Crispr Therapeutics' Exa-Cel In The Lead For Sickle Cell Disease

Summary

- The Food and Drug Administration bestowed Priority Review for their gene therapy.

- That keeps CRISPR’s candidate ahead of a rival for potential first-to-market.

- Blockbuster status seems certain given the harsh quality of life for sickle cell patients.

Chinnapong/iStock via Getty Images

My initial coverage on CRISPR Therapeutics (NASDAQ:CRSP) suggested waiting for FDA acceptance of exagamglogene autotemcel (exa-cel) Biologics License Applications (BLAs) for severe sickle cell disease ("SCD") and transfusion-dependent beta thalassemia (TDT). Then on June 8, the Agency granted a shorter 8-month review for SCD and Standard Review (12 months) for TDT and assigned Prescription Drug User Fee Act (PDUFA) target action dates of December 8, 2023, and March 30, 2024, respectively. Accordingly, traders “selling the news” the next trading day led to high volatility. With shares underperforming the broad market 12% since my previous article’s publication, it may be time to start accumulating CRSP.

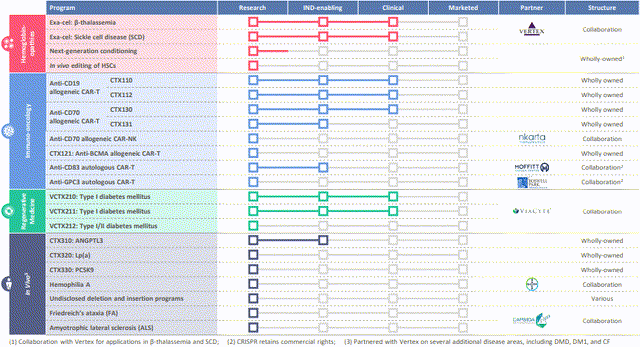

Clustered regularly interspaced short palindromic repeats and CRISPR-associated protein 9 (CRISPR/Cas9) gene editing technology enables precise modifications to genomic DNA. SCD and TDT are distinct diseases caused by different genetic mutations in the hemoglobin gene, resulting in impaired oxygen transport and severe anemia. These two are among CRISPR Therapeutics' broad portfolio of therapeutic programs that span across inherited blood disorders, oncology, regenerative medicine and rare diseases (Figure 1).

Figure 1. CRISPR Therapeutics pipeline, Q1 2023

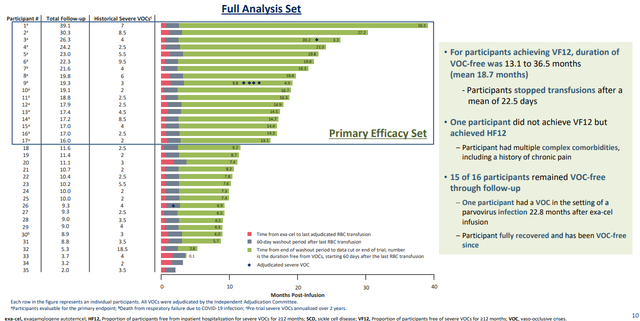

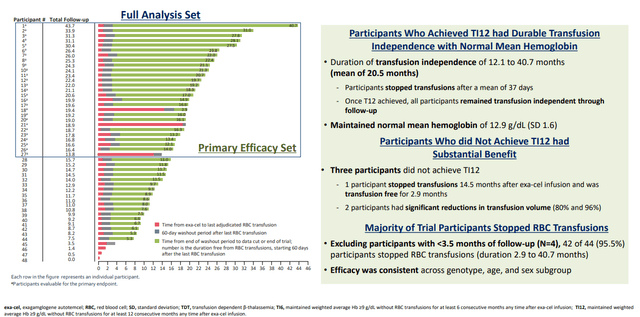

The BLA, as well as the corresponding Marketing Authorization Application in Europe, are supported by data from ongoing Phase 3 studies (CLIMB-111 and CLIMB-121). The latest results of a pre-specified interim analyses were shared in an oral presentation on June 9 at the 2023 Annual European Hematology Association ("EHA") Congress (Figures 2 and 3), including records from 8 new patients (the 4 bottom rows in each). TDT patients require regular blood transfusions, while SCD patients experience complications such as the painful and life-threatening vaso-occlusive crisis ("VOC") due to the characteristic abnormal shape of their red blood cells (RBCs). The CLIMB studies demonstrated that exa-cel eliminated SDC-induced VOC and reduced the need for RBC transfusions in TDT patients.

Figure 2. Sickle Cell Disease: Participants Who Achieved Freedom from VOC (VF12)

Figure 3. Transfusion-dependent Beta Thalassemia: Participants Who Achieved Transfusion Independence (TI12)

Of the 83 patients who received exa-cel, 35 had SCD and 48 had TDT. Seventeen SCD patients were evaluable for the primary and key secondary endpoint, of which 16 (94.1%) achieved the primary endpoint (“PEP”) of freedom from VOCs for at least 12 consecutive months (VF12) (95% confidence interval [CI]: 71.3%, 99.9%; P=0.0001). Mean duration of VOC-free lasted 18.7 months, to as long as 36.5 months. All patients achieved the key secondary endpoint of avoiding hospitalizations related to VOCs for at least 12 consecutive months (HF12) (95% CI: 80.5%, 100.0%; P<0.0001). The one patient who did not achieve VF12 did achieve HF12 and was considered sicker. One patient who achieved VF12 had a VOC 22.8 months after exa-cel infusion during a parvovirus infection; once recovered, this patient has been VOC-free. In the SCD cohort, there were no serious adverse events (SAEs) considered related to exa-cel.

Of the 27 evaluable patients with TDT, 24/27 (88.9%) achieved the PEP of transfusion-independence for at least 12 consecutive months (TI12) and the secondary endpoint of transfusion-independence for at least 6 consecutive months (TI6) (95% CI: 70.8%, 97.6%; P<0.0001). The average duration of transfusion-independence was 20.5 months and the maximum was 40.7 months. Of the 3 patients who did not achieve TI12 at data cutoff, one patient has been transfusion-free for 2.9 months. The remaining 2 patients showed substantial reductions (80% and 96%) in transfusion volume from baseline.

Two of the 48 TDT patients had SAEs considered related to exa-cel. One patient had four SAEs: hemophagocytic lymphohistiocytosis (HLH), acute respiratory distress syndrome and headache, and idiopathic pneumonia syndrome (this last was considered related to both exa-cel and busulfan). HLH is rare, but happens during transplants and is usually triggered by an infection, so all 4 were probably interrelated; all resolved. The other patient had SAEs of delayed neutrophil engraftment and thrombocytopenia (related to both exa-cel and busulfan), which resolved. Overall, exa-cel’s safety profile is consistent with myeloablative busulfan conditioning and autologous hematopoietic stem cell transplantation (HSCT).

Lifetime medical costs of $1.7 million through age 64 could be attributed to SCD, according to a study on commercially insured individuals published in January. In 2019, almost 16,000 adult patients who were hospitalized with a primary diagnosis of sickle cell crisis and received RBC transfusions during their inpatient stay. A VOC by itself is potentially fatal, but transfusions are discouraged for simple VOCs, so these are serious cases with at least anemia and possibly stroke or multiorgan failure. These economic burden and hospitalization numbers highlight the need for a functional cure for SCD.

HSCT used to be the only curative option, but is not widely available or commonly performed in the US for SCD due to several risks and challenges, chief among them are age restrictions the low availability of suitable donors. Allogenic HSCT, typically for patients with a matched sibling donor, costs more than double that of autologous transplants for patients at the ideal pediatric age range ($585k vs $244k through 100 days in 2017 USD). After the procedure, long-term immunosuppression is still necessary to prevent or treat the immunological complications. As mentioned previously, the Institute for Clinical and Economic Review (ICER), a private entity that creates cost analysis reports used by insurance companies to deny access for patients to expensive medical treatments, found a $2 million price tag to be acceptably cost-effective for exa-cel and bluebird bio's (BLUE) competing lovo-cel. And the only reason ICER assigned a better Evidence Rating of B+ to lovo-cel was due to the larger clinical trial sample sizes than exa-cel (35 vs 7) that were available for comparison at the time. With the new EHA data, exa-cel evens the field, especially since unlike CRISPR Therapeutics’ report, bluebird’s was an unprespecified interim analysis.

To conclude, the set PDUFA dates greatly de-risks the stock; the earlier date for SCD is fair as genetic mutation correction for TDT is much more complex and may need the extended review. It is now also less likely that bluebird can overtake CRISPR Therapeutics for first-to-market. A straightforward calculation puts $32 billion at stake ANNUALLY from high-risk patients, diminishing over the years of course as more are cured, as was the case with hepatitis C. Conservatively, that gives partner Vertex Pharmaceuticals (VRTX) $9.6 billion (60%) and $6.4 billion to CRSP in peak U.S. sales under the Vertex Joint Development Collaboration Agreement. These market figures don’t even account for people who suffer from multiple but simple VOCs who would be willing to eliminate further pain and risk of VOCs from their lives. Then consider it only takes 500 patients to make exa-cel a blockbuster, a demand that a minimum 15 qualified treatment centers they will likely have operational at launch can easily handle.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRSP, BLUE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am Long VRTX

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.