XLI: The Big Short Bet On Industrials

Summary

- The S&P 500's current rally is unsustainable as it is led by a few megacap tech stocks, but proponents of a new bull market argue that the rest of the market will catch up.

- The Industrial sector has seen an 8% rise in the last month, which bulls interpret as evidence of a soft landing and a broadening of the rally.

- However, the high short interest in the Industrial sector suggests that the rise could be due to short covering, making the rally more likely to be a bear market rally.

Torsten Asmus

The narrowly led "bull market"

There is currently a discussion whether we are in new bull market or still in bear market rally. Given that S&P 500 is now up over 20% since the October lows, technically we are in a new bull market.

However, the main criticism of the current rally is the fact that it has been very narrowly led by the 7 megacap tech stocks. Specifically, the equal-weight S&P 500 (RSP) is up by 5% YTD, while the market-cap S&P 500 (SPY) is up by 15% YTD, and specifically the Tech sector (XLK) is up by staggering 40% YTD.

Thus, the current rally is clearly unsustainable since it's led by the few megacap tech stocks. Yet, the proponents of the new bull market thesis are suggesting that the rest of the market will start catching up to the tech stocks - in other words the rally will broaden, and that's what's going to drive the bull market higher.

Specifically, Goldman's Kostin upgraded S&P 500 to 4500 specifically based on the catch-up market broadening thesis:

Our unchanged 2023 EPS forecast of $224 assumes a soft landing and is above the top-down consensus of $206. GS Economics assigns a 25% probability of recession in the next 12 months, compared with 65% for consensus. The P/E multiple of 19x is greater than we expected, led by a few mega cap stocks. But prior episodes of sharply narrowing breadth have been followed by a "catch-up" from a broader valuation re-rating.

The broadening rally?

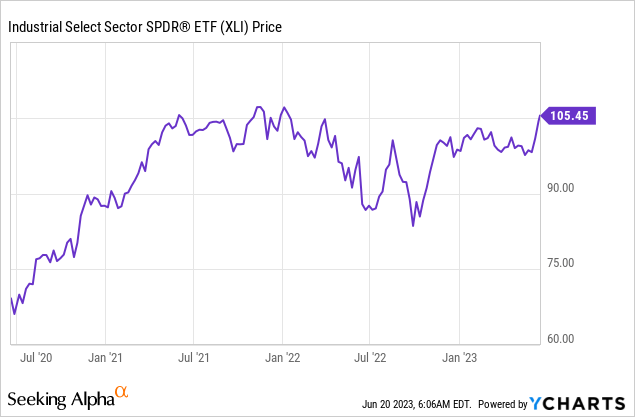

In support of the bullish thesis, the rally has broadened in June. Specifically, the Industrial sector, Industrial Select Sector SPDR® Fund ETF (NYSEARCA:XLI) made a strong move higher by rising 8% over the last month. On the surface, this is a very positive sign, since the Industrials are considered to be a cyclical sector, rising with economic growth.

The key bearish argument is that there is an imminent recession, given the inverted yield curve, and the earnings predictions are not pricing a potential recession, thus S&P 500 is likely to sharply fall as the earnings get downgraded. In fact, based on the Real Gross National Income measure, the US economy has been in a recession since Q4 2022. The industrials are cyclical, heavily dependent on global economic growth, thus during a recession the industrials generally fall as the earnings decrease.

Thus, the bulls interpret rise in the Industrial sector over the last month as evidence of soft landing, which supports the broadening of the rally and the new bull market thesis.

Here is the chart of XLI:

As the chart above shows XLI has a spike in June and it's currently near the all time levels from December 2022. The breakout to the new high could be a positive signal that indicates a broadening of the bull market beyond the few megacap tech stocks.

Or short covering?

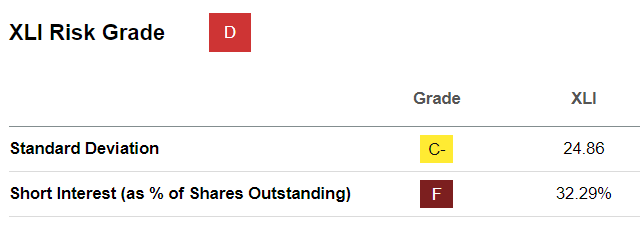

However, there is one striking statistic, the Industrials have a very large short interest at 32%:

Seeking Alpha

Thus, the Industrials are vulnerable to a massive short covering rally, and this is an important variable to consider.

Specifically, the question is whether the large move upside in XLI is really a fundamental move signaling a broadening of the bull market rally due to global economic recovery or soft landing, or the move higher is due to the short covering.

The short covering rally would support the bear market rally thesis, which is entirely based on short covering, supported by the technical trend following, and the random retail buying based on sentiment.

Why short XLI?

As previously mentioned, the Industrials are considered a cyclical sector, and we are likely facing an imminent recession, thus it makes sense to short industrials, especially given that the price is near all-time-high.

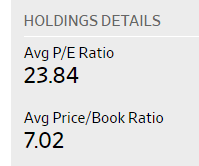

Further, the Industrials are overvalued, with the average PE ratio at almost 24 for all ETF holdings, which supports the big short.

Wall Street Journal

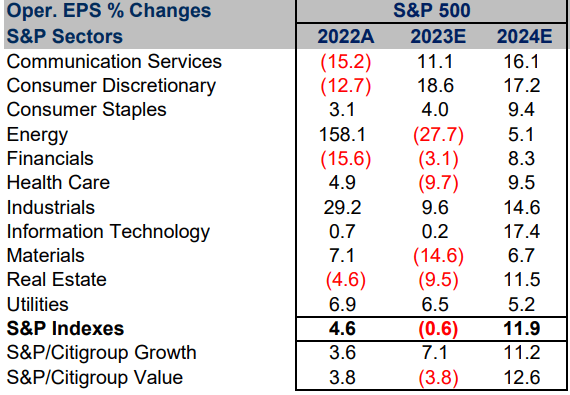

Further, the analysts currently predict that the Industrials will have a 9.6% operating EPS growth in 2023, and 14.6% in 2024. Obviously, these predictions don't account for a recession. Thus, there is a possibility for a significant earnings downgrade as the recession becomes obvious.

CFRA

The key issue comes down to where there will be a recession or not, and how long/deep the recession will be. Given that the Fed is still expected to increase interest rates due to sticky core inflation, and the expected lagged effects of the 5% increase in the Federal Funds rate since March 2022, the recession seems like a certainty.

The Industrial sector ETF holdings

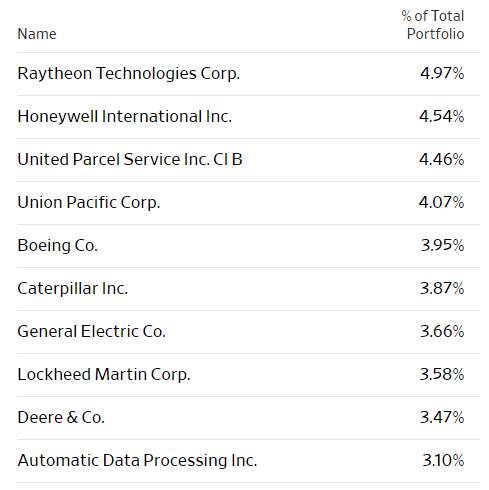

The Industrial sector ETF has 80 holdings, with top 10 holdings account for around 38% of total. The holdings include the defense companies, transportation, construction and agricultural machinery, and general diversified industrials. These are the top 10 holdings:

Wall Street Journal

Obviously, the XLI held well since the December 2021 top, given that 1) the war in Ukraine increase demand for weapons and 2) there was no actual recession in 2022, which supported the XLI earnings growth at almost 30% in 2022.

Implications

The narrowly led bull market needs a broadening to continue, which requires a soft-landing scenario or even growth acceleration. However, given the high probability of a recession, the broadening will be difficult to achieve. The move higher in XLI in June is more likely due to short covering, given the high short interest, which could be deceiving to market bulls.

Thus, the short bet on XLI makes sense, given the optimistic earnings predictions and overvalued PE ratio. However, the current market dynamic supports the short-covering thesis, as many bears are forced to cover, and some bears even turning bullish. For this reason, I don't recommend shorting XLI, but I would sell it if I owned it in advance of the likely recession.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of SPX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.