Anheuser-Busch InBev SA/NV: Sales Crater 30%, Earnings Could Be Decimated

Summary

- It has been a few weeks since we last checked in on Anheuser-Busch InBev SA/NV.

- While there are value buyers calling for shares to rebound at these levels, we think more downside is ahead.

- Bud Light no longer the top selling beer in the U.S., and the parent company is fiscally backstopping wholesalers and some employees.

- Data from just this morning shows sales were down 30% year-over-year.

- Analysts are cutting ratings, and we make the call that the company will down guide when it reports Q2.

- This idea was discussed in more depth with members of my private investing community, BAD BEAT Investing. Learn More »

Kolbz

Well investors, it has been a few weeks since we last checked in on Anheuser-Busch InBev SA/NV (BUD). In our last column, we opined that the damage looks permanent. You see, often when there is some sort of controversy around a company it often blows over after a few weeks. This has not been the case with Anheuser-Busch InBev SA/NV. The data continues to be poor, and we have recently cited sales being down 20-25% year-over-year week to week.

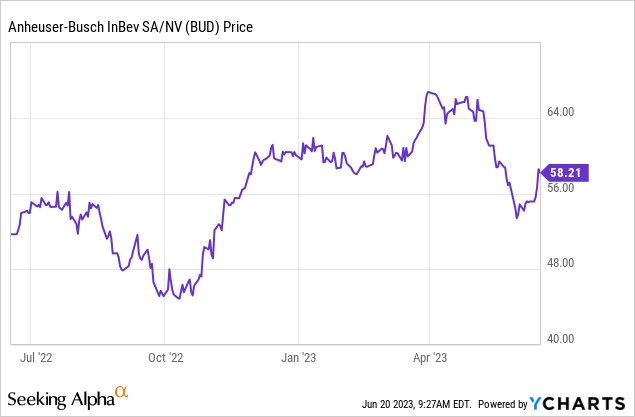

Now, what we will tell you is that the comments section of these articles have really heated up, but we left one very specific comment, and that was predicting sales of Bud Light would eventually see the down 30% year-over-year mark, and this comes months after the consumer backlash stemming from when its marketing campaign featuring transgender TikTok star Dylan Mulvaney began. Remember Dylan promoted the company’s “Easy Carry Contest” on social media outlets and featured Bud Light prominently, and as we know a strong portion of the customer base disagrees tremendously with this type of campaign and has called for boycotts. The boycott is clearly having a huge impact. The data is clear, and it has been, and the situation is worsening since we first told you that sales were plummeting and was set to be a short. The stock has recently found a little bit of value buying, as evidenced by the rebound shown in the chart below.

We previously identified support at about $56, and BUD stock fell through this level. While the recent rebound is encouraging for those betting on the stock, we would caution investors on buying here. The reason for this is that we seriously question how annual guidance can be met with the brand damage that has taken place.

The data is clear.

So as we have covered, sales have continued to be down over 20% each week when examining the comparable year-over-year period.

Last week, we saw that Bud Light is no longer the top-selling beer in the U.S. The top selling beer now belongs to Constellation Brands' (STZ) Modelo Especial. Overall, Modelo accounted for 8.4% of beer sales by U.S. retailers in the four weeks ended June 3, compared with Bud Light's 7.3%, the report said.

So why is the stock rallying a bit? Well, value buyers, of course, are stepping in thinking the damage may be done and it is a good long-term entry point. Perhaps, but we are not convinced. The stock got a lift last week when RBC called the value compelling. They believe the selloff was overdone, but we still see shares falling because we believe when Q2 earnings are reported the company will have to reduce guidance. There has to be a fiscal impact, even if Bud Light is one of many brands under the umbrella.

Now here is the thing. Shares are starting a small rebound, but they could quickly be heading back south because just this morning we got the most recent data for Bud Light sales, and it suggested sales are indeed still plummeting. Further, our prediction of sales being down 30% on the year-over-year mark was just attained.

Folks, the situation is getting even worse.

We saw today updated data from consulting firm Bump Williams in another article in Newsweek, which has been all over this issue and has provided a solid set of data for investors to chew over. Our conclusion is that you need to remain on the sidelines if not short. The firm has been following the sales trends for the company over the last few weeks following the controversy and uproar.

So, just how bad is it now? Well, in the week ending June 10th, Bud Light sales volume was 30.3% lower than in the same week in 2022, the largest such drop since the week ending April 1 right around when the initial backlash began. Bud Light's sales revenue was down 26.8% from the same week a year ago

So, we strongly question whether the global CEO, Michel Doukeris, stating that the backlash would be less than 1% of sales can be true. We also question how earnings and revenue guidance can hold up. This has been costly.

Wholesalers are also getting crushed, and the company is stepping up to support them. Over the long weekend, we learned that Anheuser-Busch CEO Brendan Whitworth wrote a letter outlining steps the company is taking to soften the blow of this backlash. Given the pain down the line, the company is extending further financial support to wholesalers and front-line employees, including free supplies and direct fiscal aid.

But the damage is being done.

By our tally, five analysts have already cut Anheuser-Busch’s ratings and the Wall Street consensus is that the company’s 2023 earnings growth will decrease from 7.4% to 6.5%. Folks, we believe more ratings and projections cuts are likely. The only way to stop the bleeding is for Anheuser-Busch to disclose clear plans on how it intends to regain Bud Light sales. Perhaps a return to a prolonged effort of old school marketing to regain some lost customers. Make no mistake, we believe some lifelong customers will never return. Other new customers who just want a good deal can likely find very good sales on Bud Light right now. But in our digging, it appears that Bud Light represents somewhere around 25-30% of the company’s U.S. earnings, which itself constitutes around 1/3 global sales. Unlike what was stated in May, about 1% of revenues at risk, by our tally, Bud Light alone represents around 8-10% of total sales. So if total sales are down 20-30% and it continues, then revenue will be down 2-3%. But folks, the data also suggests that other brands are also down, as we have previously covered.

So when management in May stated "our full year EBITDA growth outlook is unchanged," we simply suggest to you that this is not possible. Unless there are some hidden drastic spending cuts or stellar sales of products elsewhere in the line (there aren't to our knowledge), then Quad 7 Capital and BAD BEAT Investing are reiterating the call here that the company will guide down during its Q2 report.

Shares of Anheuser-Busch InBev SA/NV are down about 18% now since the marketing partnership occurred. While value buyers are starting to step in, in our opinion this is premature until the bleeding out of sales can be stopped. Earnings will likely take a hit.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

We make winners. Come make money with us

Like our thought process? Stop wasting time and join the traders at BAD BEAT Investing at a 60% off sale!

Our hedge fund analysts are available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long-term.

- Available all day during market hours with a vibrant chat.

- Rapid-return trade ideas each week from our hedge fund analysts

- Crystal clear entries, profit taking, and stop levels

- Deep value situations

- Stocks, options, trades, dividends and one-on-one attention

This article was written by

We have made millionaires! We are proud to have created thousands of WINNERS. We are the team behind the top performing investing group BAD BEAT Investing. Quad 7 Capital was founded in 2017 by a team that consists of a long time investor, health researcher, financial author, professor, professional cardplayer, and hedge fund analysts.

The BAD BEAT Investing service is a specialized carve out of Quad 7 Capital and launched in 2018. The service is run by a team of hedge fund analysts. This a top performing investing group service relative to market returns. It is focused on trading opportunistic inflections, and leveraging mispriced stocks and momentum driven events for rapid-return swing trades, options education, and long-term investments. We also teach investors how to hedge their portfolios. Further, it offers a direct access line to our traders all day during market hours and provides daily market commentary.

Quad 7 Capital as a whole has expertise in business, policy, economics, mathematics, game theory and the sciences. The company has experience with government, academia, and private industry, including investment banking, boutique trading firms, and hedge funds. We offer market opinion and analysis, and we cover a wide range of sectors and companies, with particular emphasis on news related items and analyses on growth companies, dividend stocks, banks/financials, industrials, mREITS, biotechnology/ pharmaceuticals, precious metals, and small-cap companies.

If you want to win, follow us, and if you want to make real money, sign up to BAD BEAT Investing today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)