AI Hype And Sugar Prices: Assessing Coca-Cola's Investment Potential

Summary

- Coca-Cola is a consumer-sector defensive stock, increasing dividend payments yearly and attracting thousands of long-term investors, including Warren Buffett's Berkshire Hathaway.

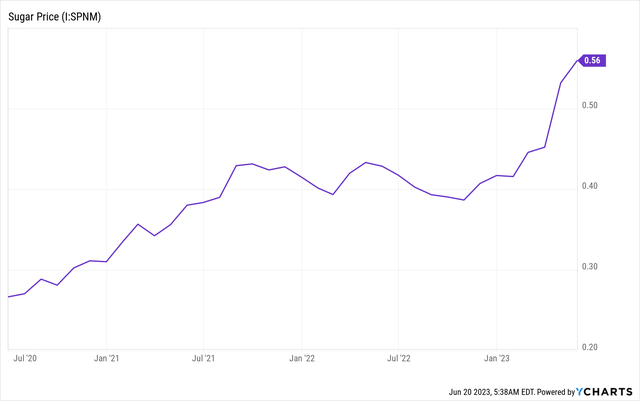

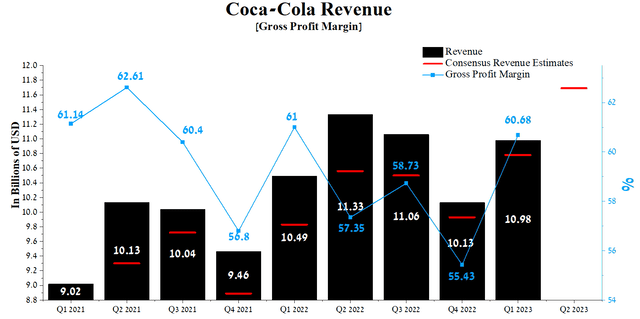

- Coca-Cola's gross margin was 60.68% in Q1 2023, up significantly from the previous three quarters despite the continued high price of sugar, one of the company's key ingredients.

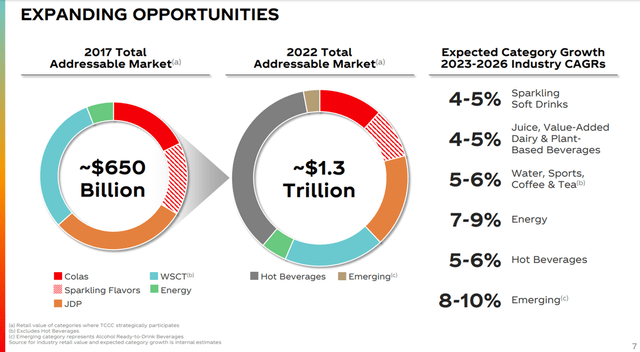

- Overall, the company is targeting the addressable market, which continues to grow at $1.3 trillion in 2022, an increase of $650 billion from 2017.

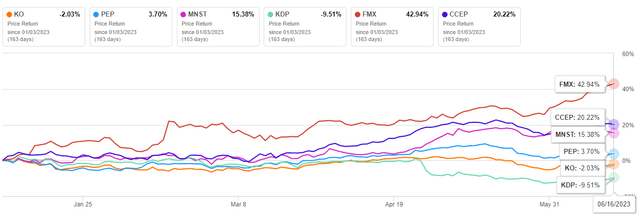

- Despite strong financial performance, the company's share price has declined by 2% since January 1, 2023.

- The article initiates coverage of Coca-Cola with a "hold" rating for the next 12 months.

Jose Luis Pelaez Inc/DigitalVision via Getty Images

The Coca-Cola Company (NYSE:KO) is one of the largest multinational beverage corporations with a portfolio of well-known soft drink brands such as Coca-Cola, Sprite, Coca-Cola Zero Sugar, Fanta, and more.

Despite the market euphoria over AI hype, Coca-Cola is one of the defensive consumer-sector companies whose share price is more stable relative to the tech giants during macroeconomic and geopolitical tensions. Moreover, we believe that increasing dividend payments from year to year can become one of the investment theses that will attract long-term investors. Thus, Warren Buffett's Berkshire Hathaway is its largest shareholder, adding confidence in the company's bright future, despite the sharp increase in sugar prices and the strengthening of the dollar against foreign currency exchange rates.

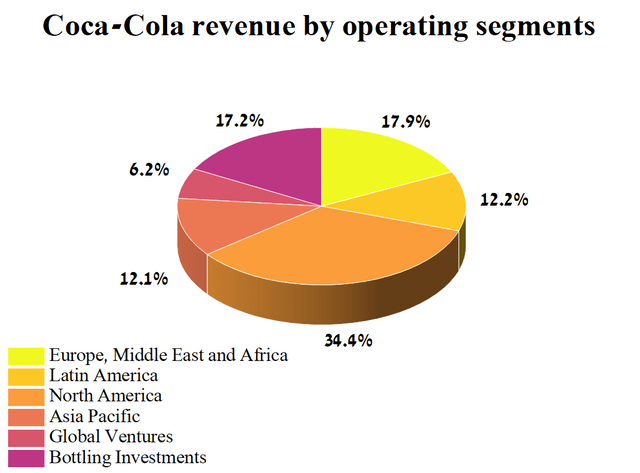

At the same time, North America remains the main region, bringing in about 34.4% of Coca-Cola's total revenue in Q1 2023.

Author's elaboration, based on 10-Q

On April 24, 2023, Coca-Cola released financial results for the first three months of 2023, which not only continued to beat analysts' expectations but were also able to bolster confidence in the company's non-cyclical demand for beverages. Moreover, the slow economic recovery in China and Europe has little effect on the demand for Coca-Cola products from millions of consumers who continue to buy their favorite soft drinks with great desire. But even so, since January 1, 2023, Coca-Cola's share price has shown a decline of about 2%, which is significantly worse than that of such major competitors in the consumer staples sector as PepsiCo (PEP), Fomento Económico Mexicano (FMX) and Monster Beverage (MNST).

Author's elaboration, based on Seeking Alpha

We initiate our coverage of Coca-Cola with a "hold" rating for the next 12 months.

Coca-Cola's Financial Position

Coca-Cola's revenue for the first three months of 2023 was $10.98 billion, up 8.4% from the previous quarter and 4.7% from the first quarter of 2022. However, Coca-Cola's actual revenue has beaten analyst consensus estimates in every quarter since the first quarter of 2021, reflecting Wall Street's conservative estimate of one of the largest multinational beverage corporations in the world.

Author's elaboration, based on Seeking Alpha

The growth of the company's revenue was mainly due to an increase in the price and range of its products, and at the same time, the suspension of the company's activities in Russia due to its invasion of Ukraine had a minor effect on the company's financial position. Thus, sales in the Europe, Middle East, and Africa operating segment, which is one of the main segments of the company's structure, amounted to about $2.02 billion, an increase of 10.4% compared to the first quarter of 2022, thanks to various pricing initiatives taken, primarily due to significant growth inflation in Turkey and some of the countries of the European Union. Moreover, revenue growth in the company's key operating segments was driven by the continued recovery in consumer activity following the end of the COVID-19 pandemic.

In addition to the increase in prices for the company's products, the trend towards an increase in the unit case volume continues, which is one of the important indicators demonstrating the demand for Coca-Cola products from consumers. Thus, unit case volumes in Latin America and Asia-Pacific grew by 5% and 10%, respectively, due to higher sales of coffee, water, dairy products, juices, and more.

We believe that, despite the increase in prices, the growth in demand for Coca-Cola products indicates the willingness of consumers to pay more for their preferred beverages, and at the same time, the positive trend will continue in the long term.

Coca-Cola's revenue for Q2 2023 is expected to be $11.5-12.07 billion, up 8.4% from analysts' expectations for Q1 2023. In addition to the growth in the price of the company's drinks and the geographical expansion of their representation, this increase will be provided by the favorable impact of various partnerships.

So, on January 6, 2022, Coca-Cola entered into agreements with Constellation Brands, one of the leaders in producing alcoholic beverages, to launch alcoholic cocktails. The company estimates that this nearly $8 billion segment continues to grow at double-digit percentages and could not only diversify Coca-Cola's product portfolio but also positively impact its revenue.

Moreover, Coca-Cola has completed the acquisition of BODYARMOR, a company focused on sports drinks and hydration beverages, which has significant commercial potential due to the growing trend of people taking care of their fitness levels and physical well-being after the end of COVID-19.

Overall, the company is targeting the addressable market, which continues to grow at $1.3 trillion in 2022, an increase of $650 billion from 2017.

Investor Overview - Updated for First Quarter 2023

Coca-Cola's gross margin was 60.68% in Q1 2023, up significantly from the previous three quarters despite the continued high price of sugar, one of the company's key ingredients.

Moreover, this financial indicator is not only higher than that of the consumer staples sector but also that of its main competitors, such as PepsiCo, Monster Beverage Corporation, and Keurig Dr Pepper (KDP). Overall, we forecast that Coca-Cola's gross margin will reach 62% by 2023 and rise slightly to 63.4% by 2024, driven by higher prices for the company's beverages, lower raw material costs, and an expanded product range.

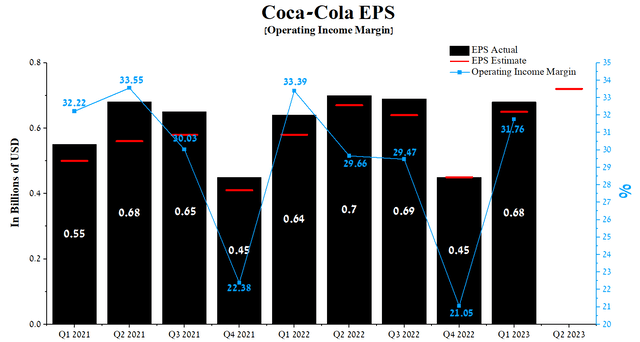

Coca-Cola's Q1 2023 operating income margin was 31.76%, up significantly quarter-on-quarter and above its median of 29.28% between January 1, 2021, and the end of March 2023. The increase in the company's margin was provided by the growth in product prices, despite the negative impact of increased operating costs and strengthening the dollar against foreign currency exchange rates such as the Argentine peso, Turkish lira, euro, and Japanese yen. The company's earnings per share for the first three months of 2023 was $0.68, up 51.1% quarter-on-quarter, and last but not least, it continued to beat analyst consensus estimates in recent quarters.

Moreover, Coca-Cola's Q2 EPS is expected to be in the $0.68-$0.75 range, up 10.8% from the Q1 2023 consensus estimate. At the same time, Coca-Cola's Non-GAAP P/E [TTM] is 24.47x, which is 30.38% more than the average for the sector and 0.96% less than the average over the past five years. On the other hand, the P/E Non-GAAP [FWD] is 23.67x, which is one of the factors indicating that the company is slightly overvalued in the current cycle of AI hype and increasing geopolitical tensions in Eastern Europe.

Author's elaboration, based on Seeking Alpha

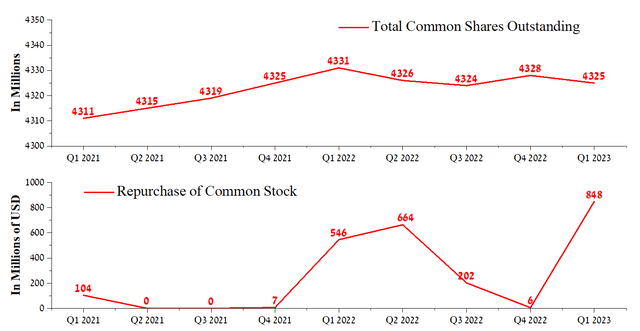

In an effort to keep up the trend of beating analysts' EPS expectations, Coca-Cola's management bought back about $848 million worth of shares, a record high in recent years. At the same time, at the end of the first quarter of 2023, the remaining authorization to repurchase Coca-Cola shares amounted to about 127.33 million shares, which could positively impact stabilizing its price in the event of a deterioration in global economic activity.

Author's elaboration, based on Seeking Alpha

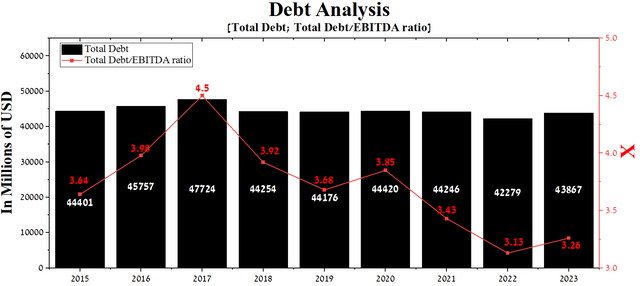

At the end of the March 2023 quarter, Coca-Cola's total debt was about $43.87 billion, down slightly from 2021. Moreover, thanks to the growth of the company's EBITDA in recent quarters, the total debt/EBITDA ratio fell from 3.43x to one of Coca-Cola's record lows of 3.26x.

Author's elaboration, based on Seeking Alpha

While Coca-Cola's total debt/EBITDA ratio is above 3x, we do not expect the company to have difficulty paying off debentures and senior notes maturing between 2024 and 2098 due to continued high cash flow and a diversified business.

Conclusion

Coca-Cola, one of the largest international beverage companies, includes well-known brands of carbonated soft drinks such as Coca-Cola, Sprite, Coca-Cola Zero Sugar, Fanta, and others in its product range. Moreover, the company is a consumer-sector defensive stock that increases its dividend payout yearly, eventually attracting thousands of long-term investors, including Warren Buffett's Berkshire Hathaway, its largest shareholder.

Growth in packaging volumes, Coca-Cola beverage prices, and new product launches not only drive the company's revenue and net income year on year but also signals consumers' willingness to pay more for their favorite sparkling soft drinks, which is among the many factors that have attracted investors to invest in a company and also reinvest their dividends over the decades. However, Coca-Cola's revenue outside of North America is more than 65%, a risk due to the continued strengthening of the US dollar against foreign currency exchange rates. With this in mind and the current AI hype cycle has begun to fade, which will not only lead to a correction in the S&P 500 (SPY) but also lead to a correction in the price of the company's shares to a strong support zone around $56.8-$57.2 in the next three months.

We initiate our coverage of Coca-Cola with a "hold" rating for the next 12 months.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)