An Updated View On Whirlpool

Summary

- Whirlpool Corporation's stock remains a "hold" due to macroeconomic headwinds and poor consumer sentiment.

- Our fair value estimate for WHR's stock has shifted lower to between $90 and $123 due to a higher estimated weighted average cost of capital.

- Improvement in consumer confidence, sales, and decreasing inventory levels and accounts receivable are needed before considering upgrading the stock to a "buy" rating.

400tmax/E+ via Getty Images

Whirlpool Corporation (NYSE:WHR) manufactures and markets home appliances and related products. It operates through four geographic regions: North America; Europe, Middle East and Africa; Latin America; and Asia.

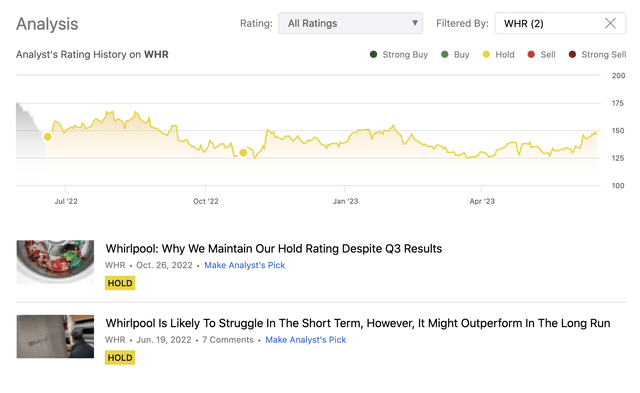

In 2022, we have published two articles about the company on Seeking Alpha, rating WHR stock as a "hold" both times.

On the positive side, we mentioned that WHR has been paying safe and sustainable dividends for a long period of time and showed commitment of returning value to its shareholders. However, we highlighted the importance of the macroeconomic headwinds, which have been negatively impacting the firm's financial performance in the past quarters. These headwinds included poor consumer sentiment, elevated levels of inflation, the increasing interest rates and the high raw material/ transportation costs.

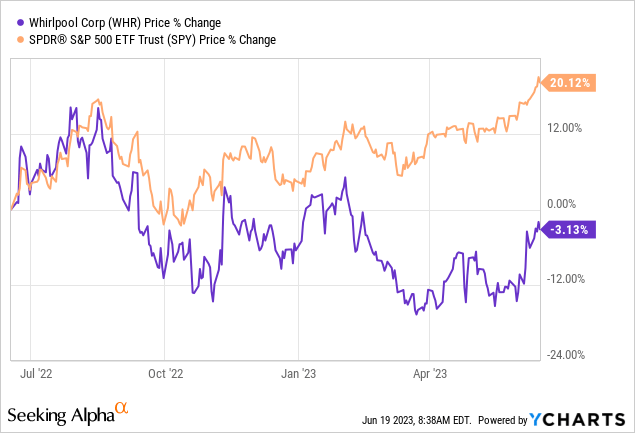

Since our first writing, the price of Whirlpool indeed has not moved much, and therefore it has significantly underperformed the broader market, which has gained more than 20% in the same period.

Today, we are revisiting WHR's stock to give an updated view on the valuation and the range of fair value that we estimated in our previous article based on the Gordon Growth Model. Then we will touch upon the macroeconomic environment and its change since 2022.

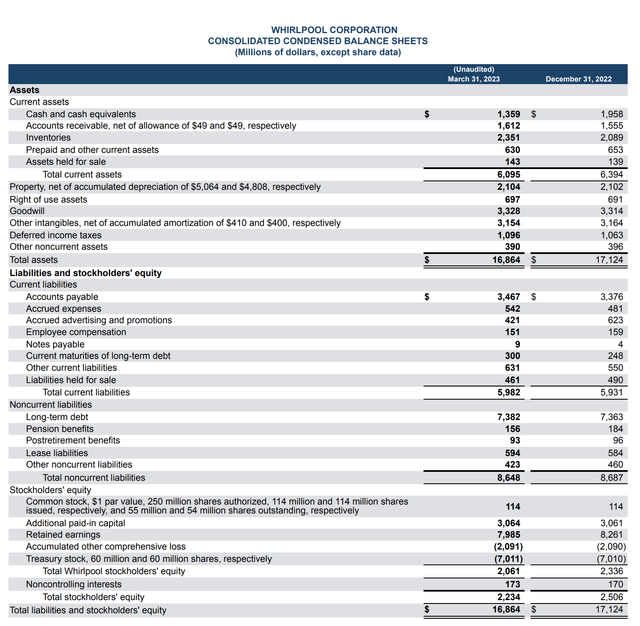

Valuation

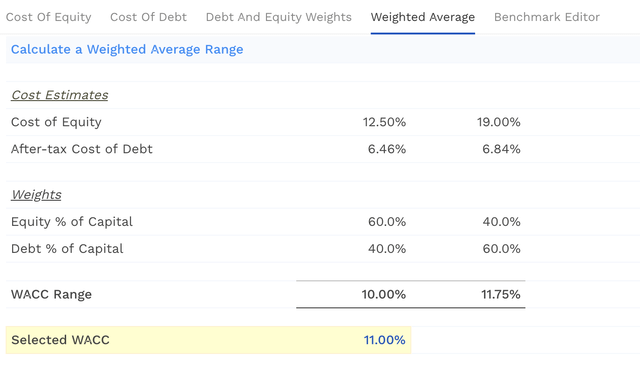

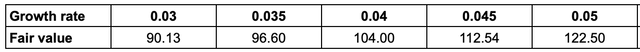

In 2022 October, we have established a range of fair values from $115 to $173. The range has been based on a required rate of return of 9.25% - equivalent to the firm's weighted average cost of capital at that time - and a perpetual growth rate assumption between 3% to 5%.

We believe that the growth assumptions established at that time were realistic and remain realistic as of today.

On the other hand, the weighted average cost of capital estimate has increased from 9.25% to 11%. This has been primarily resulting from the increase in the cost of equity capital. We also need to keep in mind that, if the firm plans to refinance any of its loans in the near future, it may be on worse terms than previously, due to the high interest rate environment.

An increase in the cost of capital naturally leads to a higher required rate of return and therefore a lower fair value based on our dividend discount model. Implementing this new discount rate yields a fair value range of $90 to $122 about 25% lower than our previous estimate.

As the stock is currently trading around $146 per share, it is more than 20% higher than the high end of our current estimate. Please, note that these estimates do not take into consideration the positive impact of the share buybacks and near term growth potential, therefore the lower end of our range may be too pessimistic.

Macroeconomic environment

Consumer sentiment

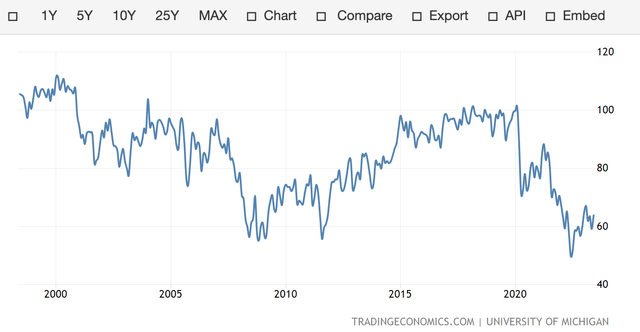

In our previous articles we have put emphasis on the consumer confidence. We underlined that during times of low consumer confidence, the demand for discretionary goods is likely to fall, as customers are more reluctant to spend money on larger, durable goods.

U.S. Consumer confidence (tradingeconomics.com)

During the past 12 months, the level of consumer confidence has somewhat increased in the United States, but not materially. The sentiment is still far below the pre-pandemic levels and continues to remain close to the 2008-2009 levels. We believe that in the near term, this is likely to keep creating headwinds for the firm.

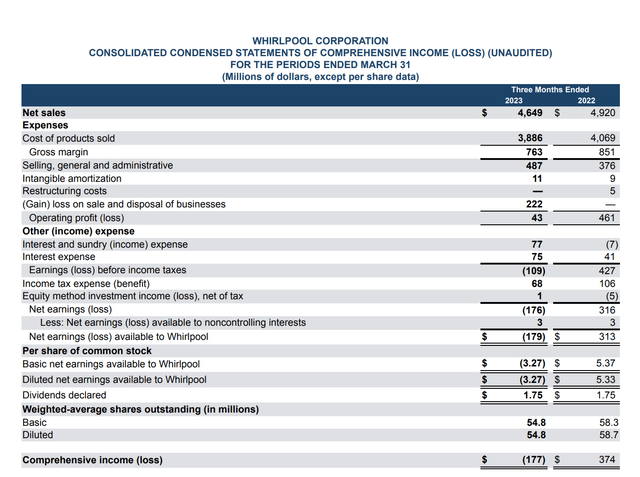

At this point, we need to mention that in the second quarter of 2023 WHR's stock rallied materially after the announcement of the quarterly results of Q1. The firm has beaten analyst estimates both in terms of revenue and EPS.

We have to, however, appreciate that the results were not that appealing. Revenue has declined year over year, diluted EPS also came in negative and the firm recorded a comprehensive loss of $177 million.

At the same time, despite the declining revenue, accounts receivable have increased as well as the inventory levels. These may all be indications that the overall demand for WHR's products is not yet improving.

In order to get a more bullish outlook on the stock, we would like to see the consumer sentiment significantly improving and the accounts receivable as well as the inventory levels decreasing.

FX environment

On the positive side we have to mention that the FX environment since last year has somewhat improved. As a substantial amount of WHR's sales are generated outside of the United States, exchange rate fluctuations can have significant impacts on the company's financial results.

Since its peak in 2022, the USD index has, however, declined substantially, potentially positively impacting the firm's financial performance in the near term.

To sum up

The headwinds generated by the current challenging macroeconomic environment do not seem to have improved significantly over the past 12 months. Consumer confidence has remained poor and the interest rates are still much higher than before.

Further, due to the higher estimated weighted average cost of capital, our fair value estimate for WHR's stock has shifted even lower, by as much as 25%. Our current fair value estimate is between $90 to $123.

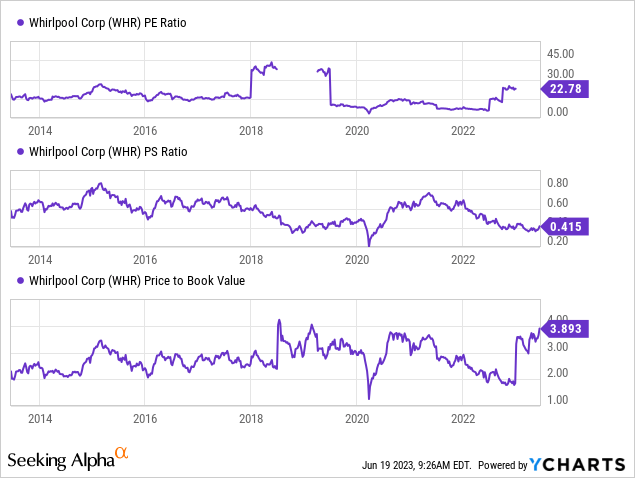

Based on a set of traditional price multiples, we also believe that the firm may be overvalued, as they do not seem to fully reflect the macroeconomic headwinds that WHR has to face.

Looking forward, we believe that as long as the consumer sentiment is poor, the demand for WHR's products is not likely to improve meaningfully. We would like to see the consumer confidence improving, sales increasing and inventory levels as well as accounts receivable falling, before we would consider upgrading the stock to a "buy" rating.

For these reasons, we maintain our "hold" rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.