have been on a tear since Mr. Burry’s prediction, but I have a hard time believing we are fully out of the woods when it comes to volatility and market declines. Especially with other worrying signs such as the UPS workers voting to strike, since we have all seen what supply chain disruptions can do to spike inflation. And speaking of inflation…the savings rates of Americans has continued to decline from 30% during the pandemic to 4.6% in February. With pandemic savings depleted and personal consumption expenditures returning to an all-time high of ~68% of GDP, there is a chance this rally could be running out of steam.

With low volatility and bull market FOMO, I have decided to play both ways in the market with a long-dated strangle. For those unfamiliar with options, the quick definition of a strangle (and link to Investopedia):

Investopedia

Strangles are typically my least favorite options play. They are relatively expensive to execute, have double theta exposure with two long options and no offsetting short positions, and require large moves in the underlying to reach profitability. But the current low volatility conditions make a strangle on SPY a good hedge against a volatility spike while also keeping with the bull market trend.

Now it’s time to find our strike prices and expiration date. I want to find the balance between close enough to current price levels to be achievable, but far enough out to keep premiums down. I’m also targeting a September expiration to keep theta down for now and leave enough spacing after the next Fed meeting in July, since that is a key event that could trigger profit taking if volatility does increase leading into it as it often historically does.

Trade Idea:

SPY Strangle

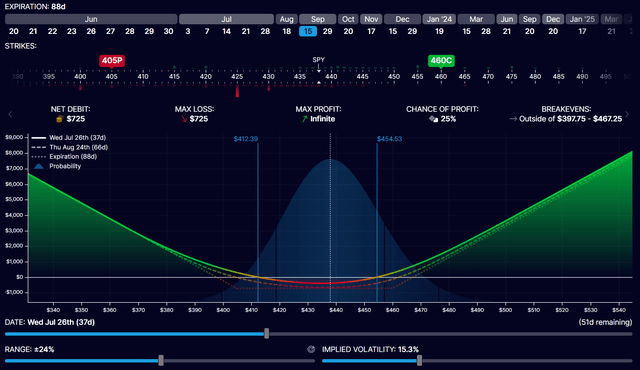

Buy to Open $405 PUT 9/15/2023 Expiration

Buy to Open $460 CALL 9/15/2023 Expiration

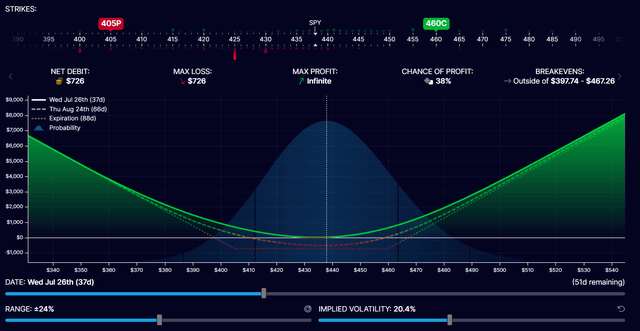

A $405 put and $460 call gives a +5% to call strike and -6.5% to put strike, and aligns with historical support and resistance levels. I like to keep the upside target slightly closer to current price action since rising prices typically suppress volatility and declining prices increase volatility, and the current Vega (measurement of the increase or decrease in options premium based on 1% change in implied volatility) currently sits at $121. This also allows for an easier profit on a short term move up (for example, all other factors remaining the same, a ~2% increase in share price by the end of June would lead to a ~10% profit). Here is a visualization using the next Fed meeting as the example date:

Not a favorable outlook with current volatility conditions with a huge drawdown area (~33% of premium value at the peak) thanks to theta decay, but if we adjust our volatility to be more in line with levels seen over the last 2 years, the vega effect will lift the prices to where the entire range is profitable.

An options strangle is not for everyone as there is a risk of losing your entire investment. It can be a dynamic piece of a well-diversified portfolio though and provide a volatility hedge with its positive vega value. The markets are at a very interesting crossroads. Volatility continues to get crushed while the AI rally takes out new all-time highs for many tech tickers, but between the banking crisis and the pressure on consumers’ wallets from inflation combined with consumer spending approaching an all-time high as a percent of GDP, there are many stumbling blocks that could quickly turn investors from greedy to fearful. And where there is fear, there is volatility.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.