JD.com: Seriously Undervalued And Unloved

Summary

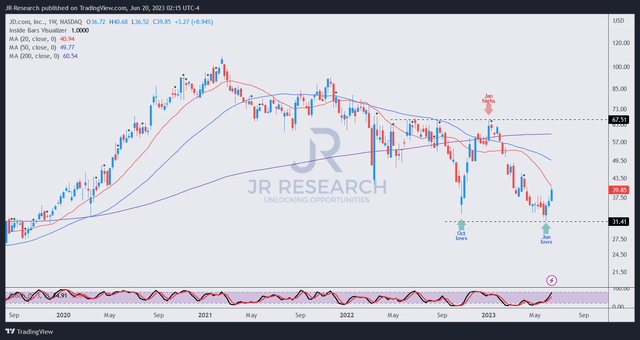

- JD.com stock surprised the market as it went below its October lows at its recent selloff.

- The Chinese government's attempts to bolster the economy have not yet led to a strong recovery in consumer sentiment and retail sales.

- Investors are pricing in significant pessimism that China could face substantial challenges in reinvigorating its economic recovery.

- However, JD's valuation is highly attractive, and its price action is constructive.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

Andrew Burton/Getty Images News

Investors in JD.com, Inc. (NASDAQ:JD) were likely hammered into submission as JD re-tested lows last seen in October 2022 recently. As such, weak investors who loaded JD, as they expected to leverage on China's leading first-party or 1P online retailer, likely fled, as they didn't expect JD's recovery to make such a disastrous turnaround, heading back into the abyss.

I also didn't expect JD to suffer such a battering as it recovered remarkably through its January 2023 highs. While a bull trap or false upside breakout at that level was expected to cause a pullback, I didn't anticipate a re-test of its October lows as investors fled in a hurry.

I assessed that the sellers had gotten it right. China's nascent economic recovery has failed to materialize according to initial expectations, putting a further recovery in the second half at greater risk.

Given JD.com's inherently lower profit margins due to its 1P-heavy model, market operators likely needed to reflect higher execution risks to account for more challenging macroeconomic headwinds.

The Chinese government has recently attempted to bolster the economy, as China's central bank acted last week to cut the rate on its "seven-day repurchase operations from 2% to 1.9%, the first decrease in short-term rates since August."

The People's Bank of China followed up with more cuts this week, reducing the rates on its one-year and five-year loan prime rate, or LPR, to bolster the faltering property market. However, the move could have disappointed the market, as previous forecasts called for a more aggressive cut, given the challenges that China's real estate market is facing.

I assessed that investors need to determine if it's sufficient to stem the recent slide and negative sentiments in China's property market, which is fundamental to a recovery in consumer sentiments.

Given the challenging state of the global economy, China needs to rely more on domestic consumption to boost its economic recovery. However, consumers' expectations of the wealth effect from a more robust property market recovery have been missing, leading to a more subdued recovery in retail sales (12.7% growth) recently, which fell short of the consensus estimates (13.7%). It also came well below April's 18.4% gain, as investors worry whether the momentum could fall further.

JD has a significant moat through its well-integrated logistics business that's best-in-class and one of the critical sources of its competitive advantages. However, the company's relatively low profitability built on the back of its 1P model suggests that its fortunes are intricately tied to the cyclical forces of China's recovery.

Moreover, JD lacks a secular cloud computing growth driver, unlike Alibaba (BABA), which could have diversified its business model further with more exposure to less cyclical headwinds.

With that in mind, I believe the market reaction to JD's highs to reflect higher cyclical uncertainty in China's recovery is justified. However, that doesn't mean that I think the extent of its hammering is reasonable, which I assessed as too harsh.

JD's valuation remains attractive with a free cash flow or FCF yield of 6.7%, well above its 10Y average of 4.3%. The company's robust cash and short-term investments balance of $28.7B provides a significant source of liquidity for further expansion and investment opportunities. Its restructuring plans are also moving constructively, expected to lift its profitability further.

As such, I believe JD.com's growth and margin expansion story is still very much in the earlier stages, even though it requires superb execution, hampered by a relatively weak Chinese economy.

However, with the headwinds likely baked into its valuation at the current levels, I assessed that JD's recent recovery is still constructive for investors to add more, even if they missed its April lows.

JD price chart (weekly) (TradingView)

Despite the pessimism that led to JD's lows in April, I gleaned a bear trap or false downside breakdown, suggesting dip buyers returned to defend JD from a further selloff.

As such, I assessed that it lent further credibility that JD could have bottomed out (hopefully) this time following the double dip, with October's lows as the first significant dip.

Still, I gleaned that buyers have returned with more caution this time after getting burned if they chased its previous momentum surge leading to its January highs.

However, that means that investors who missed adding more exposure over the past two months are still afforded a relatively attractive opportunity to capitalize.

Rating: Buy

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.