Dislocation Of The REIT Preferred Market - PFFR

Summary

- Preferreds are fixed income instruments that normally provide strong yield but minimal capital appreciation potential.

- Recently, however, prices have become dislocated and irrational.

- They now have around 50% capital appreciation potential on top of outsized dividend yields.

- Looking for a portfolio of ideas like this one? Members of Portfolio Income Solutions get exclusive access to our subscriber-only portfolios. Learn More »

HaizhanZheng/E+ via Getty Images

Those who follow my work may have noticed a recent concentration of articles about preferreds. It is not that my objectives have changed, I remain focused on maximizing total return. It is that the market has changed. The forward expected return of preferreds has become improperly high due to a price dislocation.

The dislocation

As preferreds sit between bonds and equity in terms of risk, they should provide an expected return that is higher than bonds but lower than common equity.

Usually they do.

But in the last 18 months REIT preferreds have become dislocated such that in many cases the forward expected return exceeds that of its counterpart equity. The source of this dislocation is that the REIT market moved improperly in response to the rapid rise in interest rates. In brief, the current yield moved in parallel without any attribution of value to discount to par.

As a result, REIT preferreds now have current yields that sit at a healthy premium to high yield bonds in addition to nearly 50% capital appreciation potential.

Current yield versus yield to maturity

As you know, interest rates have moved up considerably. Such a move does and should have an impact on fixed income securities. Treasuries dropped in price (yields up) and bonds move with treasuries.

The way a bond moves when interest rates change is that its yield to maturity moves in parallel with the yield curve. For a given bond that trades at, let's say, a 2% premium to treasuries, if prevailing treasuries of a similar duration had a 3% yield to maturity, it would have a YTM of 5%. So then when rates increased and that treasury moved to a 4% yield the bond would have a YTM of 6%.

Of course the risk premium could also change, but generally speaking that is how fixed income securities are supposed to move with interest rates. Indeed, that is largely what happened with the high yield bond ETF (HYG) dropping about 14% in the last 18 months. The same drop should have happened in preferreds, but instead REIT preferreds, as measured by the InfraCap REIT Preferred ETF (NYSEARCA:PFFR), dropped more than twice as much, down about 30%.

SA

I think the market was attempting to use the same yield to maturity math, but the process is a bit weirder with preferreds as they do not have a fixed maturity date. Most have a date at which they can be redeemed at the company’s option, but in this sort of environment redemption is unlikely for most.

Thus, with a theoretically infinite maturity, the yield to maturity becomes the current yield. With a bond, yield to maturity includes the capital appreciation to par through the remaining life. So if a bond with five years left is trading at 90% of par, it is getting roughly 2% return per year from capital appreciation. This is included in the YTM and is why corporate bonds were only down a moderate amount.

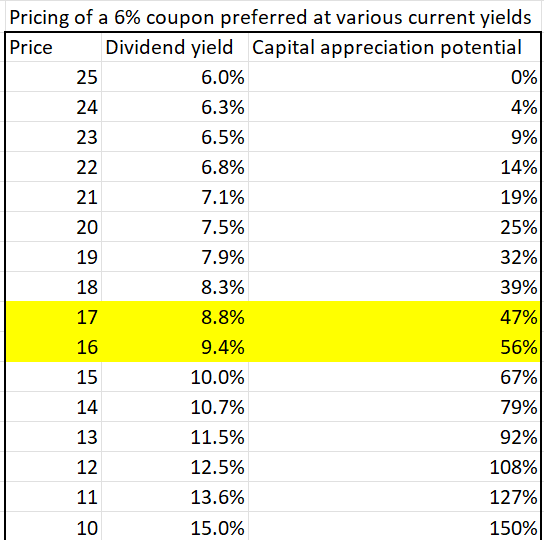

Consider the math on a REIT preferred that was formerly trading at par with a 6% coupon. As interest rates rose, the market now demands a yield of 9%. To get to a 9% current yield the $25 par has to trade down to the mid $16s.

Nominally, a 9% yield makes sense for a fixed income instrument of medium risk in this interest rate environment. However, in pricing preferreds in this way, the market has attributed zero value to the capital appreciation potential. That preferred that now trades at the 9% current yield now has 50% capital appreciation potential.

2MCAC

Surely that has some value.

Attributing no value to 50% capital gains potential is assuming there is no chance the preferreds are redeemed or companies are bought via mergers which triggers change in control clauses resulting in the full $25 payout.

Beyond special events the capital appreciation is likely to happen naturally. Market consensus right now is that the Fed starts cutting significantly in 2024. I don’t know if or when interest rates will go back down, but undoubtedly there is a pretty good chance that interest rates go back down at least a couple percentage points.

Whether you personally believe the chance of any of the above occurrences is 20% or 80%, mathematically that capital gains potential has value. Yet the market is valuing this entire set of preferreds as if they are a current yield and nothing more.

Return comparison in a normalized environment

To make the math simple let us consider the following:

- A bond with a 6% coupon and 9% yield to maturity with five years left

- A preferred with a 6% coupon and 9% current yield

Over the course of the next five years, interest rates move back down to a level where 6% is considered a proper return for a fixed income instrument of the given risk level.

Both the bond and the preferred would return to par value, but the total return is drastically different. For simplicity we will ignore compounding aspects as compounding applies more or less equally to both cashflows.

- The bond returns 45%

- The preferred returns 95%

What is the difference?

The capital appreciation is INCLUDED in the bond’s yield to maturity but it is not included in the REIT’s current yield.

Therefore, it is ridiculous that the market has treated REIT preferred current yields as if they were yield to maturity. The now vast capital appreciation potential is going completely unvalued.

It is extreme mispricing and I am taking full advantage of the dislocation.

Counterargument #1: Do the preferreds involve outsized risk relative to the bonds?

The relative risk between preferreds and bonds has not really changed. Just as there are some bad corporate bonds there are some dangerous REIT preferreds.

The HYG is a risky ETF because it contains things like DISH bonds.

PFFR is a risky ETF because it contains things like the DigitalBridge (DBRG) preferreds

That is just the nature of ETFs. They contain the junk along with the good stuff.

I believe much of this risk can be circumvented by selecting the good REIT preferreds which oddly enough in this environment trade at just about the same yield as the bad REIT preferreds. It is amazing to me how beaten up the preferreds of really high quality REITs with growing cash flows and great balance sheets have gotten.

Counterargument #2: What if interest rates stay high?

While far from my base case, it is possible interest rates will stay high for a long time. In such a scenario the capital appreciation on the discounts to par might take longer to be realized. Even in that case, however, one would still be collecting the outsized dividend which makes it much easier to wait however long it takes for the environment to normalize.

Additionally, there is another work around here in the form of floating rate preferreds. In 2CHYP, the Portfolio Income Solutions portfolio, we balance fixed income preferreds with floating rate preferreds such that the dividends actually go up if interest rates remain high.

With a mixed basket of fixed and floating preferreds, the investor gets a sort of win-win scenario with regard to the direction of interest rates.

Wrapping it up

REIT preferreds are substantially underpriced. The market has mistaken current yield for yield to maturity. Capital appreciation potential of around 50% has a non-zero value.

Opportunistic Market Sale: 20% off for a limited time!

Right now there are abnormally great investment opportunities. With the market crash, some fundamentally strong stocks have gotten outrageously cheap and I want to show you how to take advantage and slingshot out of the dip.

To encourage readers to get in at this time of enhanced opportunity we are offering a limited time 20% discount to Portfolio Income Solutions. Our portfolio is freshly updated and chock full of babies that were thrown out with the market bathwater.

Grab your free trial today while these stocks are still cheap!

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation.

Our Portfolio Income Solutions Marketplace service provides stock picks, extensive analysis and data sheets to help enhance the returns of do-it-yourself investors.

Investment Advisory Services

We now offer a variety of ways to invest with us. Our focus is on maximizing client returns while staying within risk their risk parameters. To learn more about our advisory services you may schedule a 15 minute intro meeting here: https://calendly.com/2mc/intro

Dane Bowler, along with fellow SA contributors Simon Bowler and Ross Bowler, is an investment advisory representative of 2nd Market Capital Advisory Corporation (2MCAC). As a state registered investment advisor, 2MCAC is a fiduciary to our advisory clients.

Full Disclosure. All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of the specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles. It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article. 2MC does not provide tax advice. The material contained herein is for informational purposes only and is not intended to replace the advice of a qualified tax advisor. S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P 2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)

1. Why is the market pricing reit preferreds this way?Possibly:

- they saw what happened with CDR & WHLR preferreds

- they saw what happened to PSB preferreds.with PSB, investment grade preferreds didn't get redeemed, and Blackrock shafted the preferred owners in a big way (from what I gather, I could be wrong). So if the time to maturity is infinity and at the end you may get shafted and not get your capital back, it pays to be more risk averse.