WCLD: A Storm Brewing For Cloud Stocks

Summary

- Tech stocks, including WCLD, appear overbought and may face a potential reversal in the ongoing trend.

- The fear of missing out has driven a surge in market inflows, leading to extreme overbought conditions in tech stocks.

- Stretched valuations and positive real rates make it difficult for bulls to maintain current levels, potentially leading to a repricing of equities.

TU IS

Investment Thesis

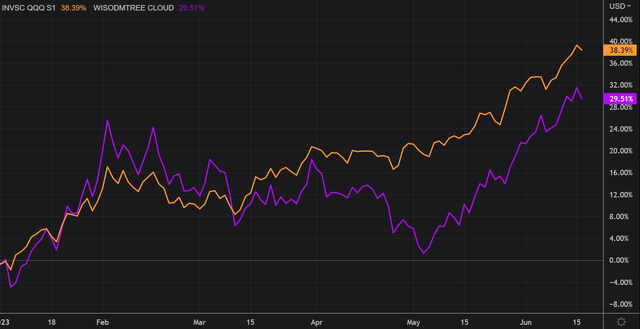

Cloud stocks have faced a challenging year, struggling to keep up with the Nasdaq's dominance driven by the AI-everywhere trend. While The WisdomTree Cloud Computing Fund ETF (NASDAQ:WCLD) has been catching up since mid-May 2023, I believe we are now entering a dangerous phase for the bulls where Cloud stocks, alongside the market, appear overbought. The surge in QQQ's price, fueled by the fear of missing out of market participants has led to overbought conditions, raising concerns about a potential reversal in the ongoing trend. As a result, I find Cloud and tech stocks unattractive for long-term investors at the moment. With WCLD ETF's stretched valuations and positive real rates, it will be challenging for bulls to maintain current levels, potentially leading to a repricing of equities.

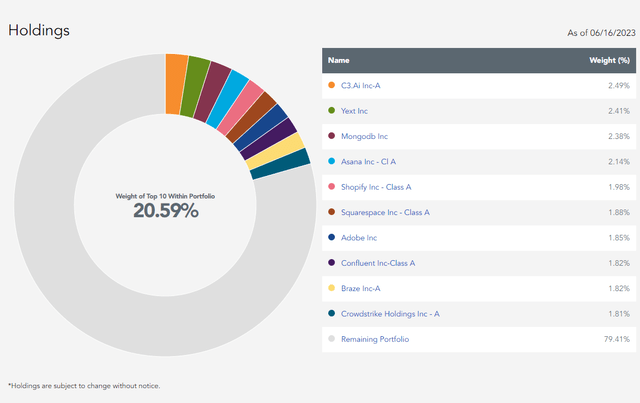

About WCLD

The WisdomTree Cloud Computing Fund ETF is an ETF designed to provide exposure to the rapidly growing cloud computing industry. WCLD aims to track the performance of the BVP Nasdaq Emerging Cloud Index. The fund's strategy revolves around investing in companies at the forefront of the cloud computing revolution. It holds a diversified portfolio of global cloud computing companies, including both established leaders and emerging players in the industry. The constituents of the index are selected based on factors such as revenue generation from cloud computing, market capitalization, and liquidity.

WisdomTree

As part of an investor's portfolio, WCLD can serve as a strategic allocation to the technology sector and specifically the cloud computing industry. With the increasing adoption of cloud services by businesses and consumers alike, cloud computing companies are expected to experience robust growth in the coming years. WCLD allows investors to participate in this growth and potentially benefit from the performance of leading cloud companies.

Stormy Clouds Ahead For Bulls

In light of the ongoing dominance of the AI-everywhere trend that pushed the Nasdaq higher from its October 2022 lows, cloud stocks have faced a challenging year and have struggled to keep pace with the overall index. In fact, WCLD has played catch up for most of this year until mid-May 2023 when it started outperforming the Nasdaq. Although both WCLD and the Nasdaq 100 have delivered impressive year-to-date returns of 30% and 38% respectively, I believe we're now reaching a dangerous area where Cloud stocks look overbought, alongside the market. This prompts the question of whether we are about to witness a potential reversal of the ongoing trend that could take WCLD lower into year-end.

Refinitiv Eikon

In my opinion, QQQ is frothy at current levels. Recent months have seen a surge in its price, driven by the fear of missing out on what many perceive as the start of a new bull market. The Relative Strength Index (RSI) now indicates an extreme overbought condition, which historically has preceded declines in the subsequent weeks. I see no reason why this time would be any different, considering the excessive proportions this current rally has reached.

Refinitiv Eikon

A similar situation arises with WCLD, which also exhibits extreme overbought levels, albeit with a relatively smaller rally compared to the Nasdaq 100 since the Q3 2022 lows. At such elevated levels, it will become increasingly challenging for bullish sentiment to sustain the upward momentum, while bearish sentiments will likely emerge, rendering the market more unstable.

Refinitiv Eikon

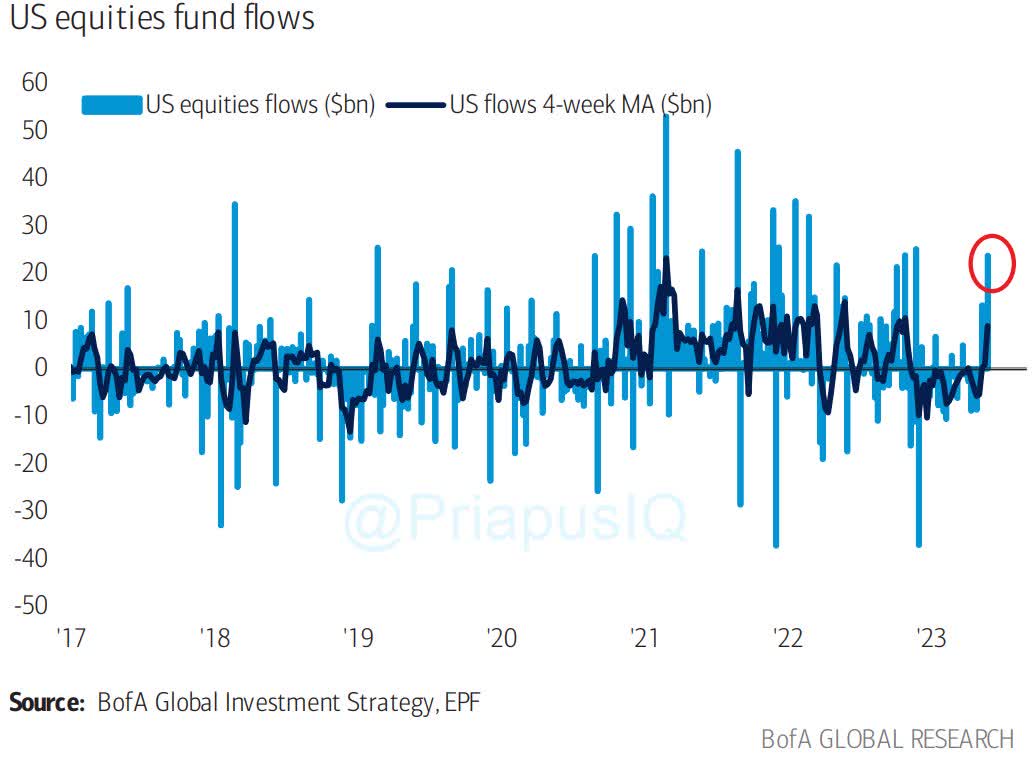

As anticipated, there has been a surge in market inflows, as participants entered the year with substantial cash allocations and are now chasing the upward move. Bank of America reports that US stocks have witnessed an inflow of $38 billion in the last three weeks, marking the strongest momentum since October 2022. Similarly, tech funds have seen $19 billion flowing in over the past eight weeks, representing the strongest momentum since March 2021.

Bank of America

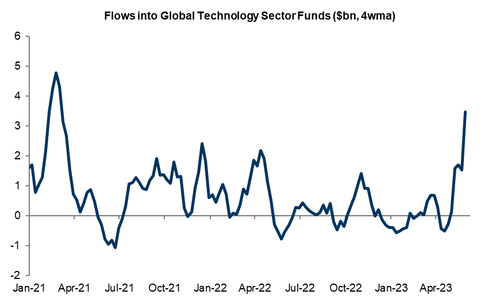

Goldman Sachs has expressed a similar view. Their 4-week moving average global Tech Flows tracker recorded the largest weekly inflow on record, totaling $8.547 billion. In my view, this epitomizes the psychological concept commonly known as the fear of missing out (FOMO), which often prevails near local tops in bear markets before a subsequent leg down. It serves as an indication that we stand at a critical juncture, where a bullish trend is nearing its end and selling pressures are accumulating, leading to an eventual decline in prices.

Goldman Sachs

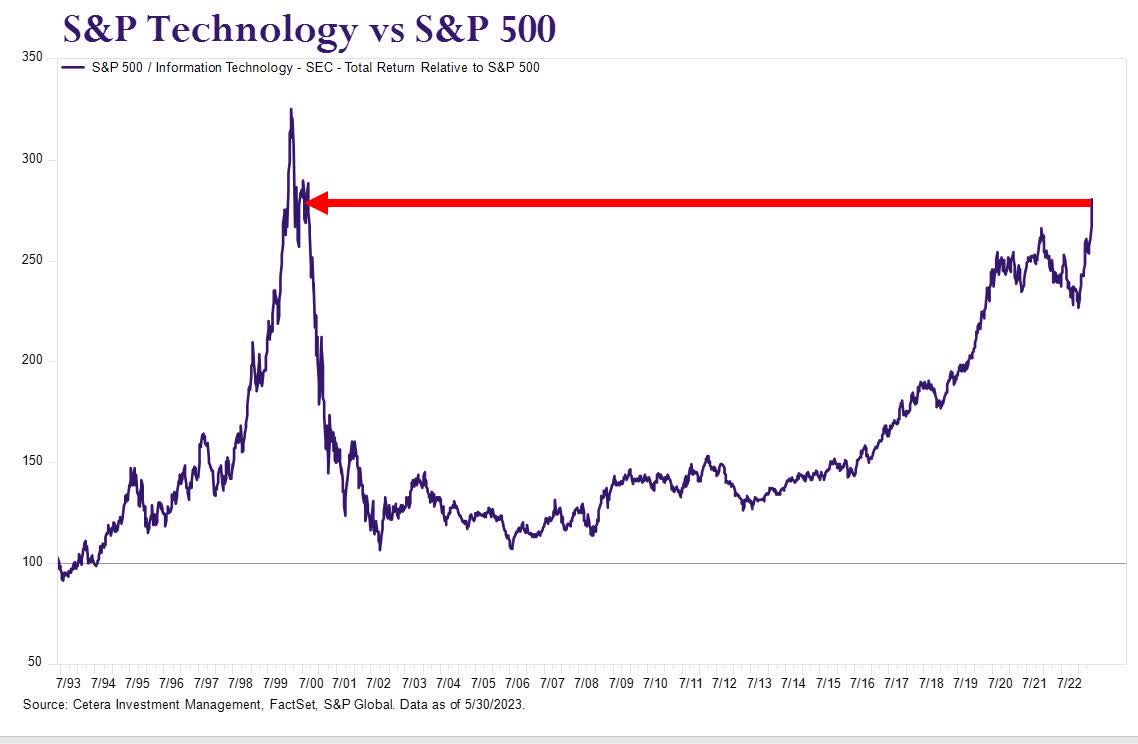

Finally, in my opinion, I find Cloud and, more generally, tech stocks to be unattractive for long-term investors currently, considering their substantial outperformance compared to the S&P 500. This chart from Cetera effectively illustrates the contrast between technology stocks and the broader market. It also shows how far the tech trade versus the rest of the market has run.

Cetera Investment Management

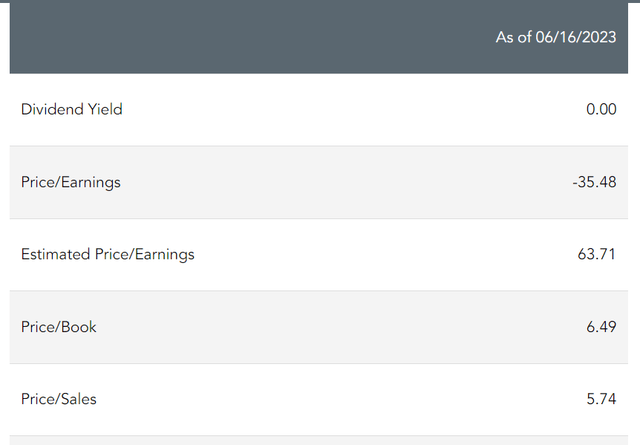

However, as with most things in markets, nothing lasts forever. At 63x forward earnings, 6x sales and over 6x book value, it will become increasingly difficult for bulls to maintain current levels on WCLD, particularly now that the entire yield curve shows positive real rates. This has been in the past a massive bear flag, and I expect equities to eventually reprice accordingly.

WisdomTree

Key Takeaways

Cloud stocks have had a great year in absolute terms, with WCLD delivery a staggering 30% return. However, I believe that WCLD is now in overbought territory, prompting concerns of a possible reversal in the ongoing trend. Given the stretched valuations of Cloud stocks and positive real rates across the curve, upholding current levels will prove challenging for the bulls, leading to a repricing of equities to lower levels.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.