Enfusion: Multiple Catalysts

Summary

- Enfusion, Inc. could reverse its earlier share price underperformance, when interest rates peak and the new management team proves itself in time to come.

- Enfusion's long-term growth potential is decent, and the company has a good chance of delivering positive surprises with its actual top line performance for the remaining quarters of 2023.

- I award a Buy rating to Enfusion, as I have identified multiple potential catalysts for the stock.

- Looking for more investing ideas like this one? Get them exclusively at Asia Value & Moat Stocks. Learn More »

Funtap

Elevator Pitch

I rate Enfusion, Inc. (NYSE:ENFN) shares as a Buy in view of multiple potential catalysts for the stock. These key catalysts for ENFN include better-than-expected FY 2023 revenue, investors gaining confidence in the new management team, and a re-rating of high-growth technology names with expectations of interest rates peaking.

Business Profile

Enfusion describes itself as a "provider of cloud-native software-as-a-service (SAAS) solutions for investment managers" in the company's media releases.

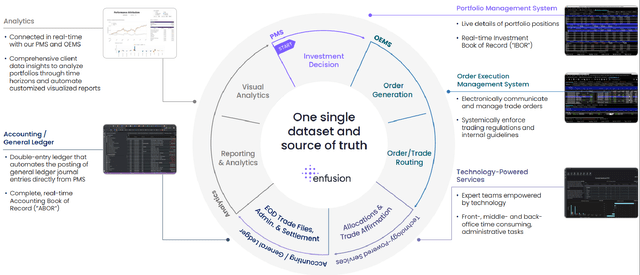

Enfusion's Solutions Across The Investing Lifecycle

ENFN's Q1 2023 Shareholder Letter

As indicated in the company's FY 2022 10-K filing, Enfusion earned 99% of its revenue from subscription fees last year. With regards to geographic market exposure, 57%, 28%, and 15% of ENFN's customers were located in the Americas, APAC (Asia Pacific), and EMEA (Europe, Middle East, and Africa), respectively, as of end-2022.

ENFN's Share Price Has Almost Halved Since October 2021 IPO

Enfusion's shares have been publicly listed on the NYSE since October 21, 2021. ENFN's last-traded stock price of $8.98 as of June 16, 2023, is just slightly over half of the company's $17 IPO price.

Between November 15, 2021 (time of initial analyst coverage) and June 16, 2023, Enfusion's consensus forward next twelve months' Enterprise Value-to-Revenue valuation multiple had compressed from 14.5 times to 3.5 times (source: S&P Capital IQ). ENFN's consensus forward next twelve months' EV/EBITDA multiple of 18.7 times at the end of the June 16, 2023, trading day is also significantly below the stock's forward EV/EBITDA ratio of 52.5 times as of November 15, 2021.

In general, high-growth technology companies have mostly witnessed valuation de-rating due to the rising rate environment. But ENFN's share price performance and valuations might have also been affected by concerns regarding the turnover in its board and management team.

Oleg Movchan was named Enfusion's interim CEO in August last year, after ENFN's former CEO, Thomas Kim, tendered his resignation. Enfusion subsequently appointed Oleg Movchan as the official CEO in late-December 2022. In the same month, ENFN hired Brad Herring to replace its former CFO, Stephen Dorton, who had retired a month ago in November 2021. The company's founder, Tarek Hammoud, was also no longer a board director after March 2022.

It is reasonable to assume that there is a good chance of Enfusion benefiting from valuation multiple expansion when interest rates peak, and the new management team builds its track record over time.

Favorable Short-Term And Long-Term Growth Outlook

Enfusion's Annualized Recurring Revenue or ARR for Q1 2023 was $167 million, as disclosed in the company's Q1 2023 shareholder letter. In its March 2023 investor presentation, ENFN estimates that its Total Addressable Market, or TAM, is as large as $19 billion. This implies that Enfusion's most recent quarterly ARR makes up less than 1% of the company's TAM.

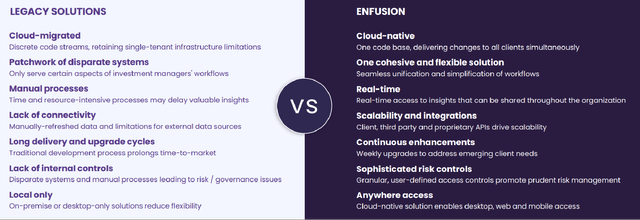

The Key Differences Between Enfusion's Solutions And Legacy Offerings

ENFN's March 2023 Investor Presentation

As indicated in the chart above, ENFN's investment management SaaS solutions are superior to legacy IT offerings in many ways. As such, it is very likely that Enfusion can increase its TAM penetration rate in the future with its solutions replacing legacy offerings. As a reference, the market's current consensus revenue forecasts for ENFN indicate that the company has the potential to grow its top line by a CAGR of +24.4% for the FY 2023-2025 period.

Separately, there is a reasonably high probability of Enfusion surprising the market in a positive way with its actual FY 2023 financial performance.

Wall Street has a dim view of ENFN's revenue growth prospects in the near term. It is worth noting that 7 out of the 8 sell-side analysts covering Enfusion's stock have lowered their respective FY 2023 sales estimates for the company in the last three months.

The vast majority of Wall Street analysts have chosen to reduce their top line projections for ENFN, even though the company has left its initial full-year FY 2023 guidance of $185-$190 million unchanged with its Q1 2023 results release in mid-May. Furthermore, the market's current consensus 2023 revenue forecast for ENFN is $186.5 million, which is lower than the mid-point of management guidance at $187.5 million. This means that ENFN has a relatively low bar to clear when it comes to beating the market's expectations.

In contrast with the analysts' low expectations, Enfusion noted that it expects "materially better dynamics in the back half of the year" at the company's Q1 2023 results call. Specifically, ENFN has a positive view of its near-term prospects, taking into account "a significant in new hedge fund launches" and the fact that its "qualified pipeline for conversions and upmarket opportunities remains healthy." On the first point raised by ENFN management, there will still be a lot of new hedge funds being established with either a contrarian approach or a specific focus on "hot" themes like AI, even in an uncertain market environment like this.

In summary, ENFN might surprise the market considering the market's low expectations, while its growth runway for the long term is pretty decent based on a comparison of its ARR with its TAM.

Bottom Line

Enfusion, Inc. shares have become much more attractive following its substantial valuation de-rating since its public listing 20 months ago. As detailed above, there are quite a few catalysts in place that could help to re-rate ENFN's stock price and valuations. This explains my bullish view and Buy rating for Enfusion stock.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

This article was written by

Those who believe that the pendulum will move in one direction forever or reside at an extreme forever eventually will lose huge sums. Those who understand the pendulum's behavior can benefit enormously. ~ Howard Marks

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.