CLOZ: Attractive Yields Based On Historical Default Rates

Summary

- The CLOZ ETF provides exposure to non-investment grade tranches of CLO securities.

- CLOs provide a yield pickup compared to similarly rated bonds.

- The CLOZ ETF is priced to deliver 6-9% forward total returns, depending on historical default rates. This may appeal to investors looking for yield with a higher risk tolerance.

Torsten Asmus

As I continue to review investment funds for my personal portfolio, I will write up those that I find interesting or allows me to discuss macro topics that are topical. I find writing for an audience helps me think through the pros and cons of investment ideas. Recently, one of my readers asked for my opinion on the Panagram BBB-B CLO ETF (NYSEARCA:CLOZ).

To preface, I am by no means a fixed income expert, as I cut my teeth managing equity and hedge funds. However, I did start my career working with credit default swaps ("CDS"), so I know a thing or two about bonds and credit risks.

I believe the CLOZ ETF's 10% distribution yield looks attractive, as it may provide 6-9% forward total returns, depending on credit assumptions. The risk to consider is whether forward default rates will be as tame as recent history and whether investors will rush for the exits in a recession, sparking a liquidity crunch in CLOZ's assets.

Fund Overview

The Panagram BBB-B CLO ETF is a recently launched actively managed ETF that primarily invests in non-investment grade rated tranches of CLO securities.

The CLOZ ETF has $71 million in assets and charges a 0.50% net expense ratio.

Brief Introduction To CLOs

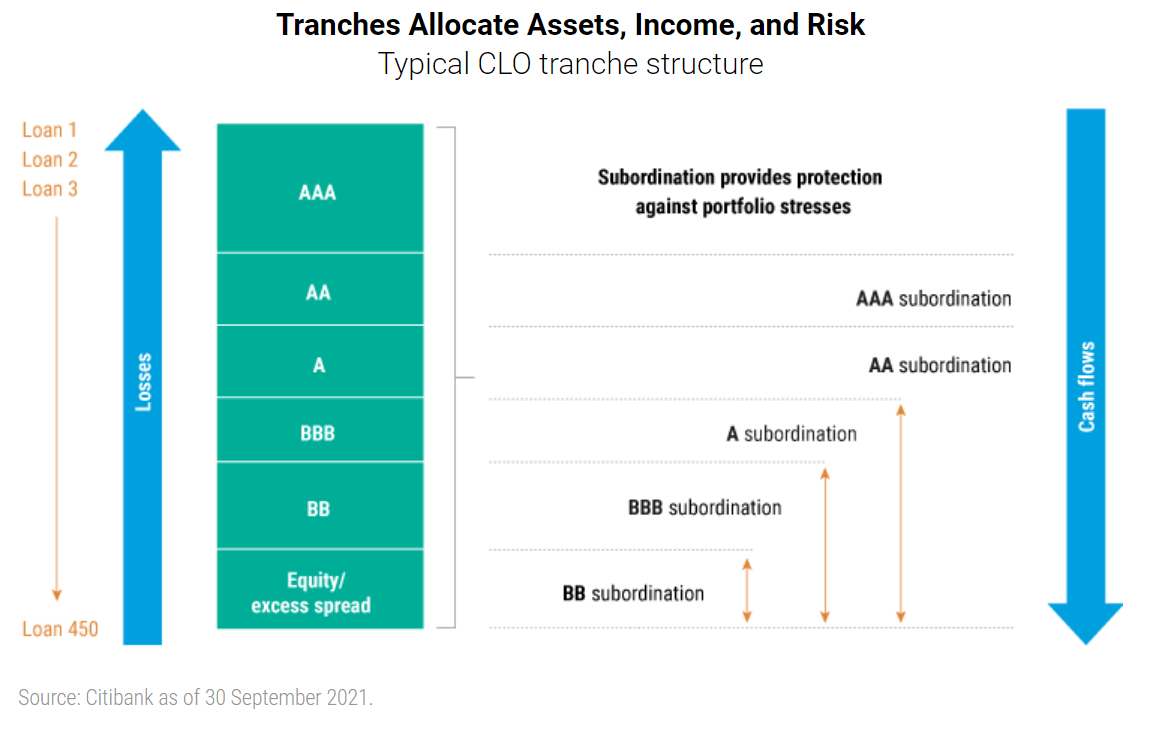

A Collateralized Loan Obligation ("CLO") is a synthetic fixed income security created from a pool of senior loans that have been packaged, securitized, and tranched (Figure 1). The securitization and tranching allows highly-rated investment grade securities to be created from non-investment grade loans.

Figure 1 - Illustrative CLO capital structure (pinebridge.com)

The CLO rated debt tranches (AAA to BB in figure 1 above), are protected from losses by structural enhancements such as overcollateralization and interest diversion. In plain English, cashflows collected from the pool of loans are used to pay interest to the most senior tranches first (AAA downwards in the capital structure), while credit losses are applied to the most junior tranches first (equity upwards).

CLOs have been compared to the infamous Collateralized Debt Obligations ("CDOs") that partly caused the Great Financial Crisis ("GFC") in 2008. Both CLOs and CDOs are synthetic securities created by packaging low-rated assets (mortgages for CDOs, senior loans for CLOs) into investment pools where highly rated securities can be tranched out and sold to yield hungry investors.

However, unlike CDOs that were backed only by mortgage bonds (i.e. single asset concentration), the raw building blocks for CLOs are senior first-lien loans across diverse businesses in the economy. Most CLOs have strict loan diversification rules (i.e. no sector can be greater than 15% of the CLO; no obligor can account for greater than 2%, etc.), are overcollateralized, and have automatic guardrails that force the structure to delever once some credit events are triggered.

According to Wharton finance professor Michael Roberts, it is highly unlikely that highly rated CLO tranches will be wiped out:

If lenders were to recover $0.40 on the dollar for loans in default, then 60% of the loans in CLO portfolios would have to default before the AAA-rated tranches would even begin to lose money. To put that number in context, the cumulative default rate for risky debt during the worst three years of the Great Depression (1931-1933) was 31%.

CLOs Proven Through Trial By Fire

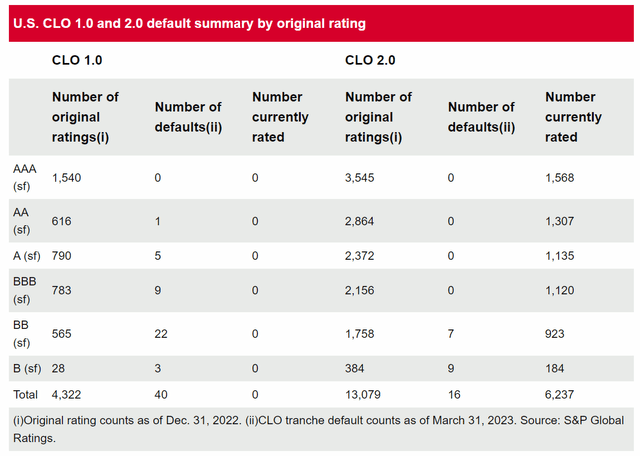

In fact, CLO debt tranches have historically performed very well, even through the GFC. According to Standard & Poor's, CLO 1.0s (those issued before the GFC) produced very few lifetime defaults. Out of 1,540 issues originally rated AAA, there were 0 instances of default, while out of 4,322 rated tranches, only 40 have defaulted, or 0.9% of the total (Figure 2).

Figure 2 - Cumulative CLO defaults (Standard & Poor's)

Since the GFC, additional safeguards were put into place to further improve the resiliency of the CLO structure. For example, subordinated bonds and other structured credit investments are no longer eligible investments and the trading period of the portfolio has been shortened. This has further reduced cumulative defaults of CLO 2.0s (CLOs issued after 2010) to 16 out of 13,000+ rated tranches, or 0.1% to March 31, 2023.

However, investors should note that the post-GFC period has generally been characterized by zero interest rate policies ("ZIRP") and central banks injecting trillions of liquidity into the global financial system, so business cycles and debt costs may have been distorted.

Portfolio Holdings

Figure 3 shows the top 10 holdings of the CLOZ ETF. Investors should note that not much information can be gleaned from a simple listing of the CLOZ ETF holdings. Can anyone truly gauge the creditworthiness of "BAIN CAPITAL CREDIT CLO 2022-6 E 13.8206% 10/22/2035" unless they are an active participant in the CLO market?

Figure 3 - CLOZ ETF top 10 holdings (clozfund.com)

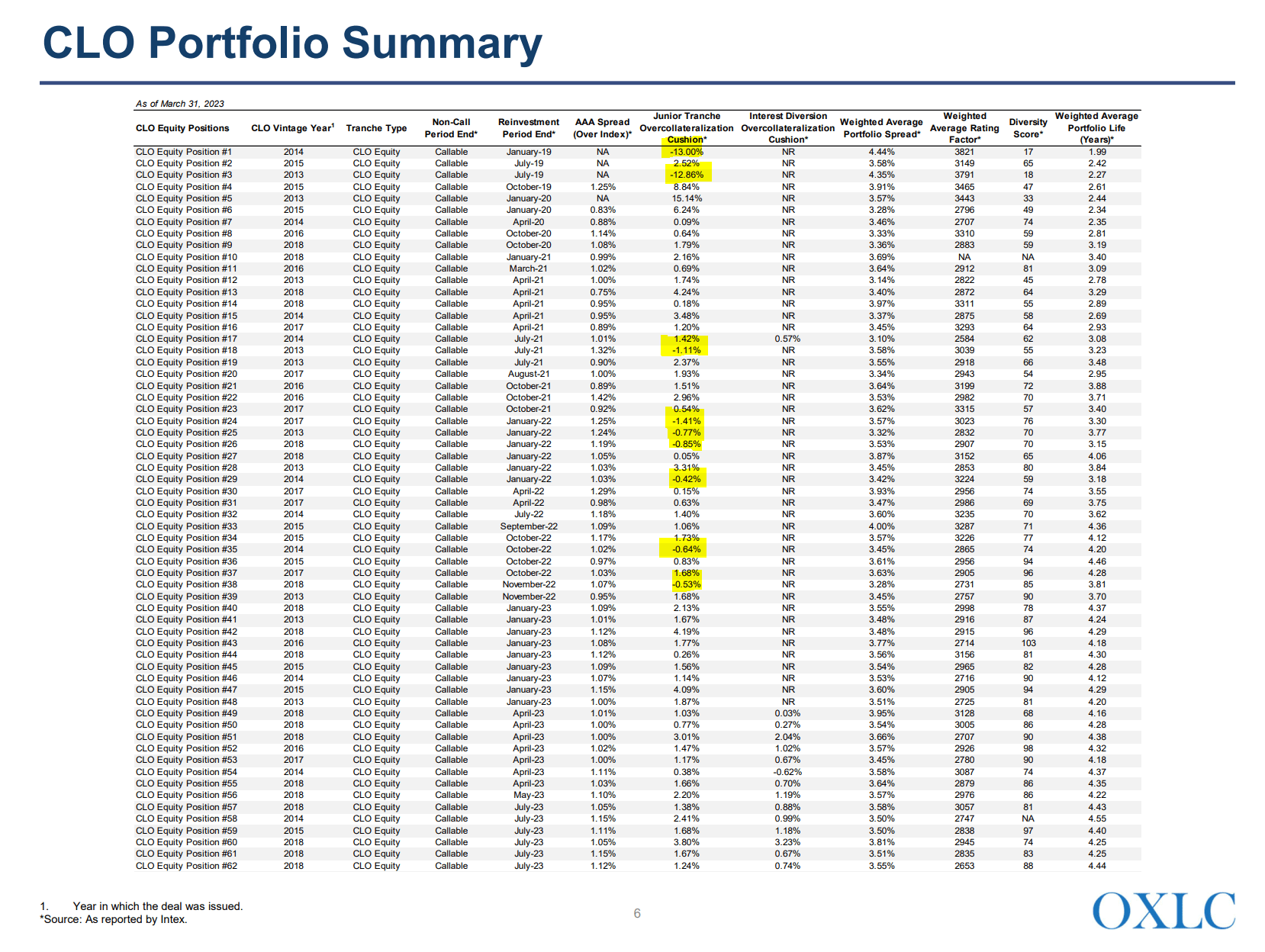

Perhaps management can help analysts assess the CLOZ ETF's portfolio by listing out additional metrics such as the equity tranche overcollateralization of the CLO structures and diversity scores, like what Oxford Lane Capital (OXLC) shows in their quarterly presentations (Figure 4).

Figure 4 - OXLC shows more details on its investment portfolios (OXLC investor presentations)

Returns

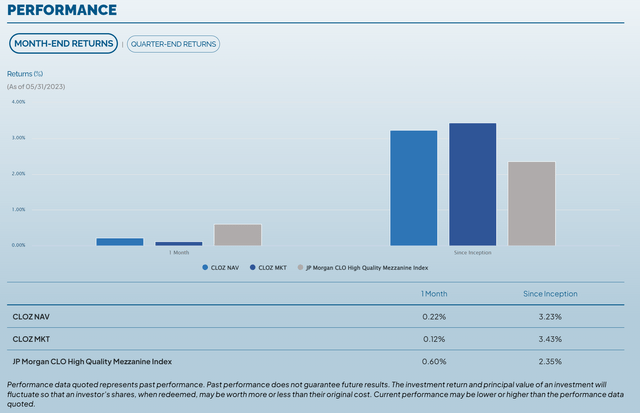

The CLOZ ETF was only incepted in January 2023, so there is not a lot of historical returns data to analyze. Since inception to the end of May 2023, the CLOZ ETF has returned 3.2% on NAV, outperforming its benchmark, the JP Morgan CLO High Quality Mezzanine Index, by 0.9% (Figure 5).

Figure 5 - CLOZ historical return (clozfund.com)

Distribution & Yield

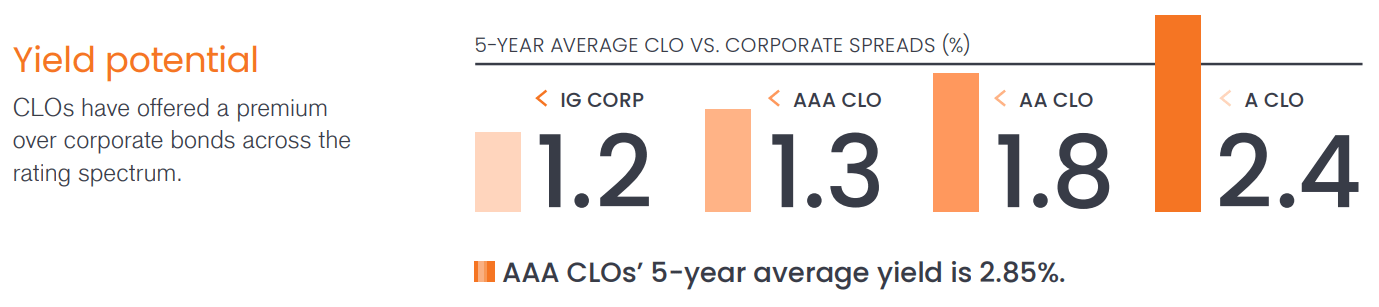

The main benefit of CLOs is that CLO debt tranches offer a yield premium over similarly rated corporate bonds (Figure 6). In a ZIRP world, any incremental yield pick-up was greatly desired by investors.

Figure 6 - CLOs offer yield premium to similarly rated bonds (janushenderson.com)

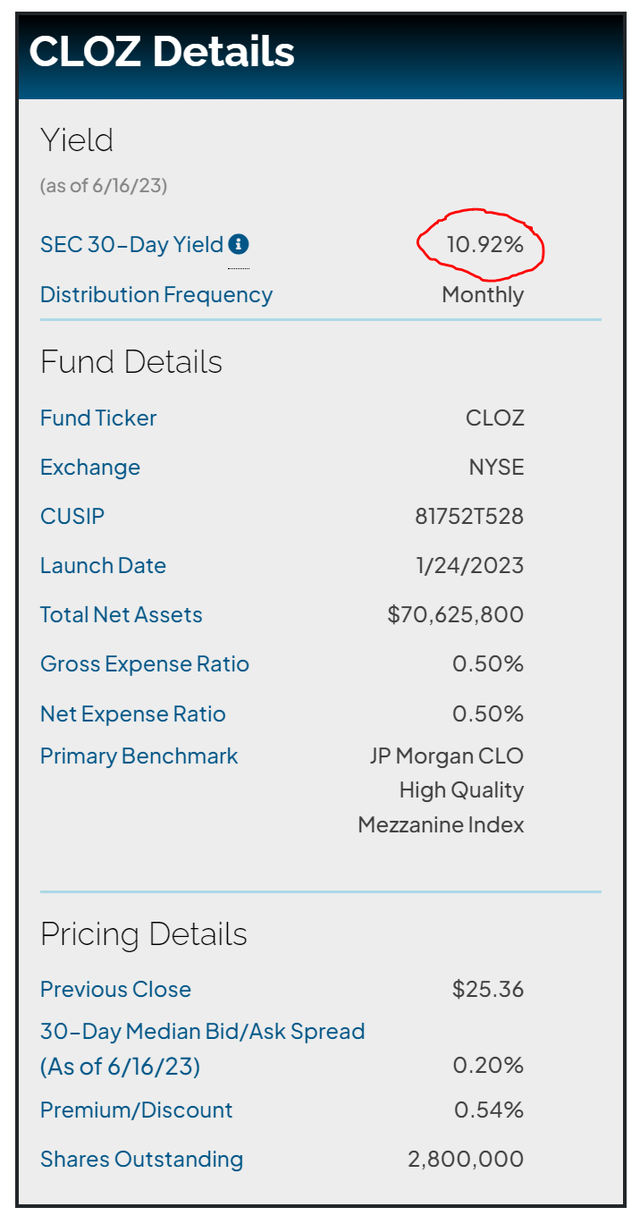

So far, the CLOZ ETF is delivering, as the fund has a 30-Day SEC yield of 10.9%, and the CLOZ's latest monthly distribution of $0.21061597 / share annualizes to 10.0% (Figure 7).

Figure 7 - CLOZ has a 10.9% 30-Day SEC yield (clozfund.com)

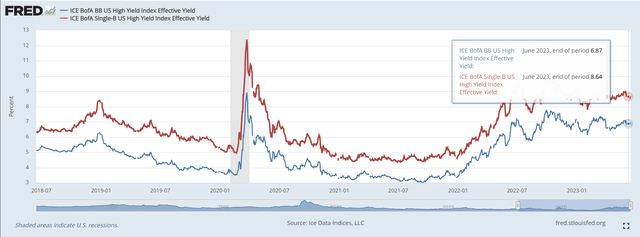

The CLOZ ETF delivers a 1.4% to 3.1% yield premium compared to B- and BB-rated high yield bonds respectively (Figure 8).

Figure 8 - B and BB junk bond yields (St. Louis Fed)

A Buy If Historical Performance Is Any Guide...

From Figure 2 above, we can see that 25 out of 593 CLO 1.0 tranches rated BB and B have cumulatively defaulted, or 4.2%. This experience includes the GFC, which was the worst recession in recent history. Even if recovery rates are assumed to be 0%, a ~10% distribution yield should translate into forward total returns of ~6%.

If we use CLO 2.0 default rates of 16 out of 2,142 BB and B tranches (0.7%) and 0% recovery rates, then the CLOZ ETF may be very attractively priced, giving ~9% forward total returns.

... However, Some Risks To Consider

However, before investors rush out to snap up the CLOZ ETF, they need to understand there is no free lunch and there are some risks they should consider. First, as I mentioned earlier in this article, the CLO 2.0 default experience may have been artificially boosted by central banks' liquidity largesse and ZIRP policies, which have kept many zombie companies afloat.

In fact, as I wrote in a recent article on the Invesco Senior Loan ETF (BKLN), the forward default experience on senior loans may not be as rosy. For example, while the high yield bond market have seen an overall improvement in credit quality as many formerly lower quality credits were pushed into bankruptcy by the COVID pandemic and some formerly investment grade credits fell into high yield territory (fallen angels), the leveraged loan market have seen an overall increase in the number of lower quality issuers, as record low interest rates kept weak issuers alive (if barely).

Furthermore, the recent rise in short-term interest rates may lead to increased defaults in senior loan borrowers, above that of high yield bonds. From the perspective of the issuer, if interest rates increase dramatically, an issuer of high yield bonds are relatively unaffected until they need to refinance. However, senior loans that pay floating interest rates are seeing dramatically higher debt servicing costs (senior loans are typically struck as spreads on top of floating rate benchmarks like LIBOR and SOFR).

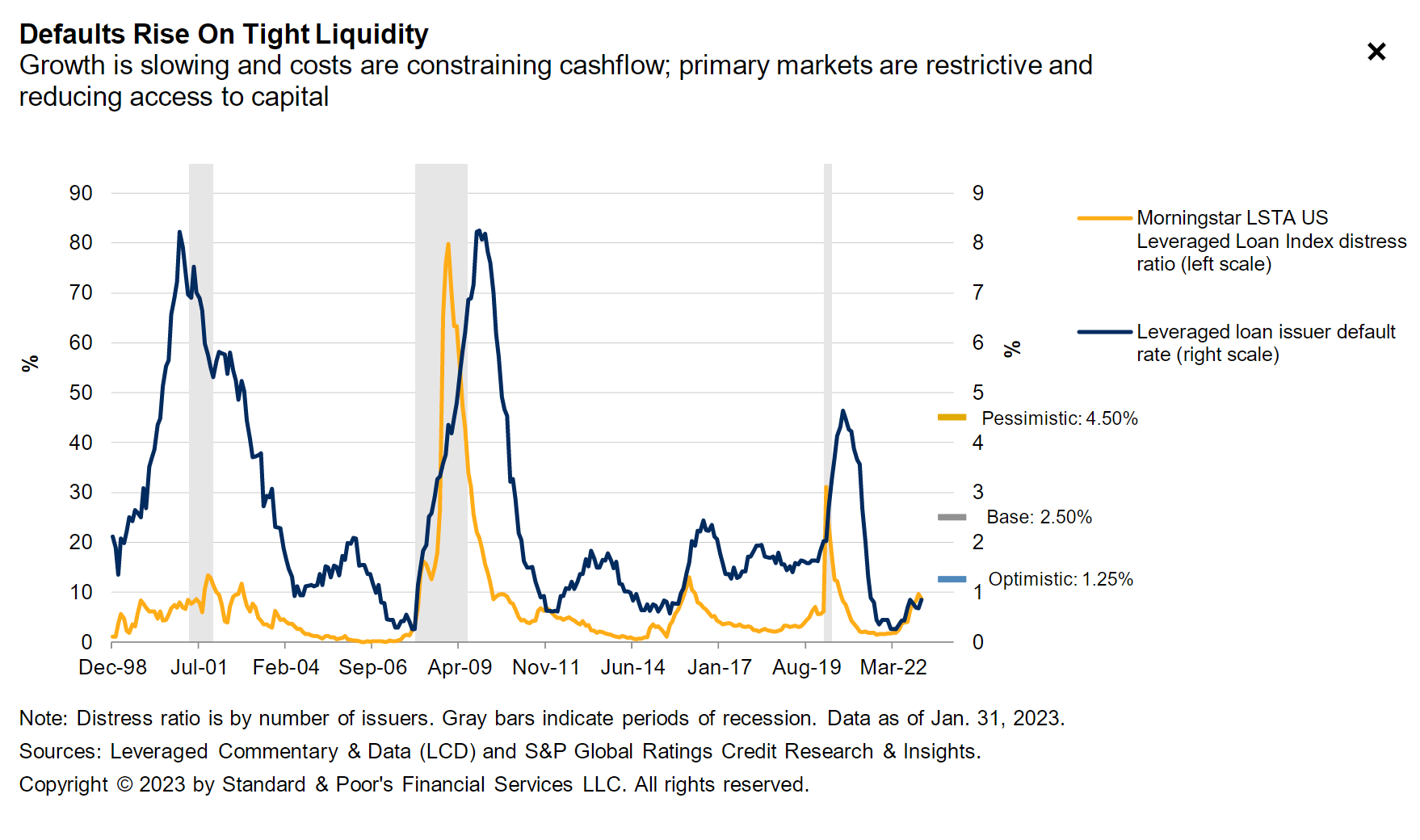

Standard & Poor's expect senior loan default rates to hit 2.5% in a base case scenario in 2023, and 4.5% in a pessimistic scenario (Figure 9).

Figure 9 - Standard & Poor's expect senior loan defaults to normalize (Standard & Poor's)

Elevated defaults in senior loans could lead to distress and defaults in the associated CLO debt tranches, especially in the lower-rated BB and B tranches that the CLOZ ETF primarily invests in.

Another risk to consider is that the CLOZ ETF is an ETF with daily creations and redemptions and not a closed-end fund ("CEF"). This key difference may come into play in a recession scenario when investors panic sell their security holdings. Being an ETF, the CLOZ ETF may be forced by redemptions to sell into a 'no bid' market, whereas a closed-end fund does not face this redemption risk. Remember, CLO tranches are relatively illiquid securities that may be hard to dispose of in a crash.

Conclusion

The CLOZ ETF provides investors with exposure to non-investment grade tranches of CLO securities. Based on historical default experiences, the CLOZ ETF's 10% distribution yield looks attractive, as it may provide 6-9% forward total returns.

As long as investors understand and accept the increased credit risks associated with non-investment grade CLO tranches, I believe CLOZ can be considered a Buy. Just watch out for a recession where default rates and credit spreads spike, which may pressure the mark-to-market on CLOZ's holdings and spark fund outflows.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)