The International Monetary Fund is working on a global CBDC platform.

Cryptocurrencies such as Bitcoin may have resulted in windfall gains — and huge losses — for some. But they have also pushed authorities to tackle the creaky nature of the cross-border payments systems, if only inadvertently. What probably began as providing legal and non-speculative substitutes for cryptocurrencies in the form of central bank digital currencies (CBDCs) has increasingly become about overhauling the entire global payments infrastructure.

In a chapter titled 'Blueprint for the future monetary system: Improving the old, enabling the new', the Bank for International Settlements' (BIS) upcoming 2023 annual report highlights the crucial nature of CBDCs to this blueprint.

"Programmable central bank money could knit together tokenised commercial bank money and assets on a single platform to enable transactions and contracts in real time," the body of global central banks said on June 20 in a release.

These comments came a day after senior officials from the International Monetary Fund talked up the role of a global platform to settle CBDC transactions.

"To have more efficient and fairer transactions, we need systems that connect countries, we need interoperability," Kristalina Georgieva, the IMF's managing director, said on June 19 at a conference in Morocco.

"For this reason, at the IMF, we are working on the concept of a global CBDC platform," Georgieva added.

CBDC experiments

While the IMF is only now thinking of getting its hands dirty, the BIS has been at the forefront of CBDC experiments, conducting multiple projects over the last couple of years to explore the various aspects of the future of global payments systems.

The first of these projects, successfully completed in December 2021, was Project Jura, which examined the direct transfer of euro and the Swiss franc wholesale CBDCs between two commercial banks on a third-party platform.

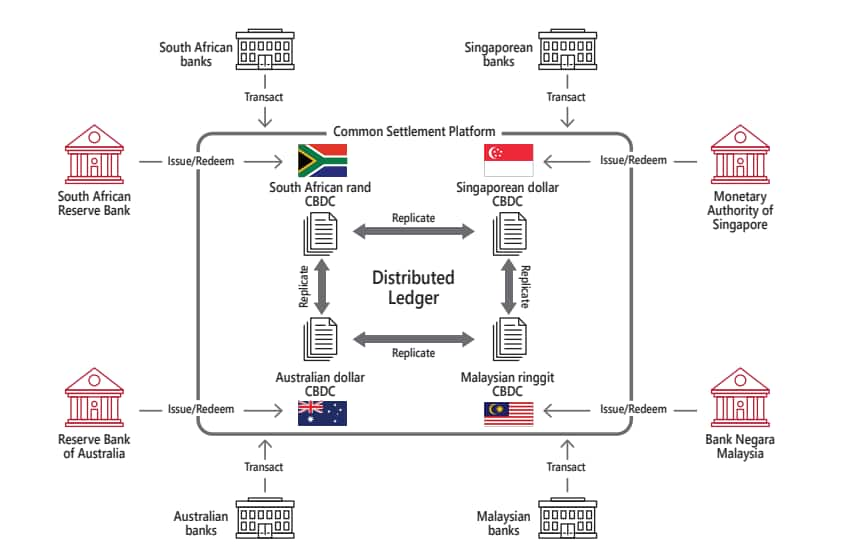

Next came Project Dunbar, involving the central banks of Australia, Malaysia, Singapore and South Africa, along with the BIS, to specifically test CBDCs for international settlements.

"Unlike domestic payments, where banks can pay each other directly on a single national payments platform, there is no single international platform today for cross-border payments and settlements," the BIS said in March 2022.

"Instead, the correspondent banking model is used, where banks hold foreign currency accounts with each other... Each leg of the overall transaction takes time and effort to process, with fees levied that add up quickly and are passed on to customers, resulting in slow and costly cross-border payments," the BIS added.

Source: Bank for International Settlements

Source: Bank for International Settlements

The inefficiencies—both in terms of cost and time—are huge at present. While international transactions can take days to settle, the costs in terms of fees can be as high as 7 percent. Under Project Dunbar, a shared platform allowed commercial banks to make payments using the participating central banks' digital currencies. While challenges remain, the BIS said the project "proved the technical feasibility of implementing a shared multi-CBDC platform" and was the "first step towards the vision of a shared platform for international settlements using multi-CBDCs".

Since then, there have been numerous other test projects covering a range of issues: improving cyber resiliency, scalability and privacy in a prototype CBDC (Project Tourbillon), a platform to provide accurate data on market capitalisation, economic activity and international flows of crypto-assets (Project Atlas), and offline payments via CBDCs (Project Polaris), among others. The latest, Project Rosalind—completed only last week on June 16—looked to develop a prototype or an application programming interface (API) that allowed a "central bank ledger to interact with private sector service providers to safely provision retail payments".

The Indian experience

While India has not participated in these international experiments, the domestic CBDC culture has been growing on the back of Reserve Bank of India (RBI) pilot projects for the retail and wholesale segments. The retail CBDC pilot project, in particular, has been growing rapidly, with the RBI aiming to have 10 lakh users by the end of June. In addition, it is also planning to make CBDC wallets interoperable using the Unified Payments Interface (UPI) and QR codes.

The RBI, which has been vociferous in its opposition to cryptocurrencies, has also said it would welcome global settlement of CBDCs as it would help sharply reduce settlement costs and time for international transactions and modernise the cross-borders payments systems that are "stuck in the last century".

"CBDCs, in my view, is the most efficient answer to this... So, the internationalisation of CBDCs is something I am looking forward to," Deputy Governor T Rabi Sankar had said in September 2022.

To be sure, India is already making headway in facilitating instant money transfers for individuals by teaming up with the likes of Singapore, with UPI attracting a lot of attention under India's G20 presidency. But it is business-to-business payments where the real gains lie, as they make up more than 95 percent of all cross-border payments.