China's Economic Slowdown: A Wake-Up Call For The U.S. Economy

Summary

- China's post-COVID economic reopening has been much slower than expected, leading to speculation about how the Party will respond.

- Americans are shunning saving and increasing borrowing, while Chinese consumers have grown increasingly cautious.

- With China rapidly slowing down, is the United States next?

- It seems likely as leading economic indicators in the US are flashing a crystal clear recession signal.

- Implications for Chinese tech, oil stocks, and more.

fazon1/iStock Editorial via Getty Images

Recent data shows that China's post-COVID economic reopening has been much softer than expected. As the economy slides, the CCP is scrambling to stem the decline. China's central bank recently cut interest rates, and speculation is rising that they'll enact fiscal stimulus to try to kick-start the economy. This wasn't supposed to happen.

Economists had widely expected Chinese consumers to follow Western consumers embracing a YOLO mentality by massively ramping up borrowing and spending after reopening. Instead, rather than spending big, consumers in China seem to largely be paying down debt and deleveraging. With leading economic indicators in the US at their weakest levels since 2008, US consumers would do well to heed the example of their peers in China. In contrast to Chinese consumers, Americans have defied expectations of a slowdown by ramping up borrowing and pushing savings rates to near-all-time lows. These contrasting stories have implications for not only the US and Chinese stock markets but also for the oil market and geopolitics.

In The West, We Understand Little About China

If you're like most of my readership, you're reading this from somewhere in the United States or Canada. If not, then you're probably in Western Europe or Australia. English is either your first language or you're highly educated enough to speak, read, and write in multiple languages. Since I'm writing exclusively in English, we're able to communicate and share ideas rather easily. Still, even sharing a common language, it's somewhat easy to be misinformed by the media about what's going on in other states, cities, and countries.

If Bloomberg or WSJ writes something about something in England or Canada or California, then I can easily pick up the phone and ask friends there what they think of the story and if it's true. This way, we can mostly filter the propaganda from true underlying trends. China is a different ballgame. The language barrier between Chinese and English is massive. While it takes the typical diplomat 24-30 weeks to get up to speed in French or Spanish, it takes 88 weeks to reach proficiency in Chinese. So what does this have to do with investing in the world's second-largest economy? It means that unless you've spent years studying China and the Chinese language, then you don't know much about it at all because everything you know is filtered through the media. Of course, this applies to me as well, despite taking a few college classes on China and being in the business of publishing macro research.

Can statistical analysis help to bridge the gap between our lack of understanding and the ocean of money flowing through China? This is where we start getting somewhere. Math and statistics can uncover truths that are more or less universal, and if we're humbly able to acknowledge our known unknowns, then there may be opportunities. However, statistics in China are hard because data is heavily manipulated by the government there. According to Chinese government figures, the unemployment rate never in history topped 5% until the pandemic, when they acknowledged a spike to about 6%. Sophisticated statistical modeling shows that this is utter nonsense. Youth unemployment in China has skyrocketed to over 20%, and it's not quite clear if there's an immediate fix.

Problematic China statistics extend from macro statistics like GDP and unemployment to earnings. A few years back, researchers used a statistical model to detect earnings manipulation in various countries. For example, the rate of likely earnings manipulation in Chinese companies was found to be about 20%, vs. about 2% in Australia (the US is higher than Australia but a lot lower than China). Of course, the US is famous for Enron and other accounting scandals, but that's Little League compared to what happens in Chinese small caps every day. This is why I don't recommend putting any money into emerging markets- investment returns are correlated with the rule of law, not GDP growth.

Here's what we do know:

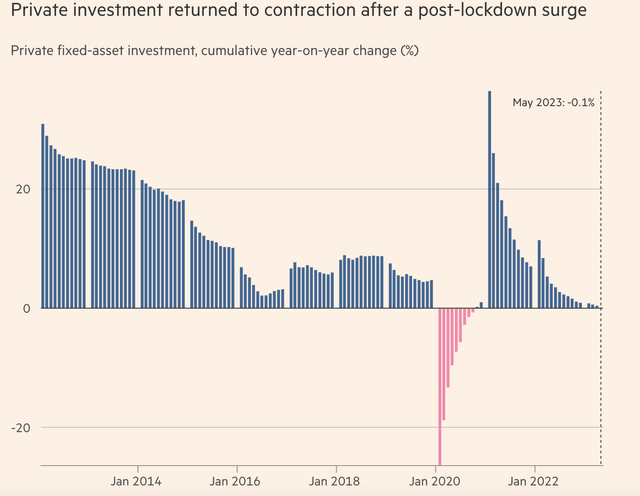

Investment in China has fallen sharply in recent years, only briefly interrupted by a pandemic lockdown and subsequent surge.

China Private Investment (Financial Times)

The problem is a huge debt load, much of it used to finance building property. However, China's population is now falling. Who's going to live in all of these houses when the population is declining? That's a huge problem, and that's why the Party is trying to sell the idea that "houses are for living in, not for speculation." Current estimates are that China's population will soon start to shrink by as many as 10 million people per year, from 1.4 billion to well under 1 billion by the end of the century. In the long run, that's probably a good thing for China's citizens, who won't have to compete as heavily for resources. This same trend hasn't happened in the US yet, but it's coming. However, population decline is a disaster for heavily indebted speculators. If your population is flat or shrinking, then basing much of your economy on constructing housing is never going to fly.

Meanwhile, in the US, housing starts showed an acceleration to 1.6 million units (annualized). Assume 300,000 houses or so go obsolete, and that's still enough to house over 3.3 million new people, while the actual population growth in the US is likely to be about one million. This is a trend that has happened every year since 2019 and is likely to abruptly end when there's no more demand to pull forward. What's going on in China is a wake-up call in many ways for the US economy, because the US will soon be in a similar demographic position.

China's Slowdown: Implications For Stocks

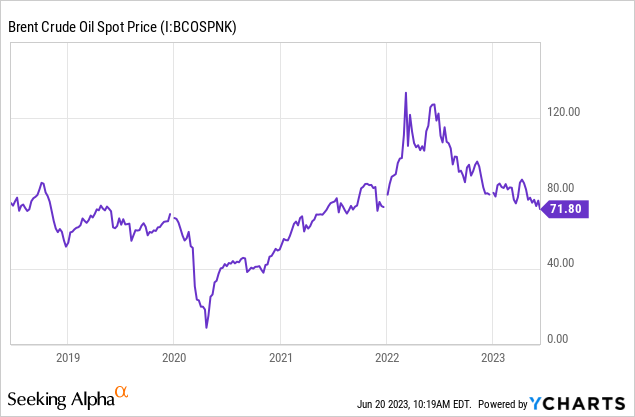

To my surprise, the oil market has traded quite bearish, despite OPEC+ supply cuts and Russia's war in Ukraine. I think it's time to take profits in oil stocks like Exxon (XOM), Chevron (CVX), and Occidental (OXY). This is partly a macro call because the oil market is selling off and oil stocks have held high, but it's partly a valuation call. Everyone thought oil was dead in 2020 when it was clearly coming back, and now many of these same people are paying peak multiples for oil stocks. If China does surprise investors and their economy starts roaring back, then you might reload on oil stocks, but the current data suggests that China's slowing economy combined with increased electric vehicle adoption are making a big dent. China also notably is seeking a thaw in relations with the US. The timing is curious with domestic issues seeming to be mounting there.

For Chinese tech, the story is actually interesting. The CCP seems to be playing nice with tech companies again now that the economy is slowing down. Alibaba (BABA) founder Jack Ma made an appearance in China at an Alibaba event. This came after wild speculation that Ma had "disappeared." Ma reportedly lives in Tokyo now. On the subject of Japan, I think it's overall a much better place to invest than China. Warren Buffett recently upped his bets on Japanese companies, Japanese companies consistently show far less earnings manipulation than China, and Japan has a more stable government with better rule of law. I wouldn't pay the extra fees to invest in a Japan-specific fund but for long-term investors, I like the Vanguard International High Dividend Fund (VYMI), Vanguard's Total International Market (VEA), and the Avantis International Small Cap Value Fund (AVDV). There is big money to be made in China, but it's high risk and high reward. However, due to endemic levels of corruption and accounting issues, I wouldn't even think about buying an index fund of Chinese stocks.

BABA and JD.com (JD) are the two most likely beneficiaries of this thawing in the business community there and are growth stocks priced at value prices. The Chinese economy may not be doing well, but deep value investing is always in season. Plus, they pass the earnings manipulation test.

With China's Economy Stalling, Is The US Next?

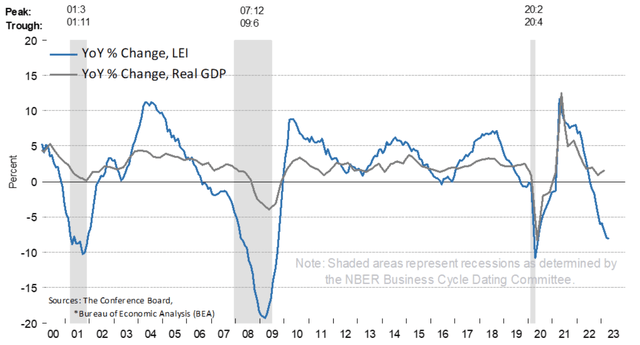

Chinese consumers are battening down the hatches, while US consumers are ready to party. The problem, of course, is that the story that leading economic indicators in the US are telling is incredibly ugly.

US Leading Economic Indicators (Conference Board)

These come as the Fed is all but forced to hike even more to prevent inflation from spiraling out of control.

Historically whenever leading economic indicators get to where they are now, it's a 100% recession signal, with an average 35% fall in stock prices and a subsequent large rise in unemployment. Monetary policy takes a while to kick in, but when it does, it tends to hit hard. The index is showing a recession is likely to occur with a similar magnitude to the post-9/11 recession, but not quite as bad as 2008 yet.

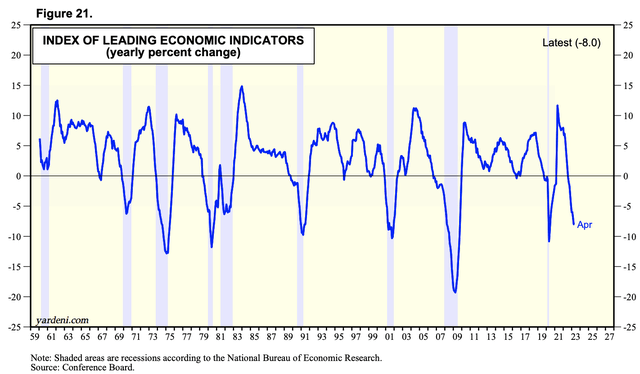

Here, the blue line is leading indicators going back to the 1950s, while the vertical bars indicate recession. Anytime it falls below -4% or so, a recession occurs quite soon after. This typically leads to stocks falling 35% or so, and housing prices falling sharply as well in markets where values are higher than fundamentals support.

Leading Economic Indicators, US (Yardeni Research)

This offers food for thought, especially with a large tax increase due to kick in soon with the student loan pause ending. The joke about economists is that they predict 10 of the last three recessions, but the trend here is unambiguous. Every time leading economic indicators (the yield curve, manufacturing hours, initial jobless claims, building permits, consumer sentiment, credit conditions, etc.) go sharply negative, a recession occurs. There have been no false positives. American consumers are partying while Chinese consumers are battening down the hatches. I just wouldn't expect the party to last.

Bottom Line

We're seeing a sharp and sustained slowdown in China's economy. Is the US next? Leading indicators are saying that it is. Value investing never goes out of style, but there simply isn't much value in large-cap US equities at all. Where is the value? For one, it's in sitting in money market funds and waiting for the business cycle to fully turn, but Warren Buffett and others are looking abroad to take advantage of the strong dollar and low valuations. Chinese tech stocks are also potentially worth a look, but they're risky.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VYMI, VEA, AVDV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (14)