ACP.PA: This CEF Debt Slice Could Be Attractive At Yields In Excess Of 6.5%

Summary

- ACP.PA is a Series A preferred equity from the Abrdn Income Credit Strategies Fund.

- The CEF preferred equity represents a fixed term funding structure that accounts for leverage in the vehicle.

- While technically 'equity', preferred shares represent a slice of debt in reality, and benefit from the structural subordination of the common equity.

- ACP.PA is rated A2 by Moody's, and has a first call date in June 2026.

NicoElNino

Thesis

The Abrdn Income Credit Strategies Fund (ACP) is a fixed income CEF. We have covered this name several times, especially in light of its merger with Ivy High Income Opportunities Fund (IVH) which happened in March of this year. The combined entity is now larger, with a higher AUM of $360 million. The CEF funds itself via both repurchase agreements as well as preferred securities. In this article we are going to look at the Series A preferred shares from the fund (NYSE:ACP.PA), and get a sense of the risk factors behind the price and attractiveness of an investment here.

Capital Structure

ACP is a global fixed income CEF, and as per its literature:

The Fund seeks to achieve its investment objectives by opportunistically investing primarily in debt and loan instruments of issues that operate in a variety of industries and geographic regions. The Fund may invest, without limitation, in credit obligations that are rated below investment grade by a NRSRO such as S&P or Moody’s or unrated credit obligations that are deemed by the Advisers to be of comparable quality.

CEFs usually get leverage in two ways:

- Repurchase Agreements or Total Return Swaps: These are capital markets instruments, usually done with a bank, where assets are pledged in return for funding:

A Total Return Swap is a contract between two parties who exchange the return from a financial asset between them. In this agreement, one party makes payments based on a set rate while the other party makes payments based on the total return of an underlying asset.

The underlying asset may be a bond, equity interest, or loan. Banks and other financial institutions use TRS agreements to manage risk exposure with minimal cash outlay. However, in recent years, total return swaps have become more popular due to the increased regulatory scrutiny after the alleged manipulation of credit default swaps (CDS).

2. Preferred Shares: This is a form of term funding at a fixed cost. The advantage for this issuance relies in its fixed cost for the term of the structure. ACP has issued a Series A preferred tranche:

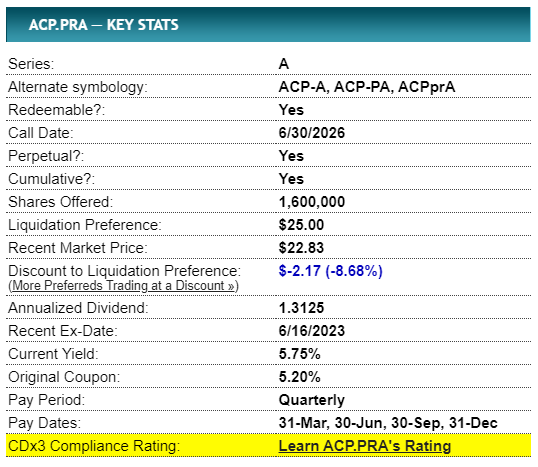

Key Stats (Preferred Stock Channel)

While technically 'equity', CEF preferred shares act like a debt slice offering the structure leverage (ACP is now running a 25% leverage ratio). We can see the Series A becoming callable in June 2026, and having a fixed coupon of 5.2%. The tranche is trading at a discount, giving it a current yield of 5.75%.

While this number is fairly low for now, do keep in mind this is a senior part of the capital structure. In order to talk about credit risk in respect to ACP.PA, we would need to see a -70% wipe-out in the common shares. These shares are highly rated by Moody's:

New York, December 20, 2022 -- Moody's Investors Service ("Moody's") has affirmed the A2 rating of the Series A Cumulative Preferred Shares issued abrdn Income Credit Strategies Fund ("ACP" or "the Fund").

Issuer: abrdn Income Credit Strategies Fund - Series A Cumulative Preferred Shares, Affirmed A2

RATINGS RATIONALE

Moody's has affirmed the A2 rating of the preferred shares issued by ACP, but notes its risk-adjusted asset coverage is low for its rating level. The A2 rating is supported by the Fund's highly diversified investment portfolio by both issuer and sector exposure which serves to reduce net asset value volatility as well as the impact that individual security defaults will have on the portfolio as a whole. Additionally, the rating reflects ACP's strong fixed charge coverage which reflects ACP's investment objective of generating a high level of income.

The take-away here is that the capital structure of the CEF provides for a credit cushion for any losses. Common shareholders are affected first, and it would take a truly cataclysmic event for these A2 rated preferred shares to be impacted.

Price and Yield

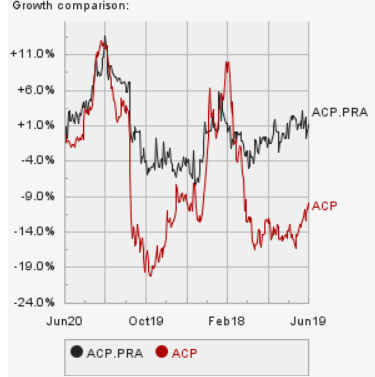

The shares have a beta to risk-off moves:

Price Moves (PreferredSockChannel)

Given their subordination, the common shares are much more volatile than the preferred shares. We can see the lower beta displayed by ACP.PA in the above graph. While currently they are slightly unattractive at a low spread of only 140 bps over treasuries, in a risk-off scenario that spread could widen significantly. We have seen the shares trade in the low 20s from a price standpoint, which would give them a yield close to 7%!

Conclusion

ACP.PA is the Series A preferred equity from the Abrdn Income Credit Strategies Fund. The CEF preferred equity represents a fixed term funding structure that accounts for leverage in the vehicle. While technically 'equity', preferred shares represent a slice of debt in reality, and benefit from the structural subordination of the common equity. ACP.PA is rated A2 by Moody's, and has a first call date in June 2026. The shares are now yielding only 5.75%, but they have a beta to risk-off environments. We have seen the preferred shares trade with yields closer to 7% on the back of risk-off environments earlier in the year. While on Hold for now, this debt piece is to be closely followed and could represent a very attractive investment at yields in excess of 6.5%.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACP.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.