Amazon: Growth Reacceleration Can Drive The Stock Price Higher

Summary

- Amazon Web Services (AWS) is expected to benefit from digitization and AI trends, driving growth in the cloud services sector.

- Amazon's retail business growth is anticipated to improve over the coming quarters, supported by enhanced customer experience initiatives and global e-commerce growth.

- The company's valuation appears compelling, considering long-term growth prospects, a favorable cost environment, and an improving global presence.

4kodiak/iStock Unreleased via Getty Images

Investment Thesis

Amazon's (NASDAQ:AMZN) Amazon Web Services (AWS) segment should benefit from secular trends towards digitization and Artificial Intelligence (AI), which should accelerate the migration of businesses worldwide to cloud services from on-premises solutions. The cost-effectiveness of AWS is expected to attract new customers, driving growth in the upcoming quarters as businesses seek cost-efficient ways to upgrade their digital infrastructure. The company’s retail business should also see improvement in growth. During the lockdown, this business’ growth rate accelerated meaningfully. While post-reopening its growth slowed to below historical levels, I expect the growth rate to normalize and improve over the coming quarters. The improvements in consumer satisfaction in Amazon's e-commerce retail business from initiatives such as increased delivery speed and the company's improving global presence, should also support the growth of the retail business and contribute to the overall revenue.

On the margin front, the company is poised to benefit from easing supply chain conditions, a favorable labor market, lower transportation costs, and operating leverage. Furthermore, Amazon is currently trading at a discount compared to its historical averages based on the forward P/E ratio and EV/EBITDA ratio. This, combined with the long-term revenue and margin growth prospects, makes the company an attractive investment.

Revenue Analysis and Outlook

During the lockdown, Amazon has experienced strong sales growth driven by increased demand on its e-commerce platform, reflecting a shift in consumer behavior towards online shopping. Furthermore, the growth of Amazon Web Services (AWS) contributed to the company's overall revenue as businesses worldwide rely on Amazon's cloud technology services to digitize their operational processes. The growth trends slowed post-reopening as there was a pent-up demand for offline shopping and AWS sales were impacted by the slowdown in the technology sector which began last year.

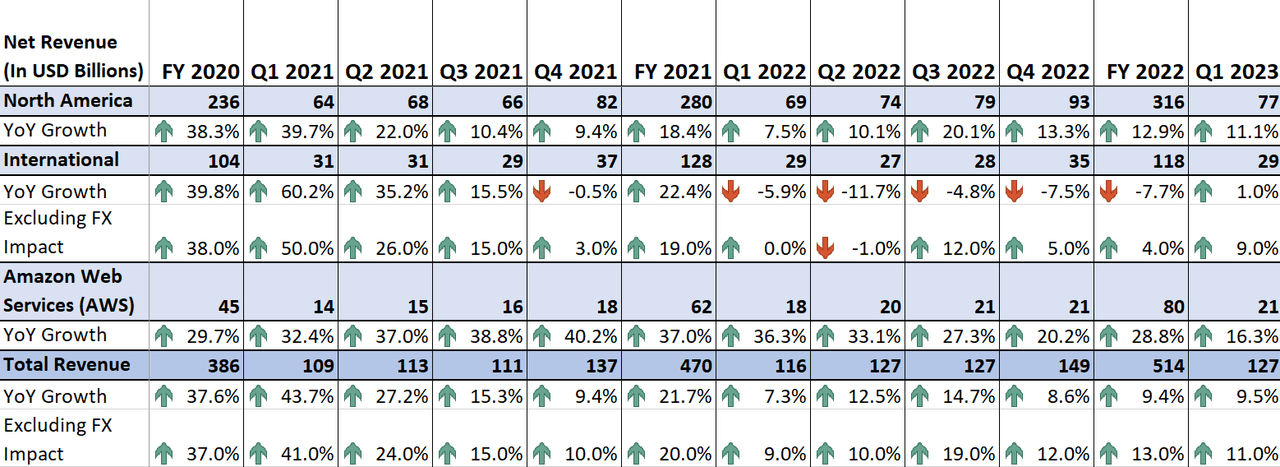

AMZN’s Historical Revenue By Segment (Company Data, GS Analytics Research)

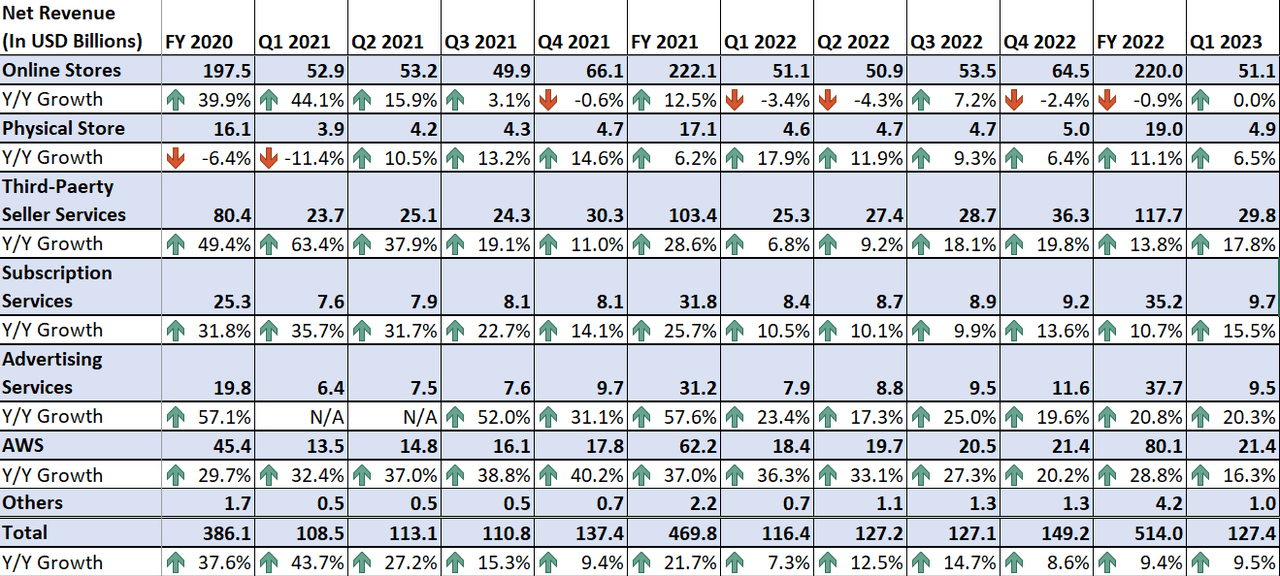

In the first quarter of 2023, Amazon’s YoY growth was slightly higher than Q4 2022 which indicated that sales growth is in the process of bottoming. Amazon continued to experience growth in its global e-commerce retail business and the AWS segment, which showed year-over-year growth of 16% last quarter. Additionally, the company's advertising services for third-party sellers contributed to top-line growth, increasing by 20.3% year-over-year. As a result, Amazon's revenue increased by 9.5% year-over-year to $127.4 billion in Q1 23. Excluding the approximately 210 basis points negative impact from foreign exchange, the company's sales grew by 11% year-over-year on a constant currency basis.

AMZN’s Historical Revenue By Type of Activity (Company Data, GS Analytics Research)

Looking ahead, I believe Amazon is well-positioned to capitalize on the growth of its AWS segment, providing a strong foundation for the company's long-term sales growth. Additionally, the company stands to benefit from its ongoing efforts to enhance the customer experience in its retail business and the promising long-term growth prospects of e-commerce platforms.

Amazon's AWS segment, which offers cloud computing technology services to enterprises worldwide, is currently experiencing a moderation in growth following a period of robust expansion in recent years. It is also facing a slowdown in the end market due to challenging macroeconomic conditions, leading enterprise customers to prioritize cost optimization and reduce expenses for cloud services. However, I view this slowdown as temporary, with the expectation that the macroeconomic challenges will eventually subside. AWS sales should start benefiting from easier comps in the second half of this year as its sales started getting impacted meaningfully by the tech slowdown from 2H22. Furthermore, Amazon is actively collaborating with its existing customers to identify smart measures for optimizing cost structures through AWS, aiming to increase customer retention and foster long-term growth partnerships. While some slowdown is attributed to current cost optimization measures by enterprise customers in the prevailing macroeconomic conditions, the company maintains a robust new customer pipeline, as businesses worldwide increasingly choose AWS and Amazon's cloud technologies to bolster their IT infrastructure for long-term growth.

Several notable contracts won by the company exemplify the strong AWS pipeline ahead. For instance, Southwest Airlines has selected AWS as its preferred cloud provider for a large-scale modernization project as part of the airline's long-term strategy to optimize operations and reduce infrastructure costs. Zurich Insurance Group is also transitioning its enterprise IT infrastructure to AWS over the next three years, encompassing 1,000 applications, to deliver new digital customer experiences and drive automation at scale. BBVA is leveraging AWS's extensive cloud service portfolio to launch innovative financial solutions, supporting BBVA Corporate and Investment Banking in expanding its business through accelerated innovation, cost reduction, rapid scaling, and increased flexibility.

These examples illustrate the robust pipeline of AWS contracts. I anticipate a further acceleration in the pipeline, fueled by the secular trends of digitization and AI. As the world progressively moves towards digitizing processes and services, the demand for cloud technology services should rise to support the expanding digital infrastructures and eliminate the constraints associated with building and maintaining physical data centers. Furthermore, cloud services offer inherent advantages over on-premise solutions, allowing for cost optimization and flexible scaling based on specific business needs. This flexibility provides significant cost efficiencies that are not feasible with on-premise services. According to management, more than 90% of global IT spending is still allocated to on-premise solutions, indicating substantial untapped potential for cloud services. Management also sees big potential in AI. During the last earnings call, the company’s CEO, Andrew R, Jassy also commented:

And I also think that there are a lot of folks that don't realize the amount of nonconsumption right now that's going to happen and be spent in the cloud with the advent of large language models and generative AI. I think so many customer experiences are going to be reinvented and invented that haven't existed before. And that's all going to be spent in my opinion, on the cloud”

So, as enterprise companies continue to enhance their digital infrastructure through building new data centers or upgrading the existing processes and also look for cost-effective measures, migration to cloud services should keep on accelerating which should serve AMZN’s topline growth in years to come.

The company is also focused on further investing in the AWS segment and it recently announced new AWS tools that make generative AI development simple, practical, and economical for businesses of all sizes. These include:

Amazon Bedrock, which is a new managed service that provides customers with the simplest way to build and scale enterprise-ready generative AI applications. Amazon Bedrock makes it simple to gain access to leading foundation models (ultra-large machine learning models on which generative AI is based). Customers will have the flexibility and option to personalize and scale to their specific needs as these models become more accessible.

AMZN also launched AWS-designed Inferentia2 chips. Any Machine learning model undergoes extensive training on a large amount of data i.e. billion-trillion gb of data before the model is launched in production and requires a huge amount of investment to complete this training. For the model to be able to accurately understand and process ranges of emotions, intentions, trends, etc., it requires both training and inferences which Amazon is providing with its AWS through building customized machine learning chips called AWS-designed Inferentia2 chips. These chips are designed specifically for deep learning inference and are network-optimizable for large, network-intensive models. Inferentia2 outperforms other EC2 instances by up to 40% in inference price performance, and Trainium saves up to 50% on training costs.

Lastly, it also developed CodeWhisperer, an application inspired by ChatGPT. It is an AI coding companion that boosts developer productivity by generating real-time code suggestions. Individual developers can use Amazon CodeWhisperer for free and it will be the quickest and most secure way to generate code for Amazon EC2, AWS Lambda, and Amazon S3.

These investments in enhancing the AI offerings of AWS, combined with easing comps and the long-term secular trends favoring cloud technology adoption and migration from on-premise solutions, position Amazon for sustained sales growth. These efforts will help the company navigate the short-term end-market slowdown.

Apart from the AWS segment, the company’s retail business is expected to do well. Amazon's e-commerce retail business is expected to continue to benefit from normalization in demand and focus on improving consumer satisfaction. The company reports its business in three segments - North America, International, and AWS. Before Covid, North America sales grew by 21% Y/Y in FY 2019 and International sales grew by 17% Y/Y (excluding FX) in FY2019. The growth rates meaningfully accelerated in FY2020 due to the lockdown, but slowed significantly as the economy reopened and there was pent-up demand for in-store shopping. In the last quarter, North America’s sales were up just 11.1% Y/Y while international sales were up 13% Y/Y. this is well below what the company saw pre-pandemic. I believe once the pent-up demand for outdoor in-store shopping fades, there will be some improvement in demand for online shopping and we should see North America and International segments grow in the high teens in a normalized environment. The company should also benefit from its efforts to improve customer satisfaction. Regionalizing distribution centers (fulfillment centers) to enhance delivery speed and implementing strategies to boost 1-day and same-day delivery sales are part of these efforts. Additionally, global retail e-commerce is projected to grow significantly in the coming years, reaching approximately $8.1 trillion by 2026 according to Statista. Amazon recognizes that in-store shopping, particularly for daily grocery items, will remain relevant alongside e-commerce platforms. To cater to this demand, the company is testing physical stores and plans to launch Amazon Fresh and Amazon Go physical stores by 2024, offering fresh daily grocery items to consumers. Amazon is also streamlining its retail business portfolio by exiting lower-performing online and physical stores, which will contribute to long-term growth. These initiatives, combined with the growth of the e-commerce business, will support the North America and International segments' growth.

Overall, I am optimistic about Amazon's prospects for future growth. The company is well-positioned to overcome near-term region-specific macroeconomic challenges and should see improvement in growth rates in the years to come.

Margin Analysis and Outlook

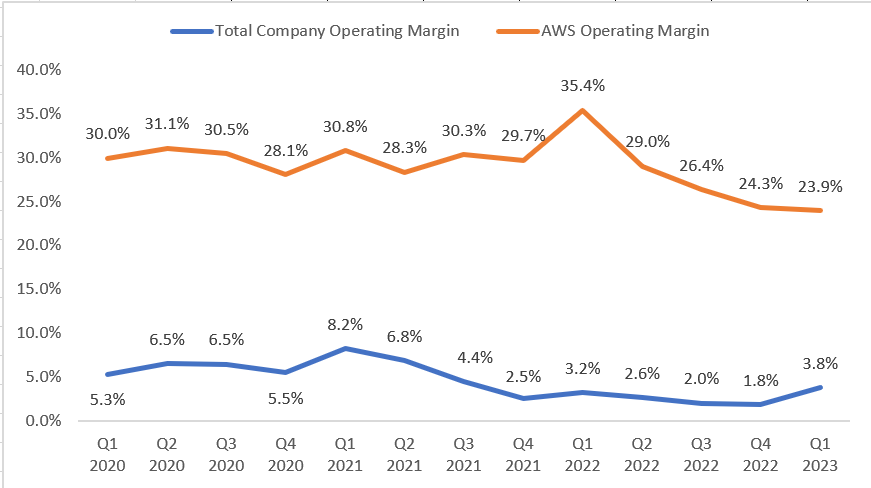

Over the past few quarters, Amazon has faced significant challenges to its operating margins, including adverse foreign exchange movements, labor shortages, substantial investments across various segments to support long-term growth, and inflationary transportation and wage costs. In the first quarter of 2023, these factors continued to affect the operating margin, with an additional impact from an employee severance charge of approximately $470 million. However, the company managed to mitigate these challenges through improved labor productivity, as supply chain conditions and the labor market showed signs of improvement compared to the previous year's quarter. As a result, there was a year-over-year increase of 60 basis points in the operating margin, reaching 3.8%.

AMZN’s Historical Operating Margin (Company Data, GS Analytics Research)

Prior to Covid, for FY2019, the company posted an operating margin of ~5.2%. Looking ahead, over the next couple of years, I expect Amazon to regain its pre-pandemic margins and potentially surpass them. The external cost environment is starting to stabilize as the labor market improves year-over-year and employee turnover decreases, resulting in reduced costs for new hires. Furthermore, supply chain challenges are easing, and transportation costs are moderating, including freight costs. The regionalization of Amazon's fulfillment centers, which were previously centralized, will also help reduce transportation expenses. During the pandemic, the company significantly expanded its distribution centers to meet the surging demand in its e-commerce business. Doubling the distribution capacity in just two years incurred higher investment and transportation costs due to the centralized nature of these centers. However, Amazon is now establishing eight interconnected regions in relevant geographic areas, enabling more self-sufficient operations while still allowing national shipping when necessary. This regionalization strategy will shorten delivery distances, leading to lower transportation and shipping costs and increased productivity.

Alongside reduced transportation costs, alleviated supply chain challenges, and a stronger labor market, the company is actively cutting costs by eliminating lower-performing roles. In the first and second quarters of FY23, Amazon has reduced its headcount by 27,000 employees and is continuously evaluating its employee base to eliminate unproductive costs. These cost-saving measures, coupled with a favorable external cost environment and operating leverage derived from revenue growth, will contribute to margin recovery moving forward. Additionally, the AWS segment, being the primary contributor to Amazon's overall operating profit, should further support margin growth as it continues to expand, and become a higher portion of the overall sales mix. Considering these factors, I maintain an optimistic outlook on the company's margin recovery prospects.

Valuation and Conclusion

Amazon is currently trading at a P/E ratio of 80.22x the FY23 consensus EPS estimate of $1.56 and a forward P/E ratio of 48.37x the FY24 consensus EPS estimate of $2.59. These figures represent a discount compared to its historical 5-year average forward P/E ratio of 190x. Similarly, the company's forward EV/EBITDA and EV/Sales valuation metrics are also below its historical average. The company’s forward EV/EBITDA is 15.75x compared to its 5-year historical average of 22.44x and its forward EV/Sales of 2.5x is also below its historical average of 3.27x.

Considering the long-term growth prospects supported by the growth of the e-commerce retail business and AWS, coupled with a favorable cost environment, the current valuation appears compelling. Furthermore, Amazon's extensive global presence, which continues to expand, positions the company well to navigate any short-term macroeconomic concerns related to reduced consumer spending. As the company focuses on enhancing delivery speed and introducing enticing offers on its e-commerce platforms, it should be able to counterbalance any potential decline in consumer demand in the near term. I believe the stock’s valuation multiples should re-rate going forward as its growth rates improve. Hence, I believe AMZN stock represents a good buying opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)