Xometry: Revolutionizing Manufacturing With AI But Near Term Challenges Persist

Summary

- Xometry aims to become the manufacturing industry's equivalent of Amazon by utilizing AI to offer immediate pricing for parts and assemblies sourced globally.

- Despite facing near-term challenges, management remains optimistic about revenue growth, international expansion, and achieving positive adjusted EBITDA in the fourth quarter.

- XMTR's stock is down 30% YTD, and I believe that it will take multiple quarters of strong execution for Xometry to regain its premium valuation multiple.

- I assign a hold rating to the stock.

bankerwin/E+ via Getty Images

Investment Thesis

Xometry, Inc. (NASDAQ:XMTR) is the dominant platform for on-demand manufacturing, connecting around 45,000 buyers (including over 30% of Fortune 500 companies) with approximately 2,500 suppliers. The company is spearheading the digital transformation of the manufacturing industry, which is valued at over $2 trillion, by offering buyers a more efficient method of sourcing parts while also providing additional revenue streams to small and medium-sized manufacturers, who often face geographical and capital limitations. However, the company is facing near-term headwinds, and the stock is trading at a considerably lower valuation compared to a year ago. The company's outlook provided by the management is still optimistic, relying on a re-acceleration in the second half, and any shortfalls in achieving targets could further push the stock to the downside. Hence, I assign a hold rating to the stock for now.

Management Remains Optimistic after Q1

Xometry 1Q results were quite a mixed bag. While the company experienced revenue growth of 26% year-over-year, surpassing management's guidance of 20-22%, its adjusted EBITDA of -$12 million fell slightly short of the guidance range of -$11 million to -$9 million. The deviation in adjusted EBITDA was primarily attributed to one-time expenses related to SOX implementation and international investments. On a positive note, the Marketplace Gross Margin showed sequential improvement, increasing by 170 basis points. Despite the recent challenges that caused Xometry's stock to decline by 30% over the past year, the 1Q results provided some relief to investors concerned about underlying issues. The company addressed problems related to supplier engagement and buyer pricing, with marketplace fundamentals showing signs of strength, including a record number of new buyers and strong order growth.

Near Term Environment Remains Challenging

Xometry experienced a significant increase in supplier engagement during late 3Q, driven by a surge in small and medium-sized manufacturers seeking work. This led to lower prices for buyers and subsequently resulted in lower reported revenue. Although this caused Xometry to lower its 4Q revenue guidance, the company managed to maintain its gross margin, and buyer demand remained strong, growing by 55% year-over-year in October. However, in 4Q, buyer demand moderated due to the macroeconomic environment, with orders slowing down to 41% (compared to 55% in October), and customers opting for lower-priced options. Xometry responded by reducing prices in an attempt to gain market share, but this did not stimulate demand as much as expected. Instead, it impacted the Marketplace gross margin and contributed to lower-than-expected revenue and adjusted EBITDA guidance for 1Q and 2023.

Regarding Xometry's future outlook, management expressed optimism. They expect revenue to pick up pace in the second half of the year, with adjusted EBITDA turning positive in the fourth quarter. I am optimistic about XMTR's efforts in resolving its supplier engagement and buyer pricing concerns. The marketplace fundamentals showed signs of improvement in the first quarter, with a significant increase in the number of buyers and strong order growth. However, I remain cautious for now because I believe it is important to observe another quarter or two of consistent execution. I maintain a bullish outlook on Xometry's long-term potential and its leading position as a marketplace for on-demand manufacturing. However, I believe there is an elevated risk in the near-term regarding execution. XMTR's stock is down 30% YTD, and I believe that it will take multiple quarters of strong execution for Xometry to regain its premium valuation multiple.

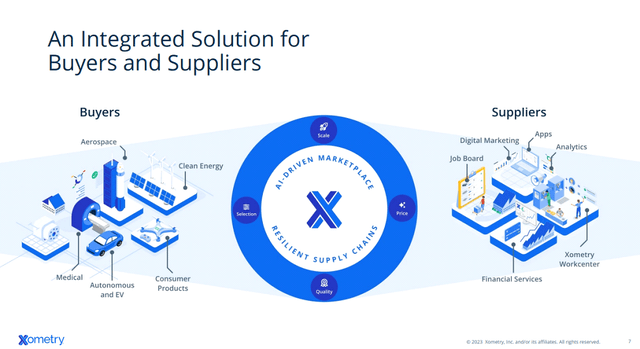

Leveraging AI to Revolutionize Supply Chain

Xometry is an online marketplace that utilizes artificial intelligence to facilitate on-demand manufacturing services. It specializes in six specific areas of manufacturing: CNC manufacturing, sheet metal manufacturing, 3D printing, die casting, injection molding, and urethane casting. The platform offers numerous advantages to buyers, including reduced lead times and access to a diverse global pool of parts suppliers. Suppliers, on the other hand, benefit from increased business opportunities and the ability to choose the types of requests they want to undertake. Since its establishment in 2013, Xometry has gained popularity among large corporations, with almost 30% of the Fortune 500 companies having procured parts through their platform. This trend is expected to continue as supply chains increasingly embrace digitalization.

Manufacturers worldwide rely on multiple tiers of parts suppliers throughout the production process, from prototyping to final manufacturing. Sourcing high-quality shops for various manufacturing styles such as CNC, 3D printing, die casting, injection molding, sheet metal, and more can be time-consuming and challenging. However, Xometry has introduced a marketplace that simplifies this process. Manufacturers can conveniently go online, upload a CAD file, and receive an instant price for their desired part. While initially gaining popularity in the prototyping phase, customers are now expanding their usage to include short-run production orders ranging from 50 to 100 units. Xometry's leadership position in this market is primarily attributed to its AI-driven engine and instant quoting system, which streamlines the procurement and pricing process for manufacturers.

Valuation

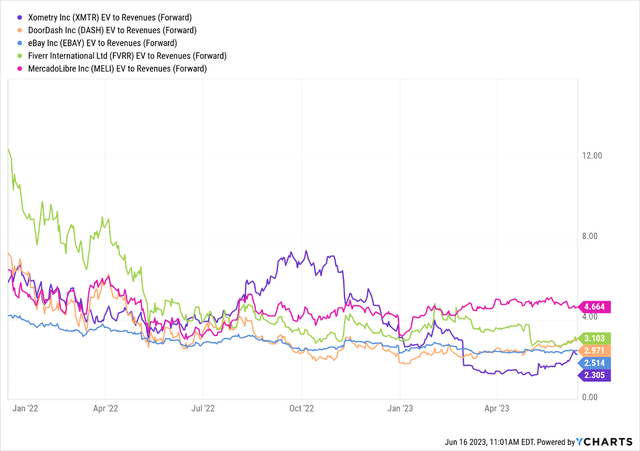

I believe the best trading comparables are the digital marketplace names such as DoorDash, Inc. (DASH), eBay Inc. (EBAY), Fiverr International Ltd. (FVRR), and MercadoLibre, Inc. (MELI). XMTR has traded down from a ∼7x EV/Sales multiple to now ∼2.5x trading at a discount to its peers. However, I believe that the company's outlook is still optimistic, relying on a re-acceleration in the second half, and any shortfalls in achieving targets could further push the stock to the downside. Hence, I assign a hold rating to the stock for now.

Risks to Downside

There are several downsides risks to investing in XMTR that should be considered. Firstly, it may be challenging to significantly improve the current marketplace gross margin of around 30% amidst a tough macro environment, risking the failure to reach the company’s target of approximately 35% by 2024. Secondly, as supply chains normalize, some buyers may shift back to their previous supplier partners, potentially reducing their engagement on XMTR. Moreover, a slowdown in global economic growth could have a more significant impact on XMTR's growth than expected due to a decrease in overall manufacturing demand. Additionally, international expansion might be more difficult than anticipated and could negatively affect the company's gross margin.

Conclusion

Xometry intends to establish itself as the manufacturing industry's equivalent of Amazon by leveraging artificial intelligence to offer manufacturers immediate pricing for parts and assemblies obtained from a worldwide network of suppliers. While manufacturing part marketplaces have existed for a while, Xometry stands out due to its ability to provide instant pricing, global sourcing, and supplier services. I maintain a bullish outlook on Xometry's long-term potential and its leading position as a marketplace for on-demand manufacturing. However, I believe there is an elevated risk in the near term regarding execution. XMTR's stock is down 30% YTD, and I believe that it will take multiple quarters of strong execution for Xometry to regain its premium valuation multiple.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.