CrowdStrike: Don't Catch The Falling Knife

Summary

- CrowdStrike stock has failed to regain positive momentum following its Q1 earnings release. The market could be trapping late buyers before selling off further.

- The company aims to leverage its AI-driven security solutions and data advantage to gain market share against legacy players and cloud computing hyperscalers.

- However, CRWD is not a pure-play AI stock. Therefore, it's unlikely to benefit from the AI hype that drove the recent surge.

- CRWD's valuation is aggressive. As investors consider rotating out of tech, the stock could get hit hard.

- With underlying sector rotation taking place, investors should consider cutting exposure and sit out the impending pullback until it's more attractive again.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

Sundry Photography

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) investors were hammered by an initial post-earnings selloff as the leading cloud-native endpoint cybersecurity player released earnings.

The company's first-quarter earnings report disappointed investors who anticipated a more robust guidance upgrade. I highlighted in my previous article that market operators have likely baked significant optimism into CRWD's aggressive valuation.

Hence, these investors likely aren't satisfied as some metrics and management commentary suggest things aren't "pristine." For instance, management annotated its commentary with "increased deal scrutiny and longer than typical sales cycles, especially for larger consolidation deals."

Moreover, CrowdStrike's net new annualized recurring revenue or ARR fell 22% QoQ. While the comp was against "an exceptionally strong fourth quarter," it highlighted that even CrowdStrike wasn't immune to the ongoing enterprise spending optimization in the software space.

As such, I assessed that the selloff is justified to reflect these ongoing uncertainties. Notwithstanding, I applaud management's continued commitment to achieving GAAP profitability, which CFO Burt Podbere aptly called the company's "third evolution." However, it's also critical for investors to consider that the company's focus is not on reaching "sustainable GAAP profitability" right now.

Given CrowdStrike's addressable market and potential to gain more share against the legacy players, I believe the company's strategy is justified. Management telegraphed its confidence in further share gains through its leadership in endpoint security, as "it's still a very fragmented market."

As such, I believe CrowdStrike must leverage its AI-driven security solutions to improve its competitive edge against the legacy players and cloud computing hyperscalers.

CrowdStrike emphasized that while generative AI has opened up new opportunities for existing players and adversaries, the company has a significant data advantage.

As such, it believes it can leverage that data advantage to further stretch its leadership, as it aims to gain more share through increased module adoptions. Notably, Podbere articulated that CrowdStrike "closed over 50% more deals involving eight or more modules this quarter compared to a year ago." Therefore, I assessed that it corroborates management's confidence that it's making substantial progress through its tech leadership.

However, investors must also take a well-balanced view of the competition the hyperscalers offer. In early May, Forrester highlighted that Microsoft Azure (MSFT) is a leader in the Infrastructure-as-a-Service Platform Native Security or IPNS. Amazon Web Services (AMZN) or AWS and Google Cloud (GOOGL) join Azure to form the leadership pack, well ahead of the other cloud service providers in Forrester's assessment.

Azure also reminded investors that it has a "multi-cloud approach," proffering the opportunities for its customers to "centralizing and unifying their security needs on other public clouds as well."

Moreover, in late April, Insider reported that Microsoft CEO Satya Nadella scored a coup, as the company managed to attract AWS co-founder Charlie Bell to Microsoft Security. Bell is a highly-regarded cloud computing executive tasked with expanding and enhancing Microsoft cybersecurity's offerings to take on AWS. Notably, Bell demonstrated his Amazonian instincts when he helped develop Azure's Security Copilot in double quick time, "which took only a matter of months to go from idea to launch, a much faster timetable than is typical at Microsoft."

As such, I assessed that with Azure committing to generative AI to enhance its offerings significantly, it remains to be seen how fast the "supposed" gap with CrowdStrike could be bridged. Microsoft could also "creatively" bundle its security offerings with its customers at a more attractive price, along with new generative AI packages exclusive to Azure.

As such, it could compel CrowdStrike to demonstrate even more value for its customers against a rejuvenated Azure that's already considered a market leader.

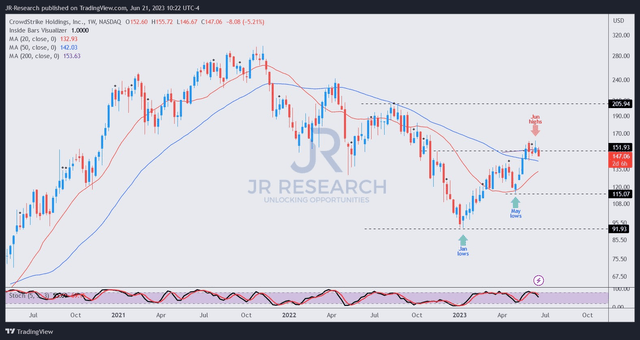

CRWD price chart (weekly) (TradingView)

I don't think there should be any doubt that CRWD's valuation is expensive. With forward earnings of more than 60x and a forward free cash flow or FCF yield of 2.7%, significant optimism has been reflected.

As such, even though the Technology sector ETF (XLK) nearly re-tested its all-time highs last week, CRWD remains more than 50% below its 2021 highs. The speculative fever has moved to pure-play AI stocks, and CRWD is not considered part of that category.

Therefore, I believe it's appropriate for investors who bought CRWD's pessimistic levels in January and May to consider cutting exposure and wait to see where this pullback takes us.

Given CRWD's aggressive valuation, investors rotating out of tech to undervalued sectors will not likely spare it from a well-deserved hammering.

Rating: Sell. (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, MSFT, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)